Nov 04, 2010

Key Strategy Issues Vol.K290

The QE2 Shock:

A New Age of Financial Monetary Policies That Target Asset Prices

QE2 has finally started. This is an enormous experiment that is unprecedented in the history of the world’s financial policies. Determining how to evaluate QE2 holds the key to establishing a forecast for the economy and financial markets for the time being. The position of critics and pessimists is simple and contains nothing that is new. Best expressing this stance is a statement by PIMCO’s Bill Gross (October 31 Financial Times): “There is simply no demand. This is why even low interest rates and Fed asset purchases will be ineffective and we will fall into a liquidity trap.” He goes on to say that in this environment, QE2 is a “brazen Ponzi scheme.” But what if he is mistaken? Let’s examine the types of arguments we can make and the outlook for the economy. We believe that QE2 is very likely to succeed. Furthermore, this success will probably produce the following “positive shocks” for financial markets. Contents (1) The success of QE2 will lead to sustained U.S. economic growth in 2011 (2) QE2 will produce a massive liquidity-driven market on a global scale (3) The historic premises that explain the need for QE2 (4) A hypothesis concerning the historic significance of QE2

(1) The success of QE2 will lead to sustained U.S. economic growth in 2011

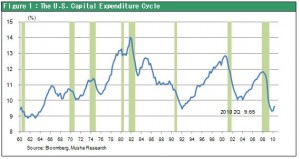

The 10-year capital expenditure cycle has hit bottom

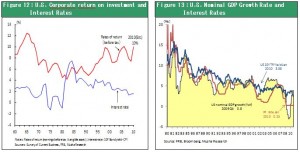

U.S. economic growth is slowly increasing following several quarters of slowing expansion in the 1% to 2% range. This indicates that the economy is on course to achieve growth of about 3% in 2011. Based on the capital expenditure cycle, this upturn in economic growth is very likely to be the starting point of an extended period of growth that spans at least a few years. U.S. economic cycles of 10 years are linked to the capital expenditure cycle. We can monitor this cycle by watching changes in capital expenditures as a percentage of GDP. Repeatedly, we have seen the economy stop falling when this ratio hits bottom and stop growing when this ratio reaches a peak. In the first quarter of 2010, this ratio fell to an historic low of 9.3%.

Animal spirit is the target of QE2

The objective of this second round of quantitative easing is to continue to support investments and consumption by reinforcing sentiment (“animal spirit”) among investors and consumers. Accomplishing this task will require a steady increase in prices of assets, especially stocks. Fed chairman Ben Bernanke plans to improve sentiment with a sustained stock market rally. He believes that the wealth effect along with credit creation by financial institutions will produce a recovery in real demand, eventually leading to a broad-based economic recovery cycle.

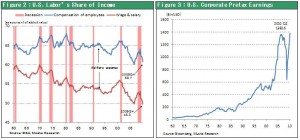

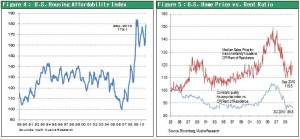

Everything is in place for a U.S. economic recovery

This optimistic outlook is based on the belief that everything is in place for a sustained economic recovery. First, U.S. companies, households and the housing sector have completely eliminated excesses. With the correction now complete, economic fundamentals are sound. Second, there has been a powerful rebound in corporate earnings, the engine of economic growth. Companies now have an unprecedented amount of liquidity. Although more time will be needed, I expect to see an upturn originating with companies to generate a recovery that encompasses the entire U.S. economy. All categories of the U.S. economy have contracted to a point where there is no more room on the downside. First, companies have made remarkable and even excessive progress in streamlining with regard to human and financial resources. Second, household demand has dropped to an extremely low level at which people are putting off many purchases. For example, annual automobile sales of about 11 million are down by about 40% from the peak of more than 17 million. Third, prices of houses plunged all the way to the pre-bubble level and have still not started to rebound. But home prices are too low in relation to affordability (based on household income and interest rates) and the cost of renting a home.

