Jun 06, 2016

Strategy Bulletin Vol.162

The May US Employment Numbers Could Push the Dollar Higher

- Be careful not to underestimate the extreme soundness of the US economy

(1) The forex market may be seriously misinterpreting the May US employment statistics

How should we view the sharp drop in new jobs?

A big contradiction could occur regarding how to interpret the May US employment figures that were announced on June 3. The United States added 38,000 non-farm jobs in May, far less than the 160,000 growth that the market had expected. This was the smallest month-to-month job growth since September 2010. Even after adding the decline of 35,000 jobs caused by a telecommunications worker strike, May jobs rose only 73,000. The dollar quickly weakened because people believe there is an increasing risk of a recession. Immediately after the June 3 announcement, the dollar plummeted 2.2% versus the yen, falling from the ¥109 level to ¥106.5. There was a 1.9% drop versus the euro. US stock prices (the Dow Jones Industrials) were down 150 points at one time but prices quickly reversed direction and the market closed down only 31.

Perhaps the May jobs report is a shift in direction that points to a decline in the US economy. If so, then this is no time to raise interest rates. An interest rate cut would be needed, which would obviously make the dollar weaker. However, a close look at a variety of data leads to the conclusion that the sharp drop in new jobs in May is probably only a temporary divergence from the real trend. If this is the correct interpretation, then the dollar’s abrupt downturn should be viewed as either an overreaction or a big mistake.

Other employment data indicates that overall employment picture is bright

All employment figures other than job growth were healthy. The average workweek (private non-farm payrolls) was unchanged at 34.4 hours. As a result, total working hours (private sector workers x average workweek) rose by 0.1% from April to May, the same as the March-to-April growth rate. Furthermore, average hourly earnings were up 0.2% and total labor income (total working hours x average hourly earnings) continued to post solid growth with an increase of 0.3% over April. A large decline in the average duration of unemployment from 27.7 weeks in April to 26.7 weeks in May was more good news. Moreover, this is down by 2.3 weeks from 29.0 weeks in February.

The number of new unemployment insurance claims, which is announced every week, has been consistently setting a new record low. This is an indication of a significant downturn in people who are losing their jobs. The number of days needed to fill a job, based on information from job placement companies, has increased from 15 days immediately after collapse of Lehman Brothers to a historically high 27 days now. Clearly, employers are having difficulty filling positions. All these numbers indicate that, contrary to the response of the forex market, the actual cause of the decline in job growth is the shortage of workers (difficulty hiring new workers).

Unemployment has declined from 5%, which is the full employment level, to 4.7%. This virtually confirms that finding workers is becoming increasingly difficult. High-ranking Fed officials and others have already stated that upward pressure on wages is becoming greater as job growth slows because of the tight supply of labor. Average hourly earnings in May were 2.5% more than one year earlier. But this increase may be less than actual wage growth because the replacement of retiring baby boomers with younger people who earn less may be artificially reducing the wage growth rate. According to the Atlanta Fed’s Wage Growth Tracker, which monitors the wages of the same individuals, the annual wage growth rate has already increased to 3.5%.

Clear upward pressure on wages points to an interest rate hike

These observations are consistent with US macroeconomic statistics. Over the past 50 years, labor’s share of income has repeated the same pattern. This figure always decreased during the first half of a period of economic growth because an ample supply of labor held down wage growth. But during the second half, labor’s share of income increases rapidly because a shortage of labor caused wages to climb faster. Looking at the current cycle, labor’s share of income ended a long-term decline in 2014 and has staged strong growth since the second half of 2015. The US economy struggled with lackluster growth and a surplus of labor for six years after the start of the global financial crisis. But this labor surplus has disappeared now that the United States is at full employment. The United States has succeeded at eliminating the risk of deflation. Next, we can expect to see more concrete signs of a growing risk of inflation.

The market’s immediate response to the job statistics may have been a mistake

As I have explained, the sudden drop in new jobs in May is a sign of strength rather than weakness for the US economy. Additionally, fewer new jobs could also point to the likelihood of increasing inflationary pressure. This would result in pressure to boost interest rates, which is the opposite of the market’s view of weak job growth. This is why we can interpret smaller growth in jobs as a reason for a stronger dollar. At the end of last week, stocks in Japan plummeted as the dollar became weaker and the yen stronger in overseas futures markets. But if we believe that the market’s response was completely wrong, then the current level of stock prices is an excellent buying opportunity.

(2) The remarkable health of the US economy

The efficient US labor and capital markets enable unprecedented innovation

The success of populist presidential candidates Donald Trump and Bernie Sanders have further reinforced the belief that the United States is in decline. However, the US economy is remarkably strong in comparison with the past and with other countries. Some people think that measures to hold down public-sector demand once the global financial crisis began led to slowing US GDP growth and an extended period of stagnation. In fact, US companies are reporting all-time-high earnings and profit margins have never been higher. Furthermore, the United States is steadily creating jobs and the unemployment rate has fallen to 5%, which is generally regarded as full employment. Due to the Phillips curve (the inverse relationship between the rate of inflation and the unemployment rate), wage growth is more than 2% and the 2% inflation target is now in sight. As a result, an interest rate hike is needed. There has been no real growth in wages for the US middle class during the past decade. But the reason is simply that the deflator does not adequately incorporate the decline in costs resulting from the information revolution. The Internet society has produced significant progress regarding convenience and utility. Consequently, there is no doubt that the living standard of the middle class has improved significantly.

