Sep 19, 2017

Strategy Bulletin Vol.186

Don’t be late for the market’s change of direction

- A Change in the pessimistic scenario among the Japanese

(1) The change of direction has come

An increase in risk-on sentiment as global financial markets rapidly evolve

Nikkei futures plunged on the morning of September 15 immediately after North Korea’s latest missile launch. But this became the springboard for a powerful rebound in stock prices. At the close, the Nikkei Average returned to the ¥19,900 level for the first time in about one month. Nikkei futures, which covered the ex-dividend drop, recovered to ¥20,000.

Signs of a major turnaround of the dollar-yen rate appeared at the same time. The yen rose rapidly to the ¥107 level on September 8 in the wake of North Korea’s August 29 missile launch and September 3 nuclear bomb test. But this upturn was very likely nothing more than a final burst of strength. All three major US stock indexes posted new highs last week. Moreover, the US long-term interest rate is rebounding after hitting bottom and the easing of China’s foreign currency investment restrictions (security deposit ratio on foreign exchange futures transactions was cut from 20% to nothing on Sept. 9) has probably stopped the dollar’s decline against the yuan. Due to these events, it is becoming increasingly clear that the conditions for a global risk-on mood and start of the dollar’s appreciation are in place. Furthermore, the short interest ratio, which is a key indicator of the outlook for Japanese stocks, is sending a strong signal of a change in direction.

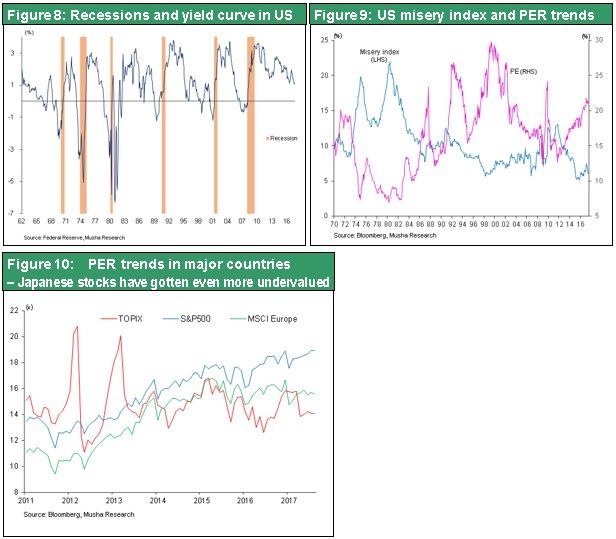

The short interest ratio has reached its peak and is clearly moving down

Early last week (Sept. 7), the Tokyo Stock Exchange short interest ratio fell sharply from the high level of 43.0%, indicating that the ratio has passed its peak. As you can see in the table below, peaks of the short interest ratio in the past have coincided with a change of direction in stock prices (either on the same day or within one week of the peak). Additionally, a short interest ratio peak usually happens at about the same time that an upturn of the yen reaches its peak. This relationship is clearly evident for short interest ratio peaks (1) through (4) as shown in Table 1.

Table 1: Short Interest Ratio and Change in Direction of Stock Prices

Average upturn after stocks bottom out is 33 days and 15%

It is also informative to look at the relationship between the bottoms of market downturns and the following peak (of a short-term rebound rather than a long-term bull market). The average increase in stock prices is 15% and the average length of upturns is 33 trading days. Applying these figures to this bottom results in peaks of 1838 for TOPIX and ¥22,165 for the Nikkei Average on October 27. Investors can therefore expect to see an unbroken increase in prices. The smallest upturn happened in April 2017. In this case, we can expect to see stock prices climb for 16 days and reach 1742 for TOPIX and ¥21,009 for the Nikkei Average on October 3.

