Apr 14, 2014

Strategy Bulletin Vol.118

Why Japanese Stocks Will Rebound (1)

A correction in Japanese investors’ aversion to risk will definitely happen at some time

Only Japanese stocks are falling, just like before Abenomics

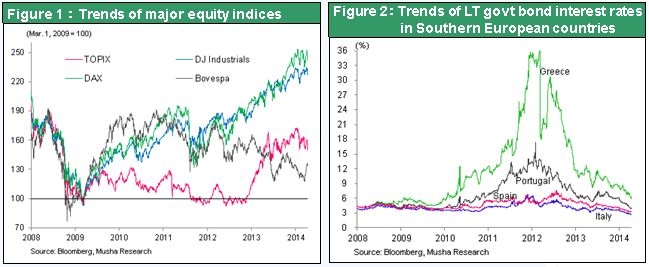

Everyone thought that Japanese stocks were finally on an upward trajectory because of Abenomics. But now Japanese stocks have gone back to being the only losers in the world, just like before November 2012. Stocks in Japan have dropped 14% since the start of 2014 (as of April 11, 2014), the most in the world. In emerging countries where there are fears about a crisis, stocks are up 9% in Turkey, 5% in South Africa and 4% in Brazil since the start of 2014. Even in China, stocks have declined only 2%. Why does Japan have the worst performing stocks in the world? After all, earnings growth is the highest in the world and the Bank of Japan has boosted the base money supply by 50%, the most in the world. What is the cause of this and what will happen next? I will examine this subject in this bulletin and the next one (Vol. 118 and 119). I believe that Japan’s position as the sole loser will be reversed due to one of the followin g reasons. First is fundamentals, meaning that it will become clear that Japan has ended deflation. Second is further easing (QQE2) by the Bank of Japan. With the Nikkei Average below \14,000 (forward PER of 14, PBR of 1.3), this may be an excellent time to buy Japanese stocks.

But perhaps we should view the sharp drop in Japanese stocks as the “canary in the coal mine.” Late last week, the Nasdaq plunged because of steep downturns in high-tech and biotechnology stocks. Fears about a global bear market have increased as a result. Some people are predicting the end of the long upturn of U.S. stocks. However, these fears are probably overblown. First of all, there is absolutely no uncertainty about the U.S. economic outlook. Second, the decline in the U.S. long-term interest rate to 2.7% shows that the Fed’s tapering and upcoming rise in interest rates are not having a significant effect. Third, prices are firm for government bonds of southern European countries, which were subjected to intense selling two years ago, and for exchange rates and stocks in Brazil and Turkey, the sources of fears about emerging countries early in 2014. Fourth, the Hang Seng Index and Shanghai Index are both steady even though China is the country where fears about an economic crisis are the greatest.

Two reasons that Japanese stocks are the world’s only loser

Why are Japanese stocks again the only loser among global stocks? Two possible reasons come to mind. The first involves supply and demand. In 2013, the stock market rally in Japan was fueled by foreign investors and there was a high volume of short-term trading. As a result, there has been no end to sales to cash out. Net trading of Japanese stocks in 2013 was as follows: foreigners \13 trillion; margin trading by individuals \1 trillion; mutual funds \0.5 trillion; corporations \0.6 trillion; financial institutions -\7 trillion, and cash trading by individuals -\8 trillion. Foreigners were obviously the dominant buyers. Japanese investors were virtually nonexistent. The drop we are now witnessing is the payment we have to make for what happened in 2013.

The second possible reason involves economic fundamentals. Financial markets are very skeptical about the success of Abenomics and end of deflation. Investors in Japan in particular are doubtful about the success of Abenomics and did not increase stock holdings as a result. Furthermore, uncertainty about fundamentals has grown because of the April consumption tax hike. Bank of Japan Governor Haruhiko Kuroda’s bullish statement that “there is no plan for additional easing (QQE2) at this time” further raised concerns about fundamentals. This became an excuse for short-term traders to sell Japanese stocks.

(I will discuss fundamentals and whether or not deflation can be ended in the next bulletin.)

Financial markets still not functioning due to the absence of Japanese investors

The almost complete absence of Japanese investors during the rally in stock prices shows that there has been no change at all in the desire of investors in Japan to avoid risk. Stocks have increased as a share of assets of households, pension funds, insurance companies and other investors. However, this is merely a passive increase caused by the rise in stock prices. Returning Japan’s financial markets, which have stopped functioning, will be vital to achieving the Bank of Japan’s inflation goal of 2%. But this small upturn in stock holdings demonstrates that little progress has been made toward normalizing financial markets.

