Oct 14, 2014

Strategy Bulletin Vol.126

Shift to indirect taxes and the QQE2 announcement will make Japanese stocks the world’s best perform

Policy risk and investment opportunities associated with the global stock market downturn

Stocks will climb due to “pessimism stew” and falling long-term rates

Stock markets worldwide started falling abruptly in October. Most pessimists believe the cause is stock sales by hedge funds. But there are actually three major beliefs of pessimists. The first is that upward pressure on stocks from easy money will dissipate as the United States ends its extreme monetary easing and starts raising interest rates. The second is that global economic growth is slowing. The third is that governments are implementing the wrong policies. All three are not at all persuasive.

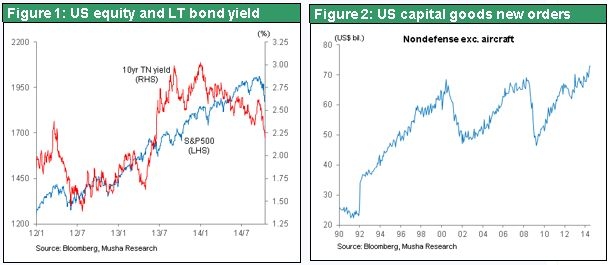

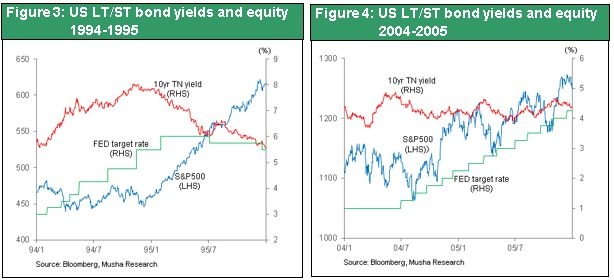

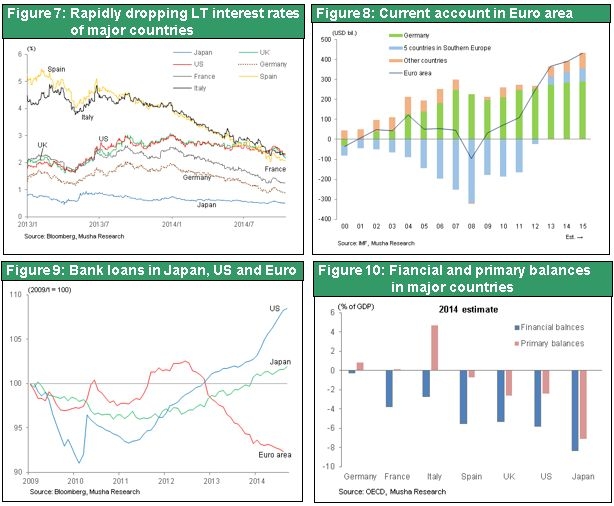

The first source of concern is the possibility of a reduction in quantitative easing by the Fed leading to an upturn in interest rates. But if this occurs, we should see long-term interest rates increase first. In fact, long-term interest rates have dropped sharply since the middle of September as stock prices declined. Lower interest rates equate to a lower cost of capital. Less expensive capital, in turn, should result in more risk taking and higher stock prices. Furthermore, looking back at times when interest rates started moving up in the past shows us that there is no need to worry about a drop in stock prices. Long-term interest rates started climbing in 1986, 1994, 1999 and 2004. Every time, stock prices remained firm as interest rates started to rise. Stock prices fell only after monetary tightening caused a big increase in long-term interest rates. Consequently, at the initial stage of monetary tightening, stock prices have shown no signs of weakness as long as long-term interest rates remained unchanged.

The global economy is the second source of concern. However, there are no signs of slowing growth despite increasing worries about a slowdown. The IMF world economic outlook announced on October 7 calls for growth led by the US economy. The IMF forecasts 3.3% global growth in 2014, including growth of 2.2% in the United States, 0.8% in the eurozone, 0.9% in Japan and 4.4% in emerging countries. In 2015, the IMF expects the global economy to expand 3.8%, including growth of 3.1% in the United States, 1.3% in the eurozone, 0.8% in Japan and 5.0% in emerging countries. The IMF foresees slower growth in Europe and Japan but has raised its outlook for US growth. The US economy is gaining momentum as the growth in jobs accelerates and non-defense capital expenditures recover. As the benefits of US economic growth spread around the world, will we see a continuation of the favorable global climate for investments or economic weakness outside the United States? I believe that a favorable investment climate is more likely.

The only legitimate source of concern is erroneous policies. This refers to the enactment too soon of measures to hold down demand. However, we can ignore this concern because, in the United States, the Fed has clearly stated its priorities. There has been absolutely no trade-off involving inflation or a drop in the dollar’s value that would force an end to monetary easing. As a result, there is little reason for concern about an economic slowdown or stock market decline caused by mistaken government policies.

