Jun 10, 2014

Key Strategy Issues Vol.K296

Japan’s “lost 20 years” was actually a “20-year model conversion”

- The real reason for record-high earnings in Japan -

(1) Earnings in Japan rebound to an all-time high

A business model conversion was essential for Abenomics to be enough

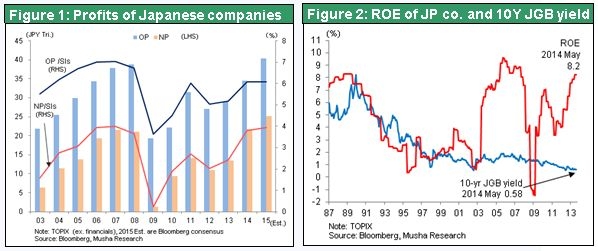

Japanese companies reported fiscal 2013 earnings that were generally higher than the previous record high of fiscal 2008. Return on equity as well has recovered to about the previous peak. Obviously, the long-term slump in Japan’s corporate earning power has made a complete recovery. It goes without saying that the primary reason for this rebound is the shift in the underlying trend toward a weaker yen. The cynical view of this performance is that higher earnings are a one-time event caused by external events. But this is merely a one-sided interpretation. Admittedly, earnings benefited from the yen’s decline from \83.1 to \100.2 (20.6%) against the U.S. dollar and from \107.1 to \134.4 (25.5%) against the euro. However, higher earnings were not caused by the weaker yen alone.

The primary cause of today’s strong earnings is the successful conversion of value creation models by Japanese companies. Furthermore, this model conversion equates to a change in the value creation pattern of the entire Japanese economy. In the postwar years, Japan consistently used a model of exporting unemployment (the value exploitation model). Now, the country has shifted to the job exporting model (the value provision model). Making this conversion possible were world’s largest scale cost-cutting restructuring along with consistent R&D investments. Without this model conversion, Japanese companies along with the Japanese economy would have probably remained mired in a long-term decline.

Shifting to a different value creation model was an essential condition for achieving the revival of the Japanese economy. Only because this revival had been largely completed were the reflationary policies of Abenomics able to function as a sufficient condition. Japan has finally ended strong-yen deflation and achieved an economic recovery. Some people think this was not because of Abenomics. They think these accomplishments were instead the result of good timing because the economy was overdue for a rebound. But this is only half of truth.

(2) The demise of the exporting unemployment model and price superiority model

Japan was the Frankenstein of value exploitation

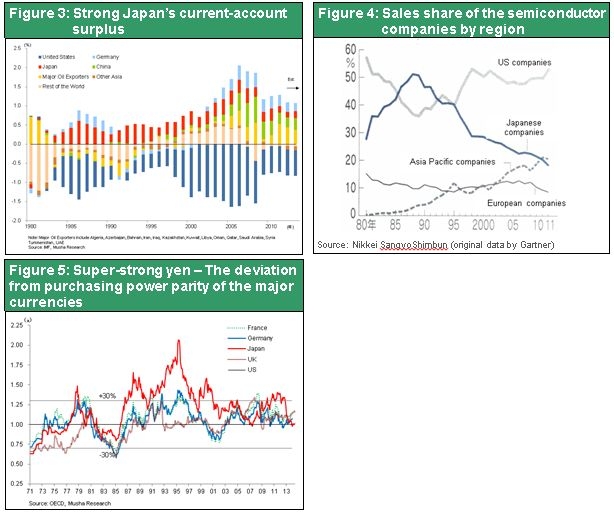

By 1990, Japan’s business model (the Japanese value creation model) had reached a dead end. Japan faced mounting criticism because of the immense volume of exports backed by its overwhelming competitive edge. Japanese companies sincerely did their best by cutting costs and capturing market share. But these actions ended up earning Japan a reputation as a veritable Frankenstein that was destroying the global order of business. As you can see in Figure 3, it appears that the global imbalance was caused solely by Japan’s massive current account surplus. Japan itself lacked balance. The country lacked wisdom (values and military and political power regarding the global order) but ranked first in the world in terms of strength (competitive and economic power and the trade surplus). There were questions about Japan’s very existence. In the book The Japan That Can Say No by Shintaro Ishihara and Akio Morita, the authors say that “the United States would be unable to maintain its military superiority without Japanese semiconductor chips because they are vital to the precision of U.S. defense technologies for missiles and other weapons.” Figure 4 shows that Japan surpassed the United States in 1990 with a share of more than 50% of the global semiconductor market. The U.S. semiconductor industry was on the verge of annihilation. When the first Gulf War started, Japan used its power due to the lack of wisdom by making a contribution of $13 billion, the world’s largest. But Japan could not provide any military support (no boots on the ground) due to restrictions imposed by the constitution. When Kuwait published an enormous advertisement thanking countries of the world, Japan was not among the many countries that were named.

