Jan 01, 2018

Strategy Bulletin Vol.192

Japan is very well positioned to welcome a new year

The foundation established during the Heisei era clearly positions Japan for a new era of prosperity

Happy New Year

Waiting for moonrise to launch a boat at Nikita Bay, the moon is up and the tide is in, now is the time to start rowing (poem by Princess Nukata in AD661)

Everything is in place for an energetic launch of Japan’s economy in 2018. I think this is the kind of year we can expect. Never during the past few decades has Japan entered a new year with so many favorable factors converging at once. This is why 2018, the last year of Japan’s Heisei period, is likely to be the starting point of a new era of prosperity.

The most serious risk factor of 2018 is not the United States, China or North Korea. I think the danger of underestimating the upside of the economy is the biggest risk. No signs of a break in the global stock market rally are in sight. Economies worldwide are healthy as countries enact friendly economic policies, companies report strong earnings and inflation remains subdued. Furthermore, Japan has stopped relying on a “number one strategy” that requires price-based competition. Instead, Japan is enjoying increasing success with a new business model, a so-called “only one strategy,” where companies compete solely on the basis of technologies and quality. Demand for Japan’s high-quality products is strong, whether for a variety of high-tech products or the consumer goods sold to foreign tourists in Japan. Nevertheless, Japanese stocks still have low valuations that do not reflect the success of this new business model.

The only explanation for the pessimistic view of many people is their failure to recognize the benefits of technological progress and the associated innovations. Progress in the fields of semiconductors and telecommunications has produced advances of 2.5 times over two years, 10 times over five years, and 100 times over 10 years. The result is an unprecedented surge in productivity with respect to both labor and capital. Companies are using this progress to generate earnings on an enormous scale. Interest rates have declined because companies are earning more money than they can use. Furthermore, prices are declining because of growth in the volume of goods companies can supply. In this environment, governments must enact policies that transform surplus capital into effective demand. Many industrialized countries are currently implementing reflationary measures. Taking these actions will eliminate the gap between supply and demand and subsequently create increasing upward pressure on prices and interest rates. I think these events will finally eradicate pessimism.

Musha Research

January 1, 2018

(1) Overview of the Economy in 2018

Is the inability to see the blind spot the actual blind spot?

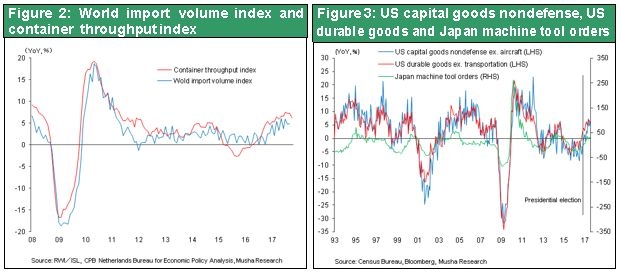

Worldwide economic expansion is gaining momentum and there are no indications at all of an impending slowdown. Forecasts for economic growth in the Japan, the United States and Europe in 2017 and 2018 have been revised upward by the IMF and many other organizations. Consumer spending and investments are climbing at an increasing pace. This is evident in numerous statistics. Examples include machinery orders in Japan, the semiconductor manufacturing equipment book-to-bill ratio, U.S. durable goods orders, and U.S. non-defense capital goods orders. Moreover, unemployment has fallen sharply in all industrialized countries and the supply-demand gap is steadily shrinking. These events will undoubtedly produce more upward pressure on wages and prices.

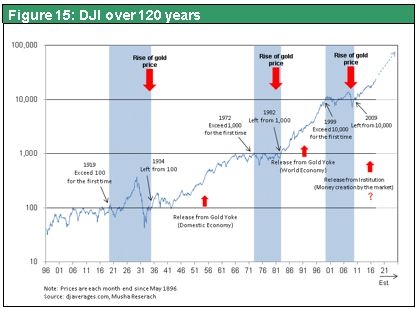

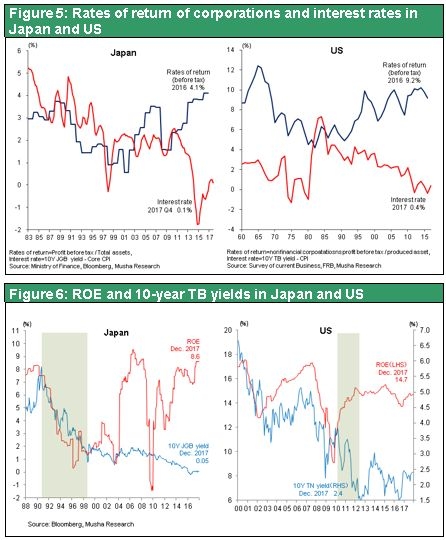

As for monetary policy, the United States and Europe are starting to move away from extreme monetary easing. Even Japan has reached the point of deciding not to expand monetary easing even more. Japan’s long-term interest rates have been declining for more than 30 years since about 1980. This downturn finally ended in 2016. In 2018, the upturn in Japan’s interest rates, although very slow, will probably become more pronounced. In the United States, which is leading interest rates upward, the supply-demand gap has narrowed significantly and upward pressure on wages and prices is growing. Additionally, the first major tax reform in 30 years, when Ronald Reagan was president, is likely to boost demand. No one can deny that this will make the dollar stronger. Earnings at companies are already very high as the new industrial revolution produces surplus profits. Overall, we can probably expect to see a continuation of the Great Rotation as investors shift their money from bonds to stocks.

