Sep 05, 2018

Strategy Bulletin Vol.207

Japan will clearly be a beneficiary as the US-China trade war continues

(1) The contrast between US-China alienation and warming Japan-China relations

Both parties, the media and the academic sector are all critical of China

The nature of the US-China battle for hegemony has become clear. The United States has apparently rolled the dice and started going down a path of no return. Now, there is mounting rejection of China in the United States in both major political parties, the media and the academic sector.

The Trump administration has rapidly enacted a series of sanctions on China. Prime examples are tariffs on $50 billion of imports from China and more tariffs to cover $200 billion of goods from China. In addition, Mr. Trump expressed US may add another 267 billion of Chinese imports which make up all imports from China last Saturday. The Trump administration is likely to continue its attacks on China even if concessions from China end the trade war for the time being. President Trump has plenty of excuses to apply more pressure on China, such as China’s violations of sanctions on North Korea and sanctions on Iran. Stopping China’s unfair trade practices is not the only objective of the trade war. The United States is also making geopolitical demands in order to stop China’s hegemonic rise. To accomplish this, the United States will have to lower China’s position within the international division of labor and is probably willing to do whatever is needed.

No compromise on suppressing China’s emergence – Semiconductor negotiations demonstrated the no-arguments US stance

The US-Japan trade war between 1980s and 1990s is an excellent illustration of how the United States reacts when there is a sense of crisis involving national security. At that time, Japan had to be contained because it was threatening the US industrial base. The United States targeted Japan with numerous measures. One step was the establishment of voluntary restraint agreement in order to suppress the sharp increase in the US market share of Japanese automobiles. Although there was no US restriction on the number of vehicles imported, Japan agreed to limit annual exports to the United States to 1.68 million vehicles each year. By doing this, the United States labeled Japan as the villain and avoided any damage to its own reputation.

For the US-Japan semiconductor friction, the United States was even more adamant about refusing to hear arguments. First was the use of allegations about semiconductor dumping to enact punitive tariffs on three items (PCs, power tools and TVs) that had nothing to do with semiconductors. Then the United States went farther by including a provision in the US-Japan semiconductor agreement (1991 version) requiring Japan to accept a market share of at least 20% for semiconductors made in other countries. Japan was forced to accept the high-handed demand to raise the domestic market share of US semiconductors from 2-3% to 20%. There were also lawsuits concerning the alleged theft of US intellectual property by NEC and other Japanese companies. The aim was to make Japanese semiconductor companies lose the will to fight and the United States succeeded. These actions revived the US semiconductor industry, which had been on the verge of collapse. And Japan became weak almost to the point of its destruction. Assuming the current sense of crisis in the US against China being far much stronger than it was during the trade war with Japan, the United States will probably keep implementing intense measures one after another.

China is unable to face off against the United States because it is China’s biggest customer by far. Consequently, China will probably have no other option than to step up US criticism while maintaining a restrained stance.

Xi Jinping’s abrupt shift regarding Japan – China’s “smile diplomacy”

A dramatic change has occurred in China’s stance regarding Japan. China is moving closer to Japan. Chinese Premier Li Keqiang’s first visit to Japan resulted in the resumption of a Japan-China economic dialogue for the first time in eight years. Talks about monetary cooperation centered on a currency swap agreement is moving forward. Furthermore, Prime Minister Shinzo Abe plans to visit China on October 23, which will be his first Chinese trip following his reelection as prime minister in Dec. 2012, for a grand celebration of the 40th anniversary of the restoration of Japan-China diplomatic relations. President Xi Jinping is considering a trip to Japan in 2019.

Criticism of Japan in China has completely stopped. In August, Shanghai Normal University had planned to hold a large international symposium about wartime “comfort women.” But China’s Ministry of Foreign Affairs ordered the university to cancel the event. In addition, there are media reports that the Chinese government told fishermen in the provinces of Fujian and Zhejiang provinces in early August to stay away from the Diaoyu Islands in Japanese Senkaku Island. In 2017, the government was still urging owners of fishing boats to operate in that area. It is informed by some media that the Chinese government has been given fishing boat owners subsidies for fuel to reach the islands. So, this is an enormous shift.