Criticism of Japan led to the extreme appreciation of the yen. As you can see in Figure 5, the yen was far overvalued in terms of purchasing power parity in relation to other major currencies between 1985 and 2000. A veritably destructive competitive edge resulted in the yen’s abnormal strength. This in turn created immense difficulties for Japan’s economy and companies. Benefits of hard work by Japanese companies made them more competitive and captured global market share. But the stronger yen and trade friction then caused earnings to fall. In sum, this was a period when it was difficult to be rewarded for hard work.

Japan’s value creation model when hard work was not rewarded

In 1992, Akio Morita, who was then chairman of Sony and vice chairman of Keidanren, wrote an article in Bungeishunju (a well-known magazine in Japan) in which he stated that Japanese-style management may no longer be viable. He told everything about the hopelessness of the current situation. The article said that Japanese companies are competing fiercely against each other in Japan with everyone doing the same thing. Capturing market share was vital to success. So companies lowered prices and then cut earnings and costs at the expense of efficiency in order to survive with the lower prices. Efficiency was sacrificed in many ways: long working hours; a low share of income for labor; low dividend payout ratios; demands on parts suppliers; little interest in corporate social responsibility; and inadequate measures to protect the environment and conserve resources. On the other hand, European and U.S. companies were in the process of targeting only their respective strategic markets. With fewer companies in each sector, competition was not as heated. Selling prices incorporated suitable profit margins and the necessary costs. From the standpoint of European and U.S. companies, Japanese companies continued to compete worldwide by using the same peculiar methods and management philosophies as they did within Japan. These companies finally could no longer put up with this behavior of Japanese companies.

Other countries want Japanese companies to compete fairly by following the same rules that European and U.S. companies use. They also want Japanese companies to set prices that adequately reflect the actions that were taken at the expense of efficiency. However, this is merely the ideal. Under the current circumstances, if one company enacts sweeping reforms, it will quickly become difficult for that company to survive. For the time being, companies should probably start by doing only what they can. For example, companies can consider actions involving flex holidays for consecutive days off, recruiting systems that do not stress academic background, and a reduction in the frequency of model changes for products.

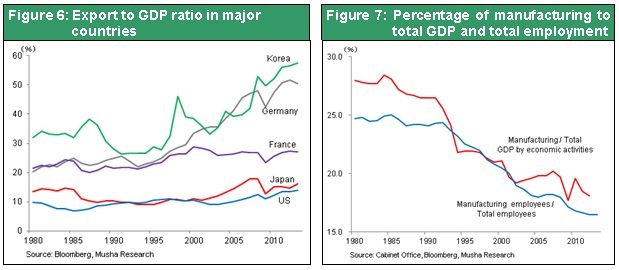

Japan’s export ratio appears to be low, but exports support value creation

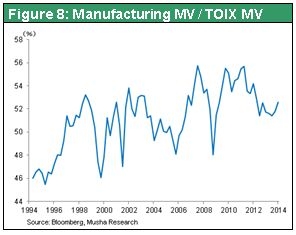

Japan’s very low ratio of exports to GDP masked the country’s business model of exporting unemployment. Figure 6 shows that Japan’s export ratio of between 10% and 15% has been much lower than in other countries. Figure 7 shows that manufacturing, the primary source of exports, accounted for less than 30% of Japan’s economy as of 1990. However, the manufacturing sector has consistently provided critical support for value creation by various companies. In 1990, half of all earnings of listed companies in Japan were at manufacturers that earned profits from exports. Furthermore, export-oriented manufacturers consistently accounted for half of the total market capitalization of listed companies in Japan (Figure 8). At that time, there was a gap between value creation and demand creation. This fundamental contradiction surfaced in the form of a massive current account surplus.

