Aug 11, 2016

Key Strategy Issues Vol.K300

Global Events and the Investment Climate for Japanese Stocks

(1) No change in ongoing advances with technology, the division of labor and productivity

An age of unprecedented growth in productivity

If you ask almost anyone in the business, media or academic sectors about the most likely scenario for the future, the answer would probably be the same: no one has any clue about the future. Some people have an extremely negative outlook. Others are optimistic. But the truth is that no one knows at all what is happening now or where the world is headed. Past experiences are useless as the world enters a new age like no one has seen before. Even the academic sector is unable to use past experience to create a viable theory. As a result, the only option for me is to take on the somewhat reckless challenge of creating my own hypothesis. There are no historical experiences that can be used to demonstrate that investments, how companies are managed and the policies of governments are correct. This is why there is a need to take on this challenge by using a hypothesis. My personal belief is that the world is on the verge of a very bright future. But some people think the world is at a turning point leading to an extremely dark future. Why is there such a big difference in these views?

Let’s begin by looking back over the long-term history of mankind. People 10,000 and even 100,000 years ago lived like animals. Our distant ancestors led lives that were defined by the fear of starvation every day. Today, we lead comfortable lives like members of royalty. I think there are two primary reasons for this change in our standard of living. First is technological progress along with the resulting dramatic growth in productivity. Productivity was basically unchanged for tens of thousands of years. But new technologies thousands of years ago sparked the beginning of an agricultural revolution. Since then, there has been a dramatic improvement in productivity that has enabled us to enjoy a very high standard of living.

The second reason for mankind’s progress is the division of labor. Long ago, our ancestors had to produce or gather everything they needed to live, much like in the novel ‘Robinson Crusoe’. Today, we benefit from the work of many people as we lead lives made possible by the division of labor. People today cannot live without access to goods sourced on a global scale from the United States, China, Europe and other regions. Ending international trade would prevent us from living the way we currently do. Therefore, the expansion of the division of labor is one more force behind economic growth. Looking back, Japan was divided into small feudal domains until only about a century ago. Each one was economically self-sufficient. But then the feudal period ended and a unified economy emerged in Japan. Now Japan is an integral part of the global economy. As the international division of labor advanced, countries became increasingly dependent on each other economically. The lives of the people of Japan are made possible by the constant inflow of goods from overseas. Of course, Japan supplies goods to other countries too.

The question today is whether or not these advances in technologies, productivity and the division of labor have come to an end. If progress has stopped, the outlook is negative. But in fact the pace of technological progress is currently faster than ever. We are witnessing remarkable shifts in the business climate and our lives because of progress involving smartphones, cloud computing, artificial intelligence, robots and many other fields. Furthermore, the advance of the division of labor (globalization), another key force behind progress, is irreversible. If we believe that these two advances will not stop, then we are in the midst of an upward trend in economic and lifestyle support backed by the advancement of mankind and a beneficial tailwind.

Outdated thinking that impedes growth (better living standards) must be eliminated

If this is true, why are there so many difficulties and pessimism? The answer is that the world is at a turning point. For example, an insect sheds its exoskeleton in order to continue growing. Economies undergo the same process. As technologies and productivity advance, it becomes impossible to manage a real economy shaped by rising productivity while still using the same framework as in prior years. This explains why the world has progressed through a number of economic stages over thousands of years. There was a period of Asian-style production, then a period of classic slavery in ancient times, then a feudal system and then capitalism. Advances in technology and productivity were behind these shifts in economic systems. Each change occurred because the prior system was no longer viable.

Today, even if technology and the division of labor advance properly, the benefits cannot be fully utilized due to interference from old systems. In fact, this situation may lead to an economic collapse. But these difficulties could very well be the pain that is needed for the birth of a new and brighter age. The next section examines today’s economy and market conditions while looking at where these difficulties exist and how they can be overcome.

(2) Market Overview and Outlook –Global Crisis Averted, a Rally of Japanese Stocks to Follow the Strong-Yen/Weak Stock Price Negative Cycle

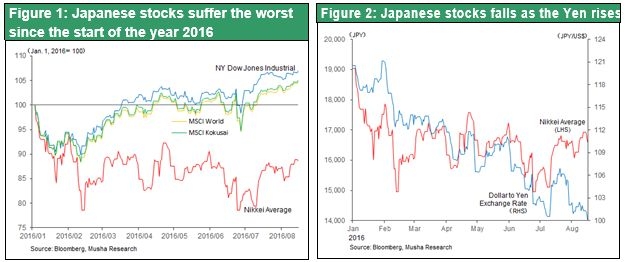

A correction is imminent and Japanese stocks will no longer be the world’s only loser

High volatility and a series of sharp drops in Japan’s stock markets have justified a broad range of pessimistic views. The most important recent characteristic is the position of Japan’s stocks as the world’s only loser. At the end of July, Japanese stocks were down 20% from the beginning of the year. But stock prices have moved up in 2016 in the United States and in Britain even after the decision to leave the EU. There were three likely scenarios for stock prices as of the end of July. (1) Japanese stocks will remain the world’s only loser. This scenario assumes that the Japanese economy will also be the only loser. But this is extremely unlikely to happen. (2) A correction will end Japan’s position as the only loser. If the cause of Japan’s low stock prices can be eliminated, a powerful catch-up rally is likely to begin in about the fall of 2016. This rally would propel the Nikkei Average from the current ¥15,000 back to the ¥18,000 level. I think there is a 70% probability of this happening. (3) There is a 30% probability of overseas stock prices falling as stock prices are pulled down by Japan’s low stock prices. In other words, this scenario calls for a global bear market. If this happens, the global stock market drop that started in August 2015 would finally reach a climax. In this case, Japan’s position as the only loser would end up as a precursor of a global downturn in stock prices and a worldwide recession.

However, US stock prices have been climbing to new highs since the middle of July. This strength means that the third scenario is no longer viable. Therefore, the likelihood of a catch-up stock market rally in Japan has become even greater.

Fundamentals cannot explain the rapid appreciation of the yen

The yen’s strength is obviously the reason that Japanese stocks have been the world’s only loser. The yen rose about 20% from ¥120 to ¥100 against the US dollar over a period of only six months. Stock prices in Japan dropped 20%. But due to the yen’s strength, the performance of Japanese stocks on a dollar basis was not too bad. But the 20% drop in stock prices did inflict serious damage on the Japanese economy and financial markets.

