Dec 17, 2013

Strategy Bulletin Vol.110

Investment Strategy for 2014

Use High Leverage - Crises are over; global prosperity fueled by the US, Japan and Europe; Japanese

Turning economic common sense upside-down

Accepted thinking that ruled economic discussions following the Lehman shock has finally been reversed. Capitalism and the market economy are still powerful. Instead of weakening, the United States is regaining its vitality. Despite declarations that the BRICS era had started, emerging countries have become mired in severe economic stagnation and other challenges. Although many people declared the euro dead, the currency is now staging a strong rebound. Above all, a remarkable economic recovery is taking place in Japan. Not long ago, the media, economists and other observers were saying that no one should expect to see growth in Japan. Apparently accepted thinking of the world at that time was way off target.

In 2014, we will probably see growth in the value of stocks and other assets with risk. The global economy is poised to expand due to significant expansion in the three major industrialized economies: the United States, Japan and Europe. This new paradigm is likely to produce a new order for investments and portfolios. “High leverage” will be the central theme and Japanese stocks will be a key element of this new order. I believe that the Nikkei Average will reach ¥22,000 in 2014 and the yen-dollar rate will be in the ¥110-¥115 range. I also think that the yield on 10-year Japanese government bonds will stay under 1%.

(1) Full-scale economic growth is beginning in industrialized countries

The US economy will become even stronger

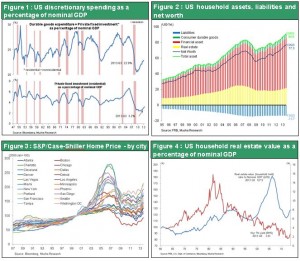

In 2014, there will no longer be an impact from the tax hikes and spending cuts that cut US GDP growth by 1%. Furthermore, the US economy will benefit from the wealth effect from rising stock prices, rebounding home prices and other events. Shale gas is another positive factor. As a result, the United States is almost certain to advance to a trajectory of solid growth at the 3% level. Tapering quantitative easing (QE), which is expected to begin within a few months, is a positive development. For the time being, there will be no negative effects or byproducts of QE. Some people are afraid that QE will lead to inflation, excessive increases in asset prices and excessive risk-taking. However, what the economy needs now is the end of excessively low inflation and asset prices as well as the sentiment of avoiding risk. But if this correction process goes too far, it would signify that the objective of government policies has been fully accomplished. In other words, the end of QE equates to a complete economic recovery and return to full employment. Even if QE is reduced, it would not signify the end of QE for a while longer. Consequently, the United States will probably remain in a period in which an economic recovery and even higher corporate earnings coexist with low interest rates.

Figure 1 : US discretionary spending as a percentage of nominal GDP

Figure 2:US household assets, liabilities and net worth

Figure 3:S&P/Case-Shiller Home Price – by city

Figure 4:US household real estate value as a percentage of nominal GDP

The crisis in Europe has ended

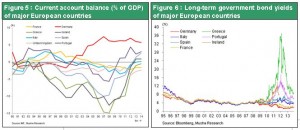

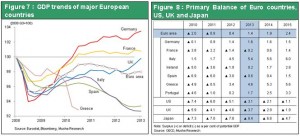

Europe’s financial crisis is definitely over. The deepest economic downturn in the postwar era has ended after three years. In southern European countries, there was a GDP drop of about 10%, which means living standards fell by the same amount. The drop reduced the external current account deficit in these countries. There was also a dramatic improvement in government budgets. For the eurozone as a whole, the primary government budget became positive. This compares with budget deficits of 3% in the United States, 8% in

Japan and 3% in the United Kingdom. In 2014, the European economy will probably stage a recovery of almost 2% because of three factors. First is the return to normalcy in southern Europe, where people have consistently been living on tight budgets. Massive pent-up demand will emerge and a sharp drop in interest rates will restore access to credit. Second is the shift in policies in Germany from austerity to growth (due to the CDU-SPD coalition). Third is the return to normalcy of credit and bank functions following completion of stress tests. The eurozone is currently the only region in the world where credit is still contracting. In fact, the inflow of investments to Europe has already started to grow. For example, John Paulson is buying distressed assets in Greece.