The “seven” omen that sparked needless anxiety

Since the 1980s, seven has been viewed as a jinx because a crisis has occurred in every year ending with “seven.” But 2017 destroyed this jinx in a spectacular fashion. The world witnessed a series of positive surprises involving the economic fundamentals of all major countries. The new Trump administration, which had created the biggest worries, ended up having a positive effect on the economy and financial markets. Although President Trump’s approval rating has been low and media reports have been critical, U.S. stock prices have increased 25% since his inauguration. This is proof of the beneficial role of his administration. President Trump has consistently received solid support from the business community. The president is overseeing the easing of regulations and a continuation of monetary easing. Furthermore, he signed a massive tax reform bill at the end of 2017. The Trump administration was expected to be pro-business, and now these expectations have been met.

There were concerns about slower economic growth in China following the National Congress in October. But instead, China has stepped up high-tech investments and exports of many countries to China are rising even faster. Exports from Japan have posted particularly strong growth. In Europe, people are worried that populism will prevent governments from taking any meaningful actions. But instead, economic growth rates are climbing. Two main reasons are the limited impact of Brexit and the restoration of the ability of banks to create credit. In Japan, worries about the Moritomo Gakuen and Kakei Gakuen scandal weakening the Abe administration turned out to be pointless. In fact, Japan’s general election demonstrated that the public’s confidence in Prime Minister Abe had increased. North Korea’s nuclear threats have brought Japan and the United States even closer together while reinforcing Japan’s geopolitical position. Excessive pessimism was the biggest mistake of 2017. In 2018, the biggest risk will probably be underestimating the upside potential of the economy and financial markets.

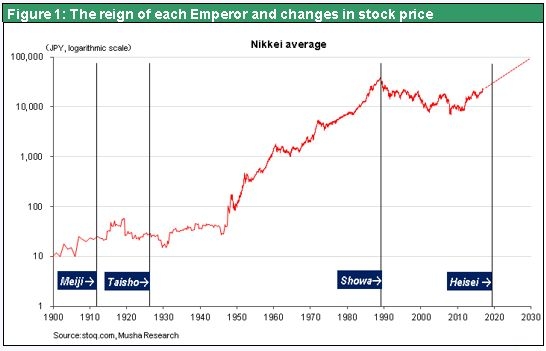

An excellent environment for investments – Most of all in Japan

Japan’s economy and stock market appear to be nearing a momentous turning point. Prospects are very good for the Japanese economy to keep expanding and set a new record in January 2019 for the longest period of continuous growth. Stock prices are also climbing steadily, including the record-setting consecutive16-day winning streak of Nikkei Average in September and October 2017, which may be worthwhile to be recorded in the Guinness Book. The Nikkei Average is now about half way back to its all-time high from the lowest point after this peak. If we believe the stock market adage that a half-way recovery will lead to a complete recovery, then we can expect the Nikkei Average to continue moving up to its 1989 all-time high of ¥38,915.

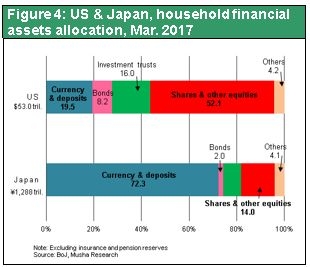

Investors in Japan are no longer worried about deflation and have abandoned their stance of avoiding all risk and seeking safety. Now investors are taking on more risk in order to earn higher returns. Cash and deposits, an extremely safe form of assets, account for about 70% of the financial assets of individuals in Japan. In the United States, assets with risk account for about 70% of individuals’ financial assets and safe assets are only about 20%. Only a small shift in the investments of individuals in Japan could produce an enormous improvement in supply-demand dynamics for stocks and spark a powerful rally.

Japan is benefiting from the global high-tech boom

In 2018, Japan’s high-tech sector is expected to end up ranking first regarding the country’s economic growth and investor interest for the first time in decades. We are at last seeing the full-scale emergence of global expenditures to build an infrastructure for the age of the Internet of things (IoT), which will encompass almost everything. In addition, China plans to make massive high-tech investments. China relies on investments to fuel its economic growth. But that also means ending investments would bring this growth to a halt, immediately creating an economic crisis. At this point, China has started making huge expenditures that are tightly focused on the high-tech sector.

