Jun 02, 2014

Strategy Bulletin Vol.121

Why are sharply lower U.S. long-term rates pushing up stock prices and the dollar?

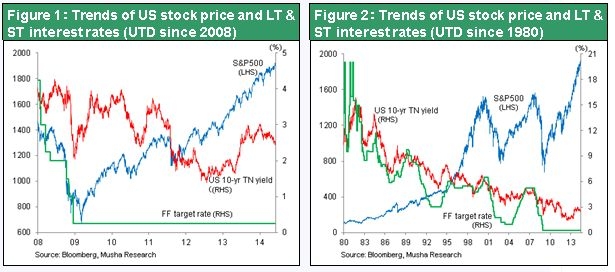

The mysterious drop in interest rates and stock market rally

A surprising downturn in U.S. interest rates is occurring. The long-term interest rate has declined from 3% at the beginning of 2014 to the current level of 2.4%. Furthermore, the yield of inflation-indexed bonds has mirrored this decline. Falling rates are the result of a decline in real interest rates rather than expectations about inflation. Lower interest rates can be interpreted as a sign of rising negative economic sentiment, such as an outlook for a decline in growth potential. But if this is true, then both stocks and the U.S. dollar should be weakening, too. However, U.S. stock prices have just reached another record high. Consequently, the only conclusion is that higher stock prices demonstrate the rising confidence among investors in the ability of companies to create value.

Government policies are the primary cause of lower interest rates

Support from government policies is the first point when explaining the drop in interest rates. Fed Chairman Janet Yellen has repeatedly stated that there will be no change in the Fed’s monetary easing. The Fed’s statements no longer include unemployment rate and inflation targets as prerequisites for ending zero interest rates. As a result, there are no prospects for an interest rate hike any time soon. The March FOMC statement stated that the FF rate may remain lower than usual even after unemployment and inflation reach the targets. The consensus view is that the terminal value (average rate in normal times) for the FF rate has been between 4% and 4.25% (2% inflation + real interest rate of 2% to 2.25%). So the Fed plans to keep this rate even lower. Moreover, New York Fed President William Dudley indicated that the FF rate exit level will be lower mainly for three reasons. First, economic uncertainty may cause companies to hold a larger cushion of savings. Second, the aging U.S. population and slowing productivity growth may reduce the economic growth potential. Third, the FF rate, which determines funding costs for financial institutions, may have to be held down t o enable these institutions to absorb expenses associated with tighter financial regulations. Therefore, Mr. Dudley is saying that monetary easing will probably continue for an even longer time.

ECB President Mario Draghi has said that more monetary easing is needed to avoid deflation. Lowering long-term rates in Germany and elsewhere in Europe would weaken the euro, which could in turn prompt funds to flow into U.S. Treasuries. In addition, China’s covert currency intervention in Belgium and other places in Europe (buying the U.S. dollar and selling the yuan) is probably having a positive effect on U.S. Treasury security supply and demand, too. Over the past six months, the yuan has depreciated 3% from 6.05 to 6.25 to the U.S. dollar. China’s foreign currency reserves have not increased during this time, but there was apparently a big increase in China’s dollar holdings at overseas financial settlement institutions. Obviously, the Bank of Japan’s quantitative easing has also been contributing to investments in U.S. Treasuries by making the yen weaker and the dollar stronger.

This explains why the actions of governments, including the U.S. Fed, have caused interest rates to fall while stock prices climb. This is the most persuasive explanation. If we believe this, then aren’t people correct to criticize these policies for creating the risk of a future asset bubble and economic crisis?

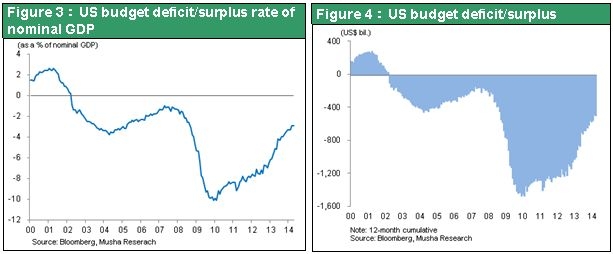

The rapid decline in the U.S. government budget deficit may also be helping to improve supply and demand for Treasuries by holding down the supply. During the year that ended in March 2014, the deficit was $493 billion. This is 2.9% of the nominal GDP, which means the deficit has returned to the pre-financial crisis level. At the peak of the financial crisis in 2010, the budget deficit of $1,477.5 billion was 10% of nominal GDP. As the budget deficit has continued to narrow in recent years, annual U. S. Treasury issues have declined by $418 billion, an amount roughly equivalent to FRB’s U. S. Treasury purchases ($45 billion per month) through its Q3 program. Therefore, in a broad sense, we can regard this as surplus U.S. savings.

