Nov 30, 2010

Key Strategy Issues Vol.K291

Geopolitical change in East Asia holds the key to the resurgence of Japan’s economy

- Why geopolitical forces will end deflation fueled by the yen’s strength-

Dramatic changes in the East Asian geopolitical environmental

Tension on the Korean Peninsula is higher than ever following North Korea’s artillery attack on Yeonpyeong Island. Apparently, this sudden attack is intended to force the United States back to the negotiating table. But this act has spotlighted North Korea’s stance of completely ignoring international law. North Korea is an absolutely helpless country in terms of its economy and military. Furthermore, the country is completely ostracized from the international community. North Korea’s adventurism is based on the premise that the country can receive the implicit support of China. If China adopts a resolute stance, it will be easy to keep North Korea in check. The problem here is that China believes that preserving communist single-party rule in North Korea is vital to protecting the security of China. Chinese Vice-President Xi Jinping is virtually assured of becoming the country’s next president. At an event in Beijing to mark the 60th anniversary of the Korean War, there was a report that he stated that the war was justified because it protected peace by fighting an invasion (Sankei Shimbun, October 28). If North Korea embraced democracy, there would be an immediate impact on the large number of Koreans who live in northeastern China. This impact would almost certainly have a domino effect on other regions of China. Recognizing this vital link between the survival of the North Korean political system and the Chinese political system shows that the problem on the Korean Peninsula is Chinese problem, too. That means the attack by North Korea signals the beginning of an age of geopolitical instability in East Asia. This is a fight between a communist dictatorship and democracy. Moreover, this situation will force a rebuilding of the Japan-U.S. alliance that had been showing signs of ending. I would like to examine how this new geopolitical age of East Asia will affect the Japanese economy along with ramifications for exchange rates and investments.

(1) Geopolitical forces were behind the rise and fall of modern-day Japan

Japan’s highs and lows were driven by the Meiji Restoration and Japan-U.S. alliance

For a particular length of time, a country’s economy fluctuates and grows in accordance with economic theory. But from a long-term perspective, politics alone is what determines when an economy will move up and down. And these political forces are determined by national strategies that prioritize security. Looking back at the history of Japan since the Meiji Era provides ample evidence. Between 1867 and the end of the 1930s, a period of about 60 years, Japan enjoyed a remarkable period of growth on a scale rarely seen in the history of the world. The reason was obviously the establishment of a modern nation following the Meiji Restoration. Next, the economy was destroyed by World War II between the late 1930s and late 1940s. Modern-day Japan’s defeat in the war was the cause. Following the war, Japan staged a miraculous comeback during the four decades between 1950 and 1990. Fueling this remarkable growth was the support provided by the Japan-U.S. security agreement. The Korean War in the early 1950s created an excellent opportunity for Japan to expand its economy. Once this growth began, it did not end until the asset bubble burst.

(2) 1990 change in the geopolitical environment

⇒ The shift in the Japan-U.S. security pact and reversal of the Japanese economy

Japan’s abrupt economic paralysis that began in 1990

In 1990, Japan’s economy entered a prolonged period of stagnation that has rarely been seen. Other industrialized nations have experienced economic stagnation in the post-war period as their economies matured. But Japan’s economic slowdown was much more severe (Figure 2). The country entered a period of persistent deflation and there was no nominal economic growth for almost 20 years (Figure 3). As a result, Japan has experienced two phases in the post-war years. First was an almost unbroken period of robust growth until 1990. Next was 20 years of no growth. Analyzing a reversal of this magnitude is impossible regardless of what types of economic theories we attempt to use.

The 1990 shift in the Japan-U.S. security pact

Modern-day Japan experienced its fourth period of transition in 1990. To understand why, we must use a geopolitical perspective that involves the major shift in Japan’s political framework. In 1990, there was a change in the Japan-U.S. security treaty. Until 1990, the treaty functioned as a fortress that protected the entire Far East. Japan stood at the forefront of Asia as an unsinkable aircraft carrier. Japan grew as the nucleus of the U.S. global strategy in political, military and economic terms. Consequently, the treaty no longer had a purpose the instant the Soviet Union and communism worldwide collapsed. But the security agreement has survived most likely because of a major shift in its strategic significance. Early in 1990, the U.S. announced its “‘capping-the-bottle”’ stance. Some The U.S.officials explained that it spends massive amounts of money to keep troops in Japan for the purpose of holding Japan in check. This does not entail solely preventing another military resurgence and regional expansion of Japan, which was the world’s second-largest economy. Preventing Japan from becoming a military power with nuclear weapons was vital to the U.S. military strategy. Of course, there were still concerns about Far East instability because China, a communist dictatorship, had shown its military might in 1989 at the Tiananmen Square incident. At that time, China was insignificant with regard to the global strategy of the U.S.

