Jan 11, 2018

Key Strategy Issues Vol.303-part1

Looking Ahead to 2018 - Macro economy and micro technology perspectives

Part1 Remarks by Mr Minamikawa and Musha

A year for a fortuitous convergence

A seminar led by Ryoji Musha and Akira Minamikawa took place on November 27, 2017 at the Kioi Forum in Tokyo. This strategy report covers the discussions at this event concerning the seminar’s theme: “Looking ahead to 2018 – A year of macro and microeconomic forces and chance meetings of technology.”

Introduction (Musha)

High-tech industries will be the center of attention in 2018. Mr. Minamikawa is an analyst who has studied the electronics industry for more than 30 years. He will discuss 2018 from the standpoints of technologies and microeconomic issues. Mr. Musha looks at the electronics industry from an economic perspective that looks at the big picture. Both views will be used to talk about the transformation now taking place in this high-tech sector. This theme was selected because micro and technological progress in Japan is starting to play a decisive role in driving macro progress. This type of change is occurring for the first time in about 30 years.

Technological progress has always been the source of value creation for mankind. Technologies have been the foundation for the emergence and demise of a diverse array of economic systems over the years. In every era, the method used to create value has been a critical resource for advancement. During the Stone Age, rocks were a valuable resource. Land was the key resource when agriculture reigned supreme and capital became the key resource when the industrial age started. Today, the world is on the verge of a new age, and even a new dimension, shaped by information networks.

What will be the source that creates wealth in this new age? The resource may be networks, knowledge or even capital just as in the preceding age. The answer is not yet known. Creating new technologies raises manufacturing capabilities and improves the lives of people. Japan’s population was approximately 200,000 during the Stone Age. Beginning with Japan’s Yayoi Period (300 BC-300 AD), the agriculture sector expanded and land replaced stones as the creator of value. The population rose to several million and reached 30 million during the Edo Period (1603-1868). When Japan entered the age of industrialization, capital became the creator of value. During this period, the country’s population increased from 30 million to the current 120 million. Now Japan is about to experience another dramatic transformation in which technology will play a decisive role.

New technologies have fundamentally redefined the value creation, altered economic regimes, and produced increasingly refined business models and life styles. Now, this historical perspective must be used to examine changes taking place in technologies and economies.

Today, we will talk about technological progress and how it is reshaping the economies and markets of individual countries.

Remarks by Akira Minamikawa: Technology and Microeconomic Outlook for 2018

A Time of Dramatic Changes in Technologies

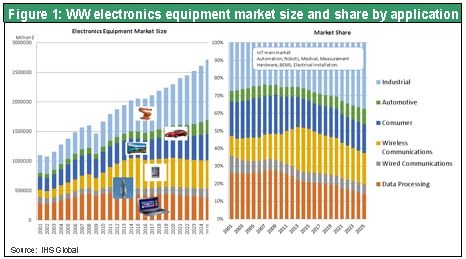

The personal computer and smartphone have been driving progress and growth of the global electronics industry for some time now. But in the past few years, the personal computer and smartphone markets have stopped growing and even started shrinking in some instances. But the advancement of the electronics sector is continuing in the automobile and industrial equipment industries. The result is a shift in the driving force of progress.

In the semiconductor industry, a momentous change is taking place regarding the development of new technologies. In the past, making the semiconductors used in electronic products more advanced has improved the performance of personal computers, reduced the size of smartphones while giving them more capabilities, and created televisions with slimmer profiles along with better picture quality. Miniaturization has been the most important challenge of this progress. But the semiconductor industry is nearing the physical limit of this downsizing process. In about 10 years, it will probably no longer be possible to reduce the size of semiconductor chips. Miniaturization progress is likely to be replaced with advances involving three-dimensional (stacked) devices and technologies to cut energy consumption.

China’s growing presence in this field must be watched closely. China has the financial strength to attract outstanding people and technologies from around the world. The country has the ambitious goal of establishing leading positions in every category of the electronics industry within about the next 30 years.

This raises the question of how Japan will survive as China moves closer to this goal.

Major Events in the History of the Electronics Industry

The first stage of rapid growth of the electronics industry took place in the 1990s as people worldwide bought personal computers in large numbers. During the following decade, smartphones and tablets fueled the industry’s growth. The world’s population is now about 7.3 billion and the number of smartphone users is believed to be approximately 7 billion. Smartphone ownership has posted remarkable growth over a period of only about 15 years. But smartphone sales have stopped increasing. In the electronics industry, growth categories are robots, health/medical products, industrial equipment and agricultural equipment. Electronics will undoubtedly become even more vital to all of these product categories.

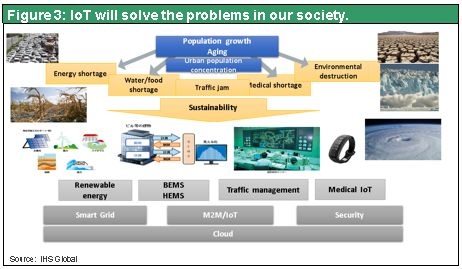

The advent of the Internet of Things (IoT) means that soon almost everything will be linked to the internet. The IoT also points to growth of the 5G telecommunications infrastructure that will facilitate these links. 5G technology is expected to replace the current 4G networks around 2020. Until now, communication products have been used mainly by people and companies. But the new 5G devices will go beyond people and companies to target the much larger social infrastructure sector. National governments and huge companies rather than people will be the buyers of these 5G products.