(3) Completion of the switch to the job creation model and superior quality-exclusive technology model

Fast growth in overseas investments drives the model conversion

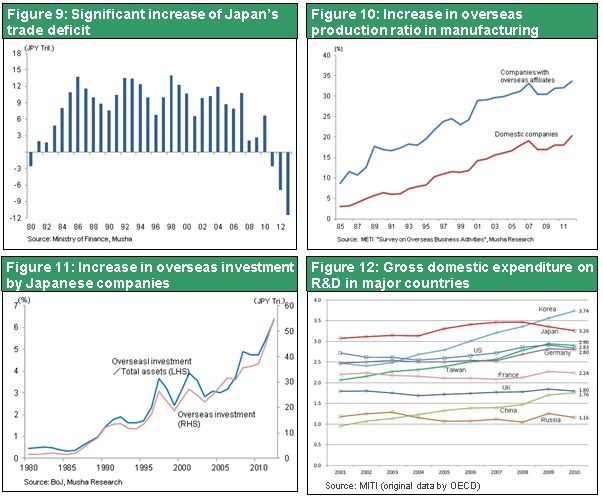

In 1990, Japan reached the peak of its exporting unemployment business model and price competition business model. Japan’s business models have undergone enormous changes during the ensuing 20 years. While Japan’s manufacturing sector was hollowed out, Japanese companies constructed many factories in other countries. Moving manufacturing overseas transformed Japan from a country with the world’s largest trade surplus into a country with a large trade deficit (Figure 9).

As you can see in Figure 10, offshore production has increased to 30% of total output by Japanese manufacturers. In terms of sales and added value, manufacturing in Japan still appears to be superior because of the high cost of operating in Japan (where companies develop technologies and have their “mother factories”). However, most of the jobs are probably at factories outside Japan. In the basic survey of overseas business activities by the Ministry of Economy, Trade and Industry, companies that returned the questionnaire alone had 5.58 million employees (including 4.36 million in the manufacturing sector) outside Japan in fiscal 2012. This was twice as high as 20 years ago. Large manufacturers have far more employees in other countries than in Japan. Moreover, net income at overseas subsidiaries doubled over the prior decade from \3.2 trillion in fiscal 2003 to \6.4 trillion in fiscal 2012.

Figure 11 shows the sharp increase in the balance of overseas investments by Japanese companies during the past 20 years based on the Bank of Japan flow of funds accounts. Over this period, there was no growth at all in Japan’s nominal GDP because of deflation. Total assets of Japanese companies were flat as well during this period. Rapid growth occurred only in cash and overseas assets. Overseas assets surged from 1.5% of total assets in 1990 to 6.3% in 2012. This demonstrates that Japanese companies have completed their conversions to business models centered on income from overseas manufacturing.

Uninterrupted technology development investments despite difficulties

Japanese companies preserved their basic technological superiority during this difficult period. Figure 12 compares R&D expenditures with the GDPs of major countries. You can see that Japan maintained the world’s highest level of technology development investments even during the country’s economic slump. Japan was unable to compete based on cost with Korea, Taiwan and China, where companies were using existing products and technologies. Furthermore, companies in Korea and Taiwan that were pursuing Japanese companies are now facing competition from Chinese companies. In response, Japanese companies shifted their core businesses to sectors where they have exclusive technologies, and thus encounter little or no competition. In the high-tech category, Japanese companies are no longer suppliers of TVs, PCs and other products that have become commodities. Manufacturers in Japan now specialize in high-tech products like basic materials, components and equipment and advanced technologies in fields like human-machine interfaces and systems. These high-tech products and technologies are responsible for Japan’s record-high earnings.

The successful U.S. model conversion of the 1980s and 1990s

Among other industrialized countries, the United States achieved an enormous transformation of its business model between about 1980 and 2000. In a big-government (Keynesian economics, modified capitalism) environment, value creation at U.S. companies had stopped growing amid inflation linked to a destructive wage-price cycle. U.S. companies also encountered a competition crisis caused by the emergence of Japanese companies. The 1984 Young Report and other research showed that U.S. companies had to restructure their operations and change their business models. Under the laissez-faire policies of President Reagan, U.S. companies established new models for creating value. Initiatives included restructuring their domestic operations (holding down unit labor cost), moving factories to other countries, shifting emphasis to high-tech industries, and dominating targeted markets (Intel, Microsoft, etc.). Transformation of the value creation model is the true reason for the revitalization of the United States, which has been the world’s only economic superpower since about 1995. I explained these events in my book America, the Revitalization of Capitalism (1993, Toyo Keizai Shinposha). Japan’s situation today is reminiscent of the United States of the early 1990s with respect to the conversion of the value creation model.