Also notable is the absence of highest-ranking Chinese government officials at national events that are critical of Japan. Officials did not attend the July 7 event to commemorate the Marco Polo Bridge Incident and the September 3 event to commemorate the WWII victory over Japan. In 2015, China marked this victory with a large military parade and invited foreign leaders to attend. Furthermore, there are media reports of a sudden surge in the popularity of Japanese culture in Shanghai. Also, Japan is becoming popular as a destination for Chinese tourists. Holding down criticism of Japan has released the pent-up admiration of and longing for Japan that has existed just out of sight in China.

US demands may reach the point of effectively asking for China’s regime change

There is no doubt that Japan and China are moving closer together as animosity in the US-China relationship grows. This situation will probably have to continue until China accepts all US demands in order to return US-China relations to normal. There are several categories of changes in China’s stance that the United States would accept. First is the denial of the duplication and dominance of Communist Party, government, companies, and its reorganization. Second is a complete solution for ending China’s so-called free ride. This includes the protection of intellectual property rights, the end of government subsidies to companies, transparency for accounting statistics, the full deregulation of foreign exchange and other actions. Third is the restoration to their original condition of China’s man-made islands in the South China Sea and the removal of buildings on these islands. Taking these actions would be a repudiation of the foundation of the regime of President Xi Jinping. Going one more step, the United States may even ask for a timetable for the termination of dictatorial rule by the Communist Party. But these changes will take a long time. The Xi Jinping administration cannot avoid a weakening of its power base due to the difficulty of responding to US demands.

(2) New ramifications are already appearing on the microeconomic level – Japan is benefiting from the US-China fight

At the microeconomic level, signs are emerging of four changes associated with US-China tension: (1) A decline in the status of China in US markets; (2) The emergence of countries that are supplying goods to offset China’s decline; (3) A decline in the positions of US companies in China; and (4) The increasingly advantageous position of Japan due to collateral benefits created by the US-China trade war. At this stage, there are merely indications that these four trends may begin. But these signs will probably become increasingly clear in the coming months.

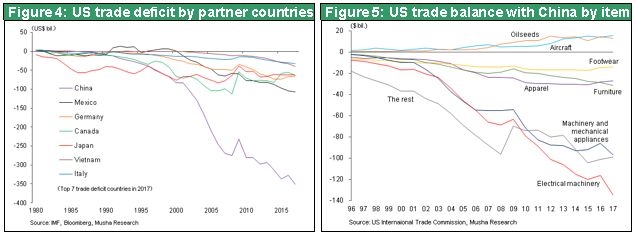

1) A rapid decline in China’s position in the US market for goods

The imposition by the United States of a 25% punitive tariff on imports from China worth $250 billion would severely damage China’s competitive edge as a manufacturing base. Many companies would probably start thinking about leaving China. The United States is watching China closely to be certain the country does not devalue the yuan to offset the impact of higher tariffs. As a result, Chinese companies that export goods to the United States would no longer be competitive due to the higher cost of doing business. Furthermore, based on the 2019 National Defense Authorization Act, ZTE and Huawei have been barred from selling goods in the United States due to national defense considerations. Australia is likely to take similar actions. We may even see measures to shut out specific companies. In addition, by giving the Committee on Foreign Investment in the United States (CFIUS) more power, the National Defense Authorization Act makes it more difficult for Chinese companies to acquire US companies. Already, this act has been used to reject the acquisition of Qualcomm (the world’s largest supplier of smartphone chips and applications processors; market is dominated by Qualcomm and Apple, with 42% and 22% market share respectively) by Broadcom, a company that was based in Singapore but has completed the transfer of its head office to the United States. Also, even before its authority was strengthened, the CFIUS used the National Defense Authorization Act to block the acquisition of Micron Technology by China’s Tsinghua Unigroup.