This will ultimately redefine entire consumption patterns. Government purchases will reflect national policies. For example, a government that wants to focus on agriculture may use the IoT to create smart agricultural equipment that requires no human operator. At some time, farms may have agricultural robots, machine tools using the IoT, and automated tractors and drones that fertilize and water fields. Accompanying this progress will be government measures that ease regulations and provide favorable treatment for specific activities. In China, for instance, the government has made electric vehicles a priority. Consequently, this is a time for companies to look at what countries rather than individuals are doing in order to predict the future.

This discussion covers major trends involving electronic devices without touching on specific items and other details. Electronics encompasses personal computers, data centers, telecommunication base stations, smartphones, household products, navigation and other automotive products, medical robots and many other categories. The computer industry is no longer growing and smartphone sales are about to peak. Televisions posted strong sales growth in the past but are increasing slowly now. Now let us see which sectors are growing. Product sectors that are not yet connected to the internet have the best growth potential. Automobiles and industrial equipment are two examples. Prospects are also good for key categories concerning the IoT: automation, robots, medical equipment, electric power distribution and military equipment. Computers and smartphones already have internet links, so these markets are not expanding.

Market sectors with no internet connections are likely to grow quickly. Using and analyzing big data in these sectors will result in products that are increasingly smart. In the medical sector, for example, sensors may be placed on an individual’s wrists for monitoring blood flow and sugar. Monitoring could be linked with insurance. Medical care currently entails treating people after a problem occurs. Japan spends about ¥40 trillion every year on health care. Funds from taxes are used to cover the ¥15 trillion shortfall in the money available to cover this expense. Japan’s public health insurance system is facing a crisis and equally dire conditions exist in the health insurance systems of other advanced countries.

IoT technology can be used for links to sensors placed on the body for smartphone oversight and big data analysis. This will help alert individuals to see their doctor when a problem is detected. Using this technology could greatly lower the incidence of diabetes, heart disease and strokes. Ailments could be prevented and more people could enjoy a long and healthy life as a result. Japanese government agencies and the health insurance industry are currently working with electronics companies to develop this type of framework. The United States is working on health care electronics too and will probably start using these systems by the end of 2019. This is merely one of many potential IoT applications. Very few benefits of IoT are visible at this time. We will most likely start to see significant improvements in our lives from this technology two or three years from now.

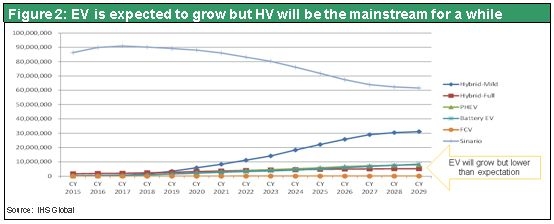

The Outlook for Electric Vehicles

In Japan, there are projections for electric cars to account for 20% to 30% of all vehicles after 10 or 15 years. But this is impossible. Electric vehicles will probably be only about 10% of total automobile production in 2029. An inadequate supply of electricity is the primary reason. Recharging a Nissan Leaf at home takes about 10 hours. If we assume that half of cars in Japan are electric in 2030 (which would be roughly 40 million vehicles), then around 15% of all electricity currently generated in Japan would be needed simply to recharge these cars. This 15% is equal to the output of three nuclear power plant reactors and 30 to 40 nuclear reactors if we extend this assumption to the entire world. This much additional generating capacity cannot be built over the next decade or so.

This outlook assumes that recharging will take place evenly during the daytime and nighttime. If we instead assume that all recharging will be done overnight, twice as much additional power will be needed. Moreover, the numbers change again if a larger share of car owners use high-speed recharging. For example, recharging in one instead of 10 hours would require the ability to supply 10 times more electricity. In Japan, delivering this power would require electricity equivalent to 30 more nuclear reactors, 10 times more than under the original assumption. Consequently, raising the share of electric vehicles to 20% or 30% over the next 15 years is theoretically impossible simply from the standpoint of the supply of electricity. Automakers are aggressively marketing their electric vehicles mainly for the purpose of demonstrating their environmental responsibility.

China may proceed as planned with its policy of making a big shift to electric cars. The main reason is that these cars can be made easily because there are fewer parts. China would need 20 to 30 years to acquire all the technologies needed to fabricate the intricate components for state-of-the-art gasoline engines, hybrid vehicles and transmissions. Chinese automakers must switch to electric vehicles in order to survive and grow. Backing of the national government is another reason that China will move ahead with its electric car campaign. China probably intends to eliminate its electricity shortage by constructing many more nuclear power plants.

Linking a variety of objects to the internet via the IoT is expected to make society, health care and factories smarter. But why is everyone placing so much emphasis on the IoT? We need to take another look at this point. There are three key issues in the world now. First is population growth accompanied by increasing numbers of older people and the rising concentration of people in urban areas. Problems created by these trends include pollution, a shortage of health care providers, traffic congestion and a shortage of resources. The IoT may be a solution. According to the United Nations, the world’s population was 2.5 billion in around 1950, only about 65 years ago. Since then, the world’s population has tripled to 7.3 billion. Furthermore, populations are aging in Japan and other countries. Health care must switch from treatment to prevention.

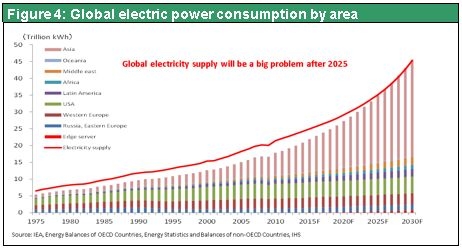

As more people choose to live in urban areas, highways are becoming increasingly crowded and damage to the environment is growing. Dealing with this problem will require converting to a smarter society. Also, a growing number of people worldwide are using electronic products to make their lives more convenient and enjoyable. Demand for electricity and other forms of energy is climbing steadily as a result. Growth in this demand has been particularly steep in recent years in China and other Asian countries. Presently, the world’s electricity generating capacity exceeds demand by about 15%. However, there may be frequent power interruptions worldwide by 2025 because of rapid growth in demand for electricity. Building plants to generate electricity is difficult because of opposition to nuclear power and the need to hold down CO2 emissions. That means the growth in demand will have to be reduced. These factors indicate that the world will not be able to raise the supply of electricity to keep up with the increasing use of electric vehicles.