(4) The world’s biggest streamlining and lower real wages changed Japan’s model

Workers and household budgets were sacrificed

Japanese companies did an excellent job of switching their business models during the 20 years of economic stagnation. Companies completed the change to the models of exporting jobs and relying on superior quality and exclusive technologies. How was this accomplished? The answer is that companies were able to invest in model conversions year after year by shifting the associated burdens to workers and the service sector. Consequently, Japan’s “lost 20 years” was actually a time of sacrifices for workers, households and the service sector.

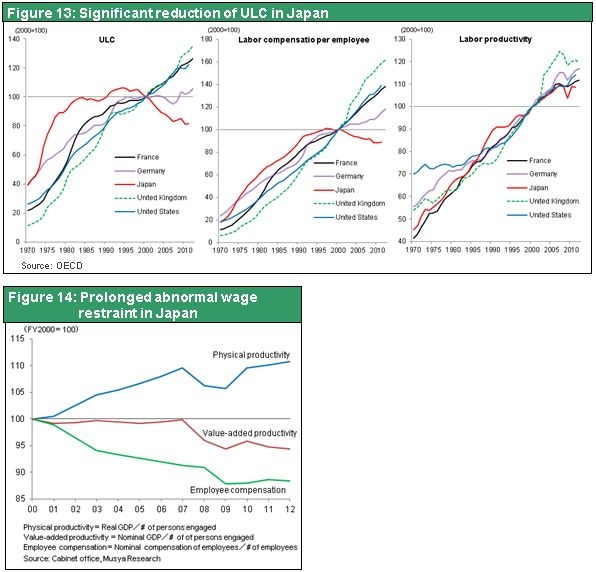

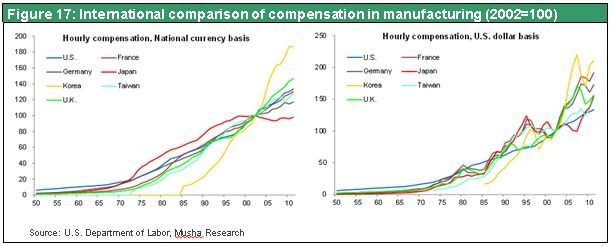

A comparison of unit labor cost in major countries is shown in Figure 13. As unit labor cost climbed in other countries, there was a significant decline at Japanese companies. This demonstrates that Japanese companies achieved more progress with streamlining than anywhere else in the world. The resulting surplus earnings made it possible to make model-conversion investments even as selling prices steadily declined because of the yen’s strength and deflation.

Falling compensation pushed up productivity

Figure 14 shows Japan’s physical productivity, value-added productivity and worker compensation since 2000. Obviously, there are big discrepancies among these three statistics. Physical productivity is higher, which signifies that workers are creating more value. But at the same time, value-added productivity (nominal income that companies earn) is down. The difference between these two figures is the decline in selling prices caused by the yen’s strength and deflation. Income shifted from sellers to buyers as a result. Compensation of workers fell even more than the downturn in value-added productivity. In other words, workers were forced to accept lower wages as labor’s share of income dropped. But there was more. Real wages fell as well, which forced workers to accept a lower standard of living. This was extremely unfair. On the other hand, the extra profits that companies earned from these sacrifices funded the model conversion. Consequently, the sacrifices of workers were not for nothing.

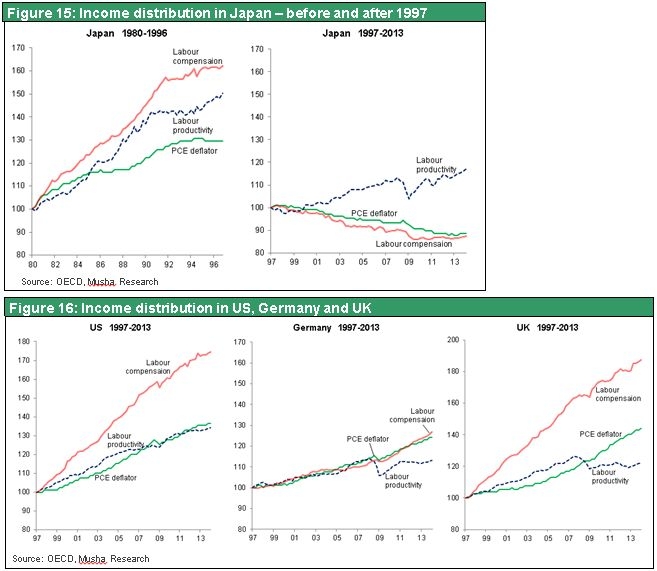

Figure 15 shows productivity, wages and prices in Japan before 1997, when there was no deflation, and afterward as deflation took hold. A big shift occurred in the structure of income distributions when deflation started. In 1997, just before deflation began, higher wages led to higher productivity and then higher prices in all countries of the world (Figure 16), including Japan. After 1997, deflation completely reversed the income distribution structure in Japan: higher productivity led to lower prices and then lower wages. The sacrifice of workers is obvious.

