Mar 12, 2014

Strategy Bulletin Vol.116

What’s ahead for Japan on the bedrock of a weak yen?

The beginning of the real Abenomics market

Don’t be fooled by the pessimism of pessimists

Sluggish stock prices since the start of 2014 have caused a sudden emergence of the pessimistic view that Abenomics has lost momentum and will soon fail. Most of the people who embrace this view were the same ones who criticized Abenomics when it first appeared in 2013 but without submitting any alternatives. They thought that financial measures could not end deflation, that trying to end deflation was a mistake because deflation was not causing Japan’s economic stagnation, and that structural reforms and renovation (it’s not clear exactly what this means) are vital to ending deflation and achieving economic growth but neither is being accomplished. Simply put, these people are doing nothing more than saying that Abenomics is about to fail just as they thought from the very beginning.

Before we decide that Abenomics is on the verge of failure, we need to look back at what happened over the past year and determine what this means for upcoming events. The most important change in the past year was the establishment of an environment for the relentless decline of the yen. This decline will probably fuel a variety of favorable cycles in Japan.

Why the yen continues to decline

Just like the work of a detective, formulating an economic outlook must begin with a confirmation of irrefutable facts. If a thorough confirmation process can be used to eliminate obstacles, the true cause-and-effect picture will emerge from the chaos. Analyzing Japan’s economy and markets reveals the irrefutable fact (a fact that no serious analyst can deny) that the conditions for a relentless decline of the Yen have come together to an unprecedented degree. Furthermore, a picture of the future as the yen declines is clearly visible.

The Bank of Japan ranks first in monetary easing and printing money

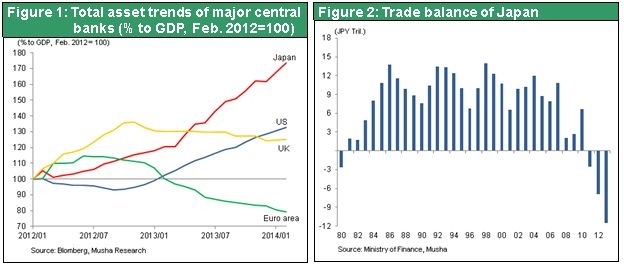

The first condition for a weaker yen is the Bank of Japan’s position as the number one dove among the world’s central banks. Japan’s monetary base is growing faster than anywhere else in the world. As everyone knows, the money supply balance is the most basic factor that determines whether a currency is strong or weak. Therefore, the greatest cause of the yen’s decline is the Bank of Japan’s decision to be the world’s largest printer of money.

Record-high trade deficit of \11 trillion and a current account deficit make real-demand yen sales inevitable

The second condition is Japan’s unprecedented trade deficit (\11 trillion in 2013), which has been creating substantial real demand for the dollar since 2013. In 2014, there is a negative income balance and current account deficit in addition to the trade deficit. Importers obviously need to buy dollars to pay for the annual imports of \11 trillion. In the past, exporters were constantly selling dollars because of Japan’s consistently large trade surpluses. Supply and demand for the dollar and yen was constantly subjected to pressure from enormous sales of dollars and purchases of the yen. But now a major reversal has occurred.

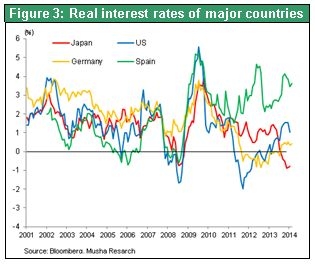

The world’s lowest interest rates and negative real long-term rates

The third condition is Japan’s low interest rates. Long-term interest rates are the lowest in the world and real long-term interest rates are negative. Deflation gave Japan the world’s lowest nominal long-term interest rates, but Japan’s real long-term interest rates were still higher than in other countries. High real interest rates mean that borrowing money is expensive. As a result, borrowers became more motivated to repay loans, which made Japan’s credit crunch even more severe. Today, Japan still has the world’s lowest interest rates and real interest rates are negative. Consequently, borrowing money is easier in Japan than anywhere else in the world. Naturally, taking out loans means shorting the yen (selling the yen). This is why the yen has shifted from being the world’s easiest currency to buy to the easiest currency to sell.

The yen is no longer a safe haven

All three of the above decisive factors behind a weaker yen are unlikely to change for the foreseeable future. In other words, the forces that determine the yen’s value have shifted 180 degrees. This shift will also greatly alter the perceptions that control the actions of hedge funds and other global investors. The yen used to be the world’s preeminent safe haven that investors chose when they wanted to avoid risk. During risk-off periods, the yen naturally became even more attractive as deflation, which was occurring only in Japan, increased the currency’s real value. However, the yen’s value is now dropping the fastest because Japan has the world’s lowest real interest rate. This makes the yen rank last among currencies that investors want to hold. Moreover, the perception that the yen will weaken is likely to spread worldwide because not all investors have adopted this stance yet.

