Jan 23, 2014

Strategy Bulletin Vol.112

A Dialogue with European Investors

By Junko Matsuda

Ryoji Musha spoke with overseas investors during a trip to Europe between January 13-17, to hear their concerns about the immediate outlook. He told them that he expects the yen to continue declining and stock prices to continue climbing. He believes the current downward correction will not last long and the extended bull market that started last year will continue. By the end of 2014, he expects the Nikkei Average to be between JPY20,000 to JPY22,000 and the yen to weaken even further to about JPY110 to JPY115 to the dollar. Almost all investors Musha spoke with agreed with his views. Overall, these meetings showed that investors basically have an extremely positive outlook.

A mixed view of Japan

When these optimistic investors were asked about their positioning of Japan, Musha learned that there is much confusion about how to assess Japan’s prospects. At one time, Japan was an economic superpower as explained in the book ‘Japan As Number One’. But now Japan’s ability to compete is declining due to many years of stagnation accompanied by deflation, as well as a falling population. China and Korea have overtaken Japan in many industries. Some regard Japan as one of the world’s declining countries that will probably continue to go downhill.

Many of the world’s financial institutions and investors have greatly altered various asset management methods in recent years. Ten years ago, most institutional investors had separate sections for the United States, Europe, Japan and emerging countries. Operations have been reorganized in the past few years. Many investors no longer have people assigned solely to Japan. The profile of Japan has dropped to the point where Japan is part of the emerging country group and just a part of Asia. But can Japan really be placed within the broad category of Asia? After all, China and Korea are unlike the Japanese economy and the nature of Japan’s markets, according to Musha. So what should investors do about Japan? This question is creating much confusion. Investors are wondering how to regard Japan and exactly what kind of country Japan is. We will explain Musha’s answers to these questions in another report. Regarding the current outlook, Musha believes that the United States, Europe and Japan will drive the global economy. In other words, within Asia, we are very likely to see a resurgence of Japan. This is why Musha has stated that investors should once again place an emphasis on Japan.

Overseas investors have numerous short-term concerns. Seven of these concerns are listed below along with Musha’s responses.

(1) Can inflation get underway in Japan?

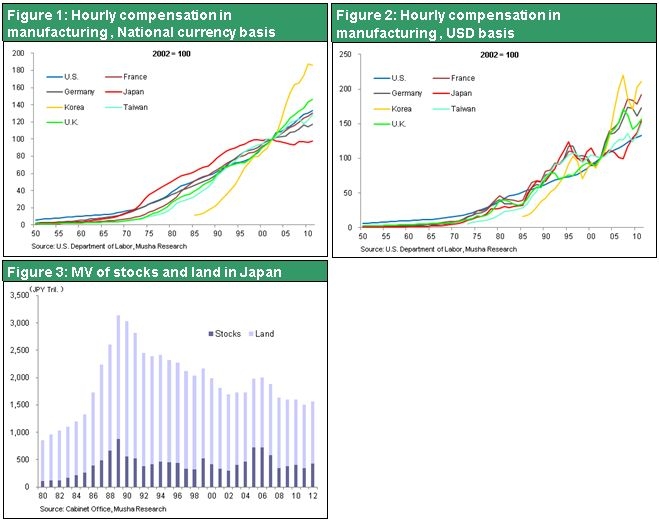

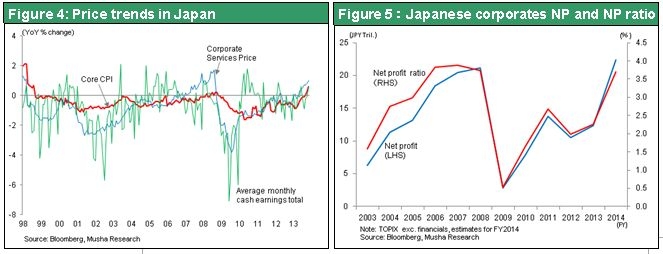

Musha responds by explaining that the causes of Japan’s deflation must be examined first. Japan is the only country in the world with prolonged deflation and declining wages. Deflation in Japan had extremely unusual characteristics. The first cause of deflation is the abnormal strength of the yen, which made wages in Japan very high in relation to wages in other countries. Nominal wages had to be lowered in order to return wages to the global average. Figures 1 and 2 illustrate this point by showing comparisons of hourly manufacturing wages prepared by the U.S. Department of Labor. Yen-denominated wages have been decreasing slowly. But in U.S. dollars, wages have been increasing at almost the global average growth rate. The second cause of deflation is the sharp downturn in the prices of stocks, land and other assets over the past two decades. The resulting loss of JPY1,600 trillion is more than three times Japan’s GDP. Moreover, JPY700 trillion to JPY800 trillion of this loss, which is about 1.5 times Japan’s GDP, was caused by an excessive drop in prices that was not necessary. To deal with these massive losses, companies in Japan held down wages and cut costs to preserve profits. A strong yen accompanied by excessive drops in prices of stocks and real estate brought about deflation in Japan. Consequently, deflation can be ended by bringing the yen back down and boosting asset prices. Musha thus believes that extreme monetary easing can be used to accomplish this.

