Feb 03, 2017

Key Strategy Issues Vol.K301

Investment strategy for Japanese stocks during the Trump administration

– A strong bull market is about to begin

The following is a discussion that I had with Toshihiko Koiwai, the president of Marusan Securities. This edited version was printed in the February 2017 issue of the Marusan Report and is presented here with the permission of Marusan Securities. (some additional contents and charts included.)

(1) Higher stock prices following the US presidential election are merely the beginning of a very strong bull market

Koiwai: US and Japanese stock markets have staged strong rallies following the US presidential election. However, in Japan, foreigners have been the major buyers while Japanese investors have been big net sellers of equities and still hold doubts about the outlook. What is your view of this rally?

Musha: I think the reason for the big rally in US and Japanese stocks since the election is that the baseless pessimism that had been controlling the market is coming to an end. It is a rebound in market consensus from this pessimism, which did not reflect reality at all. So the election was just a trigger for this rebound. I believe that a powerful rally would have taken place even if Hillary Clinton had won the election. Therefore, we are now seeing a correction of the erroneous pessimism in the stock markets.

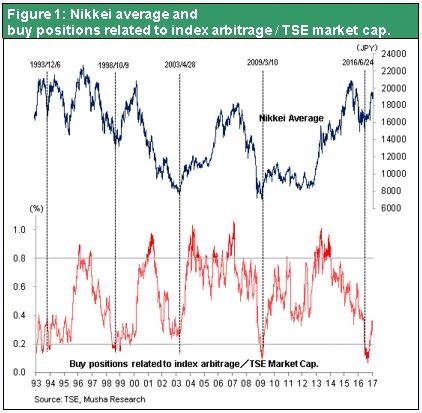

From a deeper perspective, the rally reflects the start of a shift in an extremely positive direction. The US economy, which is the primary engine of global economic growth, has been healthy and Japan’s economic fundamentals are consistently improving. Stock markets completely ignored this good news in 2016 because of negative events like Brexit and economic turmoil in China. Figure 1 shows changes in the outstanding arbitrage stock purchase ratio based on market capitalization of the Tokyo Stock Exchange first section. This ratio is one indicator of investor sentiment. As you can see, this ratio fell to an all-time low in September 2016, demonstrating an extreme downturn in the mindset of investors.

I think this rally driven by a correction of pessimism still has a long way to go. Individuals in Japan were net sellers during the rally at the end of 2016. Now they are watching prices climb and probably thinking about buying stocks on dips. But this is precisely when a dip never happens. As I explained, this is a pessimism correction rally. Consequently, prices are very likely to keep rising as long as pessimism remains in the market. Investors must quickly admit that pessimism was a mistake.

From a longer-term standpoint, this is very likely to be the start of a big global transition to a new era, especially regarding the United States and Japan. I will talk more about this point later. If we are indeed on the verge of a new era, then this rally is more than simply a rebound linked to the end of excessive pessimism. This is why the rally could become enormous. I think no one should be surprised to see continuous record highs in the US stock markets. I also think that the dollar will become much stronger. Furthermore, I believe that prospects are excellent for a very big upturn in stock prices as the second stage of the Abenomics rally.

The first Abenomics rally started on November 15, 2012. Over the next two and a half years, the Nikkei Average moved up 140%. If a rally of the same magnitude happens now, stock prices will rise 50% over the next year. That means the Nikkei Average could easily be more than ¥30,000 by the end of this year.

(2) US economic fundamentals have never been better

Koiwai: You expect powerful stock market rallies in the United States and Japan. Please explain more specifically your outlook for the US economy and stock market. President Trump’s victory was a big surprise. I think the size of the subsequent upturns in US interest rates, the dollar and stock prices have surprised many people, too. These increases probably reflect investors’ positive response to President Trump’s economic policies. What are your views on the prospects for big tax cuts, infrastructure investments and deregulation which President Trump has proposed? And will these measures produce benefits?

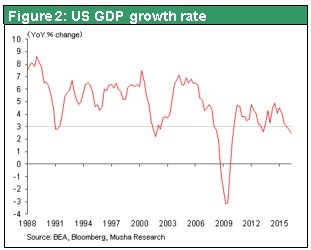

Musha: President Trump’s proposals for big tax cuts and infrastructure investments are ordinary economic measures. I think many of these ideas will be implemented and will significantly boost the US economic growth rate. The US GDP increased at an average annual rate of 3% between 1990 and the start of the global financial crisis. Since this crisis, the growth rate has declined to 2.3%. I think there is a high probability of the US GDP returning to the long-term growth trend of 3% or perhaps expanding even faster.

The US unemployment rate is 4.7%, which is virtually full employment. If the economy grows with unemployment this low, there will clearly be more inflationary pressure. I expect that the Fed will make two or three interest rate hikes this year and market interest rates will climb as well. If this happens, the dollar will appreciate significantly. For the time being, I expect to see an economic boom, rising stock prices, higher interest rates and a stronger dollar.

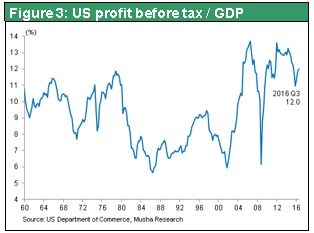

The most critical point is that the soundness of US economic fundamentals was unprecedented even before the presidential election. There are five major reasons for this strength: (1) record-high corporate earnings, (2) the existence of many companies (like Google and Apple) that use innovative ideas to be globally competitive, (3) ample funds available for investments due to a high volume of savings, (4) financial soundness in the public sector, and (5) inflation that remains under control. Consequently, the US economy is like a locomotive with immense power. We can expect that new policies of the Trump administration will become the fuel that produces massive benefits. This is the point that I want to emphasize first of all.