In addition, a decisive shift has taken place in the perception of Japanese investors. Until recently, households, pension funds, insurers and other investors in Japan avoided all risk and believed that “cash is king.” But now there is an increasing need to purchase more foreign currency-denominated assets, which expose investors to risk. Investments in Japan had placed too much emphasis on cash, deposits and bonds. But now these investors will probably greatly increase their holdings of assets denominated in other currencies. The shift in the asset management policies of Japan’s Government Pension Investment Fund may be what triggers the start of this shift in assets.

Changes in the perceptions of investors in Japan and other countries are likely to cause foreigners to short the yen and Japanese investors to move assets overseas. These events would probably alter supply-demand dynamics and result in a big upturn in the dollar and downturn in the yen. Furthermore, events in the United States are likely to provide another downward push for the yen. This is because the US government will allow the yen to weaken for geopolitical reasons as the US economy continues to recover and monetary easing is reduced. All of these factors point to an environment in which the yen will continue to weaken.

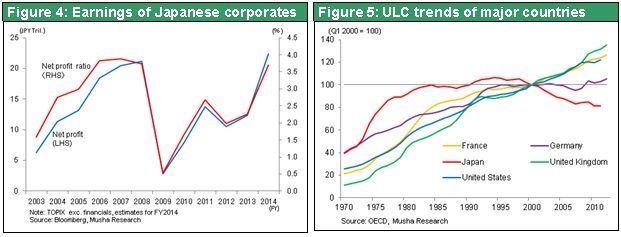

The positive cycle fueled by higher earnings from the weaker yen

If the yen is certain to continue to weaken, then we can say that Abenomics has accomplished its goal of ending deflation. This is because a weaker yen is a decisive factor for sustaining inflation and pushing up corporate earnings. The sustainability of earnings is a critical factor regarding the outlook for the economy and stocks. After all, earnings are the starting point for changes in jobs, wages (and thus spending), capital expenditures and stock prices. In Japan today, the consistent decline in the yen’s value is the key to the sustainability of corporate earnings growth. As a result, investors must not underestimate the importance of the favorable conditions now firmly in place that are bringing about a weaker yen and higher earnings. Obviously, a continuation of the Bank of Japan’s qualitative and quantitative easing will be crucial to preserving these conditions. And there are absolutely no worries about this point either.

Earnings at Japanese companies are up 70% in the fiscal year ending in March 2014 to almost a record high. This is the highest earnings growth rate in the world. Some people regard this surge in earnings as a temporary event caused by the yen’s downturn. But this is a mistake. Higher earnings are the result of the world’s greatest cost-cutting measures by Japanese companies during the many years when the yen was strong. Benefits of this cost-cutting are now appearing as selling prices recover due to the weaker yen. These are not windfall profits. The fact is that higher earnings are primarily the result of higher prices (weaker yen) and not growth in volume. Next we will probably see volume growth boost sales because of the success of Abenomics. Restructuring measures implemented over many years have significantly lowered the sales break-even point at Japanese companies. This is why these companies can probably achieve even higher profitability by benefiting from the gearing effect as sales volumes climb.

Sources of concern are limited

One potential problem is a drop in consumption as inflation lowers real wages. But this is merely an unavoidable temporary phenomenon that occurs during a period of transition. Eventually the substantial earnings of companies will lead to large wage increases. Another source of concern is the growing perception that the growth strategy, which is the third arrow of Abenomics, will be ineffective and result in disappointment. However, the growth strategy, structural reforms and deregulation will all be implemented over many years and benefits will slowly emerge over many years, too. These items should not be used to explain short-term changes in stock prices and economic growth. From a long-term perspective, Japan is making steady progress with employment systems, corporate taxes, agricultural reforms and in other areas.

Among global risk factors, there are worries about slowing economic growth and increasing financial instability in China. The country will probably be able to prevent these problems from becoming serious by using the strong leadership of the Communist Party regime. Another source of concern is the possibility that the US government will become critical of the weaker yen because of its discomfort with the Abe administration’s view of certain events in Japan’s past. But there is probably no need to worry about this either. The US needs to reinforce the Japan-US alliance as part of measures to contain China. Consequently, weakening the ability of the Abe administration, which is the strongest supporter in Japan of the Japan-US alliance, to end deflation is not an option for the United States. Criticism by the United States of Japan’s views of its history will probably settle down once President Obama visits Japan in April.