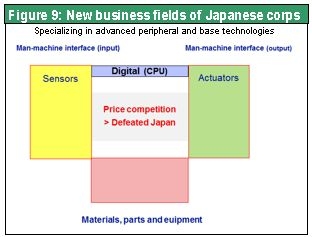

Japan is in an extremely advantageous position to benefit from this high-tech boom. No other country has an industrial infrastructure with almost all of the peripheral and base technologies required for more progress and innovation. China, Korea, Taiwan and Germany are all making high-tech investments. But companies in these countries depend on Japan for peripheral and base technologies. As a result, electronics companies in Japan have strengths that no competitor can match. These companies are leveraging these strengths to devise the best possible solutions for customers worldwide when this innovation boom arrives. In 2018, Japan’s superiority in the electronics industry is likely to start yielding significant benefits.

Japan’s growing popularity as a sightseeing destination

Increasing numbers of foreign tourists will probably contribute to the growth of Japan’s industries that depend mainly on internal demand. If balance sheet improvements backed by higher stock prices lead to more risk-taking, there will also be good reason for expectations about financial institutions with customer deposits bearing no interest.

(2) Underestimating the technology revolution is at the heart of pessimism

There is no mystery at all

The only possible cause for pessimism is the inability to recognize the significance of the technology revolution and the innovations made possible by new technologies. Semiconductor and telecommunications technologies have advanced by 10 times over five years and 100 times over 10 years, resulting in productivity growth on an unprecedented scale. The result has been prodigious profits and prosperity. Companies have earned more money than they can use, and surplus capital has brought interest rates down. Furthermore, growth in the ability of companies to supply goods has brought prices down. Consequently, governments need to take actions aimed at converting surplus capital into effective demand. Narrowing the supply-demand gap by creating more effective demand would boost inflation, increase the demand for investments involving products and finance, and push interest rates up. Japan has experienced a strong economy and corporate earnings accompanied by a lack of inflation and low interest rates. This situation does not exist in any textbook. But its existence is no longer a mystery. Japan has gone through several stages to reach this point: industrial revolution = rising productivity and earnings = rising supply of products and growth in excess capital and labor. Now there is an urgent need for initiatives that can create effective demand.

Overlooking this obvious fact, using low inflation and interest rates as an excuse for pessimism, and placing faith in anti-reflationary policies are all big mistakes.

Doing nothing about surplus capital and supply is dangerous – The critical need for reflationary policies

Allowing the current surplus of capital and the supply of goods to continue would be dangerous. The accumulation of idle capital and decline in interest rates signify that companies are not putting the money they earn to work. Idle money represents the self-denial of capitalism. Only government initiatives can solve this problem. Governments must bring excess capital back to the real economy by using fiscal, monetary and income measures. Otherwise, the economy will immediately stop growing. When excess capital is not used, stock prices will decline regardless of how much companies earn and eventually an economic crisis will begin.

The Abe administration has been taking these actions. When the Democratic Party of Japan was the ruling party (September 2009 to December 2012), Japan did just the opposite by enacting anti-reflationary policies. These policies were the reason that Japanese stocks were the world’s only losers as economies worldwide staged sharp rebounds following the global financial crisis. During this period, the yen was the only major currency that appreciated and the Japanese economy performed poorly. The Trump administration as well has the same clear policy channel for the use of fiscal and monetary initiatives to convert excess savings into demand. This is why no one should be surprised about the 25% stock market rally following President Trump’s inauguration.

(3) Japan’s new value creation business model: Japan as the only one

Shifting from “number one” to “the only one”

Japanese companies have established a business model that is completely in step with the new global business environment regarding geopolitics, new technologies and the industrial revolution, and globalization. Earnings have been rising rapidly as a result. Creating this new model has raised profit margins by giving Japan an extremely advantageous position within the international division of labor.

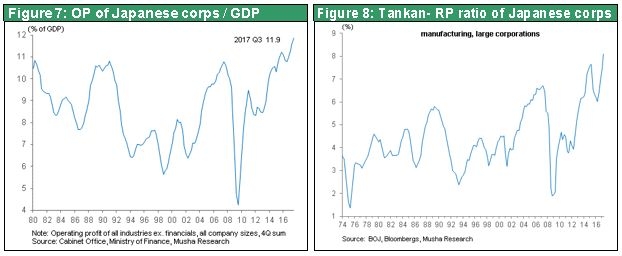

Earnings are increasing rapidly at Japanese companies. Currently, the operating income of companies in Japan is at an all-time high of 11.9% of GDP. Furthermore, the Bank of Japan Tankan forecasts an 8.11% ordinary income margin at large manufacturers in fiscal 2017. This is well above the 5.75% margin at the peak of Japan’s asset bubble (fiscal 1989) and the 6.76% margin immediately before the global financial crisis (fiscal 2006). However, Japan’s nominal GDP has been basically flat at about ¥500 trillion during the past 20 years. Why were companies able to improve profitability so much even as the economy remained lackluster?

