Jul 26, 2017

Key Strategy Issues Vol.K302

Capital market efficiency is the primary reason for the overwhelming US competitive superiority

US financial and capital markets are the center of attention of investors. The Trump administration is currently working on the question of whether to tighten or ease regulations. For instance, should the Glass-Steagall Act (separation of the banking and securities sectors) be revived? Should the so-called Volcker Rule (prohibits banks from proprietary trading), which is part of the Dodd-Frank Act, be reduced or terminated? Investors are also breathlessly watching to see if the United States can achieve a trouble-free exit from quantitative easing. The reason is that the nature of this exit will directly influence banks’ earnings, resulting in an immediate and significant impact on stock prices. However, these questions involve only individual points. As a result, investors are not focusing enough on formulating an overall view of US financial and capital markets they undergo dynamic changes and determining a comprehensive assessment of these changes.

Answering the question of whether or not capital markets are functioning properly and contributing to economic well-being is a much more important point. What are the forces behind changes in capital markets? How have capital markets evolved to serve as a place for matching the supply and demand for capital? We must examine these points by looking at the forest rather than the trees.

(1) The strong performance of US capital markets

Are capital markets functioning properly? Finance is not the answer. Two questions must be answered. First, can these markets maximize economic performance under certain conditions (technology, capital stock, population and labor)? Second, are markets achieving the matching of seeds and needs involving capital? With respect to these points, the US capital markets have the best performance in the world. Since the end of the global financial crisis, the United States has ranked first among industrialized countries in terms of economic performance, economic growth, job creation, corporate earnings growth and other statistics. During this time, the United States had the world’s smallest risk of deflation, which is proof of US economic leadership.

Number one by far in the supply of risk capital

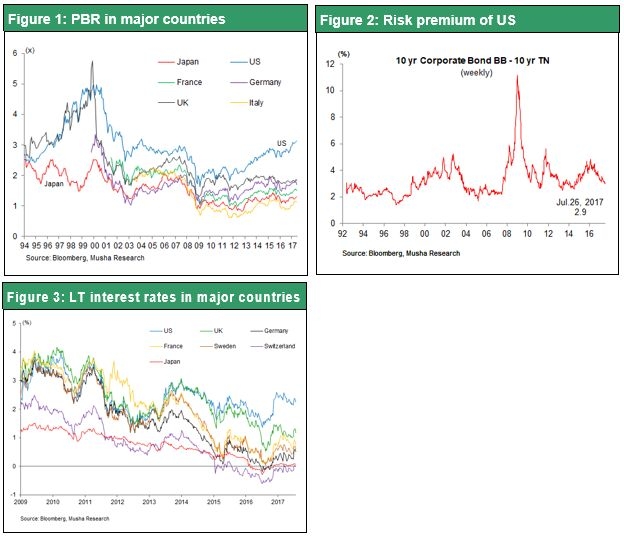

Capital markets have contributed to the strength of the US economy in three ways. First, the United States more than any other country succeeded in stimulating animal spirits. Stock prices have been consistently high with the world’s highest PBR. At the same time, the risk premium for credit has fallen sharply to an all-time low. Furthermore, the level of surplus capital is relatively small, the downside for interest rates is limited, and the risk of deflation is lower than anywhere else. As you can see in Figure 3, the United States has the highest long-term interest rate among industrialized countries. We can therefore conclude that, regarding the supply of risk capital, US capital markets have been more successful than the capital markets of any other industrialized country.

A major role in the growth of household wealth

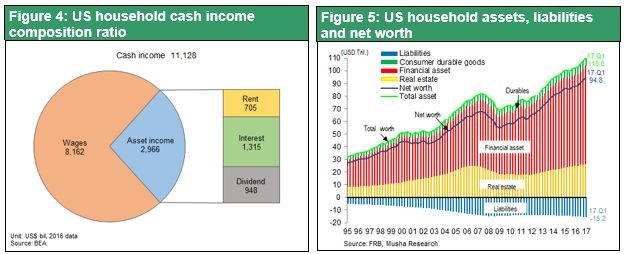

Second, capital markets have played a major role in the growth of household incomes and wealth in the United States. Income from assets accounts for a significant share of the disposable incomes of US households. Figure 4 shows household cash income after deducting the portion of pension and insurance income paid for by workers and government social security payments that are included in disposable income. The result is that income from assets is about one compared with three from labor income. In Japan, asset income is only about one compared with nine from labor income. Clearly, US households are receiving substantial benefits from capital markets. Moreover, US households have been using capital markets to build up their wealth. Figure 5 shows the change in the net assets (total assets minus liabilities) of US households. Net assets fell 20% (from $67.7 trillion in 2Q 2007 to $54.8 trillion in 1Q 2009) during the global financial crisis as asset prices plunged. But subsequently, household net assets staged a rapid recovery and stood at $94.8 trillion at the end of the first quarter of 2017. During this upturn, household net assets surged from 3.8 times of GDP to 5.0 times. The growth of these assets is what fueled the recovery in US household spending.

