The technical correction in risk assets is drawing to a close worldwide, with a high likelihood of a resumption of risk-taking in the autumn. The operative factors are: (1) strong real economies and earnings, (2) abundant investment funds and low and stable long-term interest rates, and (3) the abatement of policy concerns (disappearance of policy uncertainties). The selection of Tokyo for the 2020 Olympics will likely give a boost to Japanese stocks. The feared deceleration in China is being avoided by means of such policy countermeasures as greater public works spending and operational relaxation of real estate investment acquisition restrictions. Over the 6 months from last November to end-May 2013, 80% of Japanese share prices advanced strongly. There is a high probability that a second uptrend will start in and after September. By mid-2014, we may see the Nikkei Average rising up to about ¥20,000.

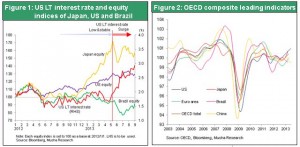

Advanced countries lead economic expansion, U.S. long-term interest rates peak out

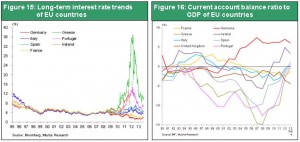

With debate on the contraction of QE3 (third round of quantitative easing) getting underway and the nearing departure of FRB Chairman Ben S. Bernanke, who has guided the series of monetary relaxations, the outflow of money from the emerging countries has had the vicious-cycle effect of sending their equities and currencies down in large part, with marked deceleration in their economies. The BRICS countries, once seen as the new drivers of the world economy, have entered a phase of stagnation. Taking an overall view of the world economy, however, we see an uptick in the leadership of the advanced countries. Economic sentiment in the U.S. and Japan has improved markedly, while Europe and the euro zone, led by Germany, are emerging from recession. Strength in real economies and corporate earnings are fed by very high savings, which equates to capital investment. Money from the emerging countries has no place to return to. If the uncertainty about QE3 contraction is over, U.S. long-term interest rates will peak out and signal the start of risk-taking.

To begin with, one driving factor first surfaced when the U.S. economy overcame "fiscal cliff" fears last year and rebounded powerfully. Long-term rates that had trended around 1.7% up to April 2013 shot up to 3% in 4 months' time, forcing investors to shift their portfolios. Rates in the 1% range were too low, but with a commitment to zero rates over the year following, 3% was an excessive reaction. If a contraction of QE3 is decided at the next FOMC meeting and the choice of the next FRB chairman narrows down (withdrawal of the favorite Summers points to higher certainty for Janet Ellen), policy uncertainties will disappear and long-term rates will likely decline to 2.5% or below. That result would tend to push investment money into equities and other risk assets.

Figure 1: US LT interest rate and equity indices of Japan, US and Brazil

Figure 2: OECD composite leading indicators

Strong U.S. economy drives the world

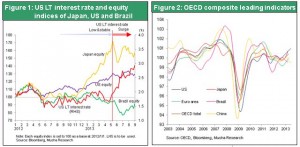

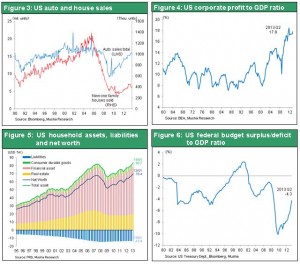

Second quarter GDP growth rate in the U.S. has been revised sharply upward to an annualized 2.5%, from the preliminary 1.7%. Although the post-Lehman economic countermeasure in the form of payroll tax cuts was terminated (= a tax increase) consumption remained strong at 1.8%. Capital investment also rose by 4.4%, housing investment by 12.9% and exports by 8.6%. The economy is thus entering an investment-led expansionary phase. Corporate earnings continued to rise, gaining 4.2%, in the second quarter. After-tax corporate profits hit a record-high 10% of GDP. Had there been no suspension of the tax cut or negative contribution from the public sector, baseline growth would have been in the 3% range. It seems that the U.S. is now entering a cycle of full scale sustained growth. Together with housing sector improvement, the household economy holds record high net assets of USD70trillion (equivalent to 5.3 times the disposable income) – a substantial stimulus to "animal spirits." Amid these changes, the fiscal deficit is also showing dramatic improvement. The federal deficit peaked at 10.2% of GDP in the fourth quarter of 2009, and has declined to 4.3% in the second quarter of 2013, in an improvement that is the sharpest on record. Contributions to this came from economic recovery and tax hikes that boosted tax receipts, cuts in defense spending and social security, and elimination of other outlays.