This explains why electricity must be one of the highest priorities. Advances in electronics have been improving the performance of devices and raising power consumption to support this performance. Running supercomputers like IBM’s Watson will demand electricity equivalent to the output of three nuclear reactors. At the current pace, the world’s supply of electricity will surpass demand in 2025. IoT must be used to develop energy conservation technologies.

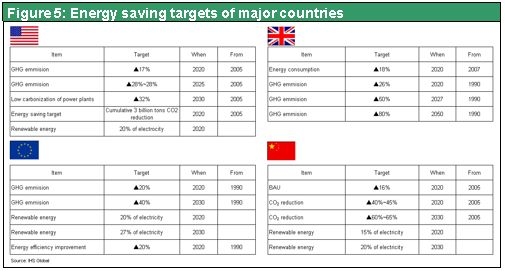

Numerous countries have established energy policies that include measures for cutting CO2 emissions and other actions. These policies make it possible to predict events in the next several years. Countries have announced their energy conservation targets and are taking actions for reaching these targets. The IoT is widely used in many countries for reducing energy consumption, lowering the use of resources and improving efficiency across a broad spectrum of industries. Unlike in the past, there are now expectations for electronic products to be used in line with government policy goals.

Motors consume 55% of all electricity in the world. But only about 20% of all industrial equipment use inverters, which automatically control a motor’s output. Motors with no inverter can only be switched on or off. If you switch on, it continues to run all the way. Using inverters on motors can cut electricity consumption by more than 30%. The International Electrotechnical Commission has established motor efficiency standards. Countries are starting to adopt these standards, which could make motor inverters mandatory. This is one reason that government policies should be closely monitored when making predictions.

The Skyrocketing Growth of Data Generated by the IoT

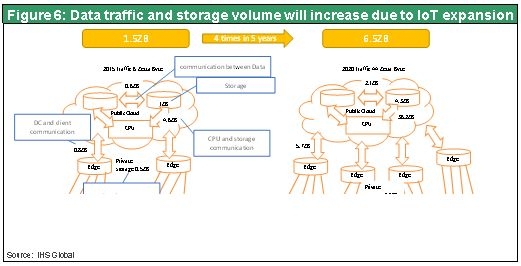

The increasing use of the IoT is generating a massive volume of data on a global scale. Big data was estimated at approximately 6 zettabytes in 2015 and is expected to explode by more than six times to 40 zettabytes by 2020. However, actual growth in data storage requirements will probably be about four times during this period. The smaller increase is chiefly the result of data compression and exchanges among data centers. By utilizing big data, the IoT aims to achieve a level of efficiency that has been beyond our reach.

Even more servers and storage units will be needed if the IoT leads to the widespread use of big data. Naturally, this will consume more electricity. Furthermore, sales of electronic products are likely to continue growing as the world’s middle-class population climbs. Demand for electricity will rise but the supply will remain limited. As a result, the most important goal for the electronics industry is to meet expectations for cutting energy consumption by utilizing the IoT for creating smart transportation, manufacturing, health care, agriculture and other elements of society.

Artificial intelligence (AI) semiconductor processors with human knowledge and a structure similar to that of the human brain are attracting much attention. IBM and Google are already producing these devices. Facebook, Amazon and Apple are also working on AI chips. We can expect to see large numbers of these chips within the next three to five years. To improve performance, chips designed to resemble the human brain will probably be used in computers that currently consume large amounts of electricity. These AI chips may yield a breathtaking reduction in electricity, slashing a server’s power consumption to a mere 1% or even 0.1% of the current level.

China’s Long-term Plans

China will celebrate the 100th anniversary of the present regime in 2049. Numerous initiatives are planned to make the country the world’s leading economic and military power. One goal is building a 5G telecommunications infrastructure with the world’s fastest speed. The reason is that communication speed is essential for expansion of the IoT. China is aiming to start using self-driving cars in a few cities by 2025. By 2030, China envisions smart cities and zero emissions thanks to the IoT. Smart cities are also part of China’s One Belt, One Road initiative to create a new Silk Road.

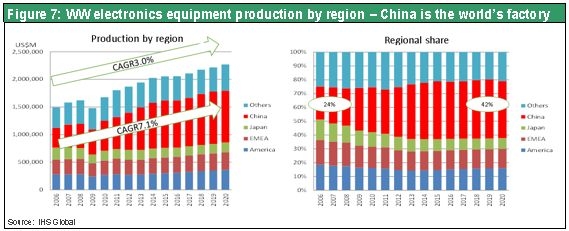

Why is China moving so quickly to accomplish these goals? Almost 40% of the world’s electronic products and devices are made in China, making this industry a major source of foreign currency. But China’s market share has stopped rising at 40%. China is no longer competitive in the manufacturing sector because wages have increased by four times over the past decade. Another method for earning foreign currency must be found. This explains why China wants to quickly build self-driving cars and smart cities. Then these advances can be transferred to other countries as completed projects. One Belt, One Road pathways will be used for these transfers.

The One Belt, One Road region encompasses about 40 countries with around 4.5 billion people, 60% of the world’s population. China plans to use this approach to establish a dominant position in the electronics industry. China is a country that is known for accomplishing its goals. For instance, China has already imposed restrictions for a rapid drop in CO2 emissions.