A cradle for innovation

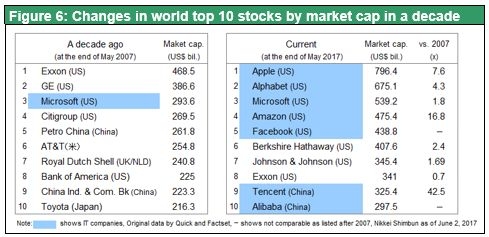

Third and most importantly, capital markets have stimulated an enormous amount of innovation. Countless new business models using the internet have originated from the United States. Businesses that create, operate and use internet infrastructures that are propelling the global economy to new stage. US companies account for all of the world’s internet platform holders. The only exception is China, where the government is protecting and fostering this business sector.

Figure 6 shows the change in the world’s most valuable companies during the past decade. At the end of May 2017, all of the world’s five most valuable companies in terms of market capitalization were US internet platform holders. This clearly demonstrates that the United States is at the forefront of the global new industrial revolution. Until 10 years ago, the top 10 companies were in banking, oil, telecommunications and other traditional industries. During the next decade, a major shift has obviously taken place in the leaders of the US stock market. Changes in market capitalization of US automakers are an excellent illustration of this shift in stock market leadership. Electric automobile manufacturer Tesla Motor was established 13 years ago and posted sales of 76,000 vehicles in 2016. But this company’s market capitalization is now higher than those of GM and Ford, which each sell approximately 100 times more vehicles. This demonstrates that electric vehicles are the future of the automobile industry. Automakers will have to greatly alter their business models. And the stock market has apparently very early on factored in the expectation that Tesla rather than the traditional automakers will be at the forefront of this business model transition.

“Banks are the conductors of the economy that make new combinations possible,” in the words of Joseph Schumpeter. The meaning is that bank financing is what creates a blueprint for the future by supporting innovation. But the days when loan portfolios of banks determined the allocation of capital have ended. Today in the United States, the big shift in the composition of stock market capitalization is what is depicting a blueprint of the future. Tesla, which has the highest market capitalization in the automobile industry, will probably use this financial power to create new business models.

Listed companies are not the only recipients of risk capital supplied by capital markets. Many other channels exist for supporting innovation. Examples include the growth of private equity, which provides capital to privately owned companies, the widespread use of mergers and acquisitions, and the emergence of junk bond funds. These other sources of capital are what made Tesla’s establishment and subsequent growth possible. In the United States, individuals who have been deeply involved with the supply of risk capital are now in control of the country’s economic policies. For instance, there have been Treasury Secretaries who spent time at Goldman Sachs and a number of venture capitalists later entered the political world where they were engaged in designing financial schemes. Two examples are Commerce Secretary Wilbur Ross and former presidential candidate Mitt Romney. There has been much criticism about the US income gap and the enormous compensation received by corporate executives. But there is a positive side as well. This system is performing the function of producing a succession of capitalists who become major sources of money for investments with risk. As a result, the United States is far ahead of other countries regarding venture capital and private equity funds (such as KKR, Carlyle, Blackstone and Bain Capital).

There is no doubt that, after overcoming the challenges of the global financial crisis, US capital markets have come back to life and played a key role in the subsequent vitality of the US economy.

(2) US capital market and monetary policies have been generally on target

The US financial sector has experienced a number of crises: the 1990 savings and loan crisis, the end of the IT bubble in 2000, and the bursting of the housing loan bubble in 2008 and ensuing global financial crisis. But US capital markets have remained relatively healthy, as I have just explained. Furthermore, these markets recovered quickly from the shock of the global financial crisis. As a result, we can conclude that US actions taken to respond to these crises were correct.