The outlook for stocks in Japan depends on the upcoming direction of the yen/dollar exchange rate. In November 2015, most market observers expected the yen’s decline to continue. However, early in 2016 most of these people suddenly shifted their stance to anticipating a stronger yen because the dollar’s upturn had ended. Fundamentals were used to support this view. But I think fundamentals provide almost no justification at all to expect the yen to appreciate.

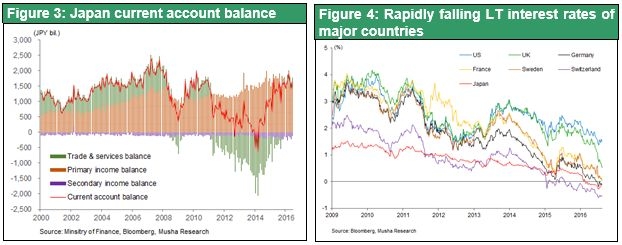

The US economy is much stronger than the Japanese economy. This difference is also evident in central bank policies. The Fed is slowly easing up on the brakes but still plans to raise interest rates. But the Bank of Japan is going in the opposite direction with more monetary easing. Therefore, the current condition of the US and Japanese economies as well as the policies of the two central banks point to a stronger dollar and weaker yen. Only one element of fundamentals appears to be persuasive: Japan’s current account balance has rapidly switched from a deficit two years ago to a surplus of about 20 trillion yen. A closer look reveals that the income balance is entirely responsible for this surplus. The trade balance is even. The current account balance therefore reflects income from sources like interest and dividends from past overseas investments and earnings of overseas companies. Since the current account surplus consists of the benefits of overseas investments, this is not a number that can be adjusted by making the yen stronger or weaker. Furthermore, as long as overseas earnings are not converted into yen, there will be no upward pressure on the yen regardless of how large these earnings become.

Some people point to the decline in effective interest rates in the United States as a reason for the yen’s strength. But even though US inflation is increasing, global downward pressure on interest rates has prevented US long-term rates from moving up. The strength of the US economy is a major reason for this situation, so there is no reason in sight for the dollar to weaken. Many economists and members of the academic community say it is obvious that the yen should appreciate. But they are wrong. Fundamentals do not provide a single reason for the yen to become stronger.

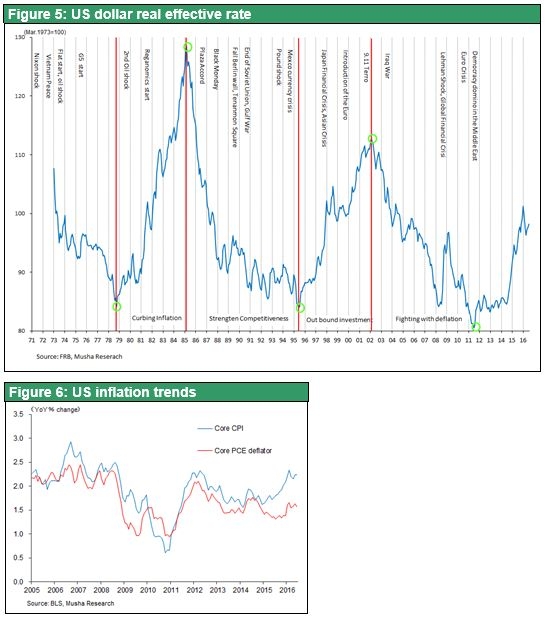

A global crisis makes the dollar weaker and yen stronger – Similarities with 1998

Exactly why has the yen appreciated? I believe the international financial crisis that began at the end of 2015 is the primary reason. A weaker dollar can be called an emergency evacuation method used to respond to an international financial crisis. A long-term cycle of the dollar started in 1971. The effective dollar/yen exchange rate has gone up and down in cycles of five to 10 years. Most recently, the dollar cycle bottomed out in 2011 and the dollar began to appreciate. But the dollar’s upturn came to an end in early 2016. There is an increasingly widespread view that the dollar has now entered the next downward phase.

There are many similarities between this downturn of the dollar and the downturn that happened in 1998. As you can see in Figure X, the dollar’s weakness in 1998 was only a brief event that occurred in the midst of an extended period of dollar appreciation between 1995 and 2002. The Russian ruble crisis happened in 1998. The Long-Term Capital Management hedge fund collapsed as a result and there were concerns about bankruptcies of Morgan Stanley and other large financial institutions. The Fed responded with monetary easing to increase the supply of dollars. This action is what caused the dollar’s brief downturn in 1998. Once the ruble crisis ended, the US returned to a tight-money stance and the dollar started appreciating again. This upturn continued for the next four years.

The dollar’s recent weakness as well was a correct response to a crisis just as in 1998. In December 2015, the Fed implemented an interest rate hike for the first time in nine and a half years. At that time, most people expected four more Fed interest rate increases in 2016. But these expectations have quickly receded since the start of 2016. Fed Chair Janet Yellen has given two reasons for the slower pace of interest rate hikes. First is concerns about the global economy, including the weakness of emerging country economies. The United States needs to reinforce its monetary easing stance as a response to the depreciating currencies of emerging countries. Second is the volatility of financial and stock markets since August 2015. There was another big drop in 2016. When there is instability like this in financial markets and the global economy, the Fed responds with actions that weaken the dollar. The dollar’s weakness this time was therefore the correct course of action just as it was in 1998.

If the dollar did in fact depreciate in response to global events, the dollar should start appreciating again as the United States resumes interest rate hikes as the global crisis wind down. This is what happened in 1998. We should regard this as the primary scenario. As I explain later, the reason is that the US economy has very few problems. The US economy is in a period of self-sustained growth and inflation is increasing. This is obviously creating an environment within the United States for higher interest rates, which will make the dollar stronger. That means we can view the dollar’s current downturn as only a brief event. Of course, the ability to end the global financial crisis will ultimately determine whether or not this view is correct. In 1998, the rubble sparked a global financial crisis. This problem was easily resolved because of the small size of the Russian economy. Only a relatively short dollar downturn and increase in the supply of dollars was needed.

Can the global financial crisis originating in China (capital outflow and yuan depreciation) be stopped?

China is the source of today’s crisis. China has probably made excessive investments on a scale never seen before. The country’s potential financial risk has skyrocketed. The massive scale of this problem means that monetary easing and an increase in liquidity over only six months, as was the case during the ruble crisis, will not be enough. This crisis could even completely block the United States from enacting effective monetary policies. In the current environment, the dollar is unlikely to stop declining and resume its upward trend simply because of US fundamentals. The key point is that the yen was appreciating at the same time.