Japan’s Position in the Electronics Industry

Japan ended up a loser in the personal computer industry. In the television market, Japan had a strong presence for a while but then lost this business to companies in Korea and China. These countries took away Japan’s smartphone operations, too. But now the playing field is starting to change. The next big stories for electronics are automobiles, industrial equipment and the IoT. In all three of these areas, Japan has outstanding technologies, materials and basic materials.

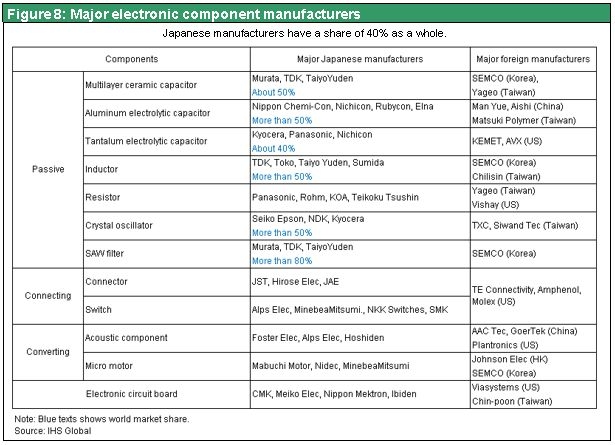

Japan is the world’s leading supplier of electronic components other than semiconductors like capacitors, resisters, quartz and filters. Although Japan is no longer at the forefront in the semiconductor industry, the country still has many advanced semiconductor technologies. Semiconductors rely on thin film formation, which originates from photography, to form the microscopic patterns on chips. Electronic components, on the other hand, require thick film formation, which originates from printing. Murata, TDK, Kyocera and other Japanese companies are highly skilled in this field. Now, manufacturers are beginning to combine their technologies. Jointly producing components will make it possible to reduce their size and achieve even better performance. Japan is the world’s preeminent supplier of motors, too. Nidec, Mabuchi Motor and Minebea are three of the country’s major motor manufacturers.

Almost all electronic products and devices incorporate semiconductors, electronic components and motors. This is true of personal computers and smartphones as well as automobiles and robots. No country other than Japan has skills at this level in all three categories of electronics: semiconductors, components and motors. With the playing field beginning to change, now is the time for Japanese manufacturers to bring together their advanced knowledge in these three categories. The opportunities are enormous. Japan also leads the world in the fields of electronic materials and basic materials. Again, companies that work together will be able to capitalize on extremely attractive opportunities.

Remarks by Ryoji Musha: The Global Economy and Market Framework in 2018

I think 2018 will be a remarkably good year. First, the current global economic strength will push up stock prices worldwide. The upward correction is likely to be especially large for Japanese stocks. This rally will probably propel the Nikkei Average to more than ¥40,000. In fact, this index could even reach this level in 2020, the year of the Tokyo Summer Olympics. On the way up, the Nikkei Average will probably reach ¥30,000 late this year or early in 2019.

The market capitalization of Japanese stocks is now around ¥600 trillion. If this doubles to ¥1,200 trillion, Japan’s per capita financial assets will grow to about ¥5 million. This increase in wealth is equivalent to Japan’s GDP. Furthermore, the consistent growth of the global economy and rising stock prices overseas can be expected to produce positive feedback for Japan’s real economy. I believe this feedback will begin to fuel a powerful virtuous cycle in 2019 and 2020. Three key points, which I explain below, are behind this outlook. First is the question of how long the current worldwide economic and stock market upturns can continue. Second is how the ongoing industrial revolution will influence the economy and markets. I will also discuss how this expected influence can be used to determine investment and business strategies. Third is my conviction that upturns of a historic magnitude have started in Japan’s economy and stock market.

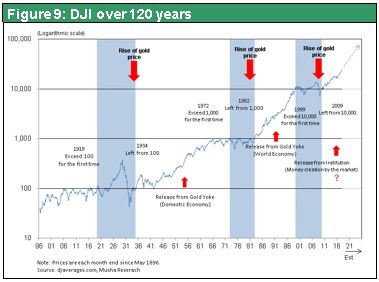

First, I think that global economic growth will continue for at least two more years. In the United States, for the past 120 years the Dow Jones Industrial Average has increased from $40 in 1896 to $23,000 now. Technology has been the primary force that raised stock prices by a multiple of almost 600 over slightly more than a century. 100 years ago, we did not have electricity and automobiles. But now we have everything. Technologies have changed dramatically. Technology is without doubt the most important force behind progress in terms of economies, living standards and markets. Now, the speed of technological innovation is faster than ever and continues to increase. Japan is no exception. This is why the long-term outlook is positive for the global economy, US economy and Japanese economy.

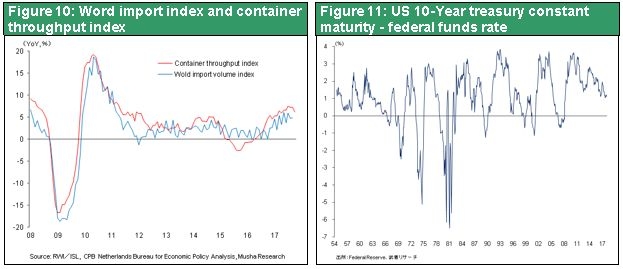

The next question is, when will the existing upward economic cycle come to an end? The global movement of goods that began in 2015 has been gaining momentum during the past year or two. How long will this last? The US yield curve shows us the probable answer. I think the economy will remain robust until the next US recession starts. This recession will trigger a global stock price downturn and economic stagnation. In the postwar era, a US recession has occurred only when long and short-term interest rates were upside-down. Long-term rates are the return that banks earn on loans. Short-term rates are what banks pay to procure funds. When long-term rates are lower, banks have a negative net interest margin. History tells us that a recession begins six months to one year after this happens.