Japan as “the only one”

Profitability improved because of the dramatic transformation of the business model used by Japanese companies. In the past, companies in Japan had the goal of being number one in their respective markets. Until the late 1980s, Japan was the leader in many key categories of manufacturing by relying on existing technologies and competitive prices. This was the age of “Japan as number one.” Eventually, this model was completely destroyed by US Japan bashing, the yen’s extreme strength, and competition from Korea and other Asian countries that copied the Japanese business model. Japan used to rule markets for key digital technology category products like liquid crystal displays, personal computers, smartphones, semiconductors and televisions. But now Japanese companies have largely disappeared from these markets.

Peripheral and base technologies associated with these digital products have been responsible for the recent growth in earnings at Japanese companies. Semiconductors and other key components are not the only items vital to digital functions. High-tech products also require sensors for the input of information processed by semiconductors as well as actuators (motors) and other interfaces that convert the conclusions reached by semiconductors into actions. In addition, manufacturing processes for digital products require base technologies involving materials, parts, devices and other items. Japan ended up a loser in market for finished electronic products and key components, which is the largest market category in the digital sector. But Japan was very successful at growing in the peripheral and base technology categories.

No more price competition – A focus on technologies and quality

Competition is intense in core market sectors where companies are making gigantic investments. China is making massive investments in these sectors to become the market leader. But these activities are certain to trigger heated price-based competition sooner or later. Having already lost in the market for finished products, Japan will be mostly immune from the effects of this competition. Japanese companies are instead active in market sectors where there are very few participants. This makes it possible to control prices. In many cases, Japanese companies are the only suppliers. Of course, these companies still have core technologies for semiconductors, liquid crystal displays, televisions, personal computers, smartphones and other digital technology products sold in Japan. Overall, Japan is the only country in the world with expertise in all three technology categories: core, peripheral and base.

Superior technologies and “the only one” strategy will give Japan a big advantage in the upcoming IoT era

All three technology categories will be vital to the fabrication of products that meet the needs of the age of IoT. Simply combining modules will not be enough to succeed. The IoT will demand the skill to refine and precisely integrate technologies. Success will also require making many items in small numbers rather than just a few items in large quantities. Furthermore, technologies will be concealed in “black boxes” to prevent copying. For research projects, companies will have to form teams that work diligently toward their goals. Utilizing feedback reflecting the needs of various customers will be essential to success in the IoT era, too. All of these requirements will make it very difficult for prospective competitors to catch up with Japanese companies in Japan’s “the only one” strategy product categories.

The Made in China 2025 plan for enormous investments is now under way in China, which is at the center of the global high-tech boom. Manufacturers of electronics, machinery and chemicals in Japan will benefit from this plan. This will be a brief but very powerful follow-wind for Japan. From a long-term standpoint, Japanese companies’ vulnerability to any negative effects of China’s massive investments will not be significant. This is because companies in Japan are no longer using prices to compete. By concentrating on technologies and quality, these companies have become the only ones in their respective niche markets, enabling them to control prices. This strategy also makes Japanese companies resilient to a stronger yen. The result has been strong earnings at companies in Japan in recent years.

The same “the only one” strategy that uses superior technologies and quality can also be employed in domestic-demand industries such as tourism and other services. People belonging to the increasingly affluent middle class of other Asian countries are visiting Japan in large numbers to buy high-quality products. According to some sources, Japan is now the most popular overseas travel destination for Chinese tourists. Furthermore, in 2017 Japan welcomed about 7 million visitors from South Korea, which is 15% of country’s population, and 4.5 million visitors from Taiwan, which is 20% of its population. Clearly Japan’s popularity in these countries has been rising rapidly, demonstrating the effectiveness of Japan’s “the only one” image among people in other countries.

(4) Japan’s political leadership is becoming stronger

The sole stable government in the free world

The strength of Japan’s geopolitical position is increasing because Japan has the most stable government in the free world. Only the Chancellor Angela Merkel in Germany has been in power longer than Prime Minister Shinzo Abe. The Abe administration’s leadership is evident in many ways, including making Britain a “quaisi-alliance” security partner and hosting a ministerial meeting of the U.N. Security Council chaired by Foreign Minister Taro Kono. In addition, Japan has played a central role regarding the Trans-Pacific Partnership after the withdrawal of the United States. In addition, Foreign Minister Kono demonstrated his stature in international diplomacy by becoming the first foreign minister of a major country to visit the Middle East after President Trump’s decision to move the US embassy to Jerusalem.