Koiwai: Henry Kravis, co-chairman of the private equity firm KKR, hopes that President Trump will end the sense of economic blockage and eliminate out-of-date rules and political system. What are your thoughts about this point?

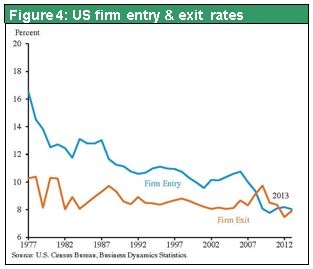

Musha: I think the emergence and success of new businesses has been the biggest source of US economic strength and vitality. Actually, the rate of new business creation had been high in the United States for a long time. After the global financial crisis, though, the rate of new company starts plunged to the same level as the ratio of companies that failed and has stayed low since then. If I had to point to a problem in the US economy, I would say it is the disappearance of youthfulness. I think this is a cause of economic blockage. I believe that President Trump attributes this to regulations. Although this is not the entire cause, I basically agree with the president’s view.

Among regulations governing companies, the highest expectations are for the easing of financial regulations. The inability of banks to extend loans due to the extremely stringent regulations of the Dodd-Frank Act is a very serious problem. The Fed is attempting to rev up the US economy with an ultra-easy monetary policy. Nevertheless, credit creation is still inadequate. Some people adopt the extreme position that this situation signifies the demise of capitalism. But this is wrong. The automobile (capitalism) is still not moving forward despite all these measures to rev up the engine. As a result, people tend to conclude that the automobile itself is broken. However, a closer look reveals that the automobile is trying to accelerate at the same time that financial regulations are applying a strong brake. Japan and Europe as well are subject to excessive rules, chiefly in the form of the Basel regulations. I believe these regulations are significantly damaging the economy.

Koiwai: During the election campaign, President Trump repeatedly backed immigration limits and protectionism. Actually taking these actions may create a labor shortage and rising inflation that could restrict the growth of the US economy. What is your position?

Musha: I am basically not worried about these problems. There is no way that the United States will take these actions. No one would benefit, so there is not logical reason for immigration limits and protectionism. During the campaign, President Trump made a lot of statements concerning protectionism and isolationism. But this was mostly nothing more than election rhetoric. So what is the real meaning of these statements? I think President Trump wanted to demonstrate that he was on the same side as poor, white manual workers. In essence, the president was telling these workers that he would punish the people who were making their lives difficult. He was very critical of Wall Street for the same reason. However, the people that President Trump selected for Treasury secretary and other key positions in his administration show that he is relying heavily on people with Wall Street backgrounds.

There is no reason at all for the leader of the United States, the world’s most powerful country, to do something foolish that would not benefit anyone. If you focus too much on what President Trump said in the past, you will completely miss the true nature of his administration.

(3) The US economy and dollar will remain strong for a long time

Koiwai: If the current upturn in interest rates and the dollar goes too far, there could be a negative impact on the US economy. Please explain your outlook for US interest rates and the dollar. Also, how do you think upcoming changes in interest rates and the dollar’s value will affect the economy?

Musha: Events during the Reagan administration shows what could happen. There was a big increase in government spending along with monetary tightening. This policy mix produced higher interest rates and a stronger dollar. Initially, the US economy was robust. But ultimately the so-called twin deficit problem surfaced due to large trade and budget deficits. As a result, most people may be concerned due to the expectation for President Trump’s plans to raise interest rates and trigger an excessive appreciation of the dollar that would stop economic growth.

But the environment today differs greatly from when Ronald Reagan was president. As I noted earlier, US economic fundamentals have never been better. During the Reagan administration, US industries were rapidly losing their competitive edge. Most of all, regarding competition with Japan, the United States was being overtaken in the manufacturing sectors like electronics and automobile. This situation caused the stronger dollar to generate larger trade deficits. The result was US-Japan trade friction. As earnings at US companies fell, chiefly in industries with significant exports, tax revenue fell short of expectations and the budget deficit ballooned.

This time, I think there will be a prolonged and beneficial increase in interest rates and the dollar. Although interest rates will climb, the pace will be slow enough to avoid cooling down the economy. And a stronger dollar will not make the US trade deficit larger. As I will explain later, an increase in the dollar’s value could even bring down the trade deficit.

At first, higher interest rates will obviously limit economic growth. But a stronger dollar will bring in more capital from overseas at the same time. I think higher capital inflows will hold down the speed of the upturn in US interest rates. Moreover, contrary to old perception of the United States, both companies and households now have high levels of savings. These savings will be another factor that prevents interest rates from climbing too quickly.

(4) US companies have overwhelming superiority in the “seventh continent”

Koiwai: Please tell me more about why US fundamentals, which differ completely from during the Reagan administration, are so much better today.

Musha: The unprecedented competitive edge of US industries is the most important point. I think almost all economists and scholars are overlooking this fact.

The fastest growth in the world is currently taking place outside the six main continents in a place I refer to as the seventh continent, or cyber space. US companies like Apple, Google and Facebook are controlling this continent. The United States has close to a monopoly in the fastest growing seventh continent and this is the source of the country’s daunting competitive superiority.

Our lives are highly dependent on smartphones and the Internet. Using these phones and the Internet automatically generates income for US companies. I think this is why US companies have competitive strengths of a magnitude that may never be seen again. People who don’t want to buy US apparel or automobiles have many other choices. However, the seventh continent has a framework that makes it impossible to do anything without using US companies.