Everyone is closely watching the Fed’s monetary policy, interest rate hikes and tapering precisely because these moves are indicators of when the yield curve is likely to become inverted. At this time, there are very few signs on the horizon of the conditions needed for this to happen. Faster inflation is the biggest cause of a yield curve inversion. But the possibility of higher inflation now is virtually nonexistent. The absence of any need to raise interest rates for monetary tightening means that long and short-term rates will not become inverted. Naturally, a recession will begin at some time. However, unless the government makes a policy mistake, this period of US economic growth is likely to continue for two more years and may go on for about five more years.

If there is a reversal of long and short-term interest rates, the cause will be an off-target economic outlook by the Fed. The most likely mistake would be a rush to hike interest rates by the Fed in response to a sudden surge in prices when the Fed had been confident that prices were stable. But inflation is subdued worldwide now. Preemptive interest rate hikes in the United States in order to prevent a short-long rate inversion are currently unnecessary. Even so, the Fed has raised short-term rates five times to prolong the economy’s health. If the Trump administration’s tax reforms and planned infrastructure investments cause the US economy to overheat, the reversal of long and short-term rates could happen sooner. But the Trump administration may be unable to boost spending. This failure would probably not have a negative impact on stock prices because the risk of a yield curve inversion would be pushed farther into the future. China is one more source of concern about the economy. However, I think investors can continue to take on risk because China is enacting policies that place priority on sustaining economic growth.

The second key point is how we should view the ongoing industrial revolution. Technological progress is driven mainly by advances with semiconductor density (Moore’s Law) and with raising communication speed and capacity. Technologies have advanced at a pace of 2.5 times over two years, 10 times over five years and 100 times over 10 years. Cost reductions have accompanied this progress. For example, manufacturers are making big improvements in smartphones every year that are made possible by new and better technologies.

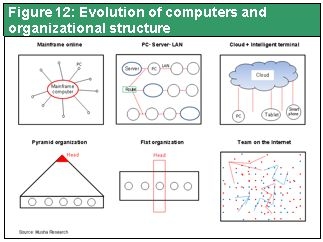

How should we regard the remarkable speed of innovation? The first influence is appearing in the form of changes in how people interact. In the past, all human relationships were structured like a pyramid. This structure existed in feudal times as well as at companies in capitalist economies. When companies began using the internet almost 30 years ago to link employees with each other, organizational structures became flat. Middle-level management became redundant. Now we have reached the point where no organization is needed. Everyone has a smartphone and internet connection. They are connected to the world, but there is no organization to connect people with society. People use networks to form teams and other types of cooperation as needed. Once a job, game or other activity is completed, the collaborative structure is abandoned. The internet makes this possible by linking everyone through the cloud. Networks, not organizations, control almost everything. In the United States, for instance, about 35% of the population work on a free-lance basis. In this era, a network presence is by far the most critical factor.

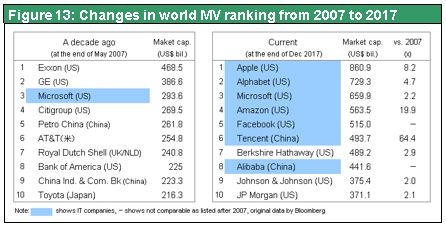

Replacements of the major players of the business world are the second major change caused by today’s industrial revolution. Ten years ago, old blue chips like oil companies, manufacturers and banks accounted for most of the world’s 10 most valuable companies in terms of market capitalization. Now, the majority of the top 10 are internet platform companies. This ranking may signify that the internet has become a more valuable economic resource than land and capital.

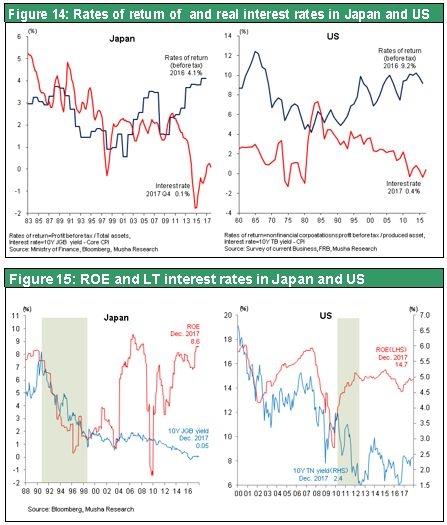

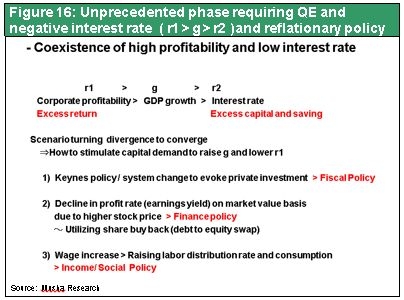

The third major change is a shift in a basic principle of economics. Today, profit margins are climbing at the same time that interest rates are falling. Conventional economics and market rules say that a widening gap between profit margins and interest rates should not occur. Normally, interest rates should rise when an economy is strong due to the strong demand for capital. But interest rates have been moving down for more than 10 years. No textbook tells us that interest rates should fall during a period of economic growth. Nevertheless, rates have been declining for many years.

A prolonged interest rate downturn is regarded as a sign of weakness of capitalism by many economists. However, this view is clearly nowhere near the truth based on events of the past decade. During the decade since the global financial crisis interest rates have decreased steadily while companies have achieved consistent growth in earnings. Consequently, investors who avoided risk due to pessimism based on falling interest rates were making a big mistake.