(2) Can wages in Japan start rising at a rate of 2% to 3% in April?

Musha believes it is possible. The main reason is that companies have ample earnings to cover the cost of higher wages. In addition to having the financial resources, companies feel they have an obligation to increase wages. One distinctive aspect of wage determination in Japan is the policy of providing workers with an adequate income. The United States differs greatly by basing wages primarily on the distribution of money based on performance. This point has been debated for many years. As a result, Japanese companies had no need to raise wages regardless of how high profits were because deflation reduced the cost of living for workers. Now that prices are starting to climb, companies should be feeling obligated to boost wages so that workers can meet their financial needs. Musha believes that there will definitely be a wage increase in April in order to offset the higher cost of living caused by the consumption tax hike. If prices of imports and land increase along with wages, Japan will see a virtuous cycle of rising wages and prices. This cycle should lead to more growth in corporate earnings as prices climb. Consequently, Musha believes that there is a very high probability that Japan will end its deflation. Many investors appear to have accepted Musha’s explanation of this point.

(3) Will the yen really continue to weaken?

Musha believes that the yen is likely to continue declining for a long time. The current foreign exchange environment in Japan is pointing at an unprecedented degree to a still weaker yen. According to Musha, never before have all five of the following factors been in favor of a weaker yen.

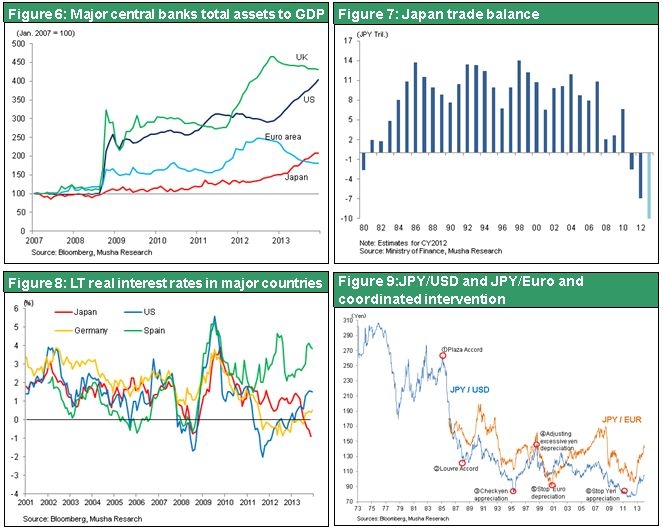

1) Central bank stance: The Bank of Japan is the most dovish of all the world’s central banks and is enacting policies that are the most conducive to bringing down the yen.

2) A trade deficit of more than \10 trillion: The largest trade deficit in 30 years is fueling enormous purchases of dollars linked to real demand. Some people believe that there is a trade deficit in only certain sectors and there is still a current account surplus because of a positive income balance and other factors. This is true. However, a trade deficit influences the supply and demand for a currency because these bills have to be paid immediately. No payments are required for an income balance and other items. Therefore, these imbalances are unlikely to have an immediate impact on the supply and demand for dollars. The trade deficit is critical to determining real demand for the dollar. This is why a big trade deficit will cause a big drop in the yen.

3) Japan’s large negative real long-term interest rate: Japan has the world’s only negative real interest rate among the world’s major countries. Deflation makes the real interest rate high. This explains why there was a negative cycle that made the yen stronger and stronger. But today, Japan has the world’s lowest real long-term interest rate.

4) Growth of overseas investments by Japanese investors: When the yen started to decline, Japanese companies with vast amounts of funds had more opportunities to buy companies in other countries. Individual and institution investors in Japan are now significantly increasing their holdings of assets denominated in foreign currencies. A consensus is emerging for holding a substantial volume of assets with risk as strong-yen deflation ends and weak-yen inflation starts. To buy risk assets, Japanese investors are choosing foreign currency-denominated assets over stocks for two reasons. First, there is a large interest rate gap. Second, these assets can benefit from a further decline in the yen. In fact, most of the assets in NISA applications submitted in 2014 are said to be for foreign currency-denominated assets rather than stocks. Obviously, Japanese investors strongly adhere to the stance of buying foreign currency-denominated assets over stocks when they decide to increase risk exposure. Therefore, we will probably see individuals, pension funds and insurance companies all increase holdings of assets denominated in foreign currencies. This is likely to create a substantial outflow of capital from Japan.

