Jun 10, 2020

Strategy Bulletin Vol.254

The Coronacrisis is Stimulating Innovation

~ Why stocks have staged a V-shaped recovery ~

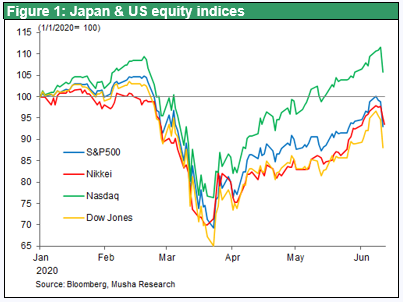

Stock prices in the United States and Japan have staged a V-shaped recovery. Earlier this year, stock prices plunged almost 40% over only four weeks, the fastest drop ever of this magnitude. But this was followed by a recovery of approximately 50% over 10 weeks, which was the fastest upturn. Overall, stock prices are back to about 95% of the pre-coronacrisis level. The tech-heavy NASDAQ index has climbed to a new all-time high. Despite this good news, the global COVID-19 pandemic is still going strong. In affluent countries, the biggest increase in unemployment in the postwar era has just now stopped. The longest period of economic growth in US history has ended as the country recorded its first recession in 128 months. A stock market rally in this environment is strange. Investors who had established short positions because they expected a second bottom are losing a lot of money as they cover these positions at higher prices. However, it is dangerous to adopt the self-justification stance of criticizing this market strength as a bubble created by abnormal monetary easing.

Today’s unperturbed stock markets are already beginning to factor in the next economic boom. The coronacrisis has spectacularly brought together all three indispensable conditions of innovation: technologies, capital and markets (needs). Remote work and other new ways of working have rapidly boosted the use of communication networks. We are about to see a fundamental shift in business models and life styles. Competition has started for the provision of 5G and other technologies capable of meeting these new needs. Furthermore, extreme monetary easing and unprecedented government spending accompanied by rising stock prices are generating a massive amount of risk capital. Until now, the information network revolution was advancing at a moderate pace. But the coronacrisis has immediately triggered rapid progress. There is no doubt that the post-corona economic landscape will bear little resemblance to what we were accustomed to prior to this crisis.

This is why stock prices are likely to do much more than merely return to the pre-corona level. Investors should view this rebound as the beginning of a prolonged bull market that is currently starting to gain momentum. Pessimists need to switch to a different stance now before they lose all their money.