Jul 06, 2015

Strategy Bulletin Vol.141

Greece says “no” – Creditors and Germany will have to compromise

The Greek debt problem can be solved if participants embrace economically rational thinking

The people of Greece voted “no” in the July 5 national referendum. Voters backed the stance of the Tsipras regime by rejecting the demands of creditors for austerity. Creditors (EU, ECB, IMF) and Germany now have two choices. One is to give-in somewhat to the Tsipras regime, which has received the support of the public. This would involve easing demands for austerity and restructuring debt. Kicking Greece out of the eurozone is the other option. However, there is actually only one viable choice. Creditors and Germany are very likely to reach an agreement with Greece that will allow the country to continue using the euro. The market will rebound strongly when there is light at the end of the tunnel.

Greece does not have a private-sector debt problem. Money is owed by the Greek government and its central bank to the EU, ECB and IMF, which are multi-national public-sector institutions. As a result, this is the type of debt where bankruptcy can be avoided if all parties involved agree to push back debt payments. Termination of the provision of funds by the ECB, which is the lifeline for Greece today, is inconceivable. There is virtually no possibility of the sudden death of Greece as the country runs out of money.

The geopolitical importance of Greece

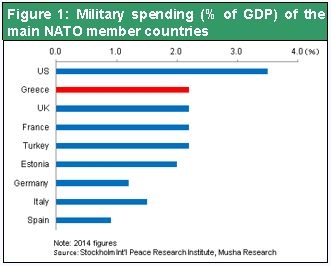

Greece’s geopolitical importance is the first reason that negotiations are unlikely to collapse as creditors and Germany refuse to alter their current positions. Creditors, Germany and the United States would never allow Greece to move toward Russia or China because of the country’s geopolitical significance. Greece is at the forefront of NATO regarding turmoil in the Middle East, Ukraine and Eastern Europe. The country is in a key position at the end of the Balkan Peninsula. As a percentage of GDP, Greece’s defense expenditures are 2.2%, ranking the country second among NATO countries after the United States at 3.8% (Germany is slightly more than 1%). NATO asks its 28 member countries to maintain defense budgets that are at least 2% of GDP. Therefore, Greece is one of the best NATO members in this respect. The Tsipras regime and the majority of the people of Greece have no desire to abandon the euro or to stop being part of the West as a member of NATO.

Recession and unemployment, not the budget deficit, are the most urgent problems

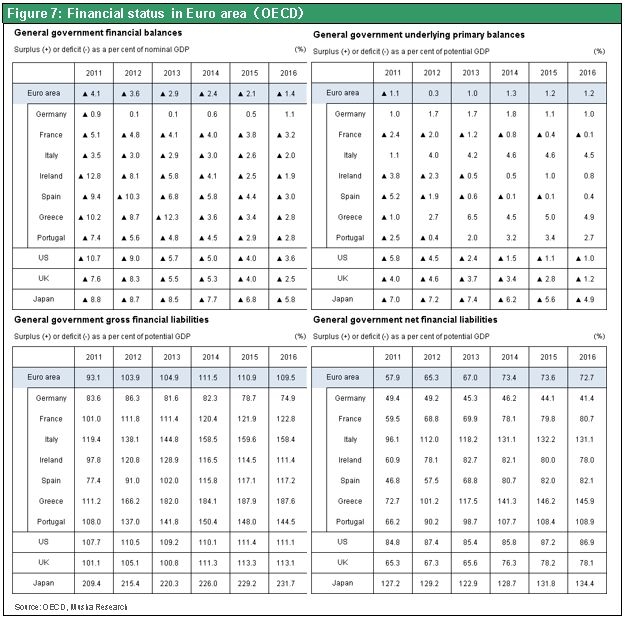

Economic and policy realities are the second reason that creditors and Germany will be forced to negotiate with Greece. On June 23, the Tsipras regime stated its openness to concessions involving higher value-added and corporate income taxes to generate tax revenue, an increase in the age to start receiving pensions, long-term financial targets, and other items. Everyone agrees that more austerity would damage the Greek economy and make the long-term restoration of financial soundness very difficult. In fact, Greece has already ended its external deficit as well as its negative primary balance (budget deficit or surplus excluding interest expenses). So the country has solved its debt problem from the standpoint of the current income and outgo of funds. Consequently, the Greek debt crisis is a problem involving loans remaining from prior years, not its present obligations.