The Japan-US strategy of wariness about China

President Trump ended worries about his isolationist tendencies with his remarks at the Asia-Pacific Economic Cooperation summit in November 2017. Mr. Trump revealed his vision of a “free and open Indo-Pacific,” showing that the United States supports the Abe administration diplomatic doctrine called an “arc of freedom and prosperity.” On December 18, President Trump announced the US National Security Strategy. The strategy reaffirmed the confrontational US stance concerning China by naming China the biggest challenger concerning the international order led by the United States.

At the US-China trade negotiations that are now under way, United States Trade Representative Robert Lighthizer, while indicating that Section 301 of the US Trade Act may be used, has asked China to correct its unfair trade practices. Massive imports of Chinese goods by the United States have been instrumental to China’s consistently high economic growth rate. The US trade deficit with China was $347 billion in 2016, about half of the overall US trade deficit. Also, the annual US current account deficit has been equivalent to about 2% of the US GDP during the past decade, an enormous number. Therefore, China has been taking advantage of the friendly US trade relationship to make its economy stronger. Moreover, the National Security Strategy includes the statement that the modernization of China’s military power and the country’s economic growth are due in large part to exploitation of the US military and US economy. A major shift in US policy concerning China appears to be inevitable.

No significant points of economic contention exist between the United States and Japan. Although Japan has a big US trade surplus of $68.9 billion, this is less than one-fifth of China’s trade surplus. Japan has opened up large parts of core components of its economy to the United States and greatly relies on the United States in these sectors. US companies have very strong positions in Japanese markets for many products. Examples include the internet, smartphones, aerospace, advanced military equipment, MPUs and other semiconductors, and financial services. In addition, Japan is providing capital to the United States as a holder of more than $1,000 billion of US Treasury securities. The current situation is nothing like the US-Japan trade friction of the 1990s. From the US viewpoint as well, the US-Japan relationship is an ideal mutually complementary division of roles. Nevertheless, the United States complains about Japan’s trade surplus from time to time. This appears to be to some degree merely a US alibi for fairness in order to retain a tough stance toward China.

Are economic factors behind the cooling of China-Korea relations and the rapid improvement in Japan-China ties?

A significant improvement in relations between Japan and China has taken place since the National Congress in October. The most probable explanation is that President Xi Jinping no longer needs to fear criticism about being weak about criticizing Japan now that he has reinforced his power base. Even if this is true, then why has China moved closer to Japan even though Japan is still critical of China’s hegemonic aspirations? The only answer is that China needs Japanese technology. China cannot accomplish the goals of its plans for making its manufacturing sector more powerful and high-tech without peripheral and base technologies from Japan. The proof is the fast growth in imports from Japan since China unveiled its Made in China 2025 plan in 2016. China has increased these imports faster than its imports from Korea, Taiwan, Germany and all other major countries.

China’s relationship with Korea has deteriorated rapidly following deployment of the THAAD missile defense system. Korean media companies reported that President Moon Jae-in received an extremely cool welcome when he visited China in December. China’s restrictions on travel to Korea have dealt a severe blow to the country’s tourism industry. At this time, Korea is China’s biggest competitor. But the Korean economy is highly dependent on China. This asymmetric relationship is the backdrop for the current friction. China accounts for 25% of Korea’s exports, a far higher share than any other country. Korea is also the largest source of China’s imports and Korea has a trade surplus with China.

These points explain why the success of “the only one” strategy at making Japanese companies competitive again is also making Japan’s geopolitical position much more powerful.

(5) Risk is limited

It is difficult to envision any risk factors that could trigger an economic recession or stop stock prices from climbing in 2018. Potential risk factors are monetary tightening in the United States, slower economic growth in China, a military conflict targeting North Korea and the public-sector financial collapse in Japan. But as is explained below, there is probably no need to worry as long as we are looking only at 2018.

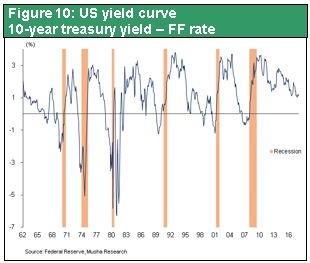

1) Risk of US monetary tightening

The only risk is that the Fed’s interest rate hikes fall behind the curve resulting in excessive tightening to catch up. But the Fed has already implemented five preventive rate hikes and is starting to downsize its balance sheet. Consequently, the possibility of excessive tightening is very small. In the postwar era, US recessions have started only when long and short-term interest rates were upside-down. At present, there are almost no signs of the conditions needed for a yield curve reversal. The primary cause of this reversal is inflation that moves up at an increasing speed. But this is very unlikely to happen. As long as there are no policy mistakes, prospects are excellent for the US economy to continue growing for two more years and possibly for even five more years.

On the negative side, the US economy in 2018 will be influenced by tax reforms and reductions and there may be substantial infrastructure expenditures. The growth of public-sector demand may tighten the balance between supply and demand, which has been sound up to now, and cause inflation to climb.

