Mar 17, 2014

Strategy Bulletin Vol.117

Time for the Bank of Japan to prepare for QQE2

Do not let down the long-term investors who accepted the call to take on risk

- Japanese financial markets are weakening, as is evident in the sharp drop of stock prices. Japan has implemented the world’s most powerful monetary easing to fight deflation and must not overlook this reversal.

- The Bank of Japan must start preparations for the second phase of quantitative and qualitative easing (QQE2) to restore the confidence of investors before selling by risk averters gains momentum.

- The Fed used QE three times to completely suppress risk averters (people who sought to destroy markets with selling by using a “black swan” as their excuse). The Bank of Japan as well should prepare for the enactment of QQE2 in order to squash speculators. Making abnormally undervalued stocks the target of QE will probably be a highly effective approach.

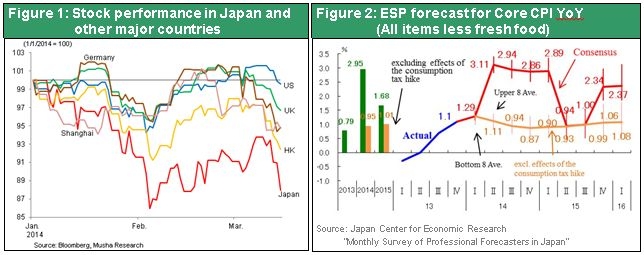

The abnormal performance of Japanese stocks

Japanese stocks are being sold off in an unusual manner. The Nikkei Average dropped most in the world slumping YTD 14% on Feburary 4. Most people regarded this as a correction in the wake of last year’s strong performance as investors unwound their substantial long positions. But the average fell another 6% over the past three days. This is abnormal. Volatility of this magnitude cannot be explained by simply pointing to economic instability in China and the situation in Ukraine. Stock prices did not drop significantly in the United States or in Europe, which is near Ukraine. Moreover, the downturns were limited even for stock indexes in Shanghai and Hong Kong amid uncertainty about the Chinese economy.

Distrust in the Bank of Japan is preserving the yen’s safe-haven status

Investors tend to hold the yen when they want to avoid risk during a deepening crisis. When people buy the yen as a safe haven, they sell Japanese stocks at the same time. We have seen this before. Starting in 2010, investors bought the yen as a safe haven while selling Japanese stocks as the European debt crisis suddenly began and became increasingly worrisome. Japan is the place that investors in a crisis mode choose to escape from danger. But now Japan has the world’s worst performance in terms of its economy and stock markets. For several years, the yen was the only major currency to consistently appreciate. This strength severely damaged Japan’s economy by quickly eroding the competitive edge of the high-tech sector and making Japan the only country in the world with deflation.

No one thinks Mr. Kuroda’s inflation target can be reached

Bank of Japan Governor Haruhiko Kuroda has reversed the bank’s policy by 180 degrees. The previous governor Masaaki Shirakawa allowed the yen to remain strong as deflation continued. Now the bank’s goals are a weaker yen and the end of deflation. Prices have already started to climb significantly. Japan’s January 2014 CPI was up 1.4% from one year earlier, the core CPI (which excludes fresh food) was up 1.3% and the core-core CPI (which excludes fresh food and energy) was up 0.7%. Japan’s real long-term interest rate is currently -0.7%, the lowest in the world and negative. However, investors still view the yen as a safe haven during a crisis. As a result, the yen and Japanese stocks are merely toys for speculators. Japanese stocks are susceptible to speculative sell-offs because of the weak supply-demand dynamics created by the extremely small number of long-term investors in Japan.

The question now is why Japan’s position of having the lowest real interest rates in the world has not prompted investors to sell the yen. The answer is most likely that no one thinks the current 1.3% inflation rate will continue. Most people think that the current upturn in the CPI will end once the yen stops weakening because higher prices of imports are pushing prices up. Investors do not believe at all that the Bank of Japan can achieve its 2% inflation target. In the recent ESP Forecast Survey (announced on March 7 by the Japan Center for Economic Research) of forecasts by 41 private-sector economists, the outlook is for inflation to peak at 1.29% in the first quarter of 2014 and then fall to 0.95% for all of 2014 and 1.01% in 2015. This creates an opportunity for speculators to target the gap between what the Bank of Japan’s words and its actions.

The BOJ must prove its worth by stopping negative feedback

Former BOJ Governor Shirakawa mistakenly allowed the yen to strengthen as stocks fell in 2011 and 2012. He thought this was unavoidable because of the global crisis. And now, the Bank of Japan must act quickly before selling by speculators gains momentum. Long-term investors are being increasingly shut out of Japan’s stock markets, which have been devastated by being treated as toys for short-term traders. This situation will probably lead to volatility and a long-term decline. The central bank must step in when there is no force that can restore stability. After the Lehman shock, quantitative easing by the Fed, BOE, ECB and other central banks enabled these banks to serve as the sole risk-takers in an environment where no one else wanted risk exposure. Buying boosted prices (lowered the risk premium), which restored the animal spirit among investors.