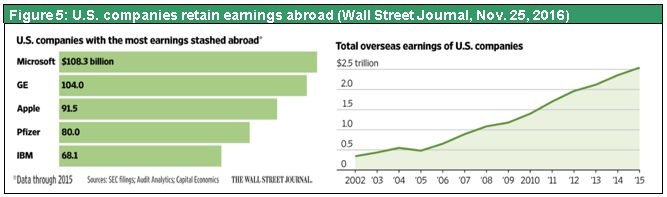

The seventh continent cannot be defined by using conventional economics and economic statistics. Now, people are finally beginning to see the critical role of this continent. In November 2016, The Wall Street Journal reported that US corporate earnings held in other countries had grown from about $500 billion in 2005 to about $2,500 billion in 2015. President Trump wants to bring these profits back to the United States to fund domestic investments. Who do these overseas earnings belong to? Basically, IT companies like Microsoft, Apple and Google are accumulating profits in the seventh continent. Companies that rule cyber space are earning huge profits worldwide and allowing those profits to accumulate in other countries.

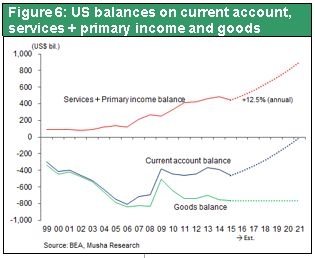

Due in part to these overseas profits, the US current account deficit has declined sharply. This deficit has dropped from a record-high $806.7 billion in 2006, equivalent to 5.8% of the US GDP, to $463.0 billion in 2015 (2.6% of GDP). Taking a closer look at this decline reveals that the trade deficit for physical goods has remained about the same at approximately $800 billion. In other words, US consumers are still relying on imports for most of their daily necessities. Also, there has been no growth in exports of automobiles and other products. An improvement in categories other than physical goods is responsible for the lower current account deficit. The United States has achieved a big increase in the current account surplus in the service and primary income categories. Primary income is returns on overseas investments of US companies. Consequently, this is income earned from invisible goods and services. In other words, this is profits that come from cyber space, financial services and other business sectors.

The United States has become a country that earns profits from goods and services that cannot be seen. Today, this strength is at last becoming apparent in the form of corporate earnings and statistics on the balance of international payments. Five years ago, these statistics did not yet clearly shed light on this US profit model. As a result, many economists and scholars thought that events in cyber space were relatively insignificant. But now we know that cyber space is the primary engine of the US economy.

(5) The US current account deficit may shrink even if the dollar appreciates

Musha: Between 2005 and 2015, the combined US service and primary income surplus has grown at an annual rate of 12.6%. If growth continues at this pace, and trade deficit remains flat, the United States will have a current account surplus six years from now. US companies have a dominant position and overwhelming industrial competitive edge in the seventh continent, where the growth rate is higher than anywhere else. This is a decisive difference in comparison with the Reagan era. Furthermore, this position will not be damaged by a stronger dollar. If the dollar appreciates, the cost of seventh continent services in other currencies will rise. Everyone will have to accept these price increases. There is no other option.

A decline in the US current account deficit will reduce the supply of dollars, the world’s key currency. This will generate immense upward pressure on the dollar. As a result, I do not expect the dollar to weaken as long as the current environment exists.

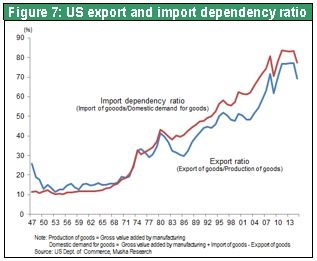

A strong dollar could create problems for the United States. Cheap imports or a decline in exports may be harmful to US manufacturers. However, the United States already buys from overseas suppliers all goods that it needs to import. In addition, there has already been a sufficient decline in the importance of export-oriented industries within the US manufacturing sector. That means a strong dollar cannot produce any more substantial economic damage in the United States. Fifty years ago, the United States had a 10% reliance on imports. Today, import reliance is more than 80%. The conclusion is that there is almost no room remaining for an increase or decrease in exports and imports regardless of whether the dollar is strong or weak.

Furthermore, the United States may become even more powerful if the dollar appreciates. US companies will expand their overseas operations due to the ability to buy foreign companies at a lower cost. Even prominent Japanese companies may be acquired if they are unable to boost their stock prices. In addition, since the United States depends on imports for household goods, a stronger dollar will allow people to buy products at lower prices. There is a tendency to think that companies exporting goods to the United States will not change their dollar-denominated export prices. That means these companies are raising prices in their home currencies. However, most products that the United States imports are in categories where competition is fierce. For instance, Japanese and German companies compete in the automobile market. In the apparel sector, there is competition among China, Vietnam, Bangladesh and other countries. Due to this situation, companies will be forced to sacrifice part of their profits in their home currencies in order to compete by cutting dollar-denominated prices. There will no longer be any brake on the dollar’s climb as a result. Most economists and scholars are unaware of this point.

Koiwai: The outlook for an extended appreciation of the dollar creates concerns about negative effects on emerging countries. How severe will these effects be?

Musha: That’s true. A stronger dollar will have a big negative impact on emerging countries. First, dollar-denominated loans will become an even greater burden for emerging countries. This will cause problems in countries that have increased dollar-denominated borrowing for economic growth beyond their actual strength. China is the most obvious example.