2) Growth of output in regions that will replace China’s production

Since total demand in the United States is unlikely to decline, a decrease in the supply of goods from China will result in higher exports to the United States from other countries or an increase in US production. In either case, manufacturing activity in countries other than China will increase. For example, Ford has cancelled its plan to export vehicles made in China to the United States. Micron Technology’s decision to build a US factory is another example of how US companies are bringing production back home. Furthermore, Foxconn plans to establish a liquid crystal display production facility in the United States. In 2015, Foxconn announced its “make in India” plan to build 10 to 12 factories that would create one million jobs in India. Foxconn says that this project is moving forward as planned. An article in the June 12 Nihon Keizai Shimbun reported that Amazon, Microsoft, Google and IBM announced plans to establish technology development bases in Taiwan and create an infrastructure for the supply of IoT terminals. The article noted that these events show that the business model based on collaboration between US IT companies and EMS companies in Taiwan is about to become even stronger. After performing a review of its global silicone production infrastructure, Shin-Etsu Chemical has decided to raise output capacity by more than 50%. This growth will exert pressure on silicone factories in China. Shin-Etsu Chemical plans to suppress production at silicon factory in China which has continued to increase production till now and boost production of silicone monomer, the intermediate product of silicones, in Japan and Thailand and raise production of finished silicone products in the United States, the Netherlands, Korea and China. Asahi Kasei has announced the shift of production of resin raw materials for sale in the United States from China to Japan.

3) The declining presence of US companies in China

US companies may be forced to accept a downturn in their market shares in China. Signs of market share loss are appearing in the automobile market. Ford and General Motors do not have strong positions in Japan, Europe and other overseas markets. However, US automobiles consistently have a market share of almost 10% in China. There are suspicions that the Chinese government is supporting US automakers in some way. China has the goal of developing energy-efficient electric and plug-in hybrid vehicles by 2020. But this project is apparently encountering problems. Additionally, there are media reports that General Motors is experiencing difficulties involving electric vehicles because the performance of batteries from a Chinese government-certified supplier did not meet the required standards. As retribution for the trade war started by the United States, China may shift from Boeing to Airbus and from Caterpillar to Komatsu and the three big Chinese industrial groups. Google pulled out of China because of censorship concerns. But subsequently, Google decided to accept censorship and now plans to resume activities to enter China. This decision sparked strong criticism of Google in the United States.

Progress will probably be very fast with regard to China’s measures to end its reliance on advanced technologies in the United States. There is an urgent need for China to meet its demand for semiconductors with internal production. China is the world’s base for the production of high-tech products. For instance, China plans to increase smartphone production even more. Despite this position, China is very dependent on imported semiconductors. China’s semiconductor demand has grown from $42 billion in 2005 to $138 billion in 2017, an increase of 3.3 times. At the same time, semiconductor production in China has increased from $2.5 billion in 2005 to $18.5 billion in 2017. During this period, China’s semiconductor self-sufficiency has increased from 6% in 2005 to a still-low 13.4% in 2017. Low self-sufficiency is definitely the Achilles heel of China’s supply chain.

The United States blocked the supply of semiconductors from US companies to ZTE because the company allegedly violated Iran sanctions. This created a bankruptcy crisis at ZTE. As a result, China is probably even more aware that reliable supply of semiconductors is a lifeline. China is currently making massive investments for the domestic production of semiconductors. Investments are centered on Tsinghua Unigroup, a government-owned company that originated at Tsinghua University. Tsinghua Unigroup plans to make enormous investments that include $24 billion dollars at Wuhan (for 3D NAND production), $30 billion at Chengdu (for DRAM production) and $28 billion in Nanjing (for contract manufacturing) (Japan Business Press, Takashi Yunogami, 3.1.2018). The question is which companies will meet this enormous demand for equipment. The answer is clear. US and Japanese companies dominate the global market for semiconductor manufacturing equipment, with the exception of lithography units. If the United States refuses to sell China semiconductor manufacturing equipment due to national security considerations, Japanese producers of this equipment would be forced to fill this gap. As China becomes increasingly wary of the United States, increasing reliance on Japan may be the country’s only option.

