Jul 09, 2013

Strategy Bulletin Vol.102

The Secret behind China’s Slowing Growth and Strong Currency

Statistics in China show the financial crisis is deepening

Why is the Chinese Yuan still strengthening even as the country’s economic stagnation becomes more severe? We have been hearing this question since 2012. The answer is probably underground fund remittances, which indicate that China is struggling with a serious credit crunch.

Why is a credit crunch happening?

Short-term interest rates in China spiked suddenly in the second half of June as the country’s fund procurement difficulties came to the surface. Most people interpret higher interest rates as the result of reforms to the People’s Bank of China and measures to prevent the formation of a bubble. But this is a one-sided view. China is very unlikely to intentionally burst a bubble while economic growth is slowing. Another way to view China’s higher interest rates is that people are shunning risk worldwide because of the impending reduction in U.S. quantitative easing. But this is a contradiction, too. If investors are avoiding risk, the dollar should strengthen as the Yuan weakens. However, the Yuan is appreciating all by itself. The reason is that money is flowing into China. Therefore, we should view the rapid upturn in short-term interest rates as the result of a shortage of funds that is greater than the People’s Bank of China expected. Figure 1: China short-term interest rate trends Figure 2: Chinese Yuan trends

The rapid slowdown of the Chinese economy

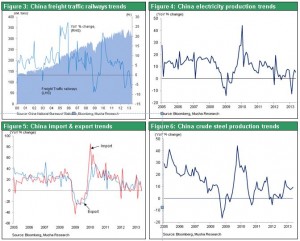

China’s economic difficulties can no longer be concealed. The movement of goods in China is already about to come to a halt for all practical purposes. Railroad cargo volume and electric power generation are the statistics that former Chinese Prime Minister Wen Jiabao relies on most of all. Currently, there is almost no increase from one year earlier in either of these figures. Steel output was flat in 2012 but is now up more than 10% from one year ago. However, the purpose of this growth is probably absorbing fixed expenses rather than meeting real demand. There are reports of higher inventories of steel, which point to falling prices and cuts in steel production. China will probably have to admit that its economy will lose momentum in late 2013 and 2014. A rapid decline in economic growth will obviously bring about a shortage of funds. Revenues will immediately decrease but there will not be an immediate downturn in expenditures. Figure 3: China freight traffic railways trends Figure 4: China electricity production trends Figure 5: China import & export trends Figure 6: China crude steel production trends

Fundamental shortage of funds = Sharp downturn in foreign currency income

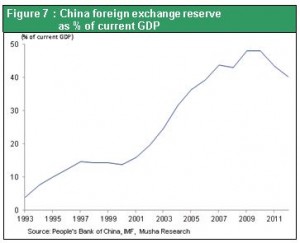

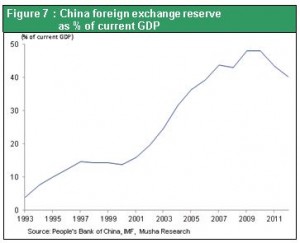

Furthermore, a significant change is occurring with regard to foreign currency, which has been the source of abundant funds for investments in China. Foreign currency reserves as a percentage of China’s GDP rose from 0% in the 1990s to 13% in 2000 and 49% in 2010. These reserves underpinned investments in China that could even be called reckless. In 2012, this percentage fell to 40% and is estimated to be about 37% now. The reason is the end of growth in foreign currency reserves, which back up the issuance of domestic currency. (1) Rising wages are eroding China’s competitive edge, resulting in the end of growth in the country’s trade surplus. (2) Securities investments and direct investments by foreigners in China are also about to start declining. Until the first half of 2012, Japan was the only major country with increasing direct investments in China. But these investments began to fall after the Senkaku Islands dispute. (3) Although China is easing restrictions on securities investments, there is unlikely to be an increase in investors who buy Chinese securities. The country has the world’s worst stock prices and there are concerns about slowing economic growth. Even Anthony Bolton of Fidelity Investments, who has had a positive view of China, has pulled back from investments in China. In addition, (4) investors in China may start to flee to foreign funds. China’s foreign currency reserves are in a downward trend despite the intensive measures by authorities to manage foreign exchange. These four events are very likely to make the credit crunch even more severe. Figure 7 : China foreign exchange reserve as % of current GDP