Why did the yen suddenly become stronger early in 2016? And why did the US Treasury Department send a message that supported the yen’s strength? As the yen continued to appreciate, Japanese Finance Minister Taro Aso made the highly unusual statement that the yen’s strength was highly disruptive to financial discipline and that Japan was ready to intervene. The day after this statement, US Secretary of the Treasury Jack Lew said that market orderliness was intact. Mr. Lew rejected Mr. Aso’s position based on the belief that market conditions were nowhere near the need for intervention. A virtually unlimited upturn of the yen continued for about six months. I think we can call this a global crisis response endaka.

The yen was sacrificed to end a global financial crisis – Now the world owes Japan a favor

The current global crisis started in China. Two key points define this crisis: the plunge in the yuan’s value and the outflow of capital from China. A catastrophic financial crisis could occur worldwide if these outflows continue and the yuan begins a free fall. Preventing this from happening will require propping up the yuan. If the bottom drops out of the yuan market, there would be an extremely serious global crisis. This is why the United States and all other developed countries need Chinese financial authorities to prevent the yuan from falling. To receive this support of the yuan from China, the yen was submitted as a veritable sacrificial lamb.

Fundamentals and other reasons specific to Japan are not why the yen has become so strong. The yen’s appreciation is a sacrificial event in order to maintain international order. This is very frustrating for Japan. International order is clearly needed. But why does Japan have to accept a sacrifice of this magnitude? I think this is simply something that occurs from time to time and Japan’s only option is to tolerate this situation. Depending on one’s view, the yen’s strength could be good news. Accepting this sacrifice to aid the world means that Japan is now owed a big favor. So Japan should just stick it out for now and look ahead to collecting this favor.

At the Davos World Economic Forum in late January 2016, George Soros loudly declared that he was selling China. He said that investors should sell the yuan and Hong Kong dollar because a hard landing in China is inevitable. Government officials in China rejected this outlook, saying the country is sound. The United States and Japan also wanted to disagree with the position of Mr. Soros. If China triggers a global financial crisis as Mr. Soros predicts, it would signal the demise of the global economy. So this crisis must be prevented at all costs. The result was a US-China coalition to counter the Mr. Soros’ shorting of the yuan. Countries that were enemies came together to protect the yuan due to their common interests. Holding up the yuan was vital for China as well as the entire world.

Starting in late January, the world’s attention was focused on the plummeting yuan and international monetary cooperation aimed at preventing China from triggering a global financial crisis. This was the central theme at the meeting of G20 Finance Ministers and Central Bank Governors that took place in Shanghai at the end of February. Participants agreed to reject competitive currency devaluations. There will be no currency devaluations to deal with internal issues that had the effect of transferring one country’s economic problems to other countries. China was the most important target. With a massive volume of surplus production capacity, China could consider devaluing the yuan in order to put idle factories to work. This would reduce the burden on China’s economy by shifting this problem to other countries. In addition, China would create turmoil in the global economy by effectively exporting deflation. Consequently, preventing this from happening was the highest priority of the Shanghai G20.

However, China is not a country that will easily respond to demands to maintain the value of the yuan because the country has its own problems. Therefore, I think China was told that the world will cooperate if the country does what is needed. In return, the yen will be allowed to appreciate. Even though China was the main target at the Shanghai G20, the yen became a target as well in order to facilitate financial cooperation. After this meeting, Mr. Aso and Bank of Japan Governor Haruhiko Kuroda said that there was no discussion about the yen. But the financial authorities of the United States and Netherlands said that in fact there was talk about the yen. Subsequently, the United States made statements supporting a stronger yen while Japan frantically tried to prevent the yen from appreciating. But US “verbal intervention” created rising expectations for a stronger yen. This was the process behind the yen’s appreciation.

The correct view is that the yen’s strength had nothing at all to do with the situation within Japan or economic fundamentals. The yen appreciated to avoid a global financial crisis because it was used for persuading China to hold up the yuan. An intervention by Japan’s Finance Ministry to hold down the yen would be very difficult due to this link between the China and the yen. China has been waiting for an opportunity to devalue the yuan. There is little doubt that China would shift the responsibility of this devaluation to Japan by saying that Japan had engaged in a competitive devaluation of the yen. Speculators understood why Japan could not intervene in the foreign exchange market and continued to increase positions that anticipated a stronger yen. Japan was trapped as a result. To determine the outlook, we must examine probable upcoming events concerning China’s crisis.

The yen/dollar rate can probably go no farther than about ¥100

The yen is probably nearing the end of its upturn. One reason is that an end to the crisis in China is almost in sight. China is about to stop the yuan from falling by imposing capital controls. In addition, the country is succeeding in preserving confidence in financial markets by using fiscal measures to create demand and monetary easing to extend the life of the asset bubble. The second reason is the outlook for a decline in the desire of the United States for a stronger yen due to three factors. First is the decreasing likelihood of a victory by Donald Trump, who is critical of the dollar’s strength. Second, the United States understands that Japan has already made its sacrifice by permitting the yen to appreciate, which created problems for the Japanese economy. The United States is unlikely to ask this important ally to accept more sacrifices. Third is the health of the US economy. Consequently, US financial authorities do not expect the yen to appreciate to more than ¥100 to the dollar. As an increasing number of investors notice this stance, we will probably see increasing momentum toward a correction that no longer makes Japanese stocks the world’s only loser.

(3) Two Key Global Forces – (1) China’s Deepening Crisis

Two conflicting forces are creating turbulence

The following section discusses two conflicting forces that exist in the United States and China. There is currently turbulence in both the global economy and the world’s financial markets. Volatility is confusing investors. When stock prices fall, people think it’s a buying opportunity. But then prices bounce back quickly and people end up buying at a peak after which prices fall again. This extremely volatile market is caused by two powerful forces moving in different directions. One is positive. This force involves the technology and industrial revolutions that began in the United States. These revolutions are creating a new and better lifestyle supported by many innovative products. The other force comes from China and is extremely negative. China has made excessive investments on a scale never seen before. Now the country has finally reached the point of paying the price for these excesses. Turbulence is produced because the positive US force and negative Chinese force are simultaneously influencing the world’s financial markets. I believe this explains the ongoing financial market volatility. Consequently, we need to take a closer look at the actual condition of the US and Chinese economies.