Figure 5:Current account balance (% of GDP) of major European countries

Figure 6:Long-term government bond yields of major European countries

Figure 7:GDP trends of major European countries

Figure 8:Primary Balance of Euro countries, US, UK and Japan

Abenomics expectations are becoming reality

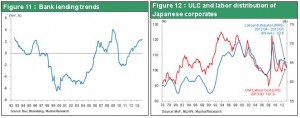

Expectations about Abenomics are now in the process of becoming reality. In 2014, a virtuous economic cycle will probably take hold that is fueled by two powerful forces: (1) rising real income as wages climb and (2) negative real interest rates. Japan can probably achieve economic growth of about 1.5% while overcoming the negative impact of the consumption tax increase. For Abenomics, the first arrow (quantitative and qualitative easing) was a decisive factor. The second and third arrows are supplementary components. Thus far, expectations about the first arrow have pushed up stock prices 60%. From now on, we will see the beginning of the real rather than expectation QE market. A virtuous cycle that originates with rising stock prices and a weaker yen has already started. Japan is benefiting from a dramatic improvement in corporate earnings (record-high earnings are predicted in FY3/14, too), the wealth effect from rising stock prices (the 2013 rally of 60% raised market cap by ¥150 trillion, 10 times the consumption tax hike burden of ¥15 trillion), rising prices mainly due to more costly imports and construction-related expenditures, higher capital expenditures within Japan, and rising wages because of higher bonuses. Bank loans have started to increase, too. Furthermore, the negative effect of the upcoming consumption tax hike can probably be offset by fiscal measures, including a ¥5 trillion supplementary budget, and additional monetary easing. Achieving the 2% inflation target will probably be difficult. As a result, there may be additional easing early in spring 2014 that could include an expansion of buying to include ETF as well as Japanese government bonds. A shift in the investment policies of the GPIF (raising the Japanese stock ratio from 16% to 18%) is also expected. Making this change would probably prompt Japanese investors to increase the weighting of stocks in their own portfolios as well.

Figure 9:Price trends in Japan

Figure 10:Machinery orders and private capex

Figure 11:Bank lending trends

Figure 12:ULC and labor distribution of Japanese corporates

As economics in industrialized countries recover, economic difficulties in emerging countries will probably be temporarily covered up. In China, the economy will probably enter a phase of slower growth because of problems created by excessive investments. The first signs of a crisis will probably be severe financial contradictions, an appreciation of the yuan along with rising market interest rates, and the emergence of non-performing loans. Furthermore, we cannot overlook the contradictions and internal conflict (stronger government control vs. economic liberalization) in China. Nevertheless, these problems will probably be contained for a while because of accelerating economic growth in industrialized countries.

(2) All vectors in industrialized country economic policies point to higher stock prices

The liquidation of “liquidationism”

In the wake of the Lehman shock, the objective that determined economic policies of the world’s major countries shifted from liquidationism to demand creation. Liquidationism entails restricting, prohibiting and punishing excessive risk-taking. But now governments have switched to reflation, which entails creating demand and pursuing growth. QE is the nucleus of demand creation. Initially, QE appeared as a stopgap measure for preventing a collapse of the financial system. But today, QE is the primary element of reflation (measures to create demand). Consequently, QE will probably come to be viewed as a financial system for a new stage that extends to the management of the risk premium.

Why will QE be legitimized?

