Japan – The world’s worst performer following the financial crisis

After the outbreak of the financial crisis, Japan has ranked last in the world in terms of both its economic growth rate and recovery in stock prices (*see note below). Other countries pulled far ahead of Japan during the so-called “lost 20 years.” After the financial crisis, this gap widened even more as Japan’s economy continued to decline. As a result, the increasingly widespread pessimism about Japan from within the country and overseas should come as no surprise.

In 2009, Japan’s GDP shrank by 5.1% while GDP declined 2.4% in the United States and 4.0% in the euro zone. Furthermore, as of the end of last week, stock indices in Japan had rebounded 25% since stock prices hit bottom in March 2009. This places Japan last in the world based on stock indices translated into U.S. dollars.

The three big cycles that held Japan back

However, we must not rush to conclusions. Japan’s economic stagnation during the lost 20 years was an inevitable correction that followed many years of excessive prosperity. During the past year or two, though, completely different factors were responsible for the weakness of the Japanese economy. Three factors exerted pressure on the economy in the wake of the financial crisis: (1) Japanese industries are the most sensitive in the world to changes in the health of the global economy; (2) the yen strengthened to an abnormally high level; and (3) the biggest-ever gap emerged between the supply and demand for Japanese stocks. All three of these factors are temporary and cyclical events. I expect to see all three reverse direction in 2010. This is why I think that the weakness of the past year or two may have set the stage in Japan for economic growth and a stock market rally that are far stronger than in other countries. Investors thus have good reason to expect a significant positive surprise with regard to Japanese stocks in 2010.

Japanese products are the most sensitive in the world to the health of the economy

Why did Japan suffer the most following the financial crisis? I believe there are three major reasons. First, due to the international division of labor, Japan handles the portion of industrial activity that is most sensitive to economic ups and downs. One reason for this sensitivity is the fact that Japan supplies products with high quality and high prices. Demand for these luxury and high-end products plummeted after the financial crisis. A second reason is that even though Japanese companies have been yielding their finished-product operations to foreign competitors like Samsung, Nokia and Acer, Japanese companies retained an overwhelming competitive edge regarding the sophisticated materials and components that overseas manufactures require to assemble these finished products. However, since these materials and components are upstream items, they suffered more heavily through inventory adjustments than was the case for finished products. A third reason is the large volume of capital goods in Japan associated with high-tech and other value-added products. Demand for these products evaporated after the financial panic and the market collapsed for some time.

Industrial output in Japan plummeted, as you can see in Figure 3. Following the Lehman shock, industrial output dropped more than 10% in the United States, where this crisis originated. But what should have been only a distant problem for Japan turned into a sharp downturn of almost 40% in industrial output. As I just explained, the reason is that industrial output in Japan is more vulnerable to fluctuations in the health of the global economy than in any other country. However, this same characteristic means that Japan can achieve a powerful recovery when the global economy improves. In fact, Japan’s growth rate for industrial output has been much higher than anywhere else in the world during the past six months or so.

The post-crisis strength of the yen has peaked

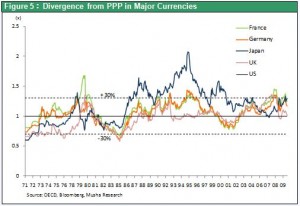

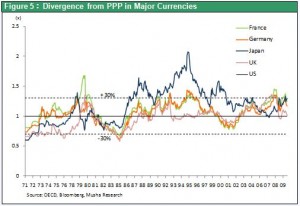

The yen’s strength is the second reason that Japan suffered more than other countries. As the yen appreciated from more than ¥110 to about ¥90 to the U.S. dollar, the Chinese yuan remained essentially pegged to the dollar and the Korean won weakened significantly. Products made in Japan became much less competitive as a result. Furthermore, downward pressure on prices from the global recession was more severe in Japan because of the yen’s strength. Falling prices caused wages in Japan to drop even faster, reigniting deflationary forces. A closer look reveals that temporary forces affecting supply and demand were responsible for the yen’s upturn. For example, panic sparked by the financial crisis prompted investors to use the yen as a safe-haven currency. In addition, the yen was supported by purchases linked to the unwinding of short positions. Consequently, we should see the yen start to weaken once the financial crisis is behind us and buying fueled by covering short positions comes to an end. Several trends involving supply-demand dynamics are now emerging that point to a decline in the yen. For instance, the volume of long rather than short yen positions is climbing. Moreover, the shift of the carry trade from the dollar to the yen is putting short positions under more pressure. As I explained in a recent issue of Strategy Bulletin (Vol. 9, March 15, 2010), I think the yen has started a decline that will end at around its purchasing power parity of ¥115 to the dollar.

Investors will no longer shun Japanese stocks

The third reason is the balance between the supply and demand for stocks in Japan. For many years, equity investors worldwide hated Japanese stocks. These investors bypassed Japan to put their money in other countries. Japanese stocks became the ultimate outcast during last year’s global stock market rally when liquidity was the main driver. But once a full-scale economic recovery begins, I expect to see Japanese stocks react quickly.

What even the world’s smartest investors are overlooking

In 2010, many of the most respected investors in the world are quietly starting to turn their attention to Japanese stocks. For proof, we need look no farther than the consistent net buying by foreigners since the beginning of the year. Why are they buying Japanese stocks? First of all, they are confident about the outlook for the global economy. Second, they believe Japanese stocks are undervalued and that a significant upward correction in prices is needed to achieve proper valuations.

Despite this optimism, investors remain doubtful about the strength of a rebound in the Japanese economy and corporate earnings. They are also uncertain about likelihood of a decline in the yen’s value. Therefore, overseas investors will probably make even more investments in Japan if the global economic recovery is stronger than expected and the yen weakens. If this happens, Japanese institutional investors and financial institutions as well will almost certainly abandon the current stance of limiting or reducing their holdings of Japanese stocks.