The world is now on the verge of the 5G communications era, which will be 100 times faster than 4G. The biggest question is who will control China’s smartphone market. Until recently, Huawei, ZTE, Xiaomi, OPPO and other Chinese manufacturers have been capturing market share. Samsung has been largely driven out of this market and Apple’s market share has fallen sharply to 11%. If nothing changes, Apple’s share of China’s smartphone market could fall much more. But Apple may be able to come out ahead of Chinese companies by launching new 5G-compatile phones. The general view is that Huawei is ahead of the other companies in the development of 5G smartphones. However, US companies can probably retain their virtual monopoly in the market for applications processors, which are a key semiconductor device in smartphones. Consequently, we may witness a resurgence of Apple’s superiority as the sole smartphone manufacturer that fabricates its own applications processors.

4) Collateral benefits for Japan due to the US-China trade war

While US automobile companies are having difficulties in China, Japanese automakers are stepping up their investments in China. The reason is that Japanese automakers are increasing their share of the Chinese market while the share of US automakers stays flat. Nissan has decided to add an eighth assembly plant in China, which will have annual output of about 120,000 vehicles, and plans to make investments of about 1,000 billion yen with its joint venture partner Dongfeng Motor between now and 2022. Toyota plans to launch 10 models of electric and plug-in hybrid vehicles in 2020 in order to raise its market share in China. Toyota plans to sell 1.4 million vehicles in China in 2018 but currently has production capacity of 1.2 million vehicles. To raise output, an expansion project is under way at a cost of $258 million. Clearly, Japanese automakers are increasing their market share in China and are expanding operations in China. Nissan’s sales in China are almost the same as in the United States: US sales were 1.59 million vehicles and Chinese sales were 1.52 million vehicles in 2017. The same year, Toyota sold 2.43 million vehicles in the United States and 1.29 million vehicles in China. At Honda, the United States accounts for 30% of global sales and China is almost the same at 28% (Wall Street Journal, August 28).

The Wall Street Journal has reported that suddenly the popularity of made-in-Japan products in China is rising. The growing middle class of China and other Asian countries wants products from Japan because a “made in Japan” sticker is a symbol of high quality and sophistication. In fact, some Chinese consumer product companies have started manufacturing operations in Japan in order to benefit from the “made in Japan” popularity. Casio is another example. This company started to increase output in Japan of its G-Shock watches, which had been fabricated in China and Thailand. Switching to Japan was obviously a response to the popularity of products made in Japan (Wall Street Journal, August 20).

Nowhere is the made-in-Japan popularity stronger than in the cosmetics sector. In 2017, Japan’s cosmetics exports to China surged 50% to 210 billion yen and growth is continuing at this pace in 2018. To meet this demand, Shiseido has constructed its first new factory in Japan since 1985. Kao plans to increase the number of stores in China selling its Kanebo cosmetics from the current 1,000 to between 2,000 and 3,000 by 2020 (Wall Street Journal, August 30; Nikkei Sangyo Shimbun, Sept. 3).

Furthermore, high-tech companies in Japan have established advantageous positions. As I will explain later, companies in Japan dominate the core technologies and peripheral technologies that are vital to the operations of mega-players in high-tech industries.

A dramatic advance is about to take place in the global mobile communications base station market as 4G is replaced by 5G, which is 100 times better in terms of communication capabilities. This switch will create enormous opportunities for Japanese manufacturers of communications equipment. Today, China’s Huawei and ZTE have a 41% share of the base station market. Other major suppliers are Nokia and Ericsson. The United States and Australia have shut Huawei and ZTE out of their markets. The result is opportunities for Japanese companies to enter this market. For example, Mitsubishi Electric has developed a dedicated device that dramatically boosts communication speed (e-Nikkei Shimbun, Sept. 4).

(3) The god of good fortune is smiling on Japan

In addition to the benefits I have just explained, Japan is now the beneficiary of the US-China trade war. The inability of Japanese companies to be price competitive due to US bashing of Japan and the extreme appreciation of the yen was responsible for the remarkable growth of the high-tech industries of Korea, Taiwan and China. Samsung Electronics and Taiwan Semiconductor Manufacturing received collateral benefits of this Japan bashing. Now, companies in Japan are in an excellent position to receive collateral benefits.