Japan’s competitive industries posed the biggest threat to the U.S. ⇒ Keep Japan in check

Although the Japan-U.S. alliance has survived, there was a sharp decline in its significance in political and military terms. But there was a complete change with regard to the pact’s economic significance. Talk about the threat posed by Japan’s economy began to emerge in the mid-1980s. In the U.S., there was a growing crisis mentality about declines in the U.S. economy and industrial might is nothing was done about Japan. In fact, U.S. companies were constantly losing to Japanese companies in such key industries as consumer appliances and electronics, semiconductors, computers and automobiles. This problem even started having a significant impact on U.S. jobs. As their financial strength increased, Japanese companies purchased many U.S. firms. Consequently, stopping Japan’s economic growth and preserving U.S. economic leadership became one of the key objectives of the U.S. global strategy. The U.S. adopted the logic that Japan had an unfair advantage by using factors not linked to capitalism to become more competitive. People believed that Japan relied on an unusual type of capitalism that relies on a strong bureaucracy, business-friendly regulations, corporate groups and affiliations, real estate-based financing and other factors unique to Japan. The result was the “‘Japan is different”’ belief. People were convinced of the need to alter these unique characteristics of Japan so that Japanese and U.S. companies could compete on a level playing field. Japan was subjected to enormous pressure. Starting in the late 1980s, Japan’s economic policies were at the mercy of U.S. demands as Japan acceded to almost U.S. requests. The capping-the-bottle stance concerning the Japan-U.S. alliance proved to be highly effective at achieving U.S. strategic economic objectives with regard to Japan. However, Japan still had many economic practices from long ago that were not consistent with a market economy but that helped make Japanese companies even more competitive. My conclusion is that the “‘Japan is different”’ view is true in many respects from an analytical standpoint. But using these practices to exert pressure on Japan is what enabled the U.S., the world’s only superpower, to achieve its economic goals.

(3) Keeping Japan in check caused deflation by making the yen too strong

Creating an extremely strong yen was the key to holding back Japan

Economic pressure from the U.S. is what produced the 20-year period of stagnation in Japan since 1990 that became known as the “‘Japan disease.”’ An unusually strong yen was the decisive element of the process that capped Japan’s economic bottle. Of course, the currency of a country with a massive trade surplus should strengthen in a floating exchange rate system. However, the yen has appreciated to a level that is far too high in relation to its purchasing power. Normally, currencies fluctuate no more than about 30% above or below their purchasing power parities (a measure of a currency’s strength). However, the yen was at one point overvalued to a point that was twice as high as its purchasing power (Figure 5). In other words, Japanese companies were burdened with operating costs that were twice the international standard. High costs forced companies to enact long-term cost-cutting programs. Naturally, wages of Japanese workers were also twice the international standard. Japanese companies responded by cutting workforces, switching from full-time to temporary workers, moving jobs overseas and taking other steps. Labor cost per unit of production plunged as a result and Japanese companies somehow remained competitive. But this was accomplished at the expense of wages. The gradual downturn in wages over many years produced persistent deflation in Japan. Figure 4 shows the yen-dollar exchange rate and purchasing power parity (the yen’s true strength). In the early 1970s, purchasing power parity was 220 yen but the exchange rate was 360 yen. Japanese companies made goods at a cost of 220 yen and sold them overseas at the 360 yen rate. In the 1990s, the dollar was worth less than 100 yen even though purchasing power parity was 200 yen. No Japanese company could make a profit by making goods at a cost of 200 yen and selling them overseas while receiving only 100 yen for each dollar of sales. There was an enormous negative spread. As long as the yen stays this high, the only way for Japanese companies to prosper was to slash expenses while addingcuttingraising purchasing power parity from 200 yen to 100 yen. Remarkably, Japanese companies accomplished this difficult feat. Unfortunately, Japan has suffered the enormous negative side-effect of deflation as wages fell and unemployment rose.  The yen’s strength is not simply an economic phenomenon. There is no doubt that the yen appreciation has also seriously reflectedseverely restricted political willJapan’s financial strength, too. At the peak of British prosperity in the 19th century during the Victorian Era, the pound was the world’s most powerful currency. British companies used the pound to target business opportunities by purchasing valuable economic resources worldwide. Japan as well should have been able to utilize its huge trade surpluses to increase its clout in the global economy. But Japan was unable to buy valuable resources like U.S. companies and real estate. All Japan did was constantly buy short-term U.S. Treasury securities that carried low interest rates. So this was really a one-sided run-up of the yen. Since the 2008 outbreak of the global financial crisis, the yen became extremely overvalued (Figure 6) as the currency became the target of speculators who believed in the global deflation scenario. However, I believe this strength is also the result of the “‘built-in”’ conviction among investors that the yen will continue to climb simply because the yen has been consistently too high.