A new definition for the Lehman shock is needed. Normally, this event is regarded as a financial collapse caused by financial misconduct and excessive risk-taking. But this is only the symbolic significance. The true cause is a constant surplus of labor and capital caused by rising productivity. The housing sector bubble absorbed this surplus for a short time. But when this bubble burst, excess labor and capital surfaced once again. This is why the financial crisis happened. Properly responding to these events required creating demand rather than imposing financial restrictions. In the United States, this was the consensus reached around 2012 by economists and government officials. A Fed research report contained the following hypothesis about the financial crisis. First, there were no forces that held back growth prior to the Lehman shock. That means the financial system collapse that began with the bursting of the bubble and led to the financial crisis was not inevitable. Second, although the financial shock itself reduced the potential growth rate, this rate can be restored by using monetary measures. In other words, using QE to boost the economic growth rate can itself hold down inflation. This debate shows that QE itself is a means of creating demand. Naturally, there are also questions about whether or not QE can smoothly translate surplus labor and capital into new demand and if monetary measures alone are sufficient. Lawrence Summers and others have stated that revising the tax rate (such as by taxing overseas subsidiaries or lowering taxes on funds transferred from overseas) may be an effective way to force companies to use their excess balance sheet liquidity.

The mechanism for demand creation by using QE

Using monetary initiatives to stimulate an animal spirit is the primary means of creating new demand. Stimulating the animal spirit requires (1) lowering the risk premium on financial assets (raising prices of these assets) and (2) shifting emphasis to long-term expenditures for demand creation (shifting from practical consumption to spending for durable goods and luxury goods and investments in housing). Obviously, the simultaneous occurrence of (1) in financial markets and (2) in the real economy would produce mutual feedback.

The revival of the Fed model is certain to push stock prices higher

Incidentally, lowering the risk premium means shifting the portfolios of private-sector financial institutions, companies and individuals from low-yield bonds to high-return (earnings yield and dividend yield) stocks. But isn’t this ultimately merely a revival of the Fed model? There was an arbitrage relationship between stocks and bonds in U.S. financial markets until about 1998. Basically, stock earnings yields were equal to government bond interest yields. But this relationship was destroyed by the forming of the IT bubble in 1999 and events leading up to the subprime loan crisis and Lehman shock in 2007 and 2008. Investors adopted a mindset of avoiding risk. Stocks became increasingly undervalued on a relative basis and people came to realize that correcting this undervaluation was vital to creating demand.

In this environment, rising corporate earnings and enormous amounts of money available for investments will probably fuel a powerful stock market rally worldwide. Even if the United States starts to reduce QE, there will still be a huge amount of surplus capital, which is mainly the result of strong corporate earnings. As a result, long-term interest rates will remain stable at the current relatively low level. The so-called “Great Rotation” will therefore not produce an extreme sell-off of bonds. Surplus capital will be used for companies’ financial activities like M&A, stock repurchases, dividend increases and new investments. All these activities will propel stock prices even higher. In 2013, U.S. stocks reached a historic all-time high (following an extended period of stagnation) for the third time in the postwar era. The other two highs occurred in 1954 and 1982. Each of these past two peaks was the precursor of a period of economic prosperity. The 2013 all-time high as well is very likely to be a sign of upcoming prosperity.

Basically, the creation of new demand comes down to “further improving the standard of living and altering life styles.” Time is needed to accomplish this. But until new demand is created, stocks will probably continue climbing into uncharted territory.

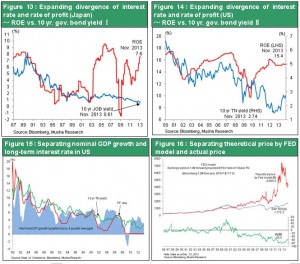

Figure 13:Expanding divergence of interest rate and rate of profit (Japan) ~ ROE vs. 10 yr. gov. bond yield Ⅰ

Figure 14:Expanding divergence of interest rate and rate of profit (US) ~ ROE vs. 10 yr. gov. bond yield Ⅱ

