Aug 21, 2017

Strategy Bulletin Vol.184

The health of the US and Japanese economies and hopes for the evolution of the Trump Administration

- Will Steve Bannon’s departure trigger progress with Trump’s policies?

Sound fundamentals

Clear signs of the health of economies worldwide are emerging at last. In the United States, indications of faster growth in the second half of 2017 are appearing. Annualized US economic growth fell sharply to 1.2% in the first quarter of 2017 due to a large inventory reduction. But real GDP growth rose to 2.6% in the second quarter with the support of big improvements in consumer spending and capital expenditures. Robust consumer spending is especially noteworthy. Retail sales rose sharply in July, increasing by 0.6% over the previous month accompanied by big upward revision to the weak data in May and June. These upturns taking place with large improvements in consumer sentiment and household income, indicate that consumer spending is likely to remain strong.

Another good news is that Japan’s economic improvement is even stronger than the US upturn. In the second quarter of 2017, Japan posted an unexpectedly high annualized GDP growth rate of 4.0%, well above the 1.9% consensus of economists. The private sector was extremely strong with consumption up 3.7% and capital expenditures up 9.9%. Most people give exports most of the credit for Japan’s economic growth. However, these figures demonstrate that internal demand is the true driver of growth. Japan’s capital expenditures are now 16.0% of GDP, the highest level since the asset bubble days. This clearly shows that the Japanese economy is being fueled by investments.

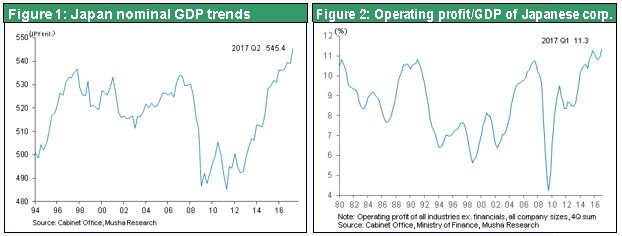

Total compensation of employees is a key element of personal spending. Although people have been concerned about slowing growth of wages, total compensation is increasing as the number of jobs climbs steadily. Significantly, companies are reporting strong earnings. Based on GDP statistics, the operating surplus is now at an all-time high of 11.3% of GDP. For the past two decades, Japan’s nominal GDP has been flat at approximately ¥500 trillion. But nominal annualized GDP rose to ¥545 trillion in the second quarter of 2017. The prolonged period of stagnation has come to an end as GDP is starting to post strong growth. Now the government’s GDP goal of ¥600 trillion in 2020 is within sight. The health of Japan’s economy shows that Abenomics is consistently producing results.

Both Japan and the United States view their low inflation rates as a problem. However, low inflation itself should not be a cause for concern. There is no need to rush to boost interest rates, therefore low inflation will allow the ongoing economic upturn to last even longer.

Stock investors are worried about the Trump administration’s ineptitude

Despite the sound economic fundamentals, stock markets have been volatile. The cause is uncertainty about political and geopolitical events. Although open-fire with North Korea is unlikely, market participants generally view this problem as an excuse to sell stocks. The ineptitude of the Trump administration is a bigger reason to worry.

When violence broke out between white supremacists and opposition groups in Charlottesville, Virginia, President Trump was critical of both sides. Some people interpreted this statement as a form of acceptance of white supremacists. This sparked criticism from Democrats and the media, which have long been critical of the president, as well as from Republican Party leadership and key individuals at the Defense Department. There was also criticism from members of the Manufacturing Council and Strategy and Policy Forum, which are policy advisory bodies formed by the president and consisting mainly of prominent businesspeople. As a result, President Trump was forced to dissolve the council and forum.

The rapidly increasing isolation of the Trump administration is creating a greater risk that US politics will stop functioning for a while. Activities for replacing Obamacare are at a standstill. Due to the resulting inability to obtain funding, the Trump administration has continued to push back tax reforms and infrastructure investments, two initiatives where expectations were high. Furthermore, the border tax idea has been discarded. Around the end of September, the United States will reach the final deadline for raising the debt ceiling, an issue that has been put off again and again. If Congress is unable to reach an agreement, there could be a default on US debt securities.

The so-called “Russiagate” problem is unlikely to lead to the impeachment of President Trump. However, financial markets can no longer retain their stability when the level of policy-making ineffectiveness reaches this magnitude. This situation may reach the point where markets will have to generate a warning signal in order to wake up the president and Congress.

Will Steve Bannon’s dismissal lead to evolution of the Trump administration?

Late last week, President Trump finally made the decision to fire Steve Bannon, who had been his chief strategist and one of his most trusted advisers. Mr. Bannon was at the heart of inward-looking US policies involving priority for white people, isolationism and protectionism. His statements were often a source of friction for the Trump administration. People are now watching closely for a big change in the nature of the Trump administration following Mr. Bannon’s departure. There are hopes for an evolution in the policies of the Trump administration and an improvement in relations with Congress. We may see activity involving economic policies that have been idle for some time. This could spark a big upturn in stock prices that are currently slumping.

In Strategy Bulletin No 177 (February 13, “The true nature of the Trump administration – Imperialism, not protectionism, an offensive rather than defensive stance”), I made the following point about the Trump administration. President Trump wants to make the United States strong, make the world safe and create jobs in the United States. Obviously, isolationism and protectionism would have precisely the opposite effect. Furthermore, it is inconceivable that radical discrimination could ever take hold in the United States, the most democratic country in the world. As a result, with progress of the Trump administration’s policies and a correction in the media’s misinterpretation, we can expect to see a rapid improvement in the administration’s three negative perceptions: isolationism, protectionism and discrimination.

In Strategy Bulletin No 179 (April 10, “Trump’s policies continue to evolve – The Trump rally is not over”), I made the following point. People will probably view the bombing of Syria as demonstrating the evolution and greater reliability of the Trump administration. President Trump stated that using inhumane chemical weapons to kill innocent children and babies crossed a lot of red lines. Taking this step dramatically alters the prior US strategy of working with Russia to destroy ISIS while affirming the existence of the Assad regime. At the same time, Steve Bannon was removed as a permanent member of the National Security Council. Mr. Bannon was opposed to overseas involvement and to bombing Syria because of his America-first stance. Moreover, at the US-China summit, President Trump stated that the United States may act on its own if China provides no cooperation concerning North Korea. Apparently, the Trump administration is in the midst of an enormous shift, abandoning its isolationist stance and returning the country to internationalism. US activities are an indication that the Trump administration is going back to being the world’s policeman, a role that the Obama administration had discarded.

The removal of Mr. Bannon demonstrates that his position of eliminating the possibility of military action against North Korea, a reflection of his America-first stance, is not consistent with the thinking of the Trump administration. This may be a sign that the administration’s agenda no longer includes the policies involving isolationism, anti-foreignism and protectionism backed by Mr. Bannon. If true, this is good news for the stock market. Moreover, this change may produce an evolution of the Trump administration’s economic policies. The start of this evolution would very likely trigger a resumption of the Trump rally within the next few weeks.