Japanese-style governance aided the model conversion

These events illustrate the positive side of corporate governance in Japan, which differs from generally accepted governance standards. Governance in Japan often has the negative aspects of lacking openness and limiting a company’s internal democracy. Furthermore, Japanese-style governance tends to place priority on a company’s inner circle at the expense of distributions to shareholders. Nevertheless, most companies in Japan were able to convert their business models and avoid bankruptcy during the “lost 20 years.” The reason may be that the distinctive governance systems of these companies functioned effectively.

Without Japanese-style governance, companies would have paid workers’ in line with their productivity, increased dividends and raised other outflows of funds. Converting business models would probably have been impossible. Look at the difference between Fuji Film and Kodak. Fuji Film did not seek to maximize its ROE, instead accumulating large amounts of equity and cash on its balance sheet. Overseas investors criticized the company as a symbol of the problems of Japanese-style financial management and governance. When the switch to digital technology ended the market for photographic film, Kodak declared bankruptcy. But Fuji Film successfully established a new business model. Making this possible were the funds generated by Japanese-style governance.

(5) The benefits of the model conversion are emerging: Higher earnings, wages, dividends and stock repurchases

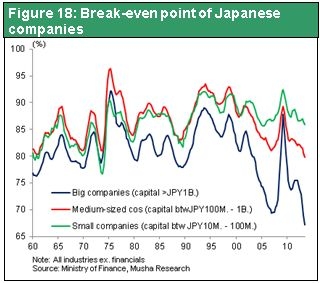

Deflation has ended. Having created new models, Japanese companies are now earning adequate profits. As a result, Japanese companies no longer require the financial cushion (surplus equity, cash and other sources of liquidity) that was needed to fund the model conversions and cope with a series of financial crises. Now companies are in a position to increase emphasis on outflows like wages, dividends and stock repurchases. Growth in real wages will probably trigger the start of full-scale expansion of domestic demand. Unit selling prices of Japanese companies will climb because of the weaker yen and inflation. Companies in Japan will benefit from both the volume effect of rising domestic demand the price effect due to the end of deflation. The result will be even more growth in earnings. As you can see in Figure 18, Japanese companies have significantly lowered their break-even point in terms of sales. That means we can expect to see a big improvement in profit margins as sales grow. Companies have announced very conservative forecasts for sales and earnings in the fiscal year ending in March 2015. Substantial upward revisions are likely to occur as the success of Abenomics produces a variety of reforms.

I expect to see many Japanese companies distribute earnings to shareholders through dividends and stock repurchases. These actions will significantly improve the ROE, which is generally lower than at companies in other countries. Symbolizing this shift is the recent announcement by Amada, a typical Japanese company with regard to retaining liquidity. Amada has changed its stance and plans to distribute all earnings in the next two fiscal years to shareholders. Amada has established an adequate foundation for business operations (for both global operations and developing technologies and products). Completing work on this infrastructure is what allowed the company to shift to prioritizing shareholder distributions and ROE. Many more Japanese companies will probably take similar actions.

We are on the verge of a significant increase in the value of Japanese stocks. Prices of stocks have already factored in the reality of Abenomics. Now we are about to advance to the stage where prices factor in the long-term growth in earnings that will result from the conversion of business models. Reforms to Japan’s Government Pension Investment Fund were the first step in what is likely to be a massive movement of money from low-return instruments like bank deposits and bonds to higher-return assets with risk. This is why I believe that a Japanese stock market rally of an unprecedented magnitude is about to begin.

**************

Additional information

For your reference, please see Key Strategy Issues (Vol. 288) of February 25, 2010 titled Perspectives on deflation in Japan ? 2, How the “lost 20 years” made Japan even stronger”.

http://www.musha.co.jp/attachment/issues_288_20100226_en.pdf