What should investors do now that they have made so much money? Interest rates are low. Is this the time to borrow money and increase leverage in order to take on more risk and earn more high returns? This was definitely the correct strategy in the years following the global financial crisis. At this point, managers and investors must reach decisions on their own about what to do next. These decisions will determine whether upcoming business activities and investments succeed or fail.

To avoid making the wrong decision, company managers and investors need to understand why profit margins and interest rates no longer obey economic rules that viewed as common sense. Musha Research believes the reason is the industrial revolution. Productivity of labor and capital have improved dramatically. Companies can operate with fewer people and a smaller amount of capital. In other words, the cost of equipment and systems has dropped sharply. Using smaller amounts of money and people has enabled companies to generate surplus earnings. As a result, companies are benefiting from an unprecedented business climate.

Conventional thinking tells us that competition should heat up in business sectors with high earnings as more companies enter the market. High profit margins should not be sustainable due to this competition and margins should fall. This is what economics textbooks say. But profit margins have been climbing for more than 10 years. Earnings of this magnitude should prompt companies to take out loans to fund more investments. Then why have interest rates been declining? The answer is that companies are making money but have no need for any more. Prices of equipment are falling fast. For instance, a company may require only ¥2 billion to replace equipment for which depreciation was ¥10 billion. Cash of ¥8 billion remains on the balance sheet. Google, Apple and Facebook, which are generating massive earnings, need to make only small investments. Their need for people is not significant either. As a result, their earnings accumulate as idle money. This cycle produces enormous retained earnings and excess savings that exert downward pressure on interest rates. Although this situation is most prominent in Japan, surplus earnings and savings exist on a global scale as well.

There are reasons to believe these surpluses as extremely dangerous. Idle capital and falling interest rates are signs that companies are not putting the money they earn to work. Unused capital is itself a self-denial of capitalism. The accumulation of surplus earnings at companies is bringing down interest rates. Resolving this problem will require government intervention. Governments can use surplus capital to create demand. Governments must enact fiscal, monetary and personal income measures that bring surplus capital back into the real economy. Otherwise economic growth will immediately stop.

Initiatives by governments to create demand must be effective. If these measures fail to accomplish their goals, stock prices will drop quickly regardless of how high corporate earnings are. The Abe administration has been taking demand creation actions. But the Japanese government had the opposite stance under Democratic Party of Japan leadership from September 2009 to December 2012. During that period, Japanese stocks were the only losers in the world as economies worldwide staged strong rebounds following the global financial crisis. Japan’s economy weakened and the yen was the only major currency that appreciated. The Trump administration also has a clear policy channel for using fiscal and monetary initiatives for the conversion of surplus savings into demand. This explains why stock prices are up about 25% since President Trump’s inauguration.

Medium to long-term appreciation of the dollar is a fourth aspect of the industrial revolution. The main reason for this outlook is the remarkable growth of offshore earnings held by US companies. Estimates place these earnings at $2.5 trillion in 2015 and approximately $3 trillion now. Bringing this money back to the United States is a key objective of the tax reform package. Financial markets have high expectations for this money to come home. Ten years ago, US companies had only a small amount of earnings accumulated overseas. High-tech companies, primarily Microsoft, Apple and Google, are mostly responsible for the growth in offshore profits. The new major players in the US business world have been earning huge profits worldwide. They have no exports. Overseas subsidiaries are generating enormous earnings.

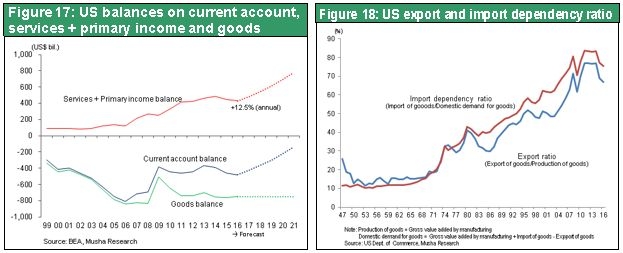

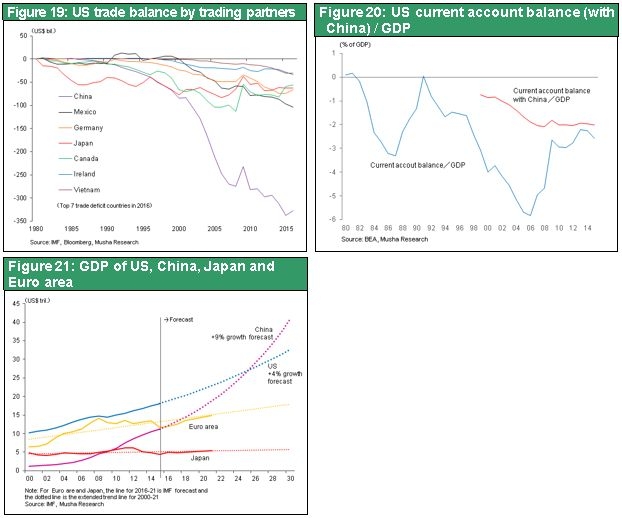

How do we project the dollar-yen exchange rate? The dollar-yen exchange rate is absolutely linked to changes in US debt, meaning the current account balance. More US loans raises the supply of dollars and makes the dollar cheaper. If there are no loans, the dollar becomes stronger. The US current account deficit peaked at $800 billion in 2006, which was 5.7% of the GDP. Presently the deficit is at the $400 billion level and 2.6% of the GDP. About 10 years from now the United States may have a current account surplus. Switching to a surplus would create a shortage of dollars. US companies have established a framework for generating profits in other countries. Everywhere in the world except China, connecting to the internet with a smartphone produces profits for companies like Microsoft, Apple and Google. This is a key component of the US current account balance. The surplus for the service and primary income balance in Figure 17 is the result of the offshore profits of US companies. Based on the annual growth rate of 12% over the past decade, this surplus is likely to increase by more than $400 billion over the next decade. The result would be a surplus larger than the US trade deficit and a positive current account balance.

