Dec 10, 2013

Strategy Bulletin Vol.109

Paradigm shift in pension fund management

- The Nikkei may reach ¥22,000 in 2014

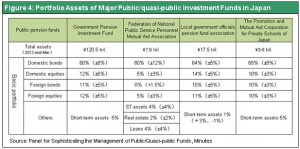

Stocks in Japan are abnormally cheap. The earnings yield is 7% and dividend yield is 1.7% while Japanese government bonds yield 0.6% and bank deposits have no yield at all. This was caused mainly by (1) the Bank of Japan which decided to allow deflation to continue and (2) investors in Japan (pension funds, insurance companies, banks and individuals) who had an extreme aversion to risk with the belief that deflation will never end. A major shift in the Bank of Japan’s deflation stance occurred in April when Governor Haruhiko Kuroda initiated new quantitative easing. Nevertheless, Japanese investors still retain a negative posture. As a result, the recent surge in stock prices in Japan has been fueled entirely by overseas investors.

However, we are about to see a dramatic change in the investment policy for public-sector pension funds by the Government Pension Investment Fund (GPIF), which is the world’s largest institutional investor with holdings of ¥124 trillion. Making this change will probably spark a massive shift in the sentiment of Japanese investors who have been clinging to the belief that more deflation equates to avoiding risk.

At the end of November, a panel of experts held a meeting to discuss using more sophisticated methods for investing public and semi-public funds and managing the associated risks. The gathering resulted in two suggestions. First is to reexamine the current portfolio that is heavily weighted toward Japanese bonds and make new investments in assets with risk. Second is to enact reforms at the GPIF. Most people believe that these recommendations will receive the strong support of Prime Minister Abe. This will probably make it impossible for the managers of GPIF to oppose the reforms. Consequently, the GPIF is likely to undergo several changes: (1) a revision in weighting based on the current basic portfolio guidelines; (2) a major reexamination of the basic portfolio; and (3) reforms involving its organizational structure.

Making these changes will increase the desire of Japanese investors to buy stocks. These investors have had no interest in stocks because they were following the lead of GPIF. The result will probably be a correction in the abnormal undervaluation (negative bubble) of stocks.

Figure 1: Abnormally cheap Japanese stock (1) – Earnings yield trends

Figure 2: Abnormally cheap Japanese stock (2) – Earnings yield / bond yield

Figure 3:Asset allocation of institutional investors, Global vs Japan – Persistently risk-averse Japanese investors

Statements made by Professor Takatoshi Itoh of Tokyo University, the chairman at the November meeting, were clear and right on target.

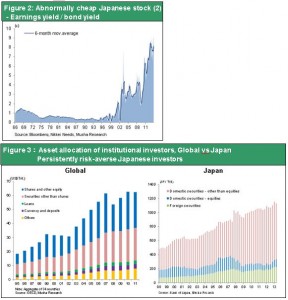

(1)The 2% inflation target of the Japanese government and Bank of Japan can be achieved. If pension funds continue to hold an excessive amount of Japanese government bonds, they will incur enormous opportunity losses. Consequently, a dramatic shift in asset composition, such as a reduction in the ratio of Japanese government bond holdings, is needed to prevent this from happening. In normal market conditions, massive sales would disrupt the market for these bonds. However, Professor Itoh said that these sales will not cause problems at this time because of the quantitative easing of Bank of Japan Governor Kuroda. He thinks financial markets as well will welcome these GPIF sales and that it would be dangerous to sell bonds after consumer prices, the inflation forecast and market interest rates have increased. He went on to say that overseas portfolios and other factors show that a Japanese bond portfolio weighting of 35% to 40% should be one goal of the GPIF.

(2)Professor Itoh notes that the GPIF, as a public-sector pension fund, must support the 2% inflation target of the Abe Cabinet and Bank of Japan. He goes on to say that if the GPIF said reaching this target is difficult, overseas investors would be confused about whether Abenomics or the GPIF are mistaken. If consumer prices and the inflation forecast climb to about 2%, then we should expect to see the long-term interest rate rise to around 3%. Professor Itoh thus concluded that the GPIF should pursue earnings based on an economic and consumer price outlook in which Japan switches from deflation to inflation.