2) A serious financial crisis in China can be prevented

China’s economy continues to expand at a rate of more than 6% with the backing of high-tech investments and public-sector expenditures like construction of the Xiongan Special Economic Zone. Now that China has become the world's second largest economy and a middle-income country, it is impossible to sustain 6% growth. However, China will have to continue relying on public-sector investments to support the economy in order to prevent an economic crisis caused by slowing economic growth, which is what happened in 2015. Reliance on these investments poses the risk of surplus factories and other facilities, unprofitable social capital, and an increase in loans that may not be repaid. The central government can intervene to prevent bankruptcies of companies and regional governments. Also, the central government, which has most of the country’s power, has the ability to rescue zombie companies by issuing an unlimited amount of money. If necessary, the government can even conceal or manipulate statistics and financial data. But this raises the question of whether or not China can contain a crisis forever.

The trade surplus falls as capital controls become tighter

Investors should keep a close eye on China’s cross-border payments balance in order to know when and where a crisis is about to begin. This number can be obtained from the international balance of payment statistics and external asset and liability data that China announces quarterly.

Changes in the level of foreign exchange reserves are important because they are linked to the cross-border payment balance. Until 2014, a trade (current account) surplus and gigantic inflows of capital due to money from overseas fueled China’s economic growth. Now the trade surplus is falling at an annualized rate of 20% and the inflow of capital has stopped. The situation concerning foreign currencies has undergone a dramatic shift as a result. In 2017, China was barely able to avoid a downturn in its capital account balance by restricting capital transactions, holding down overseas investments and limiting the amount of foreign currency taken out of the country. Due to these actions, foreign exchange reserves remained mostly level at over $3,000 billion. Even tighter capital controls will probably be needed in 2018 because of the outlook for a further downturn in China’s trade surplus. There are two main reasons for the lower trade surplus. First, the cost of labor in coastal China is higher than in any ASEAN country, making China’s exports less competitive. Second, China’s substantial investments in the high-tech sector are producing a large and unavoidable increase in imports. The declining trade surplus is therefore a structural problem.

Allowing the yuan to weaken is not an option

China would like to devalue the yuan in order to reduce its high cost of labor. But this step would create a problem by further lowering China’s capital inflows. Even worse, thoughts of a weaker yuan bring back memories of the country’s currency crisis that happened only a few years ago. Furthermore, the United States is very wary of a yuan devaluation as trade friction with China heats up. During the election campaign, President Trump promised to immediately name China a currency manipulator. If he does this, the result could be a series of serious retaliatory US actions to punish China. The conclusion is that keeping the yuan at its current overvalued level is China’s only option. However, a strong yuan is certain to result in even tighter capital controls and a further downturn in capital inflows. This will probably cause a rapid decline in China’s international financial strength. However, these events are unlikely to trigger an immediate crisis. US interest rate hikes in 2018 will create a problem for China by increasing upward pressure on capital outflows. But this is probably a problem that China can handle.

The foreign exchange market is China’s Achilles heel

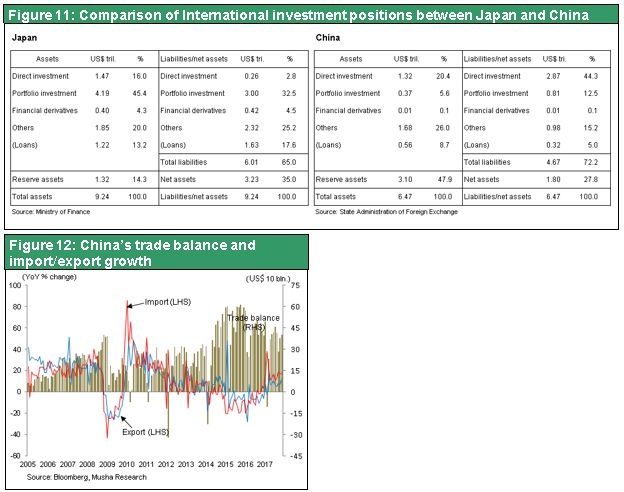

The amount of external assets and liabilities are a key indicator of a country’s true financial strength. But this is a major weakness in China. Foreign exchange reserves are enormous in China. These reserves are the largest in the world and almost three times more than in Japan. This would appear to make China the world’s most powerful country in terms of international financial strength. In fact, as you can see in Figure 11, debt represents approximately half of China’s foreign exchange reserves. China is highly reliant on overseas capital (investments and loans from other countries) to fund domestic investments. This clearly sets China apart from Japan, which also has substantial foreign exchange reserves. Japan has funded economic growth entirely with internal sources (savings) while China has funded growth by accumulating overseas debt. At some point, other countries may start asking China to return the investments and loans that were used to support its economic growth. If this money leaves China, a severe currency crisis would begin immediately. This vulnerability is a major weakness of China’s economy.