China asserts it will not have any difficulty repaying its dollar-denominated debt because of the country’s large foreign exchange reserves. However, China’s foreign debt is 40% higher than these reserves. Naturally, the country also has foreign assets that can be used to fund debt repayments. But most of these assets are direct investments, long-term loans and other assets that are difficult to liquidate. Most of the foreign debt, on the other hand, has a relatively short term. So as the dollar appreciates, China’s dollar-denominated loans will become increasingly dangerous. Growing dollar-denominated loan repayments will generate an enormous outflow of capital that will cause the yuan to become steadily weaker. From a long-term standpoint, this negative cycle may eventually create very serious problems for the Chinese economy.

This is why I think there is no doubt that economic leadership will shift from China and other emerging countries to the industrialized countries. Labor-intensive manufacturing is the main component of the economies of emerging countries. Markets for these products are highly competitive because emerging-country goods can be easily replaced with competing items. Rapid growth rates of emerging countries in recent years may create the impression that these countries have immense potential. In fact, most emerging countries have simply been using cheap labor to make products that anyone can manufacture. Now this era is coming to an end for China and other emerging countries in part because of rising wages. But industrialized countries have strengths that cannot be copied. One example is expertise in the infrastructure and other aspects of the Internet that no one can imitate. The United States is a prime example. Another example is Japan’s advanced know-how involving robots, automobiles, and highly sophisticated materials, parts and devices. Japan has many technologies that no one can copy. This is why I believe that the world is entering an era in which industrialized countries will have a growing advantage regarding international terms of trade.

(6) One-time factors are behind the absence of economic growth after the global financial crisis

Koiwai: As you mentioned earlier, the US GDP growth rate after the global financial crisis was 2.3%, which was well below the growth rate prior to this crisis. Harvard professor Lawrence Summers believes this is a secular stagnation caused by downward pressure on economic growth from a chronic shortage of demand. In your opinion, what are the reasons for the prolonged lack of economic growth following the end of the global financial crisis?

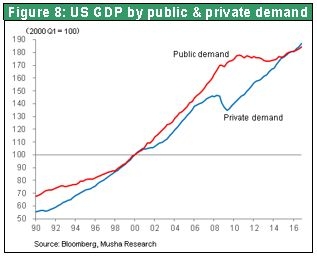

Musha: Government fiscal policies are responsible for this stagnation. The difference between public and private-sector internal demand in the United States makes this very clear. The growth rate of private-sector demand has returned to the pre-crisis level but public-sector demand has been flat since 2009. Obviously, the absence of public-sector demand growth for six years is the sole reason that the US GDP growth rate has been only about 2% after the global financial crisis compared with the long-term trend of about 3%. Therefore, we should naturally expect to see the US GDP growth rate start to climb if President Trump’s economic policies increase public-sector demand. Furthermore, as I explained earlier, the failure of ultra-easy monetary policies to increase lending after the global financial crisis is partly responsible for low GDP growth. However, I think the biggest cause is excessive financial regulations.

There has definitely been a slowdown of US economic growth in the wake of the global financial crisis. Some people say that growth will remain slow because of the decline of capitalism and structural problems involving the US economy. But this thinking is clearly wrong. I believe post-crisis economic stagnation is the result of temporary factors like government policies and the inability of money to go where it is needed because the speed of technological progress is too high.

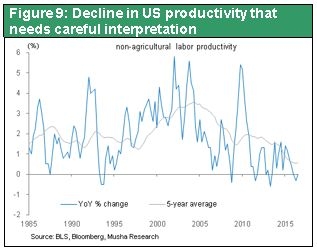

Koiwai: Since the global financial crisis ended, US productivity has been climbing at an extremely slow pace of less than 1%. Isn’t the slow productivity growth holding back the economy? Also, why do you think there is so little growth in US productivity?

Musha: In technical terms, productivity is the amount of economic added value in relation to the amount of resources used. Dividing output (the benefits of economic activities) by input (labor and capital) yields productivity. Consequently, the result of this division differs greatly depending on what is used to calculate output. If we use standard GDP data, the result is the slow productivity growth that you mentioned. However, this approach has several problems.

The first problem is whether or not GDP is accurately measured. Semiconductors and high-tech devices are one example. Consistent improvements in the performance of these products are increasing their real value. But prices are falling because of intense competition. Lower prices may cause this increase in value to be underestimated in GDP calculations. The seventh continent is another example. Value created in cyber space is difficult to quantify and there are no statistics. As a result, seventh continent value may be largely missing from GDP data.

No growth in productivity is equivalent to saying that output is not increasing. This happens when demand is low and savings are high. Savings can be regarded as a means of pushing back demand into the future. Therefore, we can also adopt the view that savings are a reason for the current slow growth of productivity.

Accurately measuring output is an extremely complex task. In practical terms, there are two ways to measure output: corporate earnings and the satisfaction of people. US companies are currently reporting record-high earnings. As for satisfaction, I think that there is only a small percentage of people in the United States with low satisfaction. Of course, dissatisfaction is probably increasing in some segments of white manual laborers.

This thinking leads to the conclusion that a large gap exists between productivity statistics and reality. Most of these statistics are nothing more than the abstract theories of economists. The structure of the economy is changing dramatically. I have a feeling that many economists are frequently overlooking these changes and that these changes are left out of many economic statistics.

Koiwai: You said that US companies have an overwhelming competitive edge in the seventh continent. What characteristics do you think make these companies as well as the United States overall so competitive?

Musha: I think innovation is the primary source of US competitiveness. The United States has a culture that is conducive to innovation. Technologies in the Internet and cyberspace domain, which is the sector where the United States is most competitive, are a spontaneous result of this culture. Well-known founders and executives of US Internet and high-tech companies are often not Americans. These people come from India, Russia, Hungary and many other countries. Clearly, this US culture is open to outsiders and can attract talented people from around the world. Prominent seventh continent companies like Apple, Google, Amazon and Facebook rank among the world’s largest companies in terms of market capitalization. This is proof that the US culture is also conducive to dramatic changes sparked by new companies that grow quickly to become market leaders.