Figure 3: US auto and house sales

Figure 4: US corporate profit to GDP ratio

Figure 5: US household assets, liabilities and net worth

Figure 6: US federal budget surplus/deficit to GDP ratio

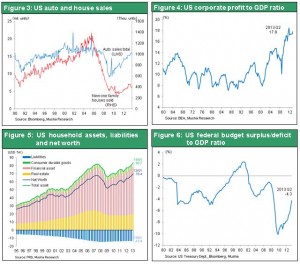

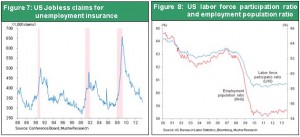

The only fly in the ointment is the extremely slow recovery in employment. In the second week of September initial unemployment insurance claims were filed by 290,000 persons, down to a level matching the historical best, while August's unemployment rate, at 7.3%, was down from 2009's 10%. Still, most of this improvement derived from declines in the labor participation rate (increases in those who have given up job searches). The ratio of employed persons to the population has declined from the pre-Lehman 66% to 61%, showing almost no improvement. Which is to say that even as corporations post abundant profits, these are not being sufficiently channeled back into the economy in the form of increased employment.

Figure 7: US Jobless claims for unemployment insurance

Figure 8: US labor force participation ratio and employment population ratio

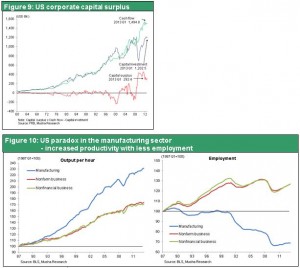

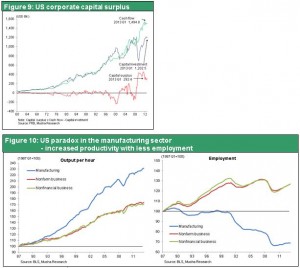

Further, corporations hold unprecedented amounts of retained earnings, meaning that they are investing little of their profits and are hoarding them in ready cash. The causes of this lie in the Internet and IT revolutions and globalization-driven historical productivity gains. Apple, for example, has earned unprecedented profits but has not increased domestic employment nor has it contributed to economic growth. Employing people and surplus capital by shifting into the service sector, where there is potential demand, is a grand strategy that is steadily taking shape, albeit slowly. It is here that monetary ultra-relaxation (QE) is necessary. A good time to terminate QE would be when employment has increased sufficiently. This could come sometime 2014 to 2015.

Figure 9: US corporate capital surplus

Figure 10: A paradox in US manufacturing sector - increased productivity with less employment

Japan's economy enters a virtuous cycle

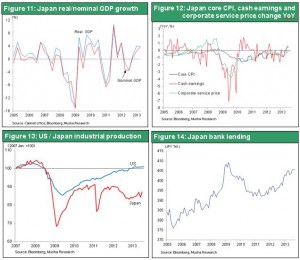

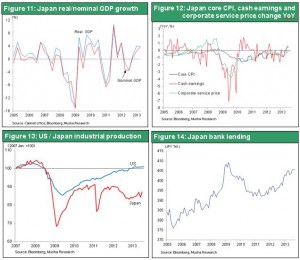

The advent of Abenomics and the appearance of a new dimension in monetary easing by Mr. Kuroda, means repainting a difficult history. In GDP statistics for the second quarter, we saw uptrends in nominal GDP and nominal wages, and confirmation of the end of consumer price declines. The nominal growth rate of 0.9% (3.7% annualized) is effectively the same as the real rate. The nominal GDP growth rate far outpaced long-term interest rates, making the realization of a virtuous cycle between the real economy and asset prices more likely. If the consumption tax is hiked as planned, an anticipatory demand rush and a subsequent reaction are unavoidable, but an economic falloff can likely be avoided. If economic stimulation reportedly worth ¥5 trillion includes corporate tax cuts, that would be a positive surprise for the markets.