The yen’s strength is not simply an economic phenomenon. There is no doubt that the yen appreciation has also seriously reflectedseverely restricted political willJapan’s financial strength, too. At the peak of British prosperity in the 19th century during the Victorian Era, the pound was the world’s most powerful currency. British companies used the pound to target business opportunities by purchasing valuable economic resources worldwide. Japan as well should have been able to utilize its huge trade surpluses to increase its clout in the global economy. But Japan was unable to buy valuable resources like U.S. companies and real estate. All Japan did was constantly buy short-term U.S. Treasury securities that carried low interest rates. So this was really a one-sided run-up of the yen. Since the 2008 outbreak of the global financial crisis, the yen became extremely overvalued (Figure 6) as the currency became the target of speculators who believed in the global deflation scenario. However, I believe this strength is also the result of the “‘built-in”’ conviction among investors that the yen will continue to climb simply because the yen has been consistently too high.

(4) The new geopolitical era of 2010

The emergence of China, a communist autocracy

In 2010, there has been a growing need to take another look at the Japan-U.S. security treaty. Instead of the “‘Japan is different”’ stance of the 1990s, we are now hearing people say that “‘China is different.”’ Even more than Japan in the late 1980s, China is now feared because neighboring countries anticipate a destructive level of strength in the near future. China’s GDP ($4.8 trillion in 2009) is about the same as Japan’s GDP and about one-third of the U.S. GDP. At the current rate of growth, China’s GDP will probably overtake the U.S. within 10 years. At nominal growth rates of 5% in the U.S. and 15% in China, US's GDP will be 1.27 times and China's 2 times compared to the current levels in five years. At this point China's GDP will be almost on a par with that of the U. S. Furthermore, if the yuan’s value rises by 50%, China’s nominal GDP will be about the same as the U.S. GDP slightly more than five years from now. No one can deny that China’s buying power will overwhelm other countries as China’s foreign currency reserves become even larger. China’s growing global stature is certain to be a disruptive force globally based on the current status of market-based economies, democracy, the rule of law, financial rights, intellectual property rights that are already problematic issues today. As the world leader, the U.S. cannot allow this to happen. Moreover, even more than Japan, China’s strength depends on a growth structure that relies on overseas technologies, capital and markets. This is why China is enjoying a “‘free lunch”’ in many respects.

The Japan-U.S. alliance is vital to exerting pressure on China

Without achieving a balance by enhancing the stature of Japan, China’s neighbor, it will be impossible to contain China and exert pressure on the country to change from within. Enduring prolonged economic stagnation has caused the Japanese public to lose faith in capitalism and a market-based economy. If Japan starts to drift, the result could be widespread instability in East Asia. This explains why revitalizing Japan’s economy has become an urgent matter for the U.S. as the global leader. The need for economic growth makes it even more unlikely that we will see a reappearance of an unusual upturn in the yen’s value to penalize Japan. As you can see in Figure 7, there has been a steep downturn in Japan’s presence in global finance since 2000’.stature Bbetween the mid-1980s and mid-2000s, Japan has been enjoyinged position as the globe’sal sole source of capital .surplus This occurred while even though JapanJapan had a huge trade surplus and was extremely competitive. However, now, bBased on the current account surplus, Japan now ranks behind China, Germany and major oil-exporting nations. Clearly, we are nearing the end of the age when ‘“capping-the-bottle”’ measures were required starting in the 1990s to hold down Japan. Ending this period will generate the greatest amount of energy for reversing the extreme appreciation of the yen.