(2) The baffling strength of the yen and stock market weakness – The culprit is probably excessive pessimism among Japanese investors

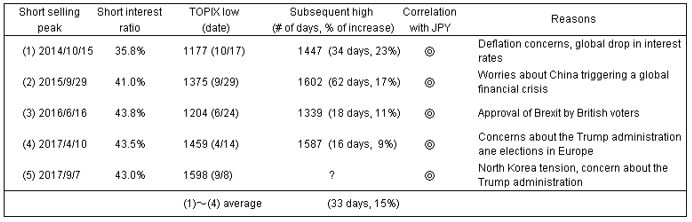

Shorting of the yen is growing as the yen is used to procure funds for emerging country investments

Between June and August 2017, the key trends in international capital markets were the unwinding of Trump positions, emerging country investments and the euro’s appreciation. The cause was the following series of events: Disappointment in fiscal policies of the Trump administration = Declines in US interest rates and the dollar = Higher investments in the euro and high-yield emerging country instruments = Big upturns in the value of the currencies of China, India, Australia and Brazil (all appreciated about 5%). These events were accompanied by rising stock prices in emerging countries. However, there was an enormous sell-off of the yen (increase in yen short positions based on the carry trade) because it was used to procure funds for emerging country investments. On September 14, the Wall Street Journal reported that foreigners’ investments in short-term bonds in China are climbing rapidly, in sharp contrast to the big increase in yen short positions.

The secret behind the yen’s appreciation even as short positions increased

The real mystery is why the yen continued to strengthen even as short positions increased. Who was selling the dollar as global investors shorted the yen? The answer is likely individual and institutional investors in Japan. People in Japan are very wary of the United States under President Trump’s leadership. This is caused in part by somewhat one-sided reporting by the Japanese media. Furthermore, the global risk-off environment is expected to become stronger as North Korea continues to make military threats. In response, it appears that Japanese investors have been reducing their overseas investments. On September 14, the Nikkei Shimbun reported that Japanese investors are very cautious about overseas investments. In addition, the Nikkei Shimbun reported that Japanese foreign exchange investors (so-called Mrs. Watanabe), who are normally contrarian, started reducing rather than increasing their dollar investments after the yen rose sharply on September 8. The Nikkei Shimbun interpreted this as a sign that, unlike in the past, Japan’s foreign exchange investors had doubts about the sustainability of the dollar’s upturn.

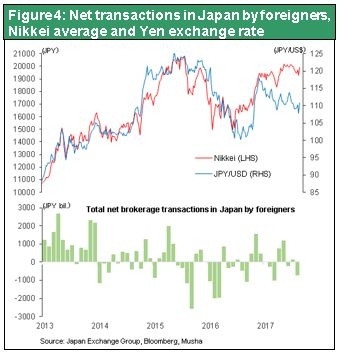

The weakness of Japanese stocks increased as this mystifying appreciation of the yen took place. In prior years, there was a high correlation between falling stock prices in Japan and the yen’s appreciation in relation to the dollar. There were two periods of rising stock prices during the past year: November and December 2016 and April and May 2017. Both upturns occurred as the yen depreciated and foreigners increased purchases of Japanese stocks. Consequently, as the yen appreciated, foreign investors sold Japanese stocks just as they did before when the yen strengthened.

Baseless criticism of the Abe administration is prompting foreigners to sell

An article in the September 18 issue of Nikkei Business stated that sales by foreign investors are the reason for declining stock prices in Japan. Foreigners are selling stocks and lowering their Japanese equity weighting because of pessimism about the Japanese economy. One reason is doubts about the stability of the Abe administration. The article’s title was “North Korea is not the only risk for Japanese stocks.”

However, the actual reason for slumping stock prices in Japan is probably Japanese investors. Media companies have taken the lead in criticizing Prime Minister Abe due to problems involving the Moritomo Gakuen land-sale scandal and suspicions involving Kake Education Institution. Media reports are also pointing out that the 2% inflation target is unlikely to be reached. There is a veritable media campaign for concluding that Abenomics has failed. Other media reports have stated that the Liberal Democratic Party’s big loss in the recent Tokyo assembly election will make the Mr. Abe a lame-duck prime minister. There is a strong possibility that these reports from Japan about political instability have had an effect on foreigners.