Figure 11: Japan real/nominal GDP growth

Figure 12: Japan core CPI, cash earnings and corporate service price change YoY

Figure 13: US / Japan industrial production

Figure 14: Japan bank lending

Corporate profits are also benefiting greatly from the weaker yen and rising asset prices. In the second quarter of 2013, listed companies' consolidated operating income rose by 40% YoY, with auto and other exporters in particular benefiting from sales recovery and a weaker yen. Sales of big-ticket items at department stores and sales of condominiums have also turned up. In the real estate sector, office rentals have bottomed out and brisk movement of goods in the corporate sector boosted transport and other domestic industries. In the non-manufacturing sector profits have not only topped the pre-crisis levels but are rising to record highs. Gains in the manufacturing sector have stimulated movement of people and goods as these gains spread wider throughout the domestic economy. If the Yen’s exchange rate estimated in the low ¥90s takes hold at ¥100, manufacturers would announce further upward revisions, and the fiscal year ending in March 2014 could see record high profits. For the 20 major exporters, incidentally, a ¥1 variation against the US dollar and the euro would have an effect of nearly 2%, so on a ¥10 rate premise our trial calculation would result in upward revisions of 20%.

Alone in the world, Japan's long-term deflation derived from an abnormally strong yen and declining asset prices (land and equity market cap sank from ¥3,140 trillion to ¥1,500 trillion) over an extended period. This was Japan's historical peculiarity, but it has already changed. The question now is whether the 15-year decline in wages will end. Corporate managers who recognize wages as livelihood income are expected to offer wage increases in excess of the growth rate in consumer prices. Thus, the probability is high that the lost 20 years are coming to an end.

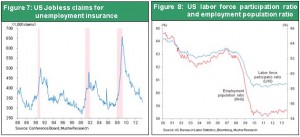

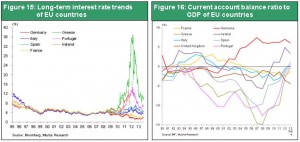

Improving Europe, pausing China

The European economy is transcending recession and ending its financial crisis. Restructuring of the southern European countries and a reduction of excessive consumption have greatly reduced the current-account deficits that were the cause of the disaster. With the support of Germany and the ECB, long-term interest rates in these countries have plummeted. The burdens of the ECB's support for southern Europe have eased and the bank's total assets have shrunk substantially. Restoration of economic growth and an improved export environment underpinned by an expected stronger US dollar (= weaker euro) will likely trigger a virtuous cycle. Since Germany seems to be determined to maintain the Euro and to support southern Europe, another uncertainty will disappear after the election there on September 22nd.

The China deceleration that is a cause for concern is being avoided by stimulus measures that include higher public works spending and relaxation on the operational side of restrictions on real estate acquisition for investment. While excessive investment and credit growth to avoid deceleration and promote growth are of medium- /long-term concern, the powerful regulatory authorities' commitment will likely stabilize the economy in the near term.

Figure 15: Long-term interest rate trends of EU countries

Figure 16: Current account balance ratio to GDP of EU countries

Goldilocks investment environment redux

Higher equity prices look inevitable in view of unprecedented corporate earnings, unprecedented surplus capital (= low long-term interest rates), and a markedly large excess labor force that are caused by a productivity revolution, need to be absorbed by the creation of new demand. In the financial markets, excess capital will bolster risk-taking and push share prices higher. In the real economy, greater risk-taking will inevitably gravitate towards capital and other long-term investment. The unprecedented risk equity premium must be narrowed. It will likely bring about restoration of the Fed model (= resumption of arbitrage between the bond and stock markets). That suggests a considerable advance in P/E multiples.

Notwithstanding who becomes the next FRB chairman in the U.S., we see no change in the policy relationship whereby excess capital, via bullish stocks, results in demand creation (= growth).

The only fly in the ointment is the extremely slow recovery in employment. In the second week of September initial unemployment insurance claims were filed by 290,000 persons, down to a level matching the historical best, while August's unemployment rate, at 7.3%, was down from 2009's 10%. Still, most of this improvement derived from declines in the labor participation rate (increases in those who have given up job searches). The ratio of employed persons to the population has declined from the pre-Lehman 66% to 61%, showing almost no improvement. Which is to say that even as corporations post abundant profits, these are not being sufficiently channeled back into the economy in the form of increased employment.

Figure 7: US Jobless claims for unemployment insurance

Figure 8: US labor force participation ratio and employment population ratio

The only fly in the ointment is the extremely slow recovery in employment. In the second week of September initial unemployment insurance claims were filed by 290,000 persons, down to a level matching the historical best, while August's unemployment rate, at 7.3%, was down from 2009's 10%. Still, most of this improvement derived from declines in the labor participation rate (increases in those who have given up job searches). The ratio of employed persons to the population has declined from the pre-Lehman 66% to 61%, showing almost no improvement. Which is to say that even as corporations post abundant profits, these are not being sufficiently channeled back into the economy in the form of increased employment.

