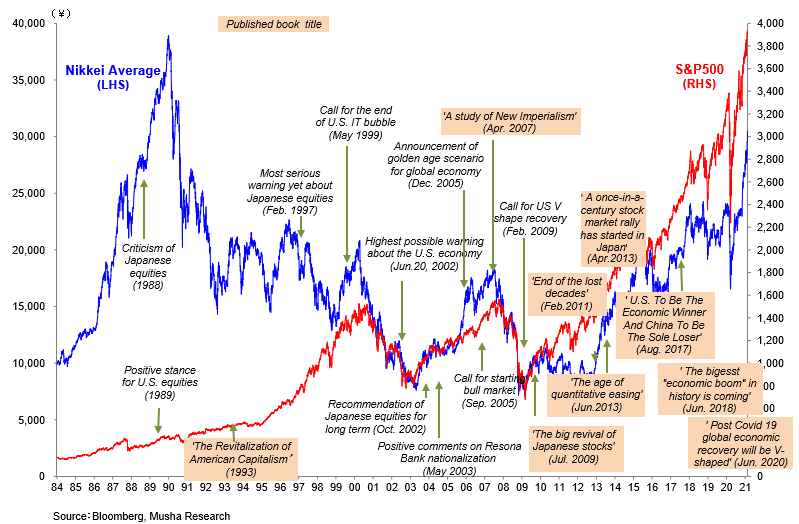

Past Investment Opinions

1990-1999 / Positive stance on the return to health of the U.S. economy and investing in U.S. equities ⇒ CORRECT

< Reasons >

- Belief in the efficiency of the U.S. restructuring process and the faith of the U.S. public in capitalism that was behind this restructuring

- The power of the information revolution led by the United States

Since May 1999 / Criticism of the “bubble economy” ⇒ CORRECT

< Reasons >

Problems involving the U.S. Internet valuation bubble and the self-fulfilling increases in ROE backed by rising stock prices

1997-2002 / Negative outlook for Japanese equities ⇒ CORRECT

< Reasons >

- Large volume of hidden non-performing loans (financial assets that produce no cash flows) in the financial sector

- Decline in Japan’s global presence due to strengthening economies in other Asian countries

- Unreasonably high expectations for returns on investments

Oct. '02 - May '03 / Switch to medium/long-term positive outlook for Japan ⇒ CORRECT

< Reasons >

- Japanese government established an effective system to deal with non-performing loans

- Attractive valuations of Japanese equities

2005 / Very positive stance regarding Japanese and U.S. equities ⇒ CORRECT

< Reasons >

- Belief that the world was entering a golden age backed by globalization and the Internet revolution

- Extremely low valuations of Japanese equities

Since July 2007 / Consistent positive outlook for Japanese equities ⇒ BIG MISTAKE

< Reasons >

- Failure to recognize the magnitude of financial crisis originating with subprime loans

- Inability to foresee the catastrophic breakdown in supply-demand that caused financial markets to collapse

- Failure to anticipate the destructive power of the market collapse and the speed at which the shock waves expanded; inadequate insight concerning the impact of the market collapse on the real economy

Since Mar. 2009 / Start global equity bull market ⇒ Correct so far for US

< Reasons >

- Could not predict weakness of Japan equity with ext ream yen strength

- Under estimate difficulty accompanied by secular turning period of US equity

Since Nov. 2012 / Start Japan equity long-term bull market ⇒ orrect so far

< Reason >

- The shift in monetary policy ended the Yen's strength and deflation