Mar 09, 2015

Strategy Bulletin Vol.136

Buy now – The best part of the Abenomics market is about to begin

(1) Another all-time high amid rising skepticism

For years, stocks in Japan have lagged far behind as stock indices in the United States, Germany, United Kingdom and other countries posted one record high after another. But at the end of last week (March 6), the Nikkei Average reached its highest point in 15 years by climbing to the ¥18,900 level. This may very well be the start of a powerful long-term rally. Numerous events have produced benefits for the economies of developed countries. The price of oil has plummeted, central banks are implementing extreme easy-money policies, and companies are reporting record earnings. Seldom do we see all of these events happen at the same time. I believe that this rally in Japan is the beginning of the second stage of what I view as one of the biggest bull markets ever.

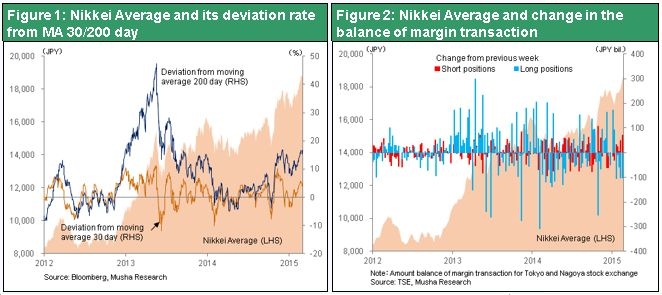

Stock prices are setting new highs even as skepticism grows. The stock market appears to be overheating because of the speed of the rally. But in terms of supply and demand, there is an increasing amount of money waiting on the sidelines. On the Tokyo and Nagoya Stock Exchanges, the balance of long margin positions has decreased for six consecutive weeks, while short positions have increased for six consecutive weeks. These are the longest consecutive decreases and increases since the Abenomics market started in November 2012. Investors are obviously very cautious. Stock prices in Japan have pulled back three times since the start of the Abenomics market: May 2013, January 2014 and October 2014. Every time, there was a big increase in the margin ratio as short positions decreased and long positions increased. But the situation today is precisely the opposite. Moreover, foreign investors, who have been fueling the rally since 2012, were net sellers up to mid-February 2015.

The reason that foreigners are selling Japanese stocks is clear: The powerful rally has produced a large gap between stock prices and moving averages. One mutual fund that is well-known as a long-term investor has stated its intent of raising cash from less than 5% to 30%. From a cyclical standpoint, there is no doubt that this is not the time to buy stocks. So the question is whether or not the overall trend of the market has shifted, irrespective of the cycle.

(2) A new trend has started: The age of ultra-high stock prices

I believe that the overall market trend has changed. The stock market is now in a phase in which prices will rise sharply and the perspective of cycles is no longer valid. Three major forces have come together to create this new trend.

Quantitative easing is fueling rallies in developed countries

The first force is the age of global quantitative easing. US quantitative easing and the accompanying stock market rally prompted Japan and Europe to do the same thing. Central banks of the United States, Japan and Europe are all taking the same actions. They have established a 2% inflation target and are doing whatever is needed (no limit on quantitative easing) to achieve that target. Declaring a firm commitment to 2% inflation is equivalent to saying that the amount of quantitative easing will be determined by the probability of achieving this inflation. The level of quantitative easing has an immediate impact on stock prices. Therefore, the justifiable level for stock prices is the point at which 2% inflation can be achieved. The conclusion is that the amount of quantitative easing needed for 2% inflation will significantly boost the stock price level that can be regarded as reasonable. In other words, there is a link between the 2% inflation goal and both quantitative easing and stock prices. Stock prices will continue to climb until inflation reaches 2%. As a result, in Japan and the eurozone, where the 2% target is far away, we can expect to see massive quantitative easing that will create a very high ceiling for stock prices.