We are currently witnessing the sudden spread of the belief that “a stew of pessimism is the cause of stock sales.” However, this is obviously nothing more than an argument intended to lead to a pre-determined conclusion. This is why investors should view the current market downturn as an excellent opportunity to buy stocks.

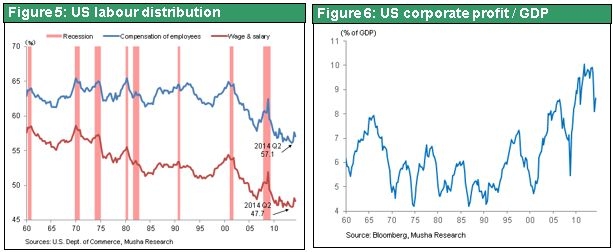

Eventually the US economy will start approaching the end of the current period of growth. Once this happens, the dollar will remain high, labor’s share of income will stop falling and start rebounding, and long-term interest rates will start to climb. Earnings at US companies will begin to slow as a result. These events are precisely the result of the outlook for an improvement in the US economy. Consequently, investors should remember that US stocks are unlikely to continue moving upward when the US economy reaches this point. Nevertheless, this will not signal the end of the long-term increase in stock prices.

Policy risk appears; insufficient demand in Europe

Although the US is moving in right direction, wrong decisions about financial policies in other countries are the sole legitimate reason to worry. During 2014, long-term interest rates have unexpectedly dropped in major countries. A significantly insufficient level of demand is the cause. In industrialized countries, stock prices are strong only in countries able to enact policies for translating surplus capital into effective demand.

The interest rate decline has occurred primarily in Europe, and especially for the national bonds of countries in southern Europe. Only last year, people were worried about Spain and Italy abandoning the euro. But now long-term interest rates on bonds of these two countries are about the same as for US treasuries or even lower. The national bonds of Germany now have an all-time-low yield of less than 0.9%. Remarkably low interest rates in Europe are a sign of the severity of the demand shortfall. Looking at the balance between investments and savings in Europe, there was insufficient savings in southern European countries. But this problem ended during the euro crisis in these countries as the big drop in living standards greatly reduced budget and trade deficits. Figure 10 shows the primary balance, an indicator of a country’s financial soundness. As you can see, there is a large surplus for the eurozone as a whole. In Germany, there is little emphasis on creating demand because of the outlook for a continuation of the large external current account surplus. The result is even more growth in surplus capital in the eurozone. For the eurozone overall, there are no initiatives to deal with insufficient demand and excess capital. Moreover, reforms of the eurozone banking system are slower than in other areas of the world. Strict capital adequacy rules are causing bank loans to fall. This is preventing the monetary easing by the ECB from producing benefits outside the banking system. Consequently, Europe needs to ease up on government budget cuts by using more flexibility regarding the Maastricht Treaty, which caps budget deficits at 3% of GDP. Now that the ECB has started quantitative easing, we will probably see a broad-based economic recovery begin in 2015 if stress tests of European banks can be completed this fall.

Japanese stocks will be the world’s best performers if Japan is truly committed to ending deflation

Policy risk may be greater in Japan than anywhere else in the world. Critics of Abenomics are delaying various actions. Economists and the Japanese public are opposed to reflationary measures. But Abenomics has gone against the consensus view from the outset. When Abenomics first appeared, economists, the academic community and the media all were extremely critical. The critics have since been quiet as Abenomics was successfully executed. But now they are speaking up again because of the economic slowdown following the April 2014 consumption tax hike. “Ending deflation with monetary easing will be impossible.” “The economy will be underpinned only by the growth strategy, deregulation and structural reforms.” “Deflation is not as bad as inflation.” “Cutting the budget deficit should be the highest priority.” “The weak yen caused by Abenomics has produced more problems than benefits and should be reversed.” Criticism like this is pointless now that the government has already decided on its economic policies. These are all strong statements that should be made only if Abenomics had failed. But there are concerns about whether or not criticism like this from public opinion will influence Japan’s policies. People have not overlooked the fact that Prime Minister Abe has made many conciliatory statements to his critics, such as that “the weaker yen has both advantages and disadvantages.”

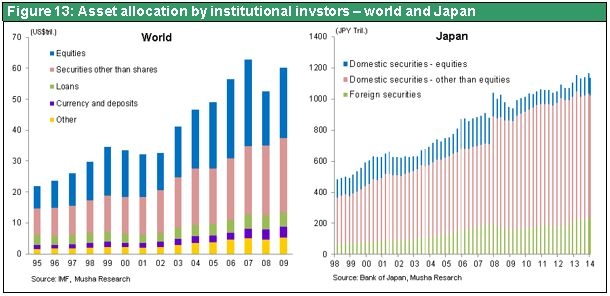

Disappointment in the performance of Japanese stocks has emerged as these events have taken place. Since the start of 2013, the Japanese stock market rally ranks first in the world. But since the start of this year, the performance of Japanese stocks is the worst in the world. Foreign investors are disappointed. Japan’s economy started to recover in the second half of 2013, but the recovery appears to have lost steam after the April 2014 consumption tax hike. Japan’s GDP plunged an annualized 7.1% in the second quarter. This drop shows the weakness of the recovery after the rush to make purchases prior to the tax hike. Unfavorable summer weather is also having a negative effect on consumption. Starting in the third quarter of 2014, there will no longer be the one-time disruption of the consumption tax hike. Although Japan will probably return to economic growth, the pace of growth will probably be lackluster. Financial market participants do not yet believe that the end of deflation and success of Abenomics are a sure thing. There is still no change in the extreme risk aversion of Japanese investors, who continue to leave too much of their money in safe assets.