The trade balance also has a significant influence on the current account balance. The United States had a very large trade deficit and the Trump administration still views this deficit as a problem. But the deficit is decreasing slowly. Prospects are good for the deficit to continue to decline. The reason is that the United States has no need to import any more goods. In the 1980s, the United States economy was largely self-sufficient. Now the country depends on imports for 80% to 90% of goods in some sectors. If we assume that the trade deficit will not become any higher and that the service and primary income surplus will continue to climb, there will obviously be a big drop in the current account deficit. This would make the dollar stronger. I believe this will be a very significant impact of the industrial revolution on markets.

How will a stronger dollar affect the economy? Looking at the GDP of 4 major regions in the world, China surpassed Japan in 2009 and the eurozone in 2016. If China’s economy continues to grow at this pace, the GDP will surpass the United States in 2026. This appears to mean that China will soon rule the world. China’s leaders are confident that the country’s international influence will be greater than that of the United States by 2049, the centennial of the current regime. But will this actually happen? Musha Research does not think so. If the value of the dollar doubles, the US economy will be more than twice as large as the Chinese economy in 2026. Furthermore, the rapid growth of China’s economy relies greatly on the United States. China’s trade deficit with the United States is $347 billion, about half of the enormous deficit that the United States wants to reduce. In addition, the US current account deficit with China has been consistently about 2% of the US GDP for the past decade. Another way to look at these numbers is that the United States has been transferring about 2% of its income to China every year. This is a far more serious situation than the conditions that existed long ago when there was trade friction between Japan and the United States. The United States will certainly not allow China to pose a threat to US global hegemony. A US-China trade war has already started. From this standpoint, a stronger dollar would have substantial benefits for the United States with respect to its geopolitical standing, too.

My third subject today is Japan, specifically, why Japan is now entering one of the greatest stages of growth and progress in its history.

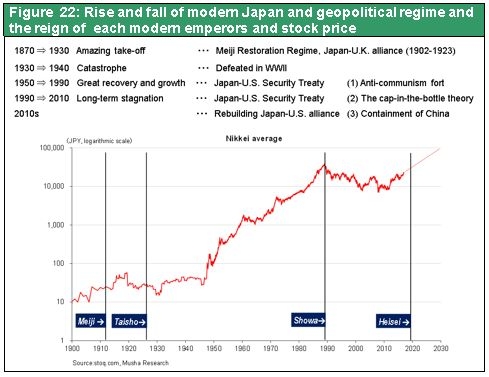

Geopolitics is the first reason for my belief that Japan is entering a stage of rapid advancement. Modern day Japan, which dates back to the visit by Commodore Perry’s “black ships,” has experienced economic cycles for many years and geopolitical factors play a big role in these cycles. The black ships were actually a type of geopolitics. The alliance between Japan and Britain greatly contributed to Japan’s prosperity during the Meiji and Taisho periods. Thanks to this alliance, Japan won its war with Russia and then became the only imperial country in Asia.

Japan collapsed after World War II, when Britain and the United States were two of its adversaries. During the postwar era, Japan enjoyed an extended period of prosperity spanning four decades from about 1950 to 1990. The Cold War was responsible for the beginning and the end of this period. As a fortress of freedom in Asia, Japan received many forms of support from the United States. This support stopped after the end of the Cold War around 1990. The United States no longer needed its alliance with Japan. U.S. armed forces remained in Japan to restrain Japan, which was on the verge of an explosion, rather than to protect Japan.

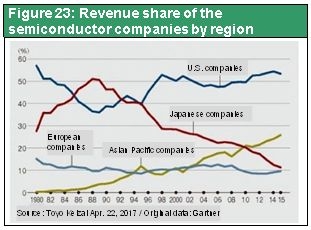

This was the start of intense Japan bashing that included trade friction and the abnormal appreciation of the yen. Events at that time impacted Japan’s industries with effects that still remain today. Semiconductors are a prime example. Japan’s had a 20% share of the world’s semiconductor market during the 1980s and a share of roughly 50% in the 1990s. Japan was clearly the world’s foremost high-tech country. In his book “The Japan That Can Say No,” Shintaro Ishihara stated that the weapons of the US military were highly dependent on Japan’s semiconductor technology. Looking back now, we can see that was a very arrogant statement. But Japan was soon severely hurt by trade friction with the United States.

Japan now has 10% of the global semiconductor market. Electronics companies in Japan were forced to completely withdraw from their respective markets due to prolonged geopolitical pressure from the United States. This is a spectacular illustration of the consequences of geopolitics. Today Japan is entering a new geopolitical climate in which the United States is facing off against China. The increasing power of China is making the US-Japan alliance even more valuable. Britain as well is interested in cooperating with Japan because of concerns about China. Japan was the target of severe geopolitical bashing after the end of the Cold War. But the current environment will give Japan an advantageous position. In fact, Japan will be the most important alliance partner for the United States. Due to this position, the international division of labor, foreign exchange rates and many other factors will probably be having a positive influence on the Japanese economy.

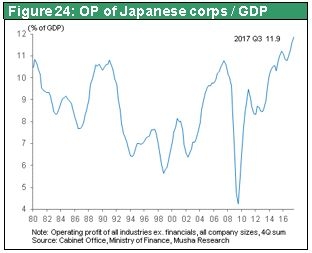

Strong profitability is the second strength that is behind Japan’s new era of growth. Earnings at Japanese companies peaked in 1990, which was viewed as the highest point of Japan’s postwar prosperity. The cause was the complete collapse of Japan’s business model in 1990. Japan’s infrastructure for creating value was broken. Simply put, the main forces behind Japan’s earnings growth up to that point were the asset bubble first of all and the United States after that.