Figure 15:Separating nominal GDP growth and long-term interest rate in US

Figure 16:Separating theoretical price by FED model and actual price

(3) The scenario for higher stock prices in Japan

Three additional positives for Japanese stocks

As stock markets worldwide rally, Japanese stocks should be the center of attention. The reason is that stocks in Japan are supported by three additional positive factors that do not exist in other countries. First is the end of strong-yen deflation due to Abenomics. After stock market lows in the wake of the Lehman shock, U.S. and German stock markets have rebounded by 140%. But stocks in Japan remained lackluster until November 2012 and even now are up only 60%. After the Lehman shock, central banks in Europe and the United States implemented quantitative easing. But the Bank of Japan alone, under the leadership of Masaaki Shirakawa, adopted a negative stance regarding monetary policy. The yen thus became the world’s only major currency to strengthen and Japanese stocks performed poorly. The yen’s rapid upturn eroded the competitive edge of Japanese companies. Moreover, Japan became the only country in the world to become mired in deflation. With the yen doubling in value against the Korean won, Japanese companies came under pressure to cut wages in half. Deflation severely impacted internal demand-reliant service industries in Japan that had few if any options for cost cutting. All industries in Japan were weakened by strong-yen deflation and Japan ended up as the world’s only economic loser as a result. However, Abenomics is now resolving the fundamental causes of this situation.

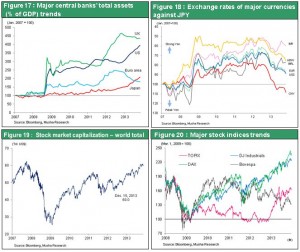

Figure 17:Major central banks’ total assets (% of GDP) trends

Figure 18:Exchange rates of major currencies against JPY

Figure 19:Stock market capitalization – world total

Figure 20:Major stock indices trends

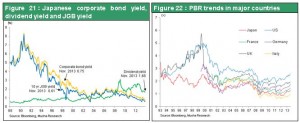

The second additional positive is the correction of the undervaluation of Japanese stocks, which had reached an unprecedented level in relation to anywhere in the world. Today, the earnings yield of Japanese stocks is 7%. That means there is ¥7 of profit for every ¥100 of a stock’s price (and about ¥1.7 of dividends alone). But for bonds, the yield is 0.8%, which is ¥0.8 of profit for every ¥100 of a bond’s price. This is a difference of eight times. Moreover, bank deposits have no yield at all. Despite these gaps, money did not flow into the stock market. However, a major shift is starting to occur that will end this disparity.

Figure 21:Japanese corporate bond yield, dividend yield and JGB yield

Figure 22:PBR trends in major countries

The first positive geopolitical environment since the Korean War

The third additional positive for Japanese stocks is geopolitical forces. For 23 years after the bursting of the asset bubble in 1990, Japan’s economy was stuck in an extended period of stagnation. The fundamental cause was the U.S. policy of “containing Japan.” Up to 1990, Japanese companies in the automobile, electronics and other industries acquired an overwhelming competitive edge. This allowed Japanese companies to use and improve U.S. technologies and greatly expand their presence U.S. markets. However, this predominance posed a threat to the industrial base of the United States as the world’s only superpower. This strength was also detrimental to the national interests of the United States. Trade friction, the yen’s extreme strength and many other “Japan bashing” measures were used to knock Japan back down. But now a reversal is taking place. Restoring the health of the Japanese economy has become critically important to U.S. national interests. This is because allowing Japan to weaken any more would put all of Asia under the control of China. A strong Japanese economy is vital to containing China and preserving U.S. influence in Asia. In other words, geopolitical forces in Japan have switched from a headwind to a tailwind. Japan’s postwar prosperity (1950 to 1990) began with the outbreak of the Korean War in 1950. The war made it vital to revive the Japanese economy quickly. Today, 60 years later, geopolitical risks are once again increasing. The collapse of North Korea and transition of China to democracy appear to be inevitable. Heightening the profile of the Japanese economy will be essential as these events unfold. The world wants Japan to shift from obedience to the United States to a powerful force for creating a new world order (“the Republic of the World”)

All of these events are finally setting the stage for the simultaneous achievement of global prosperity and the end of Japanese economy’s position as the world’s only loser.