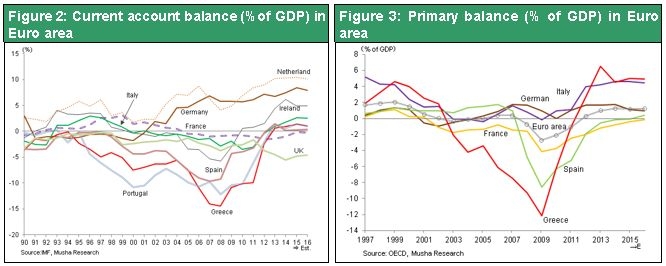

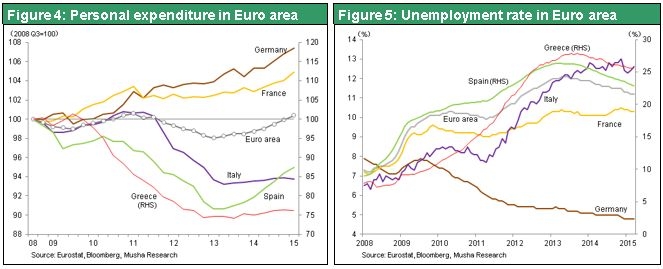

There are fundamental differences between today’s Greek crisis and the situation in 2010. Excessive spending and debt in Greece and other southern European countries was the problem in 2010. But now, measures by these countries to hold down consumer spending have eliminated excessive debt. In 2010, the current account deficit of southern European countries was about 10% of GDP. Today, this deficit is close to zero or there is a slight surplus as a percentage of GDP. Moreover, all southern European countries, including Greece, have a positive primary balance. The cause is a dramatic drop in the living standards in these countries due to rising interest rates and measures to cut budget deficits. However, unemployment has increased in southern European countries because of the recession. As the figure shows, consumer spending in Greece is now more than 10% less than when the Greek debt crisis began. But unemployment has surged from 7% before the crisis to the current 25%. Therefore, economic growth rather than more austerity is what Greece needs most of all right now.

In 2010, southern European countries responded properly to the crisis by suppressing consumer spending while repaying their debt. But these actions were followed by an economic downturn. Today, precisely the opposite problem exists in these countries: too much savings and too little demand. As a result, the proper response this time is to end the surplus of savings by creating demand. In other words, countries need to stimulate economic growth by enacting reflationary policies. But Germany supports fiscal austerity and opposes monetary easing while it has accumulated its massive amount of excessive savings resulting from an enormous current account surplus. Germany is thus unwilling to support reflationary measures. Due to this situation, there is an increasing risk of the entire eurozone becoming mired in deflation just as Japan did.

Can Germany suppress the anti-Germany mood that is increasing below the surface?

Refusing to give-in to Greece and allowing Greece to abandon the euro (the so-called “Grexit”) would be like opening Pandora’s box. This is the third reason that creditors and Germany must negotiate with Greece. Rising unemployment caused by an economy brought down by too much austerity is a problem in France, Spain, Italy, Portugal and all other southern European countries. Residents of these countries will probably oppose Germany as a center of the euro if governments fail to take actions aimed at lowering unemployment. French sociologist Emmanuel Todd recently wrote a book titled Imperial Germany Will Destroy the World. In this book, he says that opposition is growing to Germany’s overwhelming influence as the country uses its enormous competitive edge and a cheap currency (the euro) as weapons. He goes on to say that the time has come when Germany must use its financial power (current account surplus) to assist southern European countries by recycling capital and providing other financial support. The ball is in German chancellor Angela Merkel’s court. I believe that the chancellor will make the intelligent choice of avoiding a Grexit by offering concessions to the Tsipras regime.

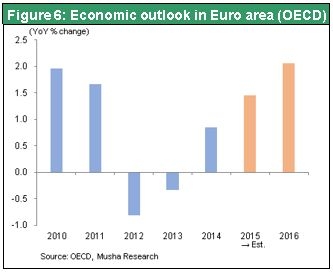

The economic outlook in Europe will instantly improve if an agreement is reached with Greece. The economy will benefit from the weak euro, the low cost of crude oil and the long-awaited start of growth in bank lending. Furthermore, growth of demand in southern European countries will probably be fueled by the release of pent-up demand that accumulated during the prolonged period of economic stagnation. An agreement with Greece is therefore very likely to trigger a sharp upturn in stock prices of industrialized countries that signals the start of a summer rally.