Why the U.S. needs to stimulate an animal spirit

The problem is that more time will be needed for growth in corporate earnings to create the necessary amount of demand and jobs. As I will explain later, this is because a structural change (the productivity revolution) is responsible for the drops in demand and jobs. As a result, the economy must produce new types of demand and jobs that did not exist before. Continuous initiatives are needed to stimulate an animal spirit until the creation of new demand begins. And QE2 is aimed squarely at creating animal spirit. In terms of the financial picture, there is already sufficient easing in terms of quantity and interest rates. This is why many people believe that a further easing, namely QE2, will produce few benefits, if any. However, the United States is poised for an economic recovery. The resulting improvement in expectations (sentiment) is very likely to have a major positive impact on investments by lowering the risk premium.

Unlike the U.S., Japan is not poised for an economic recovery

Japan implemented its own quantitative easing process (2001-2006) following the financial crisis of the late 1990s. However, during this time Japanese companies were not able complete even half of the measures needed to restructure operations. Earnings continue to decline as a result. Even so, household spending was supported by the generous employment policies of companies. At that time, Japan did not meet the requirements for reaping benefits from a quantitative easing program.

The wealth effect will spark a rebound in demand

There are several potential channels for translating the massive amount of earnings and excess capital at U.S. companies into demand and job creation. First is growth in spending and investments fueled by rising stock prices and the wealth effect. Second is demand and job creation fueled by government financial policies. Third is government programs that stimulate demand (like the green new deal). Fourth is using a weaker dollar to boost exports, thereby increasing net external demand. Based on current policies, the wealth effect is likely to be the primary channel.

(2) QE2 will produce a massive liquidity-driven market on a global scale

Raising U.S. stock prices is the unwavering goal of Chairman Bernanke

QE2 must not be allowed to fail. The U.S. economic recovery would come to nothing if asset prices fall and the risk premium rises despite QE2. The resulting drop in sentiment would probably lead to another Great Recession. Mr. Bernanke understands that he cannot allow the economy to retreat to another recession. This must be prevented regardless of the magnitude of risks involving negative byproducts like inflation and the moral hazard. In other words, the Fed and stock prices are inextricably linked. Moreover, as long as the Fed retains this clear commitment, all investors regardless of their beliefs will be forced to discard scenarios that include falling stock prices and deflation. All of the pieces for a stock market rally are now in place. First, the Fed is supporting stock prices. Second, valuations of U.S. stocks are very low. The gap between the long-term interest rate of 2.5% and returns on stocks has reached one of the highest levels ever. For example, many stocks have an earnings return of 7%, a combined dividend and repurchase return of 4%, or a straight dividend yield of 2%. Third, stock prices have always increased in the third year of a president’s term since the 1940s. All these factors point to a stock market rally in 2011 backed by the participation of all categories of investors.

An emerging country bubble grows as the weak-dollar carry trade takes hold

Prospects are excellent for excess liquidity in the United States to spark a worldwide investment boom. The dollar will weaken as QE2 causes the supply of dollars to grow (but this has already been largely factored into the dollar’s exchange rates). A carry trade that uses the dollar for funding is already emerging. This will probably generate further growth in investments in emerging countries, the primary target of this carry trade. Increasing concerns about inflation have prompted India, Australia and other emerging countries to hike interest rates. As the interest rate gap widens even more, we will probably see more growth in investments in emerging countries. This situation points to steady growth of the economies of these countries. By channeling “hot money” to China, QE2 will also increase pressure on China to allow the yuan to appreciate.

More pressure for further monetary easing in Europe as the euro strengthens

QE2 will probably increase the momentum of the euro’s ongoing appreciation. Axel A. Weber, president of the Deutsche Bundesbank and the leading candidate to be the next head of the European Central Bank, has repeatedly rejected quantitative easing. But this stance along with the growing interest rate gap will cause the euro to become even stronger. Consequently, even in the euro zone where the economic growth rate is only 1%, the likelihood of quantitative easing (in concert with the Fed) will increase in order to hold down the euro’s value.