The new NAFTA and US-EU agreements will be good for Japan

The previous NAFTA prompted US, Japanese, German and Korean manufacturers to move their factories to Mexico. Mexico’s automobile output and exports to the United States were expected to increase rapidly. In fact, automobile production rose from 2.26 million vehicles in 2010 (including 1.86 million exports) to 3.46 million vehicles (including 2.76 million exports) in 2016. In 2017, production was 3.77 million vehicles with a big increase in exports to 3.10 million largely responsible for the increase. Based on plans for increasing output, it was expected that automobile production in Mexico would probably be more than 5.80 million vehicles in 2020.

The US Big Three planned to boost production in Mexico from 1.63 million vehicles to 2.49 million over the next five years, an increase of 860,000 units. During this same period, these companies planned to cut US production from 6.41 million vehicles to 6.14 million. However, the Big Three will be forced to cut back this “great escape” of manufacturing in response to the revised NAFTA. The main reason is the hike in the local content ratio from 62.5% to 75%. In comparison, the TPP’s local content ratio is 55%. In addition, Mexico’s automobile exports to the United States are capped at 2.40 million vehicles and there are restrictions on imports from regions with an hourly wage of less than $16. Overall, the NAFTA revisions will probably stop almost all of the planned transfer of automobile production from the United States to Mexico. This is good news for US manufacturing and jobs. As this change applies to automakers worldwide, the revised NAFTA will not be detrimental to the competitive position of Japanese automakers.

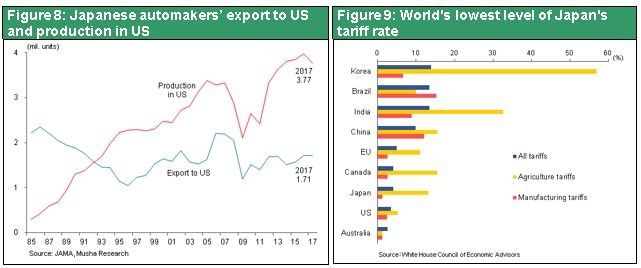

The Trump administration has started discussions with the EU with the goal of eliminating tariffs. Currently, passenger car tariffs are 10% in Europe, 2.5% in the United States, 8% in Korea, 15% in China (reduced from 25% in July) and 0% in Japan. If US-EU discussions result in the elimination of automobile tariffs, automakers in Japan will probably be the biggest beneficiaries. No tariffs would probably boost Japan’s share of the eurozone automobile market. There are worries about the threat of including Japanese vehicles in the US 25% automobile tariff hike in association with negotiations with Japan. But this is very unlikely. Furthermore, Japanese automakers produce 3.77 million vehicles in the United States, which is more than double imports from Japan of 1.74 million vehicles. As a result, Japanese automakers could easily use their US assembly plants to offset the impact of a 25% tariff in the event it is imposed.

Japan has established a significant competitive advantage

Japan is the only country in the world that has experienced intense trade friction with the United States. To overcome the extreme challenges created by this friction, Japan created an entirely new business model. Having taken these actions, Japan is now more resilient to trade friction than any other country. The following four points demonstrate this resilience.

1) The lowest tariffs in the world = Japan has the world’s lowest tariffs in the manufacturing sector (Figure 9). President Trump says that his ultimate goal is no tariffs and no barriers. If this happens, Japan would probably be the world’s biggest beneficiary.

2) A much stronger global supply chain than other countries have = Japan has a very small trade surplus. Moreover, the primary income balance is responsible for the majority of the country’s current account surplus. Japan’s primary income surplus should be viewed favorably by other countries because it is the result of investments, jobs and other business activities outside Japan. On the other hand, a trade surplus is criticized as a sign that a country is stealing jobs from other countries. Japan’s huge primary income surplus therefore is proof that Japan is far ahead of other countries in terms of the high level of globalization of its companies and the strength of global supply chains (Figure 10).