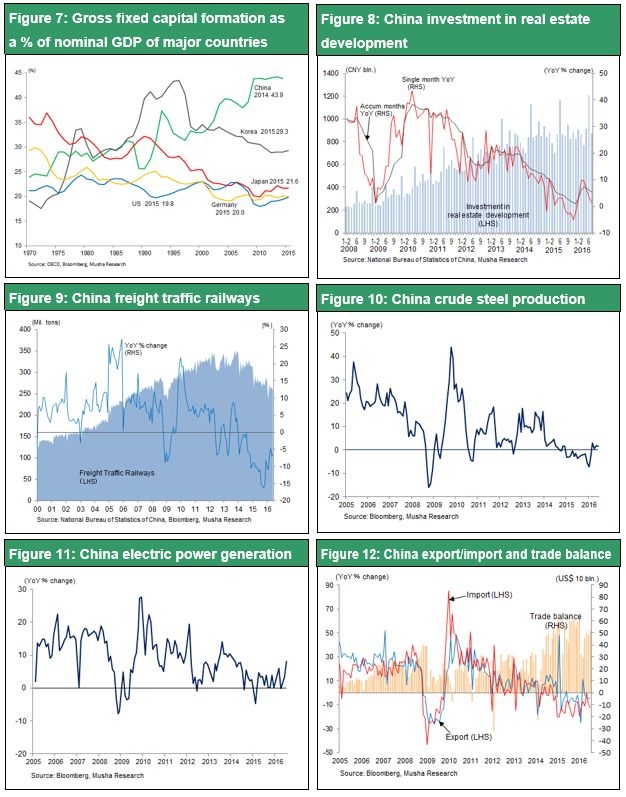

China’s crisis is advancing – Physical growth has stopped

Very serious economic problems are about to emerge in China. The country’s economy will probably stop growing in terms of physical goods and may even start to shrink. Declines are occurring in many sectors. Examples include cargo transported by rail, crude steel production, electricity generation, and exports and imports. Furthermore, a recovery is probably impossible because China can no longer keep increasing investments, which fueled growth in the past. In fact, investments in China will decrease. There are three main categories of investments in China: (1) Housing and real estate, (2) Capital expenditures by companies, and (3) Infrastructure and other public-sector investments. Investments in all three categories rose to extraordinarily high levels at one point. In 2011 and 2012, China used about the same amount of cement as the United States did during the past century. Enormous investments dramatically altered the Chinese landscape during the past several years. Massive expenditures for buildings, expressways, high-speed rail lines, subways and other projects changed China to a remarkable degree. However, China could not avoid the big distortions that these investments caused.

China’s excessive production capacity and hidden non-performing assets

One major distortion in China is the large surplus of factories, houses and other assets resulting from rapid growth in these sectors. China has substantial excess capacity in the majority of its industries, including steel, cement, shipbuilding and many others. Much of the large volume of newly constructed housing is empty because there was no accompanying growth in purchasing power. Housing developments on the periphery of cities are virtually ghost towns now. Big drops in housing prices, especially in inland China, occurred very recently. Prices are rebounding due to supportive measures. However, there are similar surpluses involving infrastructure and public-works investments in China. Excessive investments have resulted in excessive production capacity. If no one lives in the currently empty surplus housing, the next distortion will be non-performing loans. China is attempting to conceal this problem for the time being by using monetary easing. But non-performing assets are certain to become a problem in the near future. Once this happens, China will be unable to achieve economic growth. Although China says its GDP is expanding at an annual rate of 6%, the country has entered a phase in which physical GDP growth is impossible.

China’s Achilles’ heel – Declines in foreign exchange reserves and the yuan

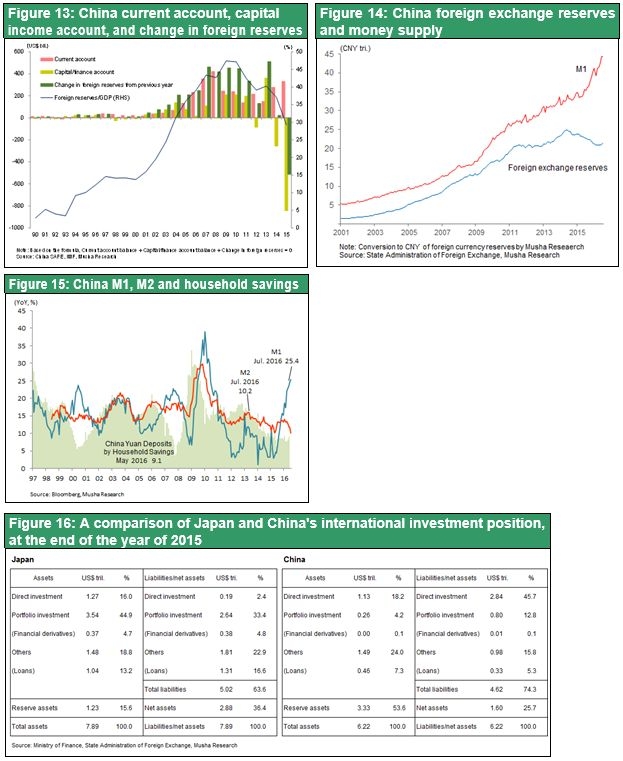

In addition to the end of physical growth, China is facing challenges posed by a problem that is the country’s Achilles’ heel. Regardless of the magnitude of excess investments and hidden non-performing loans, China can keep its asset bubble alive with additional loans and unlimited monetary easing. Continuing to extend loans to zombie companies that are about to become insolvent conceals the financial statement losses and allows these companies to survive. However, since August 2015, there has been a growing problem, in a sense China’s Achilles’ heel, that will make it very difficult to continue these actions: falling foreign exchange reserves and the risk of a plunge in the yuan’s value. China’s money supply (M1) has increased significantly for many years. Growth in the money supply is what made it possible for China to make investments to a degree that was even reckless.

Foreign currency was the source of China’s money supply. Basically, China was steadily accumulating foreign currency and using those reserves to back up the supply of its own currency. Foreign currency-denominated assets now account for about 80% of the assets of the Bank of China, the country’s central bank. Very recently, China’s currency system has become similar to the currency board system of an emerging country, where money is supplied with the backing of foreign currency holdings. Investments in China increased because of growth in the supply of money, which was linked to foreign exchange reserves. But these reserves have been falling quickly after peaking in June 2014 and the yuan began its own rapid downturn in August 2015.