3) The North Korea crisis will not cause a global recession

Rational thinking about North Korea results in the conclusion that a military confrontation is not a possibility. A preemptive strike by North Korea is inconceivable because the counterattack would decimate the country. The United States, as a democracy, is unable to make a first strike because of the outlook for the devastating loss of lives due to a North Korean counterattack. Many people fear that a mistake could spark a war. But this is impossible, too. Both the United States and North Korea want to avoid full-scale hostilities. There is no doubt that preparations for a war that begin with a mistake would be stopped at some point.

The sole possibility for an attack is if the United States becomes confident that it can very quickly eliminate North Korea’s ability to counterattack. But an attack of this nature would probably not have a serious negative impact on the global economy. Moreover, a preemptive US strike would almost certainly result in more economic pressure from China that would force North Korea to establish a new government under China’s oversight. Preventing the destruction of North Korea and loss of government stability is in the best interests of the United States, China and South Korea.

4) No need to worry about Japan’s own problems: Government debt and criticism of debt financing by the BOJ

The senselessness of debating financial soundness from the balance sheet side alone

Japan’s public-sector debt problem has become somewhat of a slogan for the country. But there is absolutely no need for concern from a short-term or a longer-term standpoint. Even though the government has more liabilities than assets, households and companies have a large volume of surplus savings. As a result, Japan’s overall assets are far more than the country’s total debt. This is the most important fact of all.

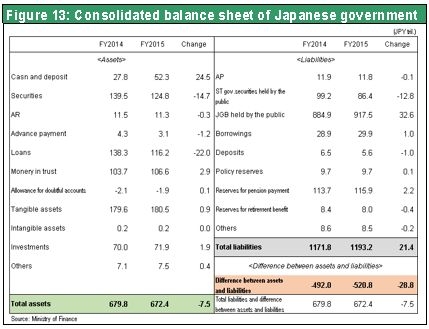

Japan has the world’s soundest external balance sheet (external assets and liabilities). Japan’s net external assets total $3,200 billion, almost twice China’s net external assets. Some people think there is a problem with public-sector financial soundness in Japan based solely on the liability side of the balance sheet. But this is a largely baseless view. The Japanese government has a massive volume of tangible assets like expressways and a huge amount of foreign currency-denominated bonds and other assets (these assets total ¥670 trillion based on Ministry of Finance data) that underpin foreign exchange reserves of more than $1,000 billion. Deducting these assets from the government’s debt of ¥1,200 trillion results in net debt of ¥520 trillion, less than half of the total debt based on government data. Total debt is 2.23 times Japan’s GDP but net debt is only 97% of GDP. In Europe and the United States, net government debt is generally between 80% and 90% of GDP, so Japan’s level of debt is not extreme.

Japan has the world’s lowest interest rates (based on government bond yields). This is proof of the confidence that financial markets have in the Japanese government as a sound investment. Greece is the world’s largest debtor country and it has the highest interest rates. But Japan can borrow money at a very low cost. This demonstrates the financial health of Japan after combining public-sector debt with the extremely high level of surplus savings in the private sector.

Debt financing by the BOJ – Evaluation should be based on whether to promote or suppress private-sector value creation

The BOJ has dramatically expanded its assets (by issuing more money) and now holds approximately ¥400 trillion of Japanese government bonds. Many people are critical of the BOJ’s actions to finance the government’s debt. But perhaps these BOJ bond holdings should not be regarded as government debt because the BOJ is part of the Japanese government. If we accept this view, then the actual government debt falls to ¥120 trillion, the result of deducting the BOJ’s ¥400 trillion of government bonds from total net government debt of ¥520 trillion. This figure can be used to say that there is no reason at all to worry about the Japanese government’s debt.

Assets of the BOJ can be used to offset government liabilities. After all, the BOJ has the authority to procure funds at no cost by issuing money. Therefore, some people argue that the BOJ can repay government debt by issuing money, which obviously has no repayment obligation. There is no problem with this thinking in theory. But there is a danger of hyperinflation as the BOJ prints vast quantities of currency. This would cause Japan’s productivity to fall and reduce the ability to create private-sector income. Ultimately, Japan’s economy could collapse.

The decision about financing government debt is a private-sector issue that depends on whether or not the private sector is able to create value. Japan’s private sector is generating a sufficient amount of value and becoming even stronger. Therefore, Japanese currency will not lose its value due to its ability to produce value. Even if we assume that the yen’s value plunges because of hyperinflation, the already strong competitive position of Japanese industries will become even more powerful. This would further enhance Japan’s ability to create value. Mongolia was the first country in the world to issue non-convertible currency. People lost confidence in this currency immediately prior to Mongolia’s collapse. Consequently, the loss of a currency’s value means that the country issuing that currency can no longer create value. In other words, the country can no longer exist. There is no doubt that Japan is nowhere at all near this point.