Excessive pessimism among Japanese investors about the investment climate in Japan and overseas has probably prompted foreigners to sell Japanese stocks. This is likely to be the reason for the poor performance of Japanese stocks. If this mistaken pessimism in Japan did indeed spark sales of Japanese stocks, then we should be on the verge of a rapid upward correction. This correction would probably contribute to more risk-taking worldwide as markets factored in a number of events. Major examples are (1) market sluggishness caused by the constant military threats of North Korea, (2) a change in the Trump administration resulting in US policies that create a positive surprise for financial markets, (3) undeniable signs of a simultaneous global economic upturn, (4) upward revisions in earnings of Japanese companies and rising support for the Abe administration resulting in a general election that boosts Japan’s political cohesion, and (5) the shifts in the monetary policies of the Fed and ECB are not bad news for financial markets. A stronger dollar and a stock market rally in Japan will be at the center of this growth of worldwide risk-taking.

(3) There is no longer any reason not to buy Japanese stocks –Excessive pessimism may result in a short-covering rally

The evolution of the Trump administration – Renewed action involving economic initiatives the president had abandoned

An unavoidable correction of the excessive pessimism of market participants is about to begin. First, we are finally starting to see a shift in the policies of the Trump administration. Positive surprises are beginning to appear concerning actions by the administration where there were previously no expectations. There was cooperation with the Democrats to pass an extension of the debt limit. Also, work has started on legislation that would help the children of illegal immigrants. Furthermore, indications of a reversal of the decision to withdraw from the Paris climate accord are emerging. One more development is bipartisan discussions about tax reforms and infrastructure investments. President Trump’s policy agenda targeting big government and Keynesian initiatives has always had similarities with the Democrats’ policies. As politicians look ahead to the 2018 midterm elections, prospects are good for progress involving policy discussions that had reached an impasse. If this happens, the only option for Republicans will be to cooperate with the president for a number of policy initiatives. The result will probably be a stronger dollar and higher stock prices.

The economic improvement is gaining momentum

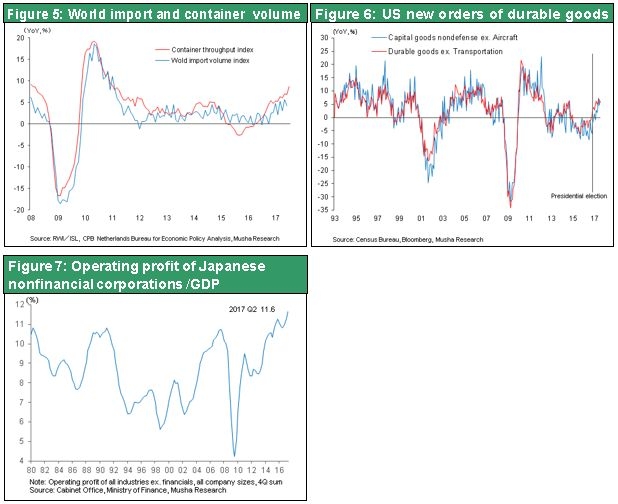

The global economic upturn is finally gaining momentum. As you can see in Figure 5, there has been strong growth in the volume of global trade and the number of containers. Rising demand in China is a major reason. However, the strength of the US economy as well is increasing. Consumer spending and the housing sector are healthy and capital expenditures are growing. Strength of US non-defense capital goods and non-transportation durable goods, as shown in Table 6, are viewed as signs of an increasing desire to make investments. Strong earnings along with difficulty hiring people due to the tight US labor market are making companies even more interested in making capital expenditures. The increasing optimism of US corporate executives is also likely to contribute to the growth of capital expenditures. Despite worries about inflation, the core CPI rebounded significantly in August to record annualized growth of 1.7%. This number eliminated concerns about deflation. The resulting expectations about an interest rate hike are causing interest rates and the dollar to move up.