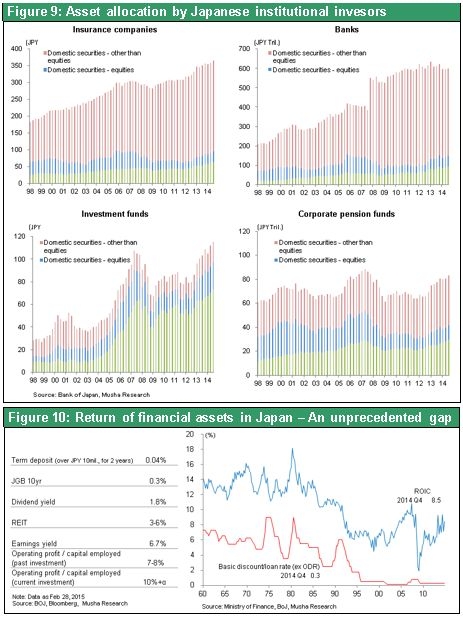

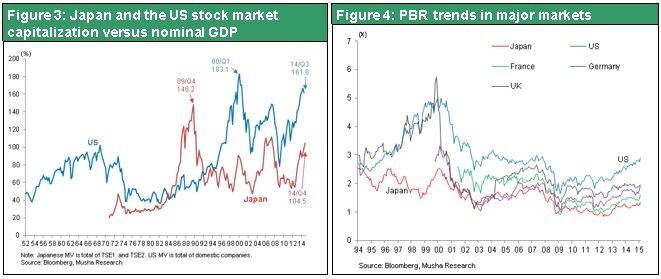

In the United States, where quantitative easing started, market capitalization has increased significantly as a percentage of GDP. When quantitative easing began in 2009, this percentage was less than 100%. But now market capitalization is 160% of GDP. A similar upturn is likely to occur in Japan from the current 100% as quantitative easing continues. If this happens, there will also be a big increase in the PBR of Japanese stocks, which is currently the lowest in the world.

The United States is nearing the 2% inflation goal now that the country is not far from full employment. So quantitative easing has been a spectacular success. US stock prices have been climbing along with a steady stream of good news: falling unemployment, rising wages, a positive CPI, strong corporate earnings, and a high volume of financial activity by companies (no accumulation of idle capital). In this environment, the Fed rate hike that is expected in the middle of 2015 is very unlikely to stop the stock market’s momentum. The Fed would probably push back a rate hike if there was a possibility of negatively impacting stock prices. Today, there are absolutely no developments, like a drop of the dollar or rising inflation, that call for higher interest rates in the United States.

Japan is on the verge of a dramatic economic rebound

The second force is the impending start of a dramatic economic turnaround in Japan. We are about to see an unprecedented swing in Japan’s fundamentals. Two one-time events in 2014 and 2015 created enormous swing factors. In 2014, the April consumption tax hike robbed the private-sector economy of 8 trillion yen (1.6% of GDP) of purchasing power. In 2015, much cheaper crude oil added almost 10 trillion yen (2.0% of GDP) of purchasing power. Starting in April 2015, when the consumption tax hike will no longer affect year-to-year comparisons, these two factors will raise Japan’s GDP by 3.6% over the prior year. Never before has Japan experienced a swing of this magnitude. Japan’s economy will also reflect the emergence at once of the delayed benefits of Abenomics and the weaker yen. Until recently, there has been growing criticism of Abenomics. People thought this policy was producing no benefits and even a mistake. The reason was the lack of an economic recovery backed by manufacturing as in the past when export volume rose as the yen weakened. But the benefits of Abenomics have been building up in the form of a consistent and unprecedented improvement in corporate earnings. In a sense, the reservoir is full but no water has gone downstream yet. There is no doubt that these stored benefits will eventually flow downstream with significant positive effects. During the past few years, there has been only a minor virtuous cycle originating with the growth of corporate earnings. In 2015, though, these earnings will probably surface in the real economy in the form of higher wages, growth in capital expenditures and R&D expenditures, higher dividends and stock repurchases, and more financial activity like mergers and acquisitions. This is why I think the Japanese economy and Japanese stocks may be the biggest positive surprises in the world in 2015.