Monetary policy with two fronts and tighter restrictions based on lessons learned from asset bubbles

The United States has learned much from the end of the IT bubble, widespread financial scandals, and the collapse of financial and capital markets sparked by the subprime mortgage meltdown and global financial crisis. To avoid a crisis, the United States used a battle that had two fronts.

The first front is the imposition of tighter regulations, which reflects lessons learned from the asset bubbles. In the postwar era, the United States made steady progress with deregulation. Financial reforms and deregulation (liberalization of interest rates = termination of regulation Q, allowing banks to operate in many states and other moves) during the 1980s and 1990s sparked innovation and new products in the US financial sector. However, deregulation came to an end with the 1999 termination of the Glass-Steagall Act and passage of the Financial Services Modernization Act, which eliminated the barrier separating the banking and securities businesses. Afterward, the tide shifted to enacting stricter regulations.

Following the 2000 bursting of the IT bubble and revelations of financial crimes at Enron, WorldCom and other companies, the United States established a series of new regulations. One step was the 2000 prohibition of using a pooling of interest for combining companies because of the susceptibility of this scheme to fraud. The next big step was the Sarbanes-Oxley Act of 2002, which was aimed mainly at preventing fraudulent financial statements and accounting methods and reinforcing internal oversight at companies. In 2008, the subprime mortgage problem produced a financial crisis that brought down Lehman Brothers, AIG and other large financial institutions. The crisis also triggered a global chain reaction of credit problems. In 2010, the United States enacted the Dodd-Frank Wall Street Reform and Consumer Protection Act, a comprehensive package of financial regulations designed to prevent another global financial crisis. The Dodd-Frank Act prohibited proprietary trading, limited investments in PQ and hedge funds, prohibited high-risk businesses in order to protect depositors and had other provisions. Collectively, these regulations severely impacted earnings of investment banks. The Trump administration recognizes the barriers that have been created and wants to take sweeping actions for deregulation.

Measures to encourage risk-taking after the crisis

The second front of the US battle in order to prevent a financial crisis was the 2008 establishment of the Troubled Asset Relief Program (TARP) for the use of government funds to bail out companies in trouble. There was also a monetary easing policy to support risk-taking. TARP had a budget of about $700 billion to supply capital to financial institutions, automakers and other companies. Ultimately, a total of $454.6 billion was distributed. Almost all of these funds were repaid as companies returned to financial soundness. With respect to monetary policy, the United States started quantitative easing and began announcing an inflation target in January 2012. These measures had the effect of boosting animal spirits by raising prices of assets. Due to this monetary easing policy, US capital markets recovered rapidly from the turmoil created by the subprime loan bubble. Without these reflationary initiatives (a new type of monetary easing), the US economy could not have returned to normal.

The BIS view vs. the Fed view

The rapid recovery of the United States stands in sharp contrast to the prolonged period of economic stagnation and deflation in Japan after the collapse of its asset bubble in the early 1990s. In both countries, an unsustainable upturn in asset prices produced a financial imbalance. But there are two views on what should be done to respond to the resulting economic collapse. The Fed’s view was to clean up the mess after the collapse. The BIS view is to place priority on preliminary measures to suppress the bubble. The Fed believes that the aftermath of the bursting of an asset bubble can be handled by implementing powerful monetary easing. Additionally, the Fed believes that a cautious stance is needed regarding preliminary measures to hold down the bubble’s growth. In other words, the Fed prioritizes reflationary actions. But the BIS places emphasis on advance monetary tightening to prevent the growth of an asset bubble. Even after an asset bubble bursts, the BIS focuses on the negative effects of excessive monetary easing. (Source: Japan’s response to the bubble – Comparisons with the United States and lessons learned by Ryozo Himino of the Financial Services Agency)

During the global financial crisis, Ben Bernanke, who directed US monetary policy as Fed chairman, was critical of Japan. He believed that Japan’s asset bubble was created by financial deregulation that was not accompanied by measures for strengthening the country’s extremely weak regulatory and oversight framework for the banking system. Then Japan was too timid about subsequent monetary easing. When the US asset bubble burst, the country responded with extensive reflationary measures based on its own beliefs. The Fed implemented quantitative easing three times. By purchasing long-term Treasury debt and mortgage-backed securities, in the process expanding its balance sheet, the Fed aimed to directly influence asset prices. This initiative went far beyond conventional monetary policies. However, the Fed played a decisive role in stopping the decline in asset prices and pushing prices up. Japan adopted the opposite stance. The Bank of Japan and other agencies were reluctant to enact reflationary measures until Bank of Japan governor Masaaki Shirakawa, who embraced the BIS view, was finally replaced.