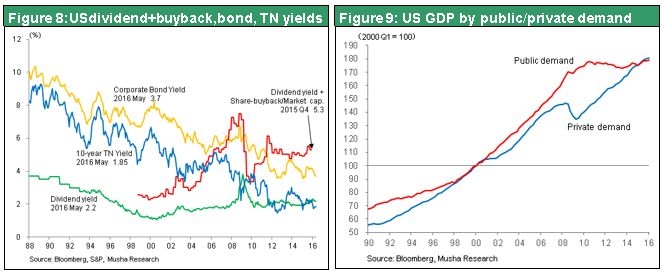

With respect to finances, the United States alone among industrialized countries did not become mired in the liquidity trap. There was no interruption in the capital allocation function of US markets, so there was no accumulation of idle capital. While not as pronounced as other developed countries, the high corporate profit levels have not translated into capital investment-related demand. But US companies supported the asset income of households by distributing 5% of their market capitalization to shareholders in the form of dividends and stock repurchases.

Making this possible was the consistent fair market function of labor and financial markets. The AI/IT revolution fueled innovation on an unprecedented scale. The United States has the flexible markets and institutions required to translate technological progress into benefits for society, businesses and life styles. Therefore, whether we look at the current status or the long-term direction of the US economy, it is likely that the United States will be the largest driver of growth for the global economy.

Lawrence Summers and a number of other prominent economists believe that the US economy entered a long period of no growth because the global financial crisis warped US GDP growth rate. Whether or not the United States experienced an extended period of stagnation is debatable. But it should be noted that the complete lack of growth in public-sector demand after 2010 is what was responsible for the warped GDP growth rate. As you can see in Figure 9, growth in US private-sector demand has returned to the long-term trend. But the US government budget deficit has fallen from 12% of GDP in 2010 to less than 3% now. Clearly there is no longer a need to hold down public-sector demand. Both Hillary Clinton and Donald Trump plan to make use of fiscal policies. They will probably implement policies that produce a big increase in public-sector demand. Enacting these policies may bring an end to the prolonged period of no economic growth.

(3) Two ways to view the US dollar

Has the dollar stopped appreciating?

Immediately after the May job numbers were announced, the dollar became weaker. What does this mean? The dollar has been declining as the yen appreciated since the beginning of 2016. Determining this meaning will have a great bearing on the ability to decide if this recent downturn is a precursor of the end of the long-term appreciation of the dollar. Figure 10 shows the dollar cycle since 1970 based on the real effective exchange rate. You can see there was a prolonged downturn between 2002 and 2011. Next, the dollar began to strengthen in 2011. But there is a sharp difference of opinion about whether or not this is a sustained upturn.

The answer depends on US economic fundamentals. There could be a series of interest rate hikes as the US economy continues to recover. In this case, the probability of a return to a stronger dollar is very high. Newspaper headlines about the May employment statistics were all pessimistic. But the reality is that the job numbers demonstrate the economy’s strength. As a result, the decline in the dollar’s value since January can be viewed as a temporary phenomenon and we should expect to see the dollar resume its appreciation.

A similar situation existed in 1998 during the Russian ruble crisis. The Fed responded to this crisis by lowering interest rates to supply liquidity. Initially, the dollar’s value plunged. But once the ruble crisis was under control, the Fed went back to raising interest rates because of the US economy’s strength. The result was a resumption of the dollar’s upward trend from 1999 to 2002. The interest rate reduction and weaker dollar during the 1998 ruble crisis were caused by an overseas crisis. This time, the US commitment to easy-money policies (pushing back the next interest rate hike) is not the result of concerns about the US economy. Instead, this stance is associated with financial instability in emerging countries, especially China. This is why the dollar has depreciated. These events are precisely what happened in 1998 when the dollar declined during a period of US monetary easing. Prospects are good for the US economy to gain momentum during the second half of 2016 and the beginning of 2017. If this happens, the dollar will return to an upward trajectory. The yen may overshoot to about ¥105 but go no farther. Afterward, the yen will probably go back to a weaker level (¥110-¥115, for example) by the end of 2016 or early in 2017.

The difference today is the magnitude of risk involving Russia and China

Do not overlook the fact that there is a decisive difference between 1998 and 2016: the magnitude of risk involving Russia and China. In 1998, Russia was a relatively small country and monetary easing by the United States was enough to end the ruble crisis.

Today, China is the major cause of the crisis. This is not a country that can be stabilized by bringing down the dollar’s value alone. In China, there is always the risk of a drastic drop in the yuan’s value sparking deflation in China that subsequently grows into global deflation. In this case, there would be no short-term appreciation of the dollar as in 1998. The dollar would instead continue depreciating in order to achieve a lasting end to the risk posed by China. Investors should also be aware of the possibility that this situation would be continuously detrimental to the yen.