We now know that a big decrease in China’s foreign exchange reserves poses a significant risk to the global financial system. But many people had no idea of the risk associated with these reserves. China’s own strengths were responsible for the growth in foreign currency reserves. The common perception is that these reserves increased because of the country’s strengths, namely highly competitive industries and a large trade surplus. The truth is that half of these reserves represent foreign trade surplus with the rest derived from loans and capital inflows from other countries. This fact was not well known until last year.

Now statistics are revealing a disturbing trend. China’s capital account balance, which was the source of the rapid growth in foreign exchange reserves, has moved significantly into the red since the summer of 2014. This is the reason for the emergence of worries about China starting a financial crisis. China’s substantial current account and trade surpluses seem to indicate that there is no reason for foreign exchange reserves to decline. The fact that these reserves are falling regardless of the size of the current account and trade surpluses demonstrates that capital outflows are far higher than these surpluses.

In the past, capital inflows gave China more money than would have been possible based on the country’s own resources. Now this situation has reversed because money is flowing out of the country. This is why the possibility that China starts a financial crisis has been increasing since August 2015. The critical point concerning this problem is whether or not China can control capital outflows and the yuan’s value. If control is not possible, monetary easing in China will come to an end, the asset bubble will burst and zombie companies will become bankrupt. The result would be the beginning of a financial crisis. This leads to the question of how these events can be prevented.

A recent issue of The Economist had a special section on China with the message that the question is not if but when a China crisis will happen. The article says that a crisis in China is inevitable, which mirrors the opinion of George Soros. This magazine is read by a large number of highly knowledgeable individuals worldwide. As a result, financial market opinion leaders are thinking about what to do as China moves closer to a crisis. We have reached a phase where people are looking for ways to contain this crisis as much as possible and sustain economic growth. There are demands for China to take a variety of actions. Can China hold out for another six months or maybe a year? At some point, China may no longer be able to prevent a crisis. There will be a stampede of capital rushing out of the country and the yuan will plunge. These events could dramatically alter the global financial environment. However, as I noted earlier, China’s capital controls are limiting the yuan’s downside for the time being. Moreover, the country has succeeded in maintaining the confidence of financial markets by using fiscal measures to create demand and monetary easing to extend the life of the asset bubble.

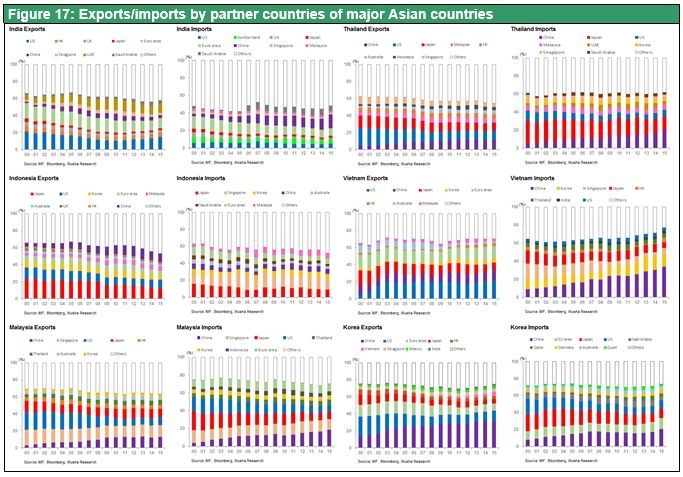

The Indian and Vietnamese economies are at take-off points

As these two economies are entering the growth phase, I see no reason to worry from a long-term perspective. Some countries and regions will see their economies strengthen because of China’s difficulties. One is India and another is Vietnam. Both countries import a large volume of goods from China but have few exports to China. In addition, as their economic growth continues, these countries can benefit from the replacement of imports from China with some domestic production. India consumed more petroleum than Japan in 2015. This may seem to be obvious because its population is more than 10 times higher than Japan’s. However, it is surprising that a country that was very poor not long ago is already using more petroleum than Japan is.

China’s petroleum consumption surpassed Japan in 2003 and the country’s strongest economic growth took place between 2003 and 2008, when Beijing hosted the Olympics. The number of industrial clusters increased rapidly in China once its oil consumption became more than in Japan. This was the beginning of China’s rapid economic growth. India is very likely at this stage today. Foxconn, which acquired Sharp, used China to produce smartphones and at one time had a workforce of more than one million in China. Now, Foxconn plans to build 10 to 12 factories in India and raise its workforce in that country to one million by 2020. India appears to have finally advanced to the point where industrial clusters can emerge as they did in China. There are expectations for this same process to take place in Vietnam. But South Korea is moving in the opposite direction. Exports to China are enormous, so a slowdown of the Chinese economy would inflict serious damage on the Korean economy. This demonstrates how China may have a negative influence on many areas of the world that could result in severe consequences for the global economy.

(4) Two Key Global Forces – (2) Innovation and growing consumption in the United States

Consumption of services is driving a virtuous cycle in the United States

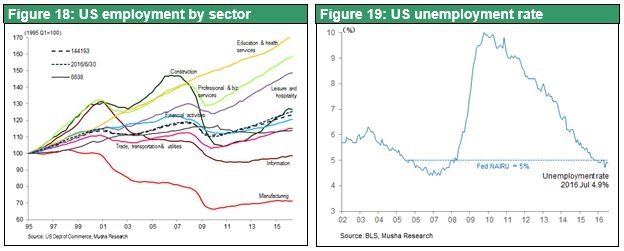

Positive events are taking place in the United States. Economic innovation on an unprecedented scale and growth in consumer spending are supporting sustained growth. Increasing spending for services is the driving force behind US economic growth. Since 1995, the number of jobs in service sectors like education, health care, services and entertainment has been climbing. The reason is a higher level of service consumption. People are eating out, seeking quality health care and education, and enjoying a variety of entertainment. US unemployment rose to 10% in the wake of the global financial crisis. But thanks to higher spending for services, unemployment has since declined to the full-employment level of 4.9%. Clearly, services are at the nucleus of a virtuous cycle of growth in consumer spending, demand, jobs and income. In addition, the most recent ISM Non-Manufacturing Index was also extremely strong.