Hyperinflation quickly makes debt disappear

Printing more money to finance government debt is regarded as harmful because it leads to hyperinflation. More money definitely lowers a currency’s value. But a weaker currency immediately produces a dramatic drop in government debt. All of these points support the conclusion that there is no sound basis for any worries about Japan’s government debt and the large volume of BOJ assets.

(6) A new era in Japan after the emperor’s abdication

The Heisei Era has already determined the direction of the new era

Years in Japan will start using the name of a new era following the abdication of Emperor Akihito on April 30, 2019. This will effectively make 2018 the last year of the Heisei period. Let’s take a look back to see what happened in Japan during this era that covered three decades beginning in 1989.

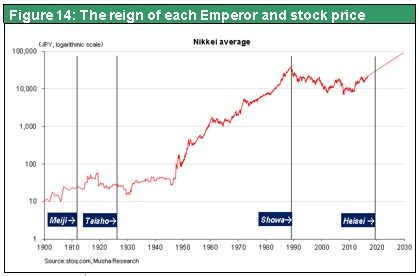

Figure 14 shows the close link between changes in the reigns of emperors and turning points in the eras of progress in Japan. The end of the Heisei period signals the start of an entirely new era for Japan. And events during the Heisei period are what will determine what the next era will look like. Were the 30 years of Heisei a time when Japan increased debt to build a foundation for the future? Or was this a period of accumulating assets for the future? The outlook for the next era hinges on the answers to these questions.

Musha Research believes that the Heisei era was a time for cleaning up the distortions and pandemonium that accompanied Japan’s period of rapid economic growth following the war. Japan became more humble and earned the respect of the world as a responsible global citizen. Overall, this was a time when the people and companies of Japan learned the proper posture for achieving sustained growth. This progress is a precise reflection of the characteristics of Emperor Akihito himself. Most significantly, Japan built a strong foundation for future growth during the second half of the Heisei period. The country’s above-mentioned strategy of “the only one” was firmly established and Japanese companies achieved a remarkable improvement in their ability to create value.

A big reversal of how people view the Heisei era is inevitable

2018 is very likely to be a year when unmistakable signs emerge of Japan’s upcoming stage of prosperity in the period of the next emperor. Right now, the overwhelming view of the 30-year Heisei era is that Japan created a burden for future generations as government debt grew and the population declined. But this perception is clearly a mistake. People are likely to see this mistake in 2018, Heisei’s final year.

Japan will probably be in a celebratory mood as the change of eras nears because the new era does not mean that the previous emperor died. This atmosphere is expected to have a big positive economic impact and could bring an end to the pervasive pessimism of the Japanese public. Japan may even see the return of the atmosphere of optimism that existed soon after the end of the World War II as people were freed from the horrors of the war years.

Major characteristics of eras of modern Japan

- Meiji/Taisho – The dawn of a modern Japan, international relations centered on the Japan-Britain alliance

- Early Showa (1926-45) – Failure of modern Japan and conflict with the world’s superpowers

- Late Showa (1946-89) – Postwar recovery and remarkable prosperity, Japan as number one, Japan-US alliance during the Cold War

- Heisei (superficial view) – Dramatic correction during Japan’s “lost 20 years,” lack of growth for 20 years, Japan as the world’s only loser as nominal GDP remains flat at ¥500 trillion, Japan-US alliance continues, but probably only to prevent Japan from becoming a military power, Japan-US trade war, extreme yen appreciation, Japan bashing

- Heisei (the truth) – Progress with sophistication (modesty, humility, social responsibility, cultural advancement, public manners), creation of a new business model (avoid competition by supplying products as “the only one”), establishment of a framework for rapid growth in the future, strong and rapid rebound from a plunge in stock prices

- The new era – Global citizenship, new economic prosperity, focus on Japan-US relations amid the US-China confrontation, the most important alliance partner of the US, the world’s most powerful country, the world’s most powerful country that does not seek hegemony

Looking ahead to even more ambitious dreams

Now that deflation has ended, the fair value of Japanese stocks for the time being is probably at a level where dividend yields would be equal to the 10-year government bond yield. That translates into a Nikkei Average between ¥30,000 and ¥40,000. Since the economic climate is favorable, as was explained earlier, prospects are excellent for the Nikkei Average to approach ¥30,000, the lower end of the fair value range, by the end of 2018. Next, stock prices may continue climbing to the ¥40,000 range by 2020, when Tokyo will host the Summer Olympics. The current rise in stock prices may very well be the beginning of a bull market of historic proportions. During about the first 10 years of the reign of the next emperor, the Nikkei Average could climb all the way to ¥100,000. The average annual increase in this index would be about 11% if the index reaches ¥35,000 or ¥40,000 in 2020 and about 9.5% if the index reaches ¥100,000 in 2030. These numbers are not necessarily out of reach after taking into account the fact that stock prices in Japan have not increased at all for 30 years. Incidentally, the Dow Jones Industrial Average has increased by a multiple of 13 during the past 30 years, which equates to an average annual gain of 9.0%.