Figure 23:Trends in stock price, land price, corporate profit and employee compensation since 1980

Figure 24:Divergence from PPP in major currencies

(4) Key Points for Investing in Japanese Stocks

Japanese companies are poised to grow

A close examination of Japan’s “lost 20 years” leads to the view that this was a period when the country was assembling the components needed for growth. Companies had many accomplishments as they faced severe challenges during this period. In particular, Japanese companies

(1) Completed the greatest streamlining and cost cutting in the world

(2) Developed advanced technologies and developed business models (integrated product-service frameworks) for providing solutions

(3) Became citizens of the world by establishing global networks

(4) Accumulated substantial capital (an unprecedented ability to make investments, which is a decisive requirement for rapid progress; Fuji Film’s success demonstrates the importance of building up substantial capital)

Collectively, these accomplishments will produce strong growth in earnings as the yen weakens and deflation comes to an end. Japan is now only at the very beginning of this impending upturn in earnings.

Figure 25:Japan’s greatest streamlining – ULC trends in major countries

Figure 26:Overseas production ratio (Manufacturing)

Supply-demand dynamics for Japanese stocks have never been better

The second wave of the “market of the century” has probably started in Japan (as I expected). This wave is likely to result in unprecedented valuations and strong supply-demand dynamics. The Japanese government’s obvious measures to entice investors to buy stocks will be a powerful force. As a result, the following events will probably occur over the short-term and long-term: (1) The additional quantitative easing by the Bank of Japan that is expected next spring will probably increase ETF purchases. (2) Reforms at the GPIF will raise the weighting of stocks. (3) Pension funds, insurance companies and other institutions that had been looking for reasons to sell stocks will increase the weighting of stocks as higher stock prices permit taking on more risk. (4) Foreigners will buy more Japanese stocks. Short-term investors are likely to establish positions that take advantage of the unusual gap between a funding cost of zero and a dividend yield of 1.7%. (5) The end of selling rush prior to capital gain tax hike and then positive impact of the introduction of the NISA

The relentless decline of the yen will eliminate strong-yen problems

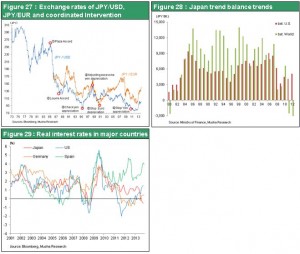

Many observers believe that the yen’s current level is appropriate, in part because the OECD purchasing power parity for the yen is ¥104 to the U.S. dollar. However, there are still an unprecedented number of factors to push the yen even lower (see below). Investors also need to keep an eye on supply-demand factors that could cause the yen to drop sharply.

(1) Increasing risk-taking worldwide and accelerating speculation about a further decline of the yen = global risk-on investing, which leads to expectations for a weaker yen

(2) Rising consumer prices in Japan, negative real interest rates and, for long-term interest rates, a reversal in the difference between U.S. and Japanese real interest rates

(3) Maximum growth in base money in Japan (Don’t fight Japanese easy money)

(4) The start of foreign exchange speculation by individual investors (“Mrs. Watanabe”), the Japanese investor group most sensitive to changes in the risk climate

(5) Japan’s rising trade deficit as fossil fuel imports increase due to the suspension of nuclear power plant operations is creating real demand for the U.S. dollar; income balance, which contributes to the current account surplus, has no relationship with real demand

The yen’s big downturn between 1978 and 1985 was the result of the trade deficit caused by the second oil shock. But a weaker yen made Japan much more competitive. This same process may be about to happen again.

Figure 27:Exchange rates of JPY/USD, JPY/EUR and coordinated intervention

Figure 28:Japan trend balance trends

Figure 29:Real interest rates in major countries

Three groups of industries that investors will like

I. Reassessments of companies benefiting from the weaker yen and global exporters: (1) higher export prices and volumes, emergence of the J-curve effect; (2) higher value of overseas yen due to weaker yen (increase in equity) = Tourism, agricultural products too

II. End of deflation improves selling prices and raises margins = Internal demand stocks, financial services, real estate, construction, transportation

III. Higher standard of living and more consumer spending = Retail, entertainment, health care, education