The upcoming 2% consumption tax increase in this environment will probably make investor sentiment even more negative. This is why there are demands for the Abe administration and BOJ Governor Kuroda to “end deflation no matter what sacrifices are needed.”

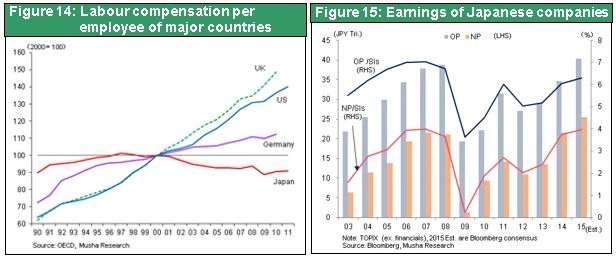

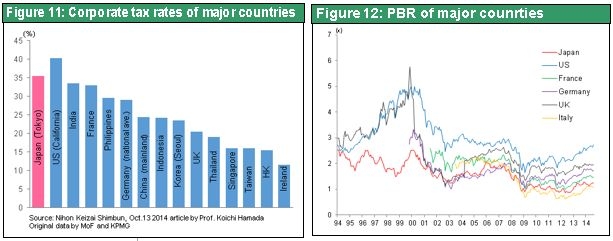

Japan should push back the 2% consumption tax hike from one to two years from now. Japan should also announce additional quantitative easing starting in April 2015. This would quickly alter public sentiment concerning deflation and risk aversion. Japan should reexamine and alter its tax structure by shifting from direct to indirect taxes. This should be accomplished by continuing to raise the consumption tax to about 15% and lowering the corporate and individual income tax rates. Taking these steps would end the outflow of income from companies and wealthy individuals in Japan. The return of these funds to Japan (companies are keeping income in Singapore, Hong Kong and other locations with favorable tax systems) would also contribute to the growth strategy by significantly boosting domestic demand. These actions would convince investors in Japan and overseas that Japan can end deflation. We would probably see the start of a dramatic correction in Japanese stock prices, which are far behind the rest of the world, as a result. This is why it is quite possible that Japanese stocks will have the best performance in the world in 2015. As you can see in the following figures, Japanese companies have completed a major transformation of their business models during the past decade. This transformation, along with the weaker yen, will allow these companies to generate earnings on an unprecedented scale. If Japan enacts the right policies too, everything will be in place for a stock market rally.

The positive cycle fueled by a weaker yen and higher earnings

As I explained in my previous report, all three vectors that determine exchange rates are pointing in the direction of a weaker yen for the first time ever. The three vectors are (1) the speed at which a country prints money; (2) the trade balance (real supply and demand for foreign exchange); and (3) the real interest rate (speculative supply and demand for foreign exchange). Moreover, geopolitical forces (the interests of the US, the world’s superpower) have shifted to allowing the yen to weaken. These same forces had been a reason for the consistent upturn of the yen for 30 years. On a purchasing parity basis, an exchange rate of about ¥103 to the US dollar is appropriate. But exchange rate movements always overshoot their marks. Exchange rate movements of major currencies have gone as much as 30% above and below the purchasing power parity (excluding the yen’s abnormal strength between 1980 and 2000 that surpassed even 30%). Consequently, we may see the yen weaken to the latter half of the ¥120 level to the US dollar. The weak yen is fundamentally raising the earning power of Japanese companies. Higher earnings will in turn probably propel stocks higher and help terminate deflation. The yen’s decline has not yet raised the volume of Japan’s exports. Furthermore, higher prices of imports, including energy, caused by the weaker yen bring down real wages. Apparently, people are correct to point to the disadvantages of a weaker yen. However, these negative consequences are only temporary. A weaker yen is good for Japan for many reasons. Export volume has not increased because most of Japan’s current exports do not compete with other products based on their prices. As a result, Japan does not have to compete by cutting prices. This is why a weaker yen does not lead to price cuts for dollar-denominated exports and a resulting increase in export volume. The absence of export volume growth is therefore proof that Japan’s export structure has shifted to products that are competitive because of technologies and quality rather than their prices.

Benefits of a weaker yen are still significant even without growth in export volume. For example, the yen-denominated income of overseas subsidiaries of Japanese companies is increasing because of the lower cost of imports