In a report that I wrote around 2000, I expressed concerns about Amazon because of its extremely shaky balance sheet. I even said that the company could go bankrupt. But Amazon has become a massive company despite this financial weakness because of its outstanding technologies and ideas. This can happen only in the United States.

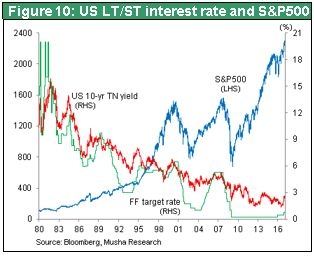

(7) The 35-year bull market for bonds is over; the rally is now shifting to stocks

Koiwai: Interest rates continued to decline in 2016 and dropped to zero and even negative territory in some countries. But now bond yields are rising (bond prices are falling) because the United States has started hiking interest rates. The 10-year US Treasury note yield declined from the 15% level in 1981 to about 1.3% in July 2016. After the November election, the yield has rebounded to 2.6% while US and Japanese stock markets staged a powerful rally. Do these movements mean that the 35-year upturn in bond prices has come to an end? Are investors starting to shift their money from bonds to stocks?

Musha: I think this shift has started. We have heard about the so-called great rotation for some time now. Now I think we have finally reached a major turning point. As you said, bond prices have been increasing for 35 years. Since bonds basically have a fixed interest rate, to some extent, they provide a stable return with no risk. A consistent increase in this return is a sign of distortion in investors’ fundamental stance regarding risk-taking as well as in the ability to obtain financing in a suitable manner. Now money is moving from bonds to stocks. I think this is good news because it shows that the world is entering an era in which investors are accepting risk and animal spirits are being properly appreciated.

(8) Contradictions plague the Chinese economy, but a crisis has been avoided for now

Koiwai: Next, let’s turn our attention to the Chinese economy. You have been saying for quite a while that China is a risk factor concerning the global economy and stock markets. What specific aspects of the Chinese economy do you regard as sources of risk?

Musha: Contradictions exist everywhere in China. The government is operating the country by using three completely different doctrines and philosophies. First is communism, the thinking of Marx and Lenin that was embraced by Mao Zedong. Second is capitalism and the market economy. China wants to use only the good elements of communism and capitalism. But is it really possible to have a capitalistic economy without democracy? Third is sinocentrism and Confucianism, which are philosophies that China began promoting only recently. Sinocentrism is behind China’s belief in its sovereignty over the South China Sea, Taiwan and Tibet. China is using Confucian principles as a pretense to justify these actions. However, this creates another contraction because the teachings of Confucius are inconsistent with communism.

China is using whatever it can as stopgap measures. One result is a variety of economic problems. The most fundamental problem involves China’s reliance on investments for economic growth. Making investments is a quick method to fuel economic growth because this spending is directly linked to demand. But China faces a burgeoning problem because infrastructure created by these investments cannot remain idle. China’s economy has expanded because of investments. But these investments have created a substantial volume of unneeded equipment, housing and infrastructure. Because of this, China has a substantial amount of debt that may not be repaid.

From a short-term standpoint, China has completely avoided a sharp economic downturn. I do not expect the potential sources of problems in China to surface for the time being. I believe that the Chinese economy can be sustained for two or three years, maybe a little longer. Every economic indicator in China started deteriorating in the summer of 2015. The country even saw growth in real estate development investments come to a halt. Furthermore, China was lifting restrictions on the movement of capital at that time in order to include the yuan in the IMF’s special drawing rights (SDR) basket. This created the risk of large capital outflows and a plunge in the yuan’s value. The Chinese government overcame this problem for the time being by boosting spending. Investments funded by this spending may become non-performing debt in the future, so all China did was to move its problems farther into the future. Currently, the movement of capital is once again under the control of the government.

(9) No reason for optimism about the European economy, but a collapse of the euro and EU is inconceivable

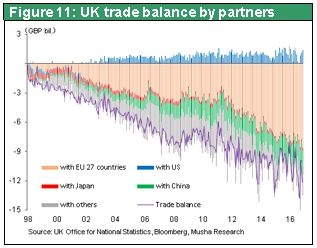

Koiwai: In addition to problems about the Chinese economy, I think that uncertainty about the European economy is another risk factor for the global economy. In 2016, British voters decided to leave the EU. In 2017, France will elect a new president, Germany will hold a federal election and other significant elections will be held. Results of these elections may dramatically alter the framework for the euro and EU. What is your view of the risks involving the European economy?

Musha: The rise of right-wing populist parties in Europe is definitely a source of concern. Nevertheless, I don’t think that abandoning the euro or EU is a realistic option because doing so would be suicidal for all member countries. Creditor countries like Germany would end up with a massive amount of bad debt if the euro collapsed. This must be avoided at all costs. Additionally, Greece and other southern European debtor countries rely on the European Central Bank as their sole channel for procuring funds. Leaving the euro or EU would result in the insolvency of these countries.

Britain can leave the EU because the country does not use the euro. The pound was always separated from the EU. Furthermore, the British economy does not rely on exports to other EU countries. Britain is a buyer of EU products, so a weaker pound caused by Brexit has the advantage of increasing domestic production to replace imported goods. This is why Britain is not a typical EU member. Therefore, I do not expect to see increasing turmoil in Europe as countries abandon the euro or even the EU one after another.