(3)The GPIF’s response is that nominal losses can be avoided even if there is inflation by holding bonds until maturity. But Professor Itoh says this fund will not fulfill its fiduciary responsibility if it incurs an opportunity loss that is inferior to the increases in consumer prices and market interest rates.

Since Prime Minister Abe is very likely to support the recommendations of the November conference, the managers of the GPIF will be unable to block these changes. As a result, the reform process will probably proceed as follows: (1) a revision in weighting within the limits of current basic portfolio guidelines, (2) a major reexamination of the basic portfolio and (3) a reorganization of the GPIF.

(1)The first step will probably be a change in the portfolio under the existing framework. The basic GPIF portfolio is now 60% Japanese bonds, 12% Japanese stocks, 11% foreign bonds, 12% foreign stocks and 5% short-term assets*. Actual holdings can vary up or down from these figures by 8% for Japanese bonds, 6% for Japanese stocks, 5% for foreign bonds and 5% for foreign stocks. At the end of September 2013, these ratios were 58.0% for Japanese bonds, 16.3% for Japanese stocks, 10.1% for foreign bonds and 13.5% for foreign stocks. If weightings are changed as much as possible under the current guidelines, Japanese government bond holdings can be lowered by 6 percentage points and holdings can be increased by 1.3 percentage points for Japanese stocks, 5.9 percentage points for foreign bonds and 3.5 percentage points for foreign stocks. The GPIF will probably make these changes over the next six months. This will further weaken the yen and push up stock prices.

*From the GPIF’s establishment in FY2006 until the first revision, the basic portfolio was 67% Japanese bonds, 11% Japanese stocks, 8% foreign bonds, 9% foreign stocks and 5% short-term assets. The Japanese bond ratio was then reduced and ratios for the other three major asset classes were raised.

(2)The next step will probably be major revisions to the basic portfolio that will be enacted by no later than about June 2014. One result is likely to be a big increase in the weighting of Japanese stocks, which have been a comparatively small portion of the portfolio. The recommendation also includes investments in assets with risk such as REITs, real estate, infrastructure, private equity, commodities and other asset categories. In addition, there is a recommendation for the GPIF to start using stock indexes other than TOPIX quickly. The recently developed JPX-Nikkei Index 400 is one example. Another recommendation calls for the creation by the GPIF within one year of “baby funds” for managing small amounts of assets. These funds could be used to manage portfolios that cover several asset classes, to manage collectively asset classes that are new to the GPIF, and for other purposes.

(3)We can also expect to see reforms at the GPIF. The first step may be to recruit individuals with sophisticated portfolio management skills. Hiring these people will initially require Cabinet resolutions for easing restrictions on the workforce and salaries as well as for securing the necessary budget. The next step will probably be amendments to laws in order to create a self-reliant and independent organization that uses the council system. Although the GPIF is the world’s largest investment fund, it is nowhere near the global standard with an organization of only four directors (including the president Takahiro Mitani, formerly a Bank of Japan director, and Kaname Okubo, formerly of the Ministry of Health, Labour and Welfare) and 75 employees. More capabilities are obviously needed.

Regarding the vision for the future resulting from the study of pension funds, Professor Itoh pointed out that “forecasts can be trusted only up to 10 years” with respect to investments in financial markets. During the next decade, he estimates that GPIF will make up to about ¥20 trillion of payments to recipients of pensions. Even if this amount of funds is managed by holding to maturity based on asset liability management, the remaining assets of about ¥100 trillion can be used for investments that seek long-term returns with no concerns about volatility. The reason is that these assets will presumably not be needed for at least 10 years. Professor Itoh went on to note that the ability to hold assets for many years in order to receive time and liquidity premiums is a key strength of pension funds. (from Bloomberg News, Dec. 6). These assertions are very logical and valid. They are unlikely to be challenged by anyone.

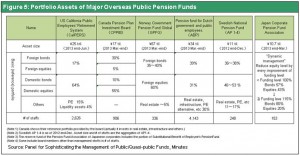

Figure 4: Portfolio Assets of Major Public/quasi-public Investment Funds in Japan

Figure 5: Portfolio Assets of Major Overseas Public Pension Funds