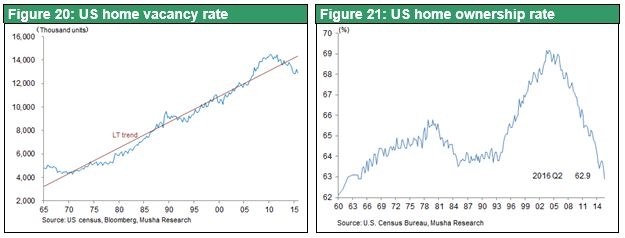

The housing sector is another reason to have a positive outlook for the US economy. During the past 50 years, US housing investments have been an average of 5% of GDP. The highest level was 6.7% just before the start of the global financial crisis. This crisis caused housing investments to plunge to 2% of GDP and these investments are now at 3.6%. As a percentage of GDP, housing investments are not even half way back to the long-term average. Housing is lagging the farthest behind of all components of the US economy. The slow pace of the recovery in the supply of housing has created a tight supply. More housing is needed as the number of rental units declines while the number of households climbs. In the rental housing market, the supply-demand balance has tightened and this has caused rents to escalate. Moreover, the US home ownership rate has dropped from 69% to 63%. This is an indication that home ownership is about to increase as people take out loans to buy homes. Consequently, the US is on the verge of an upturn in investments for both owned homes and rental residential properties.

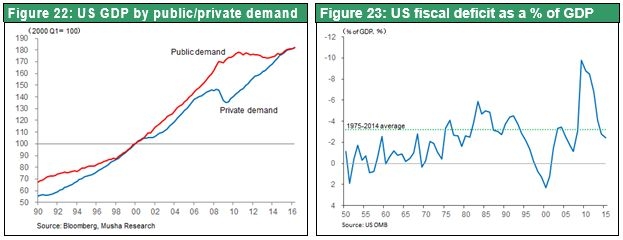

The age of Keynesian policies as public-sector demand fuels growth

Public-sector demand is another sector where expectations are high. Following the 2009 US recession, the private-sector economy returned to the prior rate of growth. But growth in public-sector demand stopped and the public sector has remained flat for about the past five years. Since 2009, the US GDP growth rate has been very different than in prior years. Some people believe the US economy has entered a prolonged period of stagnation. There is no doubt that the growth rate has decreased. However, the lack of an increase in public-sector demand is entirely responsible. Governments have been cutting jobs and expenditures, resulting in flat public-sector demand. But now we are about to see a big increase in US public-sector demand. The main reason is that there are no longer budget deficits that force governments to hold down spending due. The US public-sector budget deficit rose to 10% of GDP in 2010 but is now only 2%. These events indicate that the United States is about to enter an age of New Keynesianism in which governments borrow the surplus funds in the private sector in order to create demand. Both Hillary Clinton and Donald Trump are proponents of this spending. Furthermore, most US economists are beginning to advocate Keynesian policies.

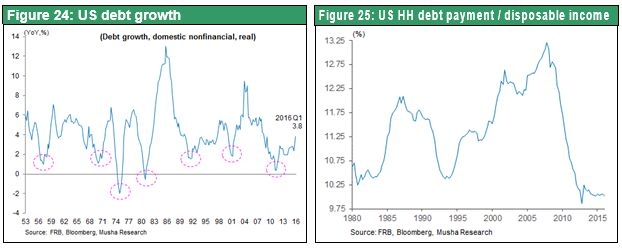

Much potential for growth of the credit cycle

The credit cycle is the fourth positive component of the US economy. Credit increases and decreases along with the health of the economy. Adjusted for inflation, the US growth rate of debt has a 10-year cycle. There were bottoms in 1971, 1981, 1991, 2001 and 2011. That means we are precisely in the middle of the cycle that will hit bottom in 2021. Based on the pattern of prior 10-year cycles, US credit will continue to increase. Nevertheless, a confirmation using logic is needed to determine the outlook for more credit growth. Are lenders in a position to extend loans? Are borrowers in a position to take on debt? On the lending side, banks have finished restructuring their balance sheets and want to increase loans significantly. On the borrowing side, the interest coverage ratio (operating income divided by interest expenses) is a key indicator because it shows the cost of debt in relation to earnings. In the United States, this ratio is at an all-time high. Companies are reporting record earnings and interest rates are at historic lows. As a result, companies are at a stage of increasing debt to boost their leverage and their financial efficiency. Companies are using loans for capital expenditures. If there are no capital projects, they are using loans for acquisitions. If there are no acquisitions, then companies are using loans to buy back their stock and pay dividends. Raising leverage is, in effect, swapping debt for equity. In other words, companies are converting high-cost equity into low-cost debt. When interest rates are low, this is a wise financial policy. If interest rates stay low, we can expect to see credit continue to grow in the United States.

If we assume this economic outlook is correct, then we need to go on to the next point to determine whether or not the US economy really is healthy.

(5) The Current Situation – How Do We Interpret the Coexistence of High Earnings and Low Interest Rates?

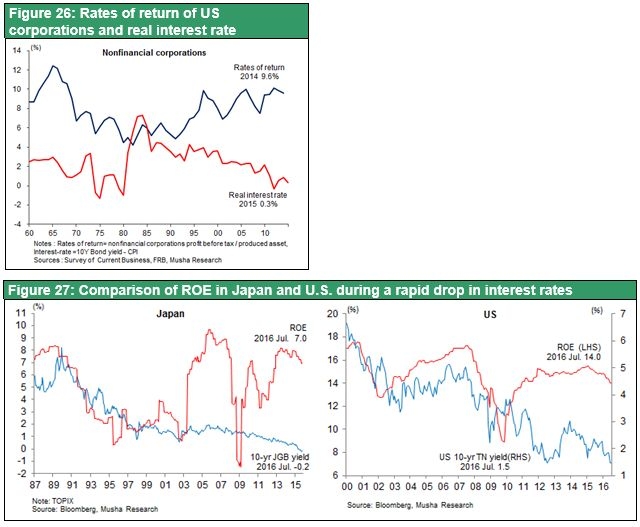

The abnormal gap between profit margins and interest rates

The most significant characteristic of financial markets and the global economy today is the gap between profit margins and interest rates. Just as an insect must shed its exoskeleton to grow, the economy must shed this gap in order to grow. What are the theoretical problems holding back the economy and financial markets? And what can we do to solve these problems? During about the past decade, companies in industrialized countries have been reporting record-high profitability (ROE) and earnings. But interest rates have been falling at the same time. Long-term interest rates are negative in Japan and Switzerland and at an all-time low of 1.5% in the United States. This peculiar phenomenon of strong earnings accompanied by falling interest rates has been going on for 10 years.