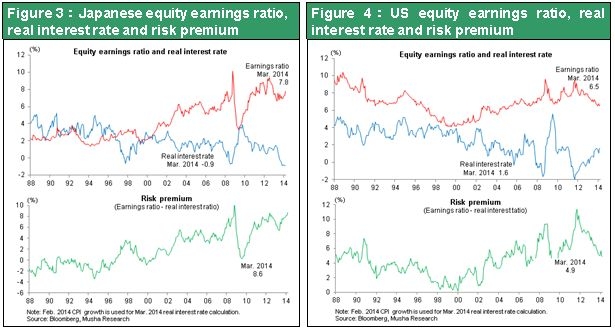

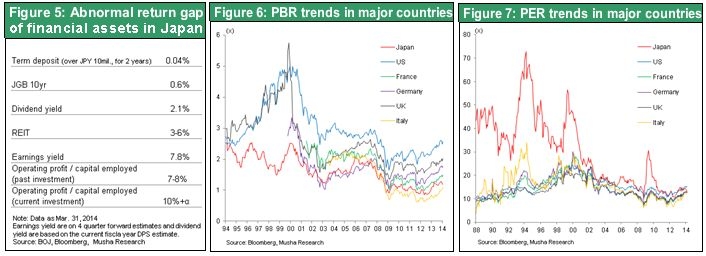

There is clearly a need to make a big change in the direction of Japan’s financial markets. Risk-free assets still account for the majority of the investments of the people of Japan and the supply of risk capital is very small. But the risk premium, which is a key indicator of investors’ animal spirit, shows that there has been no change at all. As you can see in Figures 3 and 4, Japan’s risk premium has decreased very little from the high level that was reached immediately after the Lehman shock. In comparison, the U.S. risk premium has dropped significantly. Furthermore, Japanese stocks have the lowest valuation among all stocks in the world’s major countries. For example, Japanese stocks have a PBR of 1.2, less than half the U.S. PBR of 2.5. Japan ranks last with Italy among industrialized countries.

Another key point is Japan’s abnormal gap in returns among different asset categories. Bank deposits yield 0.04%, government bonds yield 0.6%, stock have a dividend yield of 1.9% and REITs yield 3% to 6%. Moreover, the earnings yield of TSE stocks is 7.2%. The differences in these returns are remarkable and the gaps have not narrowed at all. Japanese stocks were up about 60% in 2013. Despite this rally, there was no correction in the low valuation of Japanese stocks because corporate earnings were up about 60%, too. As a result, there was no decline in the risk premium.

These numbers show that the people of Japan are still keeping almost all of their assets in safe holdings like cash, bank deposits and government bonds. The term “safe assets” may sound reassuring. However, these are financial assets with no future cash flows at all. More than half of the money held by the public has been sleeping. This was the cause of Japan’s prolonged deflation and made the Japanese economy a virtual zombie.

Deflation will not end unless financial markets return to normal

Even though financial markets have’t yet returned to normal, Japan’s inflation has picked-up through participation by foreigner investors. The cycle starts with a big upturn in stock prices (due to buying by foreigners) and downturn of the yen, advances to higher prices for imports, and continues to higher prices for assets. But there will still be worries about the sustainability of the current rise in prices and economic growth unless financial markets are returned to normal and able to function again. In other words, Bank of Japan Governor Kuroda’s true mission is to completely revitalize financial markets as a supplier of risk capital. This must be done to achieve 2% inflation, too.

If the slump in Japanese stocks, continues for another few months or even six months, the result may be negative feedback on the economy. All along, the Bank of Japan’s quantitative easing has been primarily a means of influencing expectations. There was no other channel for exerting pressure on asset prices and the yen’s value. Consequently, changes taking place in Japan will come to a halt if the stock market rally loses momentum and the yen stops declining. If this happens, there will also be no hope for the next virtuous cycle for the economy. This would raise the likelihood of an end to the increase in consumer prices that has just started.

Although unlikely, there may be mounting worries about economic fundamentals after the consumption tax hike that causes the reversal in stock prices and the yen to continue. In this event, the Bank of Japan would have to implement a second round of quantitative easing. Ending deflation is the highest priority of Bank of Japan Governor Kuroda. There are still many more actions he can use, like buying more long-term government bonds and more ETFs and ending interest payments on reserve deposits. Using these measures would probably create a surprise that would eradicate expectations for deflation and prompt Japanese investors to rebalance their portfolios. With the next consumption tax hike planned for October 2015, Japan’s Ministry of Finance will undoubtedly give its full support to these types of additional monetary easing actions.