3) An ideal complementary relationship with US industries = At one time, Japan was a threat to the US manufacturing infrastructure in the semiconductor electronics categories and others. This threat sparked US-Japan trade friction. But now, Japan has almost no competition with US companies regarding semiconductors, smartphones, internet infrastructure and platform, aircraft and other products in core industrial sectors. Instead, Japanese companies have established strong positions in the United States in market sectors where these companies have competitive advantages. Prime examples are automobiles, machinery, and high-tech materials and parts. There is no way these activities will create trade friction.

4) Quick measures to distance Japan from China = Following the 2012 Senkaku Islands tension, Japan moved quickly to distance itself from China. Japanese companies established a division of manufacturing processes across many Asian countries. As of 2012, Japan accounted for 18% of all direct investments in China, ranking first in the world (excluding Hong Kong). Subsequently, Japan has held back on investments in China as other countries increased their China investments. By 2017, direct investments in China had dropped by 50% and Japan ranked fourth with a 10% share (Figure 11).

(4) Japan as the Only One – Reaping the Rewards of Efforts During the Past Two Decades

Japan has no mega-players that fueled the global high-tech stock boom. However, Japan plays a key role in many of the core and peripheral technologies that are vital to these mega-players. Each core and peripheral technology is linked to products in small, niche market sectors. But these are sectors with little or no price competition because technological superiority allows companies to control prices. Within the international division of labor, Japan has established strong positions in many high-tech niche market categories for materials and parts. These positions are a big reason for the recovery in earnings at Japanese companies. Large companies account for most of Japan’s high-tech manufacturing activities. But even though the companies are big, they are specializing in many niche core and peripheral technologies.

Many years ago, companies in Japan were the dominant manufacturers of high-tech products because of very competitive prices. Japan then lost this position because of trade friction and the yen’s extreme appreciation as well as the emergence of companies in Korea, Taiwan and China. Today, high-tech mega-players are internet platform companies in the United States and China and mega-hardware companies in Asia (Samsung Electronics, Taiwan Semiconductor Manufacturing, Foxconn, Huawei and others). Mega-players are located in the United States, Korea, Taiwan and China. No Japanese company belongs to this club.

But now Japanese companies no longer rely on competitive prices (because they were defeated by competitors!). Instead, these companies have staged earnings rebound by focusing on niche markets where they have superior technologies and quality. Electronics is one example. Japan ended up a loser as a producer of semiconductors and finished products like LCD TVs, smartphones and PCs. There was one clear cause: the inability to compete based on prices. Having lost its positions in these core electronics sectors, Japanese companies have instead been increasing production of interfaces that are essential for digital (brain) functions. Input interfaces are sensors (equivalent to eyes, ears, noses, tongues, etc.) and output interfaces are actuators (motors and other components that function like muscles). Japanese companies also supply materials, parts and devices needed for core digital products.

Success in these market sectors demands a multitude of technologies that differentiate Japanese companies from competitors. This is a perfect match with the ability of Japanese companies to skillfully combine a variety of knowledge involving materials, techniques and other elements. By shifting their focus to this differentiation, Japanese companies have established business models centered on markets where their superior technologies and quality eliminate the need to use low prices to compete. The same business model can probably be used in the service sector and other business fields. This is Japan’s core strength. The freedom of people to do what they please will increase as internet utilization and technologies continue to advance. In this environment, people will seek products and services with even better technologies and quality. Companies in Japan have precisely the right strengths needed to meet this demand.

Reasons to expect a stock market boom in Japan

(1) In the United States, stock prices are climbing to new highs with the new industrial revolution as primary reason. The FANG companies are driving innovation. Small-cap stocks are also performing well because of solid internal demand.

(2) Japan has many leading companies in global high-tech niche markets. Japan’s increasing strength in the automobile industry will also probably attract the attention of investors.

(3) Japan will be a beneficiary rather than a victim of the US-China trade war. Global investors who think the trade war will damage Japan have been shorting Japanese stocks. These investors are probably expecting a repeat of the 2015 when Japanese stocks plunged in association with the China shock. However, this thinking is absolutely wrong. Eventually, these investors will rush to buy back Japanese stocks.