All of Japan’s leading industries at that time – electrical products, automobiles, precision instruments and machinery – were export-dependent manufacturers. Many of companies made products by using or copying US technologies. The majority of earnings were derived from exports to the United States. Earnings from US sales accounted for almost all of the earnings especially in the semiconductor and automobile industries. Japanese exports were very competitive because the yen’s weakness made the cost of labor low. Companies in Japan steadily captured market share because their products had excellent quality along with competitive prices. Then Japan’s asset bubble burst, US Japan bashing began, the yen became stronger and Japan was no longer competitive. At the same time, companies in China and other Asian countries skillfully imitated Japan’s business model of using outside technologies and offering low prices. Companies in these countries took away Japan’s market share by copying technologies and using cheap labor. Japan eventually lost as other countries deployed on a much larger scale the business model Japan had used to succeed in the US market. These events that began in 1990 are the reason for the breathtaking plunge in earnings at Japanese companies during the 1990s.

Japanese companies are currently reporting record-high earnings. Aggregate operating income is now at an all-time high of 11.9% of Japan’s GDP. No matter how this recovery is measured, there is no doubt that Japan achieved a dramatic rebound in profitability. Furthermore, Japanese companies achieved this growth in earnings even though Japan’s nominal GDP has been generally flat at about ¥500 trillion during the past 20 years. What made this surprising accomplishment possible?

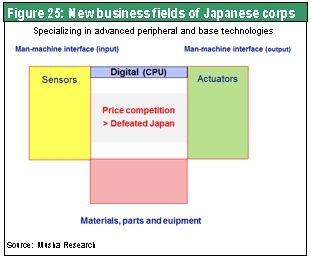

The electronics industry is a good example of how Japan staged its comeback. Digital technology products like liquid crystal displays, personal computers, smartphones, semiconductors and televisions are the primary sources of earnings for electronics companies. Japanese companies dominated these product categories in the past but now have no presence at all in these markets. Everyone thinks that Japan has been completely shut out of the world’s mega-markets for electronics. If this is so, then how did Japanese companies manage to find a way to survive and grow?

The answer is peripheral and base market sectors. Functions of digital products rely on more than merely semiconductor chips. Products also require interfaces like sensors for the input of information processed by semiconductors as well as actuators (motors) and other interfaces that convert the conclusions reached by semiconductors into actions. Japan ended up a loser in the market for finished electronic products and key components, the largest category of the electronics industry. But Japan has been very successful in the field of peripheral technologies.

Competition is intense in the markets for finished products and key components as manufacturers make enormous investments. China is making gigantic investments in these sectors in order to become the market leader. But sooner or later, these activities will trigger heated price-based competition. Japan will be mostly immune from the effects of this competition because its companies pulled out of the market for finished products long ago. Japanese companies will survive by concentrating on peripheral categories where there is little or no competition. Companies can sell their peripheral products at price levels with good margins due to the lack of price-based competition.

Competing successfully in global markets from now on will require supplying items that are not made in large quantities. Japanese companies are clearly in an advantageous position because they are active in market sectors where there are very few participants. Although Japan is concentrating on peripheral fields, the country still has core technologies for semiconductors, liquid crystal displays, televisions, personal computers, smartphones and other digital technology products sold in Japan. Consequently, Japan is the only country in the world with expertise in all three electronics technology categories: core, peripheral and base.

In the upcoming age of the IoT, all three technologies will be essential for making products of all types. Simply combining modules will not be enough to fabricate peripheral parts. This is a field that requires the skill to refine and precisely integrate technologies. Furthermore, success involving peripherals demands producing many items in small quantities rather than high-volume output and concealing technologies in “black boxes” to prevent copying. For research projects, companies will have to form teams that work diligently toward their goals.

For core technologies, products can be manufactured with ease by copying technologies and purchasing kits. Doing this requires time and money. But the core portion can be accomplished if a company has a strong desire to do this. This is precisely what China is doing right now. Just as Samsung took away Japan’s market share, Chinese companies are currently attempting to capture market share in the core technology sector.

But China is unlikely to try to target the peripheral and base categories where Japan has a strong presence. Growth in the electronics industry is expected to be centered in the IoT product sector, not smartphones and personal computers. The volume of items needed for the IoT will be 10 or even 100 times more than in previous markets for electronics. Unlike with smartphones and personal computers, all of these IoT items cannot be made by using the same method. Each one is different, creating substantial barriers to economies of scale. No matter how much China invests in this sector to steal market share from other countries, it will be impossible to become competitive in every type of key technology.

China is at the center of the global high-tech boom. Large investments are being made in accordance with the Made in China 2025 plan. Manufacturers of electronics, machinery and chemicals in Japan will benefit from these investments. This will be a brief but very powerful follow-wind for Japan. From a long-term standpoint, Japanese companies’ vulnerability to any negative effects of China’s massive investments will not be significant. This is because companies in Japan are no longer using prices to compete. By concentrating on technologies and quality, these companies have become the only ones in their respective niche markets, enabling them to control prices. This strategy also makes Japanese companies resilient to a stronger yen. The result has been very high earnings at companies in Japan in recent years. In addition to electronics, this same “the only one” strategy that uses superior technologies and quality can be employed in domestic-demand industries such as tourism and other services.

As I have explained, the simultaneous occurrence of favorable geopolitics, strong profitability and other advantageous conditions for Japan is creating an enormous opportunity for Japan’s economy and markets. With Japanese stocks now extremely undervalued, this beneficial environment is about to generate a powerful follow-wind for the stock market.

To be continued to Part 2 "Q&A Session"