(10) The Japanese economy needs a weaker yen and there are almost no obstacles in the way

Koiwai: Now let’s talk about Japan. After the US presidential election, Japanese stocks have moved up even more than US stocks. I think one reason is the dollar’s rapid appreciation as the yen declined. A weaker yen produces big benefits for Japan’s export-dependent automobile and electrical product industries, the nucleus of the Japanese economy. In addition, Japanese companies that make household products have been expanding globally, so they will also benefit from the yen’s weakness. I think the dollar-yen rate holds the key to the future direction of stock prices in Japan. What are your thoughts?

Musha: The yen’s strength prior to Abenomics was the most significant reason that Japan became mired in deflation. As you said, the dollar-yen rate has an immense impact on the Japanese economy. I expect that the dollar will continue to appreciate as the yen weakens for a long time, as I explained earlier. My primary reason for this outlook is that all the conditions for a stronger dollar are in place in the United States. First, the shrinking US current account deficit will probably create a global shortage of dollars. Second, inflationary pressure will increase because of the health of the US economy. Interest rates will rise as a result. Dollar appreciation, which functions as a type of sedative for these problems, will be in the best interests of the United States.

On the Japanese side, there is no longer any reason for a weaker yen to cause problems for trading partners because Japan’s trade surplus is already down to almost nothing. Japan has a large current account surplus. But the primary income balance accounts for most of this surplus. The surplus is nothing more than profits earned in other countries from the overseas investments of Japanese companies. Again, this is not a reason for anyone to be critical of the yen’s depreciation. Moreover, other countries should be happy about the overseas operations of Japanese because of the jobs they create. Consequently, there is no logical reason for the yen to appreciate from the standpoint of the dollar or the yen. The Bank of Japan’s extreme monetary easing is one more key factor. Overall, there are almost no fundamental conditions in sight for the dollar to depreciate and the yen to appreciate.

During the campaign, President Trump urged the adoption of protectionist policies. Some people thought he would start criticizing the yen’s weakness. However, as I said earlier, President Trump will sooner or later realize that a stronger dollar is good for the United States. So I think there is almost no need at all to be concerned about the possibility of the president making negative remarks about the yen’s depreciation.

Koiwai: You have said that Japan’s geopolitical positioning with respect to the United States is a critical point for determining the long-term outlook for the Japanese economy and the yen. This point is also associated with what you said about China. Do you think Japan’s geopolitical positioning is changing?

Musha: First of all, I think a period of conflict and even a cold war between the United States and China is about to begin. President Trump’s plans to expand the military make this point clear. The plan is to increase the military budget and to increase the Army from 490,000 to 540,000 soldiers and the Marines from 23 to 34 battalions. President Trump’s objective is the same as during the Reagan era: peace in the world. On the surface, this may look like militarism. Looking back now, President Reagan chose the correct course of action. I think the same is true of President Trump’s military expansion plans today. Using force to some degree is the only option for dealing with unruly adversaries. I think President Trump regards China in the same way that people viewed the Soviet Union during the cold war. The president named University of California professor Peter Navarro, author of a book titled “Death by China,” to be director of the new National Trade Council. Dr. Navarro is a realist (hardliner) when it comes to China and believes that the country is the source of the world’s problems. It appears to be obvious that the target of military expansion is China rather than Islamic countries or Russia.

This is why relations with Japan are of critical importance to the United States. If a period of US-China conflict is starting, Japan will be the most valuable ally of the United States. After all, Europe is a long way from China. The United States wants to maintain a consistently friendly relationship with Japan. In addition, the United States wants to avoid a shift in political power in Japan that could be caused by an economic downturn. There would be problems for the United States if Japan is unable to end deflation and return to economic growth. For these reasons, I believe that the United States will welcome rather than oppose a stronger dollar and weaker yen.

Nevertheless, there are also positive aspects of a stronger yen. A strong yen should have made it easy for Japanese companies to acquire quality companies in the United States and other countries. But there were no major acquisitions that took advantage of the yen’s strength. Perhaps this is because of the nature of Japanese people. Or maybe this was due to the international balance of power. Refraining from making these purchases meant that Japanese companies felt only the negative effect of the yen’s strengths: a decline in the ability to compete based on prices. Benefits of the yen’s appreciation were not used at all. In Japan, foreign exchange rate movements have effects that are both peculiar and asymmetric.

(11) On the verge of a mammoth rally as the stock/bond yield pendulum swings back

Koiwai: Turning to the Japanese stock market, you have been saying for a long time that stocks in Japan are undervalued. Why do you think stocks are cheap? Also, do you think the increase in Japanese stock prices will continue for some time?

Musha: I don’t know if the Nikkei Average will keep rising without any corrections. But, as I said at the beginning of our conversation, I expect this index to reach about ¥30,000 by the end of 2017. By around 2020, I think the Nikkei Average will surpass its all-time high and climb to about ¥40,000. Of course, the driving force behind stock prices will be the revival of Japan’s ability to generate profits.

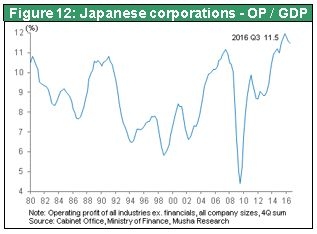

For more than 20 years, Japan’s nominal GDP has been in cold storage, remaining flat at approximately ¥500 trillion. During this same period, nominal GDP growth was 150% in the United States, 250% in Korea and 11 times in China. No one can deny that this is an abnormal situation. Despite this lack of growth, earnings of Japanese companies rose to a record high in 2015. People call this Japan’s lost 20 years. But this was actually a period when Japan’s business model was undergoing a dramatic restructuring. Although GDP remained the same, there was an enormous improvement in the profitability of Japanese companies. This is why I think that, once the right environment emerges, there is substantial upside potential for Japanese stock prices.