This is contrary to accepted thinking about finance and economics worldwide. When an economy is healthy and companies are very profitable, the resulting solid demand for capital should push interest rates up. Earnings and interest rates should obviously move in the same direction. After all, both are returns on capital so they should be two sides of the same coin. This is why economic principles cannot be used to explain why earnings and interest rates have gone in opposite directions. What has happened and how can we fix this problem? We also need to ask ourselves what sort of historical period we are in and what should be done at a time like this.

Today’s age of unprecedented earnings is producing an enormous capital surplus

The big difference between earnings and interest rates is a divergence in numerical terminology. If nothing is done, this will ultimately destroy the economic system. Allowing divergence to become the norm would be very dangerous. People believe that companies are sound because they are profitable. Investors will then borrow money to buy stocks, which will fuel a stock market rally. However, if people continue to buy stocks because they can borrow money at no cost, stock prices will eventually plunge and create an economic collapse.

Why does this gap exist? One likely explanation is that the world has entered an age in which companies are much more profitable than ever before. Companies can move factories to other countries in order to use cheap labor. Big cost savings are also possible by using robots, IT and other technologies. Overall, companies are now in a phase in which they can easily generate surplus earnings. Apple and Google have huge profits but are not making significant investments. They require no equipment. Money from profits has nowhere to go, resulting in idle funds that exert downward pressure on interest rates. In this sense, these earnings are truly a surplus.

Accumulating excess capital is the self-denial of capital

The ability of companies to use less capital than in prior years to receive the same benefits (due to the lower cost of equipment and systems) signifies that the productivity of capital has increased. If a company can earn profits without making investments, the leftover funds will be unused money that will simply accumulate in financial markets. This is a disease that can kill an economy. With capitalism, an economy grows by converting capital into different forms. According to Marx, money capital is converted into a product (commodity capital such as materials, labor and equipment) that, in turn, is converted into even more money capital through the sale of that product. In other words, this value creation process changes the initial amount of capital into a larger amount. The final step of the recovery of a larger amount of money capital is therefore impossible unless the initial money capital can be converted into materials, machinery or labor. This is the essence of capitalism.

When interest rates fall to almost nothing, the cash-is-king sentiment takes hold and companies and others simply hold their money in the form of cash. If this happens, the process of creating value by changing capital into other forms will come to a halt. Once companies hoard their cash from profits outside the financial system, there will no longer be capital to fund growth. Consequently, high profit margins and low interest rates show that capitalism is not functioning properly. There is no reason to be critical of strong earnings due to the technology revolution and other reasons. Idle money is what is bad. This is the most important point for the determination of economic policies. The only course of action is to enact policies that can make effective use of this idle money. If nothing is done, this situation will remain the same or even become worse. This is why investment strategies will depend on the types of policies that governments select.

Use policies to recycle surplus capital

Keynesian policies have the best prospects for putting surplus capital to work. That means the Japanese government should use borrowed money to create demand. Doing this would result in the effective use of idle money. This is precisely what the United States and the Abe administration are trying to accomplish now. Creating this demand would greatly reinvigorate the economy. Monetary measures are the second way to utilize surplus capital. Consistent monetary easing would cause stock prices to increase. By repurchasing stock, companies would return money to shareholders that would boost household incomes, thereby fueling economic growth. Measures targeting income are the third policy option. Here, the Japanese government would distribute excess funds directly to the people. Forcing companies to raise wages is one way to do this. Universal basic income is another way. The government could guarantee everyone a certain level of income, for example ¥1.5 million. Everyone has a right to live, so everyone should receive the resources to survive. Taking this step would create a worry-free world in which no one has to worry about starving. This radical social and income initiative can make effective use of money that is now unused.

The big question is who will earn this money and how this universal income will be funded. Technology is the answer. Robots and artificial intelligence will do the work needed to earn an income that can be distributed to the public. People will use this money to enjoy their lives with good food, concerts, watching baseball games and doing other things. Everyone will also have access to quality education and health care. The result will be growth of the service sector. Expansion of this sector will create an era where services underpin the happiness of the public. Within the next decade, tourism may very well become one of the core industries of many countries. Once people have extra time and money, traveling is often the first activity that comes to mind.

Long working hours despite higher productivity are upsetting the economy’s balance

As this process continues, standards of living will ultimately climb to the level of royalty in the 19th century as people seek even higher levels of enjoyment and fulfillment involving the arts and other fields. Today, people typically work 8 hours each day for five days every week. The day could come when people work only four hours in one day or perhaps have three or even four-day weekends. The enormous amount of free time would spark immense growth in the service sector.

Some people may regard these ideas as nothing more than dreams. England enacted laws about factory labor in the 1800s soon after the start of the industrial revolution. At that time, women and children worked long hours, so these laws were aimed at protecting the health of factory workers. A global set of rules emerged in 1919 with the establishment of the International Labour Organization (ILO). There was an international agreement to prohibit excessive working hours. The first provision limits working hours to eight hours in one day and 48 hours in one week. However, very few people actually work no more than eight hours in a day. The ILO provision is clearly being violated. Compared with 100 years ago, labor productivity is now more than 10 times higher because of machines, robots and computers. Despite this progress, people are still working about as much as they did 100 years ago. This does not make sense. Demand creation is impossible because people are working long hours and have little free time. This situation obviously makes economic growth impossible. Consequently, devising a way to end the gap between profit margins and interest rates will depend on how the supply-demand structure is changed, in other words, how to enable people to improve their living standards and enjoy happy and fulfilling lives.

Investment strategies will depend on the policies that governments choose

Enacting the correct policies will result in a stock market rally and the wrong policies will cause stocks to plunge. The economy would collapse as the number of unemployed people rises as robots steal their jobs. Actions of the Bank of Japan under the leadership of the Democratic Party of Japan and Governor Masaaki Shirakawa are an excellent example of the wrong policy. These actions made no change in the cash-is-king mindset, resulting in the growth of idle money. Due to this policy, it should come as no surprise that Japanese stocks were the world’s only loser following the end of the global financial crisis.

The Abe administration’s measures to create demand and put idle capital to work in order to end deflation are the correct course of action. The powerful stock market rally was an obvious result of these policy initiatives. The Abe administration is now shifting from placing emphasis on monetary policy to enacting bold fiscal measures. However, this is not the fiscal policy of the past. Abe’s fiscal policy has the appearance of aiming to restart the fiscal investment and loan program and use PFI and other methods for utilizing private-sector funds. A global age of Keynesianism would begin if the United States and Japan enacted this policy. Even though it would be impossible to quickly implement massive social policies like basic income or enact other income-related policies, countries would probably start moving in that direction. Japan’s payments to help cover the cost of caring for babies and children are one form of an income-related policy.