The United States had two main reasons for choosing the Fed view. First was the conviction that the ultimate goal of finance is to supply risk capital. Second was the goal of making the United States more globally competitive in the financial sector.

(3) The gap between profit margins and interest rates played a major role in the dramatic change in capital markets

Monetary policies that went beyond conventional thinking were needed because of the enormous changes taking place in US financial and capital markets. The first big change is the constant progress with computer networking technologies. Dramatic growth occurred in e-commerce, e-trading, e-payments, e-funding, financial technology, internet information distribution and other fields. As a result, the constituent functions of the financial sector were rapidly replaced by the internet and other networks.

What textbooks don’t tell you – Interest rates can fall when profit margins are high

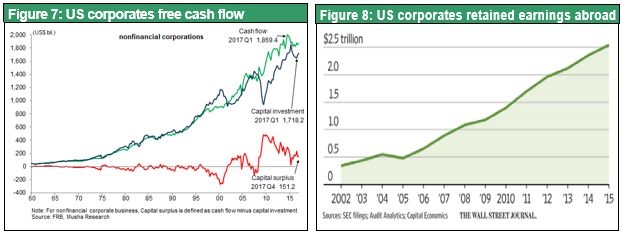

The second big change in the financial environment was the growth in surplus capital in the financial and capital markets of the United States and other industrialized countries. Excess savings worldwide (by Mr. Bernanke) was not the only cause. Surplus capital was also in large part the result of the accumulation of a massive amount of financial assets by US households and companies. There was a steady increase in household financial assets in relation to GDP and in financial assets per capita. At companies, earnings were consistently high but there was not enough demand for investment capital to use all of the earnings. This situation has produced a constant surplus of capital (especially concerning the accumulation of earnings overseas). Consistently positive free cash flows of companies clearly demonstrate the inadequacy of demand for capital. The resulting surplus of capital is exerting downward pressure on long-term interest rates.

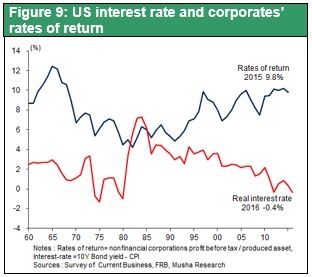

This is the imbalance that explains the current problem in capital markets: r1>g> r2. This means that r1, which is corporate earnings and profit margins, is greater than g, which is the economic growth rate, which in turn is greater than r2, which is the cost of capital for companies or interest rates. The simultaneous existence of two inequalities is a key characteristic of the current environment. Profit margins are high. Stock dividend yields are 2%, the earning yield (the reverse of the PER) is 5% and the return on equity is 14%. But the cost of procuring funds that companies need to operate is low. The yield on 10-year US Treasury notes is only at the 2% level. An enormous gap exists between profit margins and the cost of capital. Normally, profit margins and interest rates should move in tandem. When the economy is strong and companies are earning substantial profits, interest rates should obviously increase. After all, both profit margins and interest rates are returns on capital, so profit margins and interest rates are basically the same thing. This is why textbooks say that r1 should equal r2. However, a large gap exists between r1 and r2 and the economic growth rate, which is between these two figures, has been mostly flat.

Producing the greatest possible economic well-being (growth in jobs with inflation under control) through the proper allocation of capital is the central mission of capital markets. But economic benefits cannot be maximized when profit margins continue to climb as interest rates move down. In this type of environment, traditional monetary policies will only cause capital to flow to risk-free assets. Moreover, this situation causes people to hoard capital. Growth in unused capital raises the risk of deflation. Conventional thinking tells us that this situation calls for taking innovative actions and breaking a few rules. Quantitative easing is the innovative and rule-breaking initiative that central banks have been using in response to this hoarding of capital.

The new industrial revolution hypothesis is the most persuasive explanation for the Greenspan conundrum

The fundamental cause of the abnormal situation where r1 is greater than r2 is most likely the large volume of surplus earnings resulting from productivity gains at companies made possible by the new industrial revolution. Drivers of this revolution include IT, smartphones, cloud computing and other innovations. The new industrial revolution and globalization have together produced an unprecedented increase in productivity that drastically lowered the amount of labor and capital required by companies.