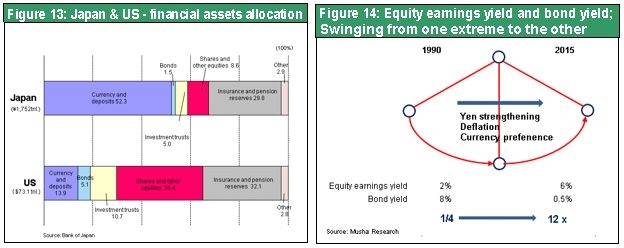

Misallocation of capital is a problem in Japan. In both the United States and Japan, pension plan assets are about 30% of the financial assets of individuals. This is money that cannot be used freely. But individuals in Japan are keeping almost 80% of their remaining funds, which can be used freely, in cash and deposits. In the United States, people keep only about 20% of money outside pension plans in cash and deposits. Almost all of the remainder is assets with risk exposure, chiefly stocks and mutual funds. When there is an extended bull market, higher stock prices give US consumers more income. But consumers in Japan can benefit very little from an upswing in stock prices. Moreover, the likelihood of the Japanese suffering heavy losses cannot be ruled out. Consequently, people in Japan have no choice other than to transfer significant amounts of their savings to assets with risk.

At the peak of Japan’s asset bubble in 1990, stocks had a dividend yield of 0.5% and an income yield of only 2%. That translates into a PER of 50. At the same time, bonds were yielding 8%. Even when interest rates were this high, people were borrowing money to buy high-PER stocks. Looking back, we can now see that this situation was abnormal. Today, dividend yields are 2%, the income yield is 6% and even corporate bonds are yielding less than 0.5%. I often compare this to a pendulum. We have seen the pendulum swing from a time when the stock income yield was one-fourth of bond yields (1990) to a time when the stock income yield is 12 times higher than bond yields (2015). Both ends of the pendulum’s swing are a highly unusual situation. Eventually, the pendulum should settle down somewhere between these two points.

In 1990, the Bank of Japan used monetary tightening to wipe out the asset bubble. Now the bank is implementing extreme monetary easing. These policies are extremely well balanced. Before adopting its current stance, the Bank of Japan focused only on stopping asset prices that had gone up too much. The bank did nothing when these prices subsequently went down too much. I think this was a preposterous one-sided policy. A constant downturn in asset prices is the biggest risk of all for the economy and financial sector. Before Abenomics, the government and Bank of Japan did nothing about falling prices. I think this was a huge mistake.

(12) Japan’s government financial agencies have shifted to encouraging risk-taking

Koiwai: My next question concerns the change in Japan’s financial administration. Nobuchika Mori, commissioner of the Financial Services Agency, said the more financial oversight relies on regulations, the more distortions and inefficiencies grow. Apparently, there has been a shift in direction from limiting risk to encouraging risk-taking. What is your view of this new stance of the Financial Services Agency?

Musha: The Financial Services Agency has clearly altered its stance. Commissioner Mori is saying that the business model of the financial sector, and especially banks, will lead to the demise of these companies and must be replaced. Previously, government oversight of the financial sector was aimed at limiting risk exposure at banks in order to prevent problems. But this approach eliminated the value that was added by financial services. In addition, the Bank of Japan’s ultra-monetary easing made it impossible for banks to earn profits from the difference between long and short-term interest rates. Now banks are trying to earn profits by selling financial products at unreasonably high fees even though the banks are creating very little added value. So how should banks create added value? The answer is taking on risk to extend loans to new customers. Banks must create credit so that borrowers can generate new value. Establishing an environment that supports the growth of new loans will obviously be good for the Japanese economy.

(13) Japan’s ultra-easy monetary policy is correct – Yield curve control is ending deflation

Koiwai: Thanks to Abenomics, unemployment is lower and stock prices are higher in Japan. On the other hand, Japan has not reached 2% inflation, a key target for ending deflation, and many people think that the Abenomics growth strategy is not going well. Furthermore, the Japanese economy is achieving only lackluster growth. What is your assessment of Abenomics?

Musha: Overall, I think Abenomics is a good policy, particularly the use of ultra-monetary easing by the Bank of Japan to eradicate deflation. The first point is control of the yield curve to hold the yield of long-term government bonds at zero. Naturally, this policy sparked considerable criticism. Textbooks tell us that it is impossible to control long-term interest rates, which are determined by markets, and that this should not be done. But saying something should not be done because a textbook says so is a novice criticism. The Bank of Japan was well aware that its actions would produce a negative reaction. People must understand why the Bank of Japan believes that this approach is correct. My opinion is that this policy of the Bank of Japan is the right choice for Japan.

Keeping long-term interest rates at zero is the objective of the Bank of Japan’s yield curve control. This is the most powerful type of monetary easing. Whether or not this can actually be accomplished is therefore the key point. I think yield curve control would have been impossible five years ago. But I am confident it can be done today. Five years ago, the Bank of Japan’s assets totaled only ¥100 trillion. Now the bank has assets of ¥477 trillion, which is enough to control the price of long-term government bonds.

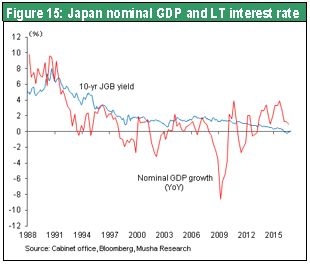

The next question is whether or not yield curve control can actually end deflation. I think the answer is yes. The reason is that keeping long-term interest rates at nothing creates an environment that rewards risk-takers. The result is a surge in investors’ animal spirits and higher risk exposure. Before Abenomics, the nominal GDP growth rate, which shows the health of the economy, was consistently below the long-term interest rate, which is the cost of the GDP. In this environment, the performance of risk-takers was below the long-term interest rate, so risk-takers were constantly betrayed.

