May 15, 2019

Strategy Bulletin Vol.224

China is certain to give in

– Market volatility for now but many attractive opportunities once a resolution is reached (perhaps

The US-China trade war has reached the climax

The Trump administration established a 25% tariff on $250 billion of imports from China and is threatening to impose this tariff on of China’s exports to the United States, a total of $540 billion, if China refuses to take steps to end its “free ride.” To avoid the new tariffs, China must protect intellectual property rights, end mandatory technology transfers, stop paying subsidies to companies and establish a level playing field for foreign investors. Levying a tariff of 25% on all US imports from China would force US companies importing these goods to pay an additional $135 billion. This is about 0.8% of annual consumer spending in the United States. If the tariff continues for two years, it would raise US consumer prices by 0.4%.

However, much of this negative impact on US consumers will probably be eliminated by price cuts by Chinese exporters, a weaker Chinese yuan, the shift of production from China to other countries and other actions. On the other hand, the additional US government income of $135 billion from the tariffs could be used to offset the monetary damage of the trade war. Annual US exports to China of $121 billion are only 0.6% of the US GDP. As a result, higher Chinese tariffs on US goods will have only a small impact on the US economy. The United States may even use monetary easing to reduce the trade war’s negative effects. Consequently, the impact of the trade war on the United States will not be on a level that produces a significant economic downturn.

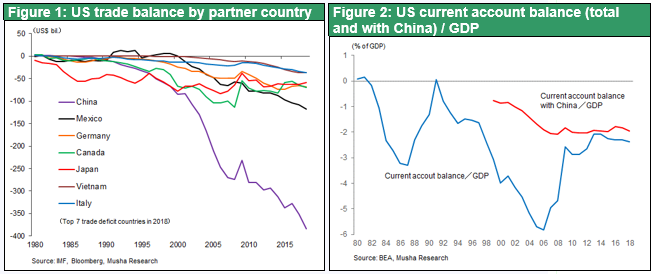

A 25% tariff is too much for China to bear

The higher US tariff will have a severe impact on China. Although the United States accounts for only about 20% of China’s exports and apparently does not seem to be a big deal, US’s current account deficit with China is an enormous $401.1 billion, equivalent to 2% of US GDP. In 2018, China had a total current account surplus of $49.1 billion (the trade surplus was $395.2 billion, including a surplus of $419.3 billion with the United States alone). Clearly, China is almost entirely dependent on exports to the United States for earning foreign currency. A sharp drop in exports to the United States would quickly create a foreign currency shortage in China. Due to this situation, China cannot allow its US trade surplus to fall significantly and will have to give in before tariff increases affect the real economy. A big drop in the US trade surplus would cause foreign currency reserves to plummet and make it difficult for Chinese companies to procure US dollars. This is China’s Achilles tendon and it must be avoided at all costs.

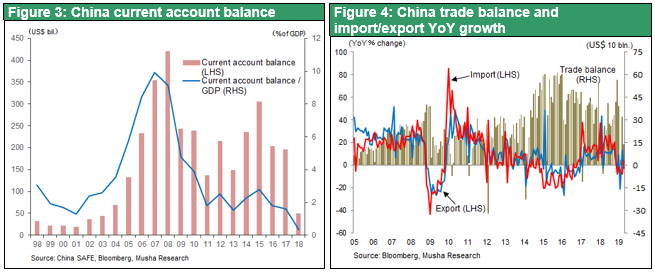

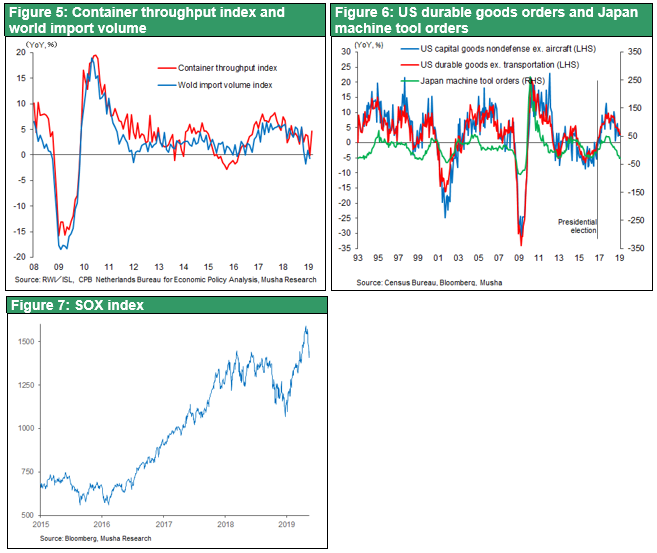

The global economy is likely to regain its vitality in the second half of 2019

Preventing China’s ability to use a free ride to become more powerful is the objective of the United States. The goal is not the destruction of the Chinese economy. That means a big economic upturn is likely to occur after China accedes to US demands. Once an agreement is reached, the accord could even create more demand. Capital expenditures in China largely came to a halt at the end of 2018 because of the inability to determine the outcome of the trade war. But at this point, there is almost no risk of a decline in final demand in the United States and China, which has been a source of concern. Therefore, a temporary halt to investments would raise the possibility of a tight supply-demand balance in the future because fewer investments would slow the growth of the capacity to supply goods. The powerful rebound of 40% in the PHLX Semiconductor Sector Index (SOX) since its Christmas 2018 bottom may due in part to factoring in the possibility of an upcoming tightening of supply and demand. If there are increasing signs of an upturn in the US and Chinese economies, the economies of countries like Japan, Germany and Korea that export goods to these two countries will also improve.

Demands for monetary easing based on geopolitical national interests

The more heated the trade war and struggle for hegemony becomes, the more the United States and China will be forced to boost domestic stock prices in order to create credit and raise demand for the purpose of reinforcing their stature in the global economy. US and Chinese stock prices staged big rallies in the first four months of 2019 based on the assumption that a trade agreement will be reached. Although the path to an agreement has been blocked for now, stocks will probably start moving up again if there is an agreement.

This is why the outcome of the US-China trade war is unlikely to be detrimental to the global economy or asset prices. In fact, the end of this war will probably have a significant positive impact on stock prices and the economy. In other words, boosting demand without any cost at all will be possible due to the absence of inflation. Furthermore, China can also benefit from the use of monetary easing to push up stock prices, thereby raising purchasing power and making the economy stronger.

Japanese stocks are on the verge of a big upturn

US and Chinese monetary policies appear to be targeting stock prices. But Japan is unable to implement new policies because of limitations imposed by the upcoming consumption tax hike and other events. This inability to act is causing investors to shun investments in Japan. Nevertheless, once investors become convinced that the global economy has started to become stronger, Japanese stocks are likely to post the biggest swing in the world. The reason is that Japan is specializing in capital goods and producer goods that have the largest price movements in the world. When prices of these goods decrease, the stock price downturn is large. But upturns in these prices are also big. Stocks in Japan have been lagging behind the prices of stocks in many other countries. But investors can probably expect to see a big upturn once there are unmistakable signs of a global economic recovery. The combination of a global stock market rally and the new mood in Japan in association with a new emperor could very well be the impetus for Japanese stocks to start a powerful rally.