Although there has been an obvious improvement in productivity in terms of microeconomics, this improvement has not appeared in macroeconomic statistics. In fact, the labor productivity in the world’s major countries has declined significantly since the global financial crisis. There are several possible explanations. But the most likely explanation is that resources freed up by using less labor and capital savings on a microeconomic-level are sitting idle due to the inability to put these resources to work on a macroeconomic level. Basically, microeconomic-level savings are raising corporate earnings while also producing macroeconomic-level slack. The abnormal phenomenon of rising profit margins and falling interest rates has persisted for about 20 years. In 2005, Alan Greenspan, who was Fed chairman, said this situation was a conundrum. Now Fed chair Janet Yellen is again viewing this situation as a big mystery.

Rising stock prices are not a sign of an asset bubble

Surplus capital constantly exerts upward pressure on asset prices. This was true before the global financial crisis and remains true today. But are higher prices an asset bubble? Is this just a dubious way to earn profits? At this time, there are legitimate reasons for higher asset prices in the United States. The first reason is corporate earnings, which signify that companies are creating value. Second, the financial efficiency of companies is raising the return on equity as companies buy back stock and conduct mergers and acquisitions. Third, higher asset prices are fueling a virtuous cycle of economic growth that will lead to even higher earnings. Furthermore, consumer spending is climbing with the support of a big increase in household net assets. Additionally, companies are using the growth in their risk-taking capacity to make more financial and business investments. The result is ongoing progress with absorbing the surplus of labor.

From this standpoint, US monetary policy based on the Fed view has been very successful. On the other hand, the BIS view of using preventive measures prior to a bubble is very dangerous. This probably explains the long period of deflation in Japan, which was strongly influenced by the BIS view.

(4) The United States, which has remained faithful to market principles, has consistently been the global leader in financial innovation

US capital markets are the most efficient in the world

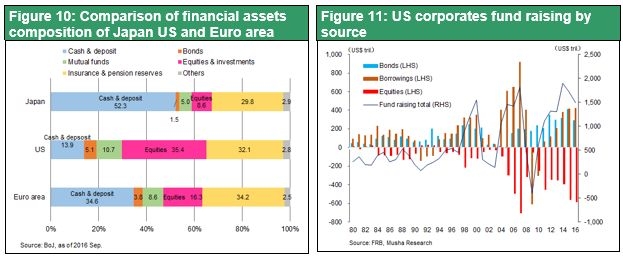

US capital markets are far ahead of markets in other countries in terms of efficiency and sophistication. One reason is that US financial and capital markets are highly focused on the pursuit of the rational use of capital. The financialization of markets is now well established in the United States. As the figures below show, the primary component of US financial and capital markets is behavior that is positive for markets. First, cash and deposits are a very low share of the invested assets of households. The majority of household assets are in mutual funds and other vehicles linked to markets (Figure 10). Furthermore, companies rely mostly on internal resources for their financial requirements and have only a small amount of bank loans.

Another key characteristic is high financial leverage because of pressure from shareholders to boost the returns on equity and capital efficiency. Even though IPOs have increased, there has been a decrease in the net issuance of stock in the United States because of stock repurchases. At the same time, debt is increasing. As a result, companies have, in effect, been swapping equity for debt. These risk-taking activities have raised prices of assets like stocks while narrowing the junk bond risk spread and bringing down long-term interest rates. This has created a consistently favorable environment for consumers and companies. US companies have had surplus free cash flows year after year because of profit growth accompanied by higher capital productivity, the result of a sharp drop in the cost of equipment resulting from the technology revolution. Companies have distributed almost all of these earnings to shareholders in the form of dividends and stock repurchases. As a result, companies have no surplus capital.

Another important point is big changes in how financial institutions are managed. Since the global financial crisis, earnings from sales and trading activities have plunged because of narrowing profit margins, tighter regulations (the Dodd-Frank Act), the growth of internet-based securities companies and other reasons. These changes forced financial institutions to shift emphasis to advisory and other activities where they can add intellectual value. Hedge fund business is declining. Investment advisory services for individual have also transformed with the establishment of RIA (Registered Independent Adviser). These changes pushed financial institutions to focus on intellectual added value.

Financial innovation in the United States (New schemes and products)

The efficiency of US capital markets is an extension of the consistent leadership of the United States in the field of financial innovation since the beginning of the 20th century. There are many examples of this innovation. First is the use of bonds rather than bank loans to procure funds. Early in the 20th century, US capital markets were backed mainly by the issuance of bonds by railroad and other companies to obtain financing. Second is the use of professional managers to operate companies (1932 Berle-Means thesis concerning the separation of corporate ownership and management), which made companies more socially responsible. Third is the pioneering role of the United States involving financial deregulation, disintermediation, the emergence of institutional investors, responsibilities concerning pension fund management (the Employee Retirement Income Security Act of 1974), and the establishment of corporate governance. Fourth is leadership in the diversification of fund procurement and asset management methods. Examples include money market funds, certificates of deposit, financial futures (establishment of CME), junk bonds, securitized instruments and shadow banking. These advances dramatically increased the market’s matching function. Fifth is changes and diversification involving corporate finance. Here, examples include mergers and acquisitions, leveraged buyouts, shareholder activism, greenmail, stock repurchases, deleveraging, and stock bonuses and options. All of these US innovations contributed to the relentless pursuit of the efficient use of capital and are signs of the soundness of capitalism in the United States.

To sum up my previous points, there are several reasons for the strength of US capital markets. (1) The liquidity and efficiency of labor and capital makes it easy to alter the allocation of labor and capital quickly. (2) US monetary policy is very efficient, as demonstrated by the success of the United States and the mistakes of Japan. (3) US companies have transparent governance. (4) The United States often sets global trends concerning the establishment of financial sector rules. (5) The United States has an overwhelming lead involving the origination (creation of products) and sale (market access) of financial products. No business is more pragmatic than finance. US companies are often criticized for their short-term goals, income inequality and high executive compensation. However, these characteristics are nothing more than byproducts of the risk capital and innovations that originate from US capital markets. Therefore, this criticism is not based on an accurate understanding of how these capital markets function.

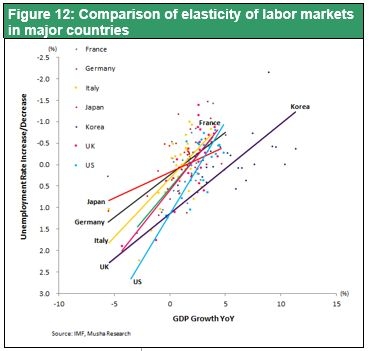

Efficiency of the US labor market is one more crucial point. Figure 12 is a comparison of the elasticity of the labor markets of major countries. As you can see, the United States clearly has the highest labor market elasticity in relation to GDP. This high elasticity demonstrates that labor market efficiency is one more reason, along with capital market efficiency, for US leadership as an innovator.

Outlook

For the reasons I have just explained, I believe that US financial and capital markets will retain their superiority in relation to markets in other countries. The United States has the greatest flexibility to adapt to changes in markets. As a result, the next new financial business model will probably originate in the United States.

The new industrial revolution is occurring worldwide and countries are competing to be the winners in this environment. To succeed, countries must shift capital, intellectual resources and labor from old to new business sectors. The United States has a big lead in this competition. The reason is the ability of the United States to use the world’s highest capital and labor market flexibility for the smooth shift of resources to other fields.

Ten years ago, Germany and France had unemployment rates of about 10%. Today, unemployment is still about 10% in France but has dropped to about 4% in Germany. The most significant reason for the improvement in Germany is the labor market reforms for greater efficiency that were enacted 15 years ago when Gerhard Schroeder was chancellor. Germany’s progress has attracted the attention of Emmanuel Macron, the new president of France who won by promising to enact reforms. President Macron’s party subsequently scored a landslide victory in France’s recent parliamentary election with many more seats than the party of the former president has. The stage is now set for France to make another attempt at implementing dramatic reforms.

Japan has the most rigid labor and capital markets among the major countries. Despite this shortcoming, Japanese companies have been reporting record-high earnings. This is an impressive accomplishment. If Japan can enact labor market reforms as Germany did and achieve capital market efficiency at the same level as in the United States, the outlook for Japan will improve greatly. Japan has made significant progress with numerous capital market reforms. Major accomplishments include the establishment of a stewardship code and corporate governance code and revisions involving the Government Pension Investment Fund and other public-sector institutional investors. Another step forward is the likely start of hostile takeovers in Japan. Having reached this point, the Japanese government should next take the initiative to implement reforms in the labor market, too.