Once Abenomics started, though, there was an unmistakable reversal in the relationship between the GDP and long-term interest rates. Long-term interest rates will stay at zero because of the Bank of Japan’s yield curve control. Since this policy will preserve an environment that rewards risk-takers, prices of stocks, real estate and other assets will begin to climb. Next, we should see inflation increase. Raising prices of assets must happen first in order to start inflation.

Numerous positive forces exist in Japan. The yen continues to depreciate, companies are reporting high earnings, the correction of Japan’s distorted asset allocation is progressing, and the Bank of Japan is controlling the yield curve. I believe that all of these factors will undoubtedly result in an upward correction for Japanese stocks.

Koiwai: Japan’s aging and declining population, a trend that is gaining momentum, is an important long-term issue for the country’s economy. Many people think a smaller population will produce deflation and make it difficult for the economy to grow. The massive amount of government debt is another source of concern. What do you think about these two issues?

Musha: Blaming Japan’s aging population for deflation is a belief based greatly on emotion rather than logic. Rather, I think that deflation is a major cause of accelerating decrease in the number of children and increase in the number of seniors. Whatever you believe, there is no doubt that Japan’s population is falling. This leads to the question of how this will affect the Japanese economy.

One impact will be a decline in demand. However, demand is determined by multiplying population by the country’s standard of living per capita and then adding external demand. The decline in Japan’s population can be easily offset by improving living standards and continuing to raise exports. Japan’s falling population is definitely a problem. However, the absence of an improvement in the standard of living in Japan during the past 20 years is an even bigger problem. I think the people of Japan should spend more on luxurious things. The relatively inferior levels of housing and life styles in Japan compared with other countries show that the desires of Japanese people are still low. There is undeniably significant room for improvements.

A declining workforce is another impact of Japan’s falling population. This can be offset by more progress involving the use of robots and machines. Using machines more will raise productivity, which will boost per capita income. So a decline in the number of workers is not all bad news for Japan. Consequently, an aging and declining population is not directly linked to deflation and people are mistaken to be pessimistic about Japan’s future for this reason.

Regarding public-sector finances, a large number of economists are talking solely about Japan’s massive debt. The government has been using loans to buy assets. Failing to look at both assets and liabilities thus results in a one-sided view. Japan is said to have the highest government debt in the world. But the country has the most government assets, too. Another critical point is that almost all government debt is owed to the people of Japan. Therefore, the large volume of government debt in Japan is merely a phenomenon on the other side of the country’s huge amount of corporate and individual savings. It is totally meaningless to discuss debt and assets separately. In this sense, public-sector debt is the result of maintaining a balance with the Japan’s surplus savings. So a move by the Japanese government to quickly improve financial soundness would produce serious problems. The people and corporates would have increasing difficulty locating places to park their money and Japan would probably return to deflation. This explains why any debt reduction measures by the Japanese government would have to be accompanied by a correction in the surplus of private-sector savings. The fundamental problem in Japan is this surplus of savings, which signifies insufficient private-sector demand for capital. Rather than reducing public-sector debt, the right prescription for the Japanese economy is actions that increase private-sector demand.

(14) Japan nears a historic turning point as brain power increases at a remarkable pace

Koiwai: My final topic involves new technologies like AI, the IoT, self-driving vehicles, biotechnology and financial technology. This subject is related to the seventh continent that we discussed earlier. I think the world is advancing to an age when all of these new technologies will blossom at once. I don’t think there has ever been a time like this when so many big technologies are emerging at once, and on a global scale as well. What types of economic and social effects will this have on Japan?

Musha: I agree that the world is advancing to a turning point of an unprecedented magnitude. I think the most important by far is that the world has advanced to an age in which brain power is expanding at a very high speed. This is true of biotechnology, AI and all other categories of new technologies. For example, after the second industrial revolution, automobiles, high-speed trains, airplanes and other forms of progress created significant expansion in the use of physical power. Until a few hundred years ago, the activities of individuals were restricted to a radius of only about 1,000 kilometers. Now people can go anywhere in the world. But there was no significant change in brain power during this period.

From now on, the brain will have power on an unimaginable scale. Smartphones that everyone seems to have are one illustration. These tiny devices give users access to virtually unlimited amount of information on the Internet. In other words, a smartphone is like an external memory device that has an incalculably larger amount of capacity than our small brains have. Not long ago, people admired people who knew everything. Now these people are being replaced by smartphones and are no longer needed. What we need now is “worldly-wise” people with knowledge that goes beyond mere facts.

Exponential increase of brain power produces enormous opportunities for creating value. The most important question is what type of business model we should establish for creating value. A dramatic improvement in productivity will be another result of the expansion of brain power. If one person can perform a job that previously required 1,000 mental workers, 999 of these workers will lose their jobs. This is equivalent to saying that working time needs to be cut by 99.9% (to one-one thousandth of the previous level) in order to provide work for 1,000 people. Since this process will give people more free time, Japan will probably see growth in golf, tennis, music, travel and other business sectors for enjoying leisure time. I foresee rapid growth in industries associated with entertainment, activities that bring people together, and services that make our lives more satisfying and fulfilling. Mankind is on the doorstep of an age of dramatic progress.

Koiwai: You have given me big expectations about the second ph