The revival of risk-taking in Japan

The worldwide increase in liquidity will obviously cause stock prices to climb in Japan. The Bank of Japan has moved ahead of the Fed to enact new monetary policies aimed at stopping the yen’s climb and pushing up prices of assets. If the yen’s appreciation and decline in stock prices cannot be halted, we will probably see an increase by the Bank of Japan in purchases of ETFs, REITs and other assets with risk to far more than the current \5 trillion. Furthermore, a revival in the willingness of Japanese investors to take on risk will trigger a rebound in investments in emerging countries and other overseas investments. The yen’s current upturn would probably come to an end as a result. At this level, the yen has become extremely overvalued to a level estimated to be 50% above purchasing power parity. Speculators anticipating a further rise in the yen’s value are the main reason. We could see a recovery in the desire of individuals in Japan (“Mrs. Watanabe”), who can collectively have a global impact on exchange rates, to make overseas investments. We may even see joint intervention for the purpose of preventing the yen from strengthening and the dollar from weakening. After all, the United States has an increasing desire to cooperate with Japan because Japan is becoming more important as a partner to contain China. This leads to the conclusion that dollar/yen exchange rate will not rise to the \70 level for an extended period.

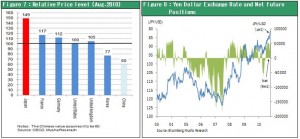

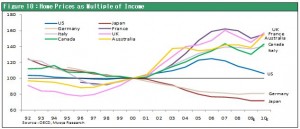

Japan has much room for a correction in asset prices

Japan’s stock markets have posted the worst performance in the world during the first 10 months of 2010. But there is no doubt that investors will take another look at the weakness of Japanese stocks if the yen’s appreciation can be stopped. Currently, the historic undervaluation of Japanese stocks is even greater than for U.S. stocks. This undervaluation points to a major stock market rally in Japan in 2011. A revival in risk-taking, stock market rally and upturn in real estate prices have not occurred in Japan in 20 years. These events would probably turn the economy around immediately by generating enormous wealth and a powerful wealth effect as asset prices climb. As I will explain later, inadequate demand is the central cause of the world’s economic woes. Boosting prices of assets is the fastest way to end this problem. Japan has the most undervalued assets among the world’s industrialized countries. That means an upward correction in asset prices in Japan can very easily create more demand. Historically low stock valuations (Figure 9) and comparisons of home prices (Figure 10) both show that assets in Japan are greatly discounted in relation to prices in other countries.

(3) The historic premises that explain the need for QE2

Can QE2 increase productivity?

I expect that some people will criticize the measures that I have just discussed because they would produce another economic bubble. These critics believe there would be negative consequences caused by inflation and the moral hazard. I cannot deny that these problems may occur. However, we must be careful not to confuse two types of monetary easing. The type that I described is enacted only after the required conditions are fulfilled (the completion of a correction as I have already explained). The other type of monetary easing involves stop-gap measures taken before the conditions are met. We must confirm that today’s monetary easing is accompanied by the necessary conditions. Demand generated by quantitative easing must contribute to an improvement in productivity. If this can be achieved, there will be very good prospects for producing healthy economic growth without inflation or a moral hazard.