Figure 7: US Jobless claims for unemployment insurance

Figure 8: US labor force participation ratio and employment population ratio

Further, corporations hold unprecedented amounts of retained earnings, meaning that they are investing little of their profits and are hoarding them in ready cash. The causes of this lie in the Internet and IT revolutions and globalization-driven historical productivity gains. Apple, for example, has earned unprecedented profits but has not increased domestic employment nor has it contributed to economic growth. Employing people and surplus capital by shifting into the service sector, where there is potential demand, is a grand strategy that is steadily taking shape, albeit slowly. It is here that monetary ultra-relaxation (QE) is necessary. A good time to terminate QE would be when employment has increased sufficiently. This could come sometime 2014 to 2015.

Figure 9: US corporate capital surplus

Figure 10: A paradox in US manufacturing sector - increased productivity with less employment

Further, corporations hold unprecedented amounts of retained earnings, meaning that they are investing little of their profits and are hoarding them in ready cash. The causes of this lie in the Internet and IT revolutions and globalization-driven historical productivity gains. Apple, for example, has earned unprecedented profits but has not increased domestic employment nor has it contributed to economic growth. Employing people and surplus capital by shifting into the service sector, where there is potential demand, is a grand strategy that is steadily taking shape, albeit slowly. It is here that monetary ultra-relaxation (QE) is necessary. A good time to terminate QE would be when employment has increased sufficiently. This could come sometime 2014 to 2015.

Figure 9: US corporate capital surplus

Figure 10: A paradox in US manufacturing sector - increased productivity with less employment

Corporate profits are also benefiting greatly from the weaker yen and rising asset prices. In the second quarter of 2013, listed companies' consolidated operating income rose by 40% YoY, with auto and other exporters in particular benefiting from sales recovery and a weaker yen. Sales of big-ticket items at department stores and sales of condominiums have also turned up. In the real estate sector, office rentals have bottomed out and brisk movement of goods in the corporate sector boosted transport and other domestic industries. In the non-manufacturing sector profits have not only topped the pre-crisis levels but are rising to record highs. Gains in the manufacturing sector have stimulated movement of people and goods as these gains spread wider throughout the domestic economy. If the Yen’s exchange rate estimated in the low ¥90s takes hold at ¥100, manufacturers would announce further upward revisions, and the fiscal year ending in March 2014 could see record high profits. For the 20 major exporters, incidentally, a ¥1 variation against the US dollar and the euro would have an effect of nearly 2%, so on a ¥10 rate premise our trial calculation would result in upward revisions of 20%.

Alone in the world, Japan's long-term deflation derived from an abnormally strong yen and declining asset prices (land and equity market cap sank from ¥3,140 trillion to ¥1,500 trillion) over an extended period. This was Japan's historical peculiarity, but it has already changed. The question now is whether the 15-year decline in wages will end. Corporate managers who recognize wages as livelihood income are expected to offer wage increases in excess of the growth rate in consumer prices. Thus, the probability is high that the lost 20 years are coming to an end.

Corporate profits are also benefiting greatly from the weaker yen and rising asset prices. In the second quarter of 2013, listed companies' consolidated operating income rose by 40% YoY, with auto and other exporters in particular benefiting from sales recovery and a weaker yen. Sales of big-ticket items at department stores and sales of condominiums have also turned up. In the real estate sector, office rentals have bottomed out and brisk movement of goods in the corporate sector boosted transport and other domestic industries. In the non-manufacturing sector profits have not only topped the pre-crisis levels but are rising to record highs. Gains in the manufacturing sector have stimulated movement of people and goods as these gains spread wider throughout the domestic economy. If the Yen’s exchange rate estimated in the low ¥90s takes hold at ¥100, manufacturers would announce further upward revisions, and the fiscal year ending in March 2014 could see record high profits. For the 20 major exporters, incidentally, a ¥1 variation against the US dollar and the euro would have an effect of nearly 2%, so on a ¥10 rate premise our trial calculation would result in upward revisions of 20%.

Alone in the world, Japan's long-term deflation derived from an abnormally strong yen and declining asset prices (land and equity market cap sank from ¥3,140 trillion to ¥1,500 trillion) over an extended period. This was Japan's historical peculiarity, but it has already changed. The question now is whether the 15-year decline in wages will end. Corporate managers who recognize wages as livelihood income are expected to offer wage increases in excess of the growth rate in consumer prices. Thus, the probability is high that the lost 20 years are coming to an end.