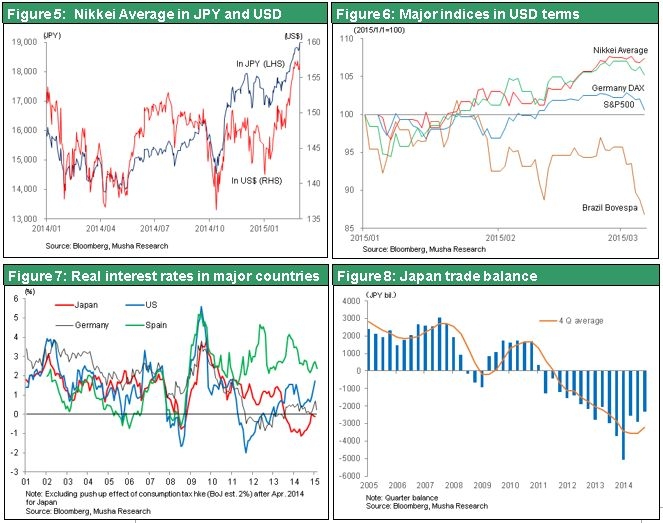

The best return even on a dollar basis; foreign investors will have to buy more Japanese stocks

The third force is emerging signs of Japan’s superiority. Since the start of 2015, Japanese stocks have had the highest returns in the world on a US dollar basis. Furthermore, Japan’s long-term interest rate has started to rise. For years, Japan had the world’s lowest long-term interest rate, which was a symbol of the country’s prolonged deflation. But now this title has been transferred to Germany. The upturn in long-term rate as purchases by the Bank of Japan and a decline in bond issues create an insufficient supply of Japanese government bonds is attracting much interest among investors. Moreover, real interest rates in Japan are increasing. Real interest rates used to be well into negative territory and the lowest in the world. Higher interest rates may be a sign that markets are starting to factor in the unmistakable end of deflation in Japan. As interest rates climb, a gap is emerging between rising stock prices and the value of the yen: stocks prices continue to increase even though the yen has basically stopped falling.

The end of Japan’s trade deficit, now an annualized 11 trillion yen, is in sight. Cheaper crude oil is one reason. In addition, a rapid improvement in Japan’s trade volume has started. There has been a big increase in the current account surplus because of improvements in the travel balance and overseas income balance. Furthermore, more capital will probably flow into Japan as investors buy Japanese stocks and real estate, which are the most undervalued in the world. By the middle of this year, the yen will probably stop falling. We will see the end of extreme fears about a financial collapse of the Japanese government sparked by an oversold yen and surge in interest rates. On a US dollar basis, there is likely to be a big increase in the market capitalization of Japanese stocks. This would probably force investors worldwide to further increase their weighting of Japanese equities.

(3) Investors doing nothing must alter their thinking and actions

The extreme negative bias of Japanese investors and absence of Japanese experts among overseas investors

In January, the IMF lowered its outlook for Japan’s economic growth in 2015 from 0.8% to 0.6%. This revision prompted a large number of overseas investors who know little about Japan to sell Japanese stocks. Due to the very poor performance of Japanese stocks for many years, the number of investors who are knowledgeable about Japan has fallen sharply. Overseas investors’ are making consensus-driven decisions involving Japanese stocks because of the scarcity of Japan experts.

For a long time, critics of Abenomics in Japan have stridently pointed to Japan’s temporary economic stagnation as evidence of the failure of Abenomics. But the economic slowdown was actually caused by the consumption tax hike and the delay in the appearance of benefits from quantitative easing and the yen’s depreciation. Naturally, investors in Japan who failed at risk-taking for many years are strongly influenced by the pessimists who are urging people to shun risk.

The shift from trading to buy and hold

Traders were the only investors who survived Japan’s prolonged bear market. For these people, stock investing is equivalent to trading (meaning buy low and sell high or sell high and buy back low). But things are different now. Investors need to alter their behavior from buying stocks simply to sell them later to buying stocks as long-term holdings. For investors with a long-term perspective, the purchase price is not a major issue. With interest on loans virtually zero and stocks returning 1.6% from dividends alone, investors can earn a good return from holding stocks. So investors who continue to hold stocks will always be rewarded. Therefore, what investors must do now is hold stocks rather than worry about the prices at which they should buy stocks.

Once investors embrace the buy-and-hold mindset, there will probably be a massive movement of capital and a revolution in the valuation of stocks. A rapid change may be about to take place in the perception and behavior of Japanese investors that have been frozen solid for some time. If this happens, there will be a big impact on financial markets. Investors will rush to move their money from safe assets like cash, bank deposits and government bonds to the stock market. But first investors will have to come to their senses to see an extremely obvious fact. Safe assets are holdings with no future cash flows. Assets with risk are holdings that will absolutely produce future cash flows.

This is why I believe that a stock market rally of an historic scale may be about to begin in Japan.