The significance of QE2 with regard to the productivity revolution

Critics of QE2 believe that economic stagnation is unavoidable as long as this policy does nothing more than generate excessive spending in a bubble economy. They compare the use of quantitative easing aimed at preventing economic stagnation to merely giving someone morphine to stop pain without treating the cause. To determine if this view is correct, we need to examine the characteristics of this recession. There is no doubt that the recession was linked to the aftermath of excessive debt and demand along with the bursting of an asset bubble. But we must not overlook the fact that insufficient demand was caused by the productivity revolution (a faster pace of growth in the ability to supply goods and services). Globalization and the Internet revolution are constantly altering the operating environment for companies. In response, companies worldwide are forced to make continuous changes to their business models. U.S. companies moved the fastest of all to trim their workforces and improve productivity. During the past two years, the United States lost 8.5 million jobs, the greatest decline in the postwar era. But 2.4 million of these jobs were associated with a bubble in the construction, real estate, finance and other sectors. Losses also included 2.2 million manufacturing jobs, 2.05 million distribution and cargo transportation jobs, and 1.56 million jobs in the professional and business services category. Reforms to business models were probably the cause of these job losses rather than a downturn in demand.

No change in the model for U.S. prosperity

Since the 1980s, the United States has relied on the same model for prosperity. Key components include (1) using computers and networks to improve efficiency and create new business models; (2) using globalization to shift to low-value-added labor in other countries and operate companies from a global perspective; (3) shift of domestic industries from manufacturing to services and shift in jobs to industries that improve the quality of living (health care, education, leisure and entertainment, better houses); and (4) using interest and dividend income to benefit from global prosperity. In the 1980s, the U.S. started losing jobs to other countries as the hollowing-out of U.S. industries progressed. Although these events raised concerns, this process is what gave the United States a new opportunity for growth. Perhaps the current situation will yield another new opportunity.

(4) A hypothesis concerning the historic significance of QE2

The asset-price approach to demand creation

The points I have just made shed light on the historic significance of QE2, although this is still merely a hypothesis. Above all, QE2 is meaningful as an experiment in which measures aimed at changing asset prices are used to create demand and jobs in industrialized countries. Today, there is an urgent need to create demand that matches the economy’s ability to supply goods. To accomplish this, I believe there is room (and a need) to utilize monetary policies.

Pooling and utilizing excess capital

A second aspect of QE2’s historic significance is the use of asset (stock) prices as a temporary means of pooling excess capital. Just as with the “Greenspan conundrum” in recent years, there is now a gap between high corporate profit margins and low interest rates. Although the gap briefly disappeared during the financial crisis, it reemerged after the crisis ended. Explanations for the cause of this gap are numerous. We believe that the primary cause is excess capital produced by the high earnings made possible by globalization and the network revolution. Higher asset prices can be used as the means of linking this excess capital with growth (the demand for capital). Doing this will lower profit margins (the earnings return, which is 1/PER) on a market-value basis, which is the market value of assets invested as the principal. This would cause the gap between profitability and interest rates to narrow. Rather than a bubble, this process involves the reevaluation of asset (stock) prices by using interest rate arbitration.

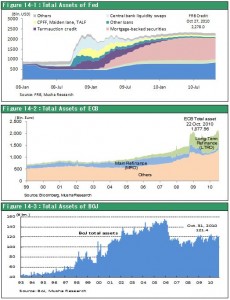

The commitment to asset prices

The third aspect of QE2’s significance is that it allows us to realize that central bank monetary policies have entered a new age. There are many new financial realities: securitization and other forms of direct financing; emergence of global networks; the transition of finance to the role of a hedge fund (an intermediary between risk-taking and risk avoidance); and the strict application of market-value accounting. In this environment, credit creation takes the form of increasing prices of assets. Consequently, the role of central banks concerning their commitment to asset prices can be viewed as an inevitable shift that is linked to these new financial realities.

The Fed is becoming the central bank to the world

The fourth aspect of QE2’s significance is the transformation of the Fed into the world’s central bank. U.S. monetary initiatives largely determine the monetary frameworks for other countries by influencing foreign exchange markets and movements of capital. This is why global capital markets have no choice other than to closely watch what the Fed does.

QE2 is not a Ponzi scheme

For these reasons, I believe that there is a strong possibility that PIMCO’s Bill Gross was mistaken when he stated that QE2 is a brazen Ponzi scheme and that we are falling into a liquidity trap in which lower interest rates and asset purchases are both ineffective because there is simply no demand.