Rising capital productivity is an even more important cause of falling interest rates

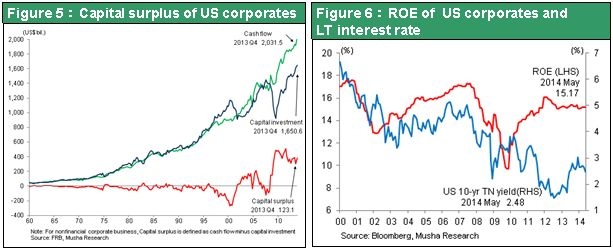

Lower interest rates are a signal of an easing in the supply and demand for capital, which means there is surplus capital. The cause could be inadequate demand and an oversupply. So why has surplus capital grown to the point where it is a problem? The reason is most likely improvements in the productivity of capital and labor at companies. IT, smartphones, cloud computing and other aspects of the new industrial revolution have combined with the benefits of globalization to generate an unprecedented upturn in productivity. Companies now require much smaller amounts of capital and labor. The result has been an immediate and large increase in corporate earnings along with the creation of surplus capital and labor.

Prices of machinery have plunged because of advances in IT. Furthermore, the cost of building factories is much lower now that globalization allows locating factories in emerging countries. These events have greatly reduced the amount of capital required for business operations. In the United States and Japan, the need for companies to reinvest all cash flows from depreciation expenses ended many years ago. Figure 5 shows the amount of surplus capital (how much cash flows exceed capital expenditures) at U.S. companies. Starting around 2000, there has been a steady surplus of capital, especially after the financial crisis began in 2008. Enormous amounts of surplus capital have become common at prominent IT companies like Apple and Google. The coexistence of high profit margins and surplus capital is clearly evident in the gap between S&P 500 ROE and the U.S. long-term interest rate that you can see in Figure 6. Many people tend to equate the decline in the long-term U.S. interest rate with lower profit margins (a downturn in the ability of companies to generate earnings). In fact, strong corporate earnings are the reason for the growth in surplus capital, which in turn is causing the long-term interest rate to decrease.

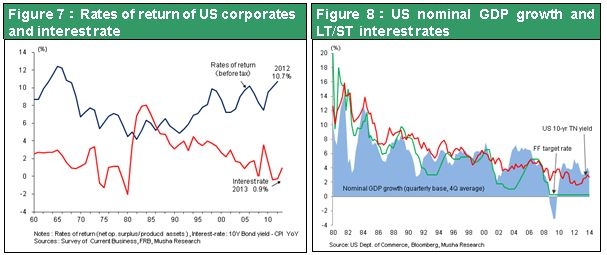

The gap between profitability and interest rates emerged in the past decade. This is a phenomenon in which companies can earn substantial profits but surplus capital exerts downward pressure on interest rates. This situation is clearly visible in Figure 7, which shows profitability and interest rates at U.S. companies, and Figure 8, which shows the U.S. nominal GDP and long and short-term interest rates. In 2005, former Fed Chairman Alan Greenspan called the combination of low long-term interest rates amid a strong economy and monetary tightening a conundrum. Furthermore, there has been no change in this conundrum since the Lehman Brothers collapse. In 2005, the previous Fed Chairman Ben Bernanke said the conundrum was caused by a global saving glut. Looking back, it is now quite clear that this glut was excess money at companies rather than a general excess of savings.

At one time, some pessimists thought that the long-term interest rate decline signified a downturn in companies’ earning power and the impending demise of the capitalist economic system. But now we can see that this belief was wrong by 180 degrees.

How will quantitative easing be justified?