No matter how undervalued Japanese stocks become, the rally that started last year will come to a complete end if most investors sell these stocks because they think no upward correction will occur for the time being. An enormous return gap exists in Japan. Stocks have an income return of 7% and dividend yield of 2% while the 10-year Japanese government bond yields 0.7% and bank deposits yield 0.04%. Japanese stocks are obviously ridiculously cheap. But that does not necessarily mean that prices will quickly rise to the true value of stocks.

Furthermore, people are starting to say that the sharp drop in stock prices proves that Abenomics has failed. As the April tax increase nears, the Economy Watchers Survey (the public’s economic sentiment) forward index has worsened for three consecutive months. People think that the possibility of the following negative feedback cannot be eliminated: lower stock prices as the yen strengthens creates a loss of confidence in the Bank of Japan’s ability to end deflation, resulting in a stronger desire to avoid risk and a loss of the animal spirit among investors.

Even if the global economy weakens because of the Chinese economy or some other event, this will probably not be regarded as an excuse by the Bank of Japan’s for the inability to end deflation. The bank must continue to fight deflation at all costs in any environment. Therefore, the more the global economy weakens, the more the importance of monetary easing by the Bank of Japan will grow. This is why the bank needs to double and even triple its easing measures.

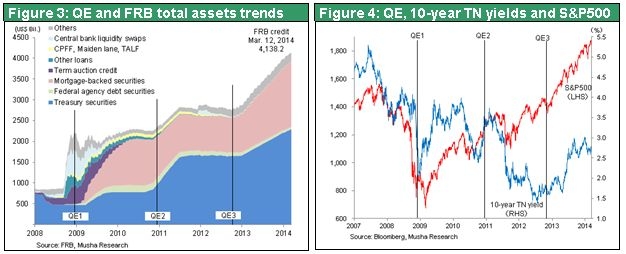

Learning from the Fed’s efforts to suppress risk averters

Quantitative easing is a political measure for influencing prices and jobs by having an impact on prices of assets. Consequently, a central bank cannot accomplish this political objective without demonstrating its immense power to financial markets by constantly influencing market prices. As the Bank of Japan works on ending deflation, the bank should learn from the actions used by former Fed Chairman Ben Bernanke and current ECB Chairman Mario Draghi to intimidate risk averters.

The Fed implemented quantitative easing three times after the collapse of Lehman Brothers. Each time there was an impact on asset prices. As you can see in Figure 3, QE1 (November 2008 to June 2010) involved purchases and credit extensions for risk assets like MBS that were way oversold. Market prices recovered significantly and there was a big drop in mortgage interest rates. QE2 (November 2010 to June 2011) took place during the European crisis as European investors sold U.S. Treasury securities and converted dollars into euros due to a shortage funds in Europe. To stop the resulting upturns in interest rates and the risk premium in the United States, the Fed bought $600 billion of Treasury securities. Making these purchases greatly lowered interest rates and the risk premium and fueled the animal spirit. The long-term interest rate fell very quickly from 3.5% to 2%. Since prices rose as interest rates dropped, investors reaped massive capital gains that made them want to take on more risk. In addition, higher Treasury prices made stocks undervalued in comparison (which pushed up the risk premium of stocks), and investors bought more stocks as a result. QE3 (started in September 2012) has involved the constant purchase of MBS and Treasury securities. This buying has encouraged investors to purchase risk assets by rebalancing their portfolios.

The Bank of Japan should also learn from the 2012 announcement by ECB President Draghi of the outright monetary transactions (OMT) scheme for unlimited purchases of the Southern European government bonds that were under intense selling pressure. This announcement quickly drove away the sellers.

Please see the following Musha Research bulletins for more information about how central banks have used quantitative easing to achieve their goals.

Strategy Bulletin Vol.78 (Sep 10, 2012) http://www.musha.co.jp/attachment/bulletin_e_20120910.pdf

A Big Reversal in Financial Markets Thanks to QE and SM2 (Super Mario)

- The world’s central banks evolve as the BOJ is left behind.

Strategy Bulletin Vol.79 (Sep 20, 2012) http://www.musha.co.jp/attachment/bulletin_e_20120920.pdf

Central Banks vs. the Black Swan ? - The BOJ Falls Behind

Strategy Bulletin Vol.93 (Feb 27, 2013) http://www.musha.co.jp/attachment/bulletin_e_20130227.pdf

QE has the power to destroy skepticism

Strategy Bulletin Vol.96 (Apr 05, 2013) http://www.musha.co.jp/attachment/bulletin_e_20130405.pdf

The Central Bank’s Battle against Pessimism and Skepticism