The Japanese economy is healthy, too. Although the preliminary report of 4% GDP growth in the second quarter was reduced, the revised annualized growth rate of 2.5% is still very good. Nominal GDP growth was 2.8%. At this rate, Japan is on course to reach the government’s GDP target of ¥600 trillion in 2020. Moreover, there may be a further upward revision to the outlook for earnings of Japanese companies to reflect the robust global economy and the end of the yen’s appreciation. Concerns about the lack of inflation in Japan exist and the government is unlikely to achieve its 2% target. Nevertheless, Japan’s labor shortage is exerting upward pressure on wages. Most economists believe that inflation will move up to about 1% as a result.

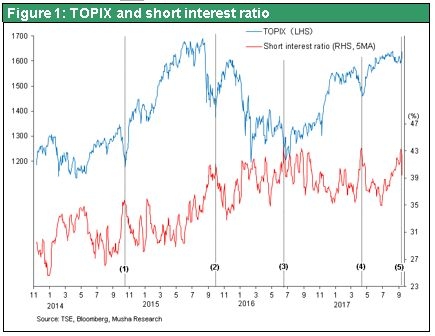

No signs of an impending US recession

Figure 8 shows that every US recession in the postwar era was caused by excessive interest rate hikes fueled by the fear of inflation. The chain of events begins with rising worries about inflation and advances to excessive tightening, a reversal of the yield curve and finally a recession. This is the background for every postwar recession with no exceptions. Concerns about a recession should not exist as long as there is no need for monetary tightening that leads to an upside-down yield curve. Furthermore, the Fed has more power than simply its control over short-term interest rates. The Fed has also gained the ability to use tapering (its balance sheet discretionary power) to greatly influence long-term interest rates, too. Both the Fed and Bank of Japan now have the ability to control the yield curve. In this environment, there is almost no possibility of a yield curve reversal in the near future.

The conclusion is that low inflation and interest rates create an excellent environment for an even longer period of economic growth. Consequently, the United States and Japan are currently enjoying an outstanding market environment with full employment, strong earnings, low inflation and no need for excessive tightening.

US stocks are not overvalued

The high valuations of stocks (PER of 21 compared with a historical average of 15.5) are used by many people as a reason for a pessimistic outlook. However, the PER alone cannot be used as an absolute standard for determining if stock valuations are too high or low. Between 1970 and 2000, the US earning yield (the reverse of the PER) mirrored changes in the long-term interest rate. Therefore, we can conclude that the long-term interest rate is what determines the suitable level for the PER. Today’s low long-term interest rates therefore can be used to justify a relatively high PER.

Some people may be skeptical of this justification because long-term interest rates are low when central banks are using quantitative easing to control these interest rates. However, the PER has a strong inverse correlation with the misery index (unemployment rate + inflation), which is a highly reliable indicator of economic well-being. In 1980, the misery index reached a peak of 22% in June shortly after the PER of US stocks fell to an all-time low of 6.96 in April. Today, the misery index is at a record low. At a time like this, no one should be surprised to see the PER climb to well above its historical average.

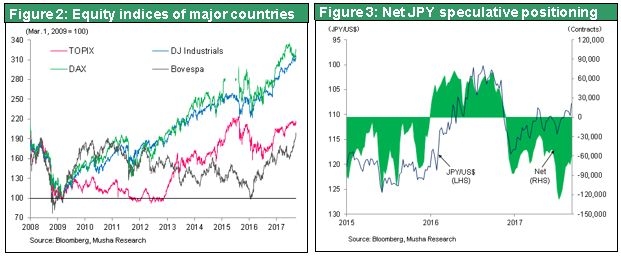

Investors’ interest in Japanese stocks will probably increase, too

Once investors regain confidence in the US economy and US stock valuations, we will see a further increase in the effects of the difference between interest rates and monetary policies in Japan and the United States. This will make a stronger dollar and weaker yen inevitable. Furthermore, investors worldwide will probably no longer be able to ignore the low valuations and PERs of Japanese stocks compared with stocks in other countries, as shown in Figure 10. Worries about the cohesiveness of Japan’s policies briefly emerged. But if there are growing expectations for a general election that will eradicate these concerns, then investors’ interest in Japanese stocks will most likely become even stronger.