(5) Japan’s 20-year streamlining and cost-cutting measures make the country very competitive

No country slimmed down more than Japan during the past 20 years

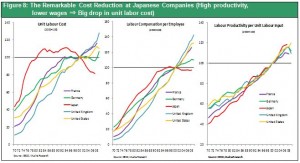

Investors must not overlook the fact that the difficult 20-year period that began in 1990 enabled Japan to fulfill two requirements for growth. Japan now has two advantages due to its success at overcoming the penalty imposed by the yen’s strength. First is efficiency resulting from cost-cutting on an unprecedented scale. Second is the globalization of Japanese companies as they became citizens of the world (Japanese companies became more international as they greatly expanded overseas workforces). Let’s take a closer look at cost reductions. A comparison of Japan today and in the early 1990s demonstrates the amount of progress made in cutting costs. In 1990, Tokyo was the most expensive city in the world. The primary reasons were (1) unusually high personnel expenses (based on dollars) because of the extreme strength of the yen; (2) high cost structures of Japanese companies (large selling, administrative and other indirect expenses because of costly distribution systems throughout the economy); and (3) government regulations and corporate customs that were detrimental to efficiency. As a result, against the backdrop of a strong yen, Japan should have taken the following actions: (1) absorb the high cost of labor by boosting labor productivity; (2) restructure companies and improve efficiency while reforming distribution systems; and (3) lower market prices of goods through deregulation and encouraging more competition. At that time, the Japanese government along with many opinion leaders and the media urged that the country take the above three actions. So what happened over the ensuing 20 years? There has been a steady upturn in the yen’s purchasing power, a measure of macroeconomic strength. Purchasing power parity increased from 200 yen to the dollar in the early 1990s to 115 in 2009, a difference of almost 100%. Looking at individual items, Japan’s utility fees were 50% to 100% higher than in the U.S. in 1993 but there is almost no difference today. For air fares, subway tickets and telephone charges, Japan is now cheaper than the U.S. The gap in the cost of electricity was more than 100% but is now almost nothing. Food prices in the early 1990s were much higher in Japan than in the U.S. But beer, for example, is now 20% more expensive compared with 150% before. A Big Mac in Japan costs 15% less than in the U.S. (Washington, D.C.). For apparel, prices at UNIQLO and other retailers are considerably cheaper than in the U.S. Once the yen’s extreme appreciation ends, the streamlining of Japan will most likely produce a surge in earnings and wages that signals the death of deflation. Figure 8 shows the efficiency and cost of labor over the past 40 years in major industrial several countries. These statistics clearly show the enormous progress that Japan has made since 1990 in streamlining by holding down the unit cost of labor.

Geopolitical factors point to an end of the yen’s unusual strength

As I have explained, several items hold the key to Japan’s ability to achieve long-term economic prosperity: geopolitical factors, changes taking place in East Asia and the U.S. “‘power game.”’ Today, all three of these forces are aligned in Japan’s favor for the first time in 20 years. All signs indicate that Japan finally has an opportunity to break away from its extended period of deflation and economic stagnation. Can Japan capitalize on this opportunity? Everything depends on the choices of the Japanese public and politicians. The U.S. has been very patiently going along with the insincere and confusing actions of the Hatoyama administration. The only explanation for this patience is that the U.S. has reconfirmed the significance of the Japan-U.S. security alliance due to the important role of Japan in maintaining stability in the Far East. The Kan administration that followed has made a major shift by placing emphasis on national security policies. Japan now stands at a turning point in its political regime that occurs only once every few decades. History is creating a need to rebuild the Japan-U.S. alliance. This rebuilding process may be the perfect opportunity for modern-day Japan to embark on its third period of remarkable progress.