5) Geopolitical factors: The United States is retaining the stance of allowing the yen to decline to help Japan break away from deflation.

Never before have all of these five conditions for a weaker yen come together. Therefore, even if the yen stages a small rebound, it will probably end as a short technical rebound. The baseline decline of the yen is very likely to continue for a long time. But investors should not become too pessimistic about the yen.

(4) Will the third arrow of Abenomics really produce any significant benefits?

According to Musha, there will be no short-term benefits from the third arrow but there will probably be steady progress. However, the third arrow is not a very important element of Abenomics. The first arrow is massive monetary expansion and a downturn in the yen’s value. The third arrow is nothing more than a side dish for the core components of Abenomics. Consequently, the success or failure of Abenomics will not depend on whether or not the third arrow is implemented. Most of the people who think the third arrow is important also think that Abenomics will fail without the third arrow because they do not believe in the effectiveness of the monetary policies of Abenomics. The first rather than the third arrow is the essence of Abenomics. Musha strongly believes that the first arrow will succeed. People who think the first arrow will fail are the same ones who point to the significance of the third arrow. This is simply one of the current positions of the people who have consistently said that monetary easing that began two years ago will produce no benefits. Therefore, the third arrow essentially has no significant meaning. Reforms cannot be accomplished within a short time and will have to be implemented over many years. Furthermore, once the reforms have been achieved, investors should expect that economic growth over the following year or two will not significantly influence corporate earnings or the business climate.

(5) Bank of Japan Governor Haruhiko Kuroda stated he will launch a new round of monetary easing in the next fiscal year, which starts in April. Will this actually happen?

Musha is not sure about what will happen. But there is no uncertainty about whether or not monetary easing will exist. Unlike previous BOJ governors, Mr. Kuroda is clearly adopting the stance of taking responsibility for producing results. Until now, BOJ chiefs have done what they were expected to do. However, they consistently refused to be responsible for results based on the belief that the BOJ could not make a commitment to do everything. Mr. Kuroda, on the other hand, has made two very clear commitments. First is 2% inflation. He will do whatever is needed to accomplish this. Second is that the consumption tax hike is needed and the BOJ will use monetary policies to offset the negative effects. These two commitments of Mr. Kuroda make the question of whether or not a new round of monetary easing will be launched in April meaningless. This is because Kuroda is confident that even if the BOJ halts monetary easing in April, 2% inflation is very likely to occur without this easing and Japan’s economy will continue to grow and the stock market rally will continue. If prospects for this inflation and economic strength become poor or unclear, the BOJ will probably use monetary easing. April monetary easing itself is definitely not a negative factor. (There will probably be more monetary easing if raising inflation to 2% becomes difficult. In this case, the most likely scenario is an upturn in ETF stocks as the targets for investments associated with this easing.)

(6) Will there be any negative effects from Prime Minister Abe’s visit to the Yasukuni Shrine?

Musha thinks there is probably no need to worry about this. Visits to Yasukuni Shrine are sparking a variety of repercussions in the United States, China and Korea. The United States could exert pressure on the Abe administration by adopting a cool stance about strengthening military cooperation and providing assistance for ending deflation. But these actions would have the opposite result of creating a negative impact. As a result, the United States is unlikely to alter its current stance regarding Japan. What about China and Korea? Retaining the current cool stance regarding Japan is probably the only course of action. But these two countries need to deepen their relationships with Japan in order to end their economic downturns. Consequently, irrespective of the Yasukuni problem, China and Korea will probably not further alienate Japan because this would result in an even greater negative impact on their economies. From the standpoint of the economies of both China and Korea, there is no doubt that strengthening diplomatic ties and economic cooperation with Japan is more important and beneficial than talking about the Yasukuni Shrine visits. This is why the Yasukuni issue will not last much longer.

(7) In closing, what risks do you envision in 2014?

Potential risk factors include the bursting of the asset bubble in China, a decline in the leadership of the Abe cabinet and the Obama administration becoming a lame duck. Musha thinks that these issues are unlikely to become serious problems for the time being. The most significant potential risk is an end to the U.S. economic recovery. This would cause the dollar to weaken and the yen to strengthen, which could in turn bring a halt to Japan’s economic recovery and stock market rally. If this happens, the United States would have to enact more monetary measures by returning monetary easing to the original level. Taking these actions would probably push up stock prices and encourage investors to buy more risk assets on a global scale. Furthermore, if there is a brief slowdown in U.S. economic growth, the slowdown may lead to new measures such as reforms of taxes and systems as well as fiscal initiatives. The bottom line is that despite the risk of a temporary loss of U.S. economic momentum, this weakness would probably not be fundamentally bad news for financial markets.