Should we believe that falling long-term interest rates are caused by declining corporate earnings power and the crumbling of capitalism? Or is the cause rising capital productivity and corporate profitability? The evaluation of quantitative easing changes completely depending on which position we choose. The first position views quantitative easing as an initiative that feeds an asset bubble by supplying money to a deteriorating economy. But the second position views quantitative easing as a sound and appropriate action that puts surplus capital in markets to work.

If we adopt this position, then there would be even more economic welfare from further reducing the cost of capital in order to put still-idle surplus capital to work. Monetary actions (quantitative easing) by former Fed Chairman Bernanke were creative with respect to the focus on eliminating economic slack (surpluses). But there was slack for both labor and capital. Surpluses of labor and capital are linked because they are simply different sides of the same coin. Therefore, a situation where there is labor slack is also a situation with surplus capital.

The next question is why central bank announcements of monetary easing this year have pushed long-term interest rates down even more? Perhaps rates would have remained steady if central banks had not made these statements. No one knows. The Fed’s stance of lowering the FF rate’s terminal value probably brought down the long-term interest rate by reducing banks’ expected cost of capital. This move is effective precisely because there is still idle capital in financial markets. By cutting the cost of capital, a further drop in long-term interest rates can probably put surplus capital to work, thereby creating new demand that increases economic growth. From a medium to long-term perspective, this process will boost the value of the dollar.

How to maximize benefits of the new industrial revolution

There are people who think that economic statistics are not consistent with the position that slack (surpluses) originate from rising labor and capital productivity fueled by the new industrial revolution. Currently, U.S. Department of Labor statistics show that U.S. labor productivity has dropped to the unprecedented level of about 1.4%. Why are labor productivity data so weak even as the new industrial revolution advances? Productivity is calculated by dividing value created by labor input. Therefore, even if physical productivity is high, statistical productivity may not increase when there is sharp drop in prices. Another possibility is that overall productivity is falling because low-productivity business sectors are accounting for a larger share of the economy. One more case is a decline in jobs in industries where productivity is rising rapidly while selling prices in these industries decrease. Nominal added value created would stop growing. If unemployed workers resulting from these job losses are unable to find new jobs and remain surplus labor, productivity for the entire economy will be flat as well.

In this event, macroeconomic statistics will be unable reveal any change in productivity even if there is an improvement in physical productivity. So how can we identify the true upturn in productivity created by the new industrial revolution? The answer is monitoring the degree of slack for labor and capital. In other words, the lack of growth in jobs and falling interest rates are themselves proof of rising labor and capital productivity fueled by the new industrial revolution.

As you can see, creating demand is an extremely effective way to eliminate slack. What would happen if the Fed raised the FF rate to increase the cost of capital even amid surplus capital and slumping long-term interest rates? The result would be even more surplus capital, a recession, falling interest rates and plunging stock prices. During the Greenspan era, interest rate hikes in 2000 and from 2005 to 2006 produced an inverted yield curve. The consequences were as expected: financial crises associated with the bursting of the IT bubble and then the housing bubble. There are still doubts about whether or not these interest rate hikes were the right course of action. Using monetary tightening to eliminate an asset bubble is not what was needed at that time. This was a time that required policies for channeling surplus capital to business sectors with sustainable demand and not for producing an asset bubble. Comprehensive macroeconomic measures were needed. The economy required revisions to various systems, financial and tax reforms, and other actions along with easy-money policies.

Recently, a number of well-known U.S. economists like Lawrence Summers and Paul Krugman have been saying that demand creation and faster economic growth will require more fiscal measures, tax reforms, income reallocation and other actions in concert with monetary easing. Some people criticize Mr. Summers’ views as a “long-term stagnation stance.” However, his position is that the use of suitable measures can increase the growth potential of the U.S. economy. There is no intent whatsoever to create a pessimistic outlook for the stock market.

Implications for long-term rates and the stock market

As I have explained, sluggish or declining long-term interest rates show that there is surplus capital that can be used. Consequently, this is basically a positive event. The problem is whether or not governments enact policies that effectively put this capital to work or that block the use of this capital. Effective policies will raise stock prices and other policies will cause stock prices to fall. As a result, the stock market today has reached a stage where stock prices are highly dependent on the direction of financial policies.