This is the age that is now emerging. Robots and machines are doing our work for us. All we need to do is make effective use of the resulting resources. As a result, the only problem we have is interference from outdated ideas, guidelines and, in some cases, a sense of justice. We have reached a point where everyone should be able to lead a more fulfilling life. But this outdated thinking is holding us back. This thinking also explains why the money we earn is not being put to work. Idle money can even destroy an economy. Pessimists are predicting the end of the world. If nothing is done to eliminate unused wealth (surplus capital), the pessimists could be right.

(6) Japanese Stocks Are Poised for a Rally – Two Key Points for Giving Stocks a Higher Valuation

The urgently needed correction of Japan’s financial distortion has started

No country has accumulated more capital with nowhere to go than Japan. This situation cannot be allowed to continue. Japan has many opportunities to end this problem. The reason is that so-called reformist bureaucrats are beginning to start a variety of initiatives under the Abe administration’s leadership. Significantly altering Japan’s financial and economic distortions is the goal of these initiatives.

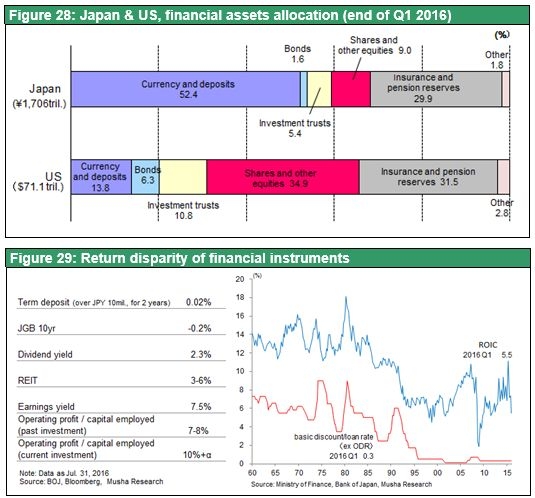

Compared with the United States, one distortion in Japan is the composition of household assets. Cash, bank deposits and government bonds, which have no risk and virtually no cash flow, account for about 80% of household investable assets in Japan, which exclude pensions, insurance policies and other holdings that cannot be used freely. Less than 20% of investments are assets with risk that have a cash flow. In the United States, stocks account for more than half of investable assets. Assets with risk rise to more than 70% after including mutual funds. A second distortion is Japan’s enormous return gap caused by the refusal to buy assets with any risk at all regardless of how high the return is. A third distortion is the composition of household income. In the United States, roughly three-fourths of income is from wages and one-fourth is from investments. Clearly, people are earning a significant return on their assets. In Japan, wages account for almost all household income. Almost complete reliance on wages is like socialism and gives people no incentive for capitalistic behavior. There is growing criticism in Japan of policies to increase income from assets because it would widen the gap between rich and poor. People believe the checks and balances of capitalism would no longer function.

Japan’s distorted composition of household income has produced paralysis in the country’s financial markets. These markets are no longer fulfilling the role of allocating capital, resulting in severe damage to the ability of the Japanese economy to grow. The leaders of Japan are just now beginning to realize that this situation must be changed. This is a critical point. In terms of the big picture, negative interest rates and other actions by Bank of Japan Governor Haruhiko Kuroda can be justified as part of measures to achieve this change. This is one encouraging trend in Japan.

The extreme undervaluation of Japanese stocks means that a correction can potentially produce very large capital gains. In most other major countries of the world, stock prices have climbed to an asset bubble level, making capital losses more likely than gains. But exactly the opposite situation exists in Japan. This is why investors around the world cannot ignore Japan.

The resurgence of earnings at Japanese companies is one more source of good news about Japan. Until about 2000, the devastating downturn in earnings at companies was the biggest problem for Japan’s economy. In the past, Japanese manufacturers used highly competitive prices to capture market share worldwide. However, this strong market position was subsequently lost because of trade friction, the yen’s strength, and competition from companies in South Korea, Taiwan, China and other countries.

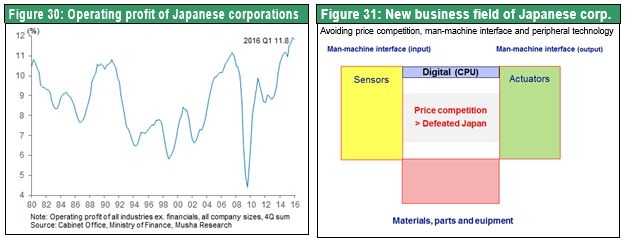

Starting in 2005, earnings have rebounded rapidly and now companies in Japan are reporting record-high profits. The decision to abandon price-based competition is the primary reason. Japanese companies are instead focusing on niche markets where their products have superior technologies and quality. Products using digital technology are one illustration. Years ago, Japan dominated global markets for semiconductors and many other electronic products. Today, Japan has been defeated in almost all categories of the electronics sector. Semiconductors, which are the nucleus of digital products, are the cause of Japan’s defeat. This is entirely due to Japan’s inability to win when competing based on prices.

How did Japan accomplish this turnaround in the electronics sector? Companies decided to concentrate on sensors and actuators, with sensors required for input data to digital devices and actuators needed for output. Sensors and actuators are products where there are many opportunities for differentiation other than by simply offering a low cost. These two products are ideally suited for skill in integrating and fine-tuning many materials, structures and other items. This is one of Japan’s greatest strengths. Successfully making this shift has enabled Japanese companies to use a business model that relies in technologies and quality rather than prices.

The yen’s strength during the past two decades may be what made it possible for Japanese companies to shift to this new business model. Companies were forced to withdraw from businesses where they were not price competitive and specialize on categories where they make products that competitors cannot match. Japan can probably use this same business model in the service sector and other industries. Clearly, this is a key strength of Japan.

As the use of the Internet continues to grow and the Internet becomes an even more integral part of our lives, demand is certain to increase for products and services with even better quality and technologies. Japanese companies will have an advantage because of their skill involving quality and technologies. In sum, there are two major reasons to have a positive outlook for Japan. First is a correction of the distortion in financial markets. Second is the establishment by Japanese companies of a value creation model backed by quality and technologies. These two factors will very likely fuel a rally in Japan as Japanese stock prices catch up to the ongoing global stock market rally.