The growth of illegal inflows of funds

Since 2012, China has somehow managed to hold foreign currency reserves steady. The country has avoided a decline in reserves despite the four factors listed in the previous paragraph that cause a downturn. Underground and illegal inflows of funds to China are filling in this gap. For example, On June 28, The Wall Street Journal reported that Chinese companies that have fallen into financing difficulty are procuring funds overseas and receiving funds from overseas subsidiaries in order to remain solvent. The article stated that rapid growth is occurring in many fund procurement channels. For example, Chinese companies are going public in Hong Kong market, issuing high-yield dim sum bonds (overseas Yuan-denominated bonds) and using Asian loan markets to obtain funds. Consequently, the use of overseas sources to meet fund shortages in China is probably the reason for the Yuan’s strength. Inflating prices of exports appears to be one source of inflows of funds from overseas. There have been doubts about the reliability of China’s trade statistics since 2012. Although the country reported a big increase in exports, statistics at other countries show that imports from China are flat. Many inconsistencies have occurred. Chinese authorities have reported that exporters are inflating the value of exports. China strictly controls foreign exchange. Therefore, to receive funds from another country, companies are creating fictitious export prices that exceed the actual value. Funds can then be received in the form of payments from importers. Until now, these illegal inflows were treated as direct investments in China by foreigners. However, international investors have been holding down their investments in China. One reason is the recent drop in stock prices. Investors are also worried about non-performing loans in the shadow banking sector. Moreover, wages in coastal China are higher than in Thailand, Malaysia and all other Southeast Asian countries. Companies are moving manufacturing operations out of China. Direct investments in China started to decline in 2012 and there is no change in the structural factors behind this downturn. If this is true, we should regard inflows of funds from overseas as the initiatives of people in China. These inflows are not investments in China from overseas. China started supervising export statistics more closely in May 2013. The result was a sharp drop in the growth of the value of exports. In other words, illegal inflows of funds were reduced. I believe we should regard this as the point when China’s credit crunch started to become even worse quickly. Due to the recent surge in short-term interest rates, the overall shortage of funds has first of all exposed the weakest link in China’s financial system: shadow banking. The shortage of funds leads to growth in non-performing loans and the insolvency of financial institutions. Due to the nature of this series of events, there can easily be an impact on the entire banking system.Slowing economic growth may create a crisis for China’s communist dictatorship system

The events I have just explained show the severity of the tight-money situation in China. Rapid slowdown of economic growth is one problem. But China also has a structure that makes the emergence of a fund shortage inevitable. The shortage is not the result of government reforms; the real cause is that money is no longer circulating in China. By building up massive foreign currency reserves, China was able to continue to make unprecedented and even wasteful investments. The result was a prolonged period of economic growth. Investments have surpassed consumption every year since 2003. Capital formation rose to the abnormally high level of 46% of GDP. But the obstacles created by these excessive investments are finally emerging all at once. Real estate investments, corporate capital expenditures and public-works investments were all made in accordance with the desires of the Communist Party rather than for rational economic reasons. Most of these expenditures will probably end up as non-performing investments. As these investments were made, only companies and governments accumulated wealth. Labor’s share of income in China is extremely low and buying power is not increasing outside China’s large cities. Apparently, the Chinese economy has at last reached structural dead end. Major components of the Chinese economy will probably suffer from a decline in earnings. Falling earnings will expose the real situation at government-owned companies that have relied on subsidies under the Communist Party regime. The financial condition of companies that have consistently used suspicious and fraudulent accounting practices will also be exposed. The result is likely to be enormous non-performing assets consisting of loans to these companies along with a steady stream of huge bankruptcies. Investment-fueled growth that was nothing more than a paper mache tiger is over. China can no longer sustain its enormous volume of investments. In the past, investments fueled more than half of economic growth. But from now on there will be no contribution or even a negative effect. Declines in jobs and wages will be unavoidable and consumption will drop, too. The Chinese economy is very likely to fall to no growth. These events will reveal the problems with the Chinese economy and China’s socialist market economy, which is an illogical term. All these events will probably deepen the crisis faced by China’s communist party dictatorship government. The reason is that no one in China believes in “carrying out the communist revolution.” Positioning a communist dictatorship as an essential system for achieving economic growth was the only way to justify the existence of this system. Once growth stops, the system will face a crisis. The end of economic growth will therefore immediately rob the legitimacy of Communist Party dictatorship system. Figure 8: Gross capital formation as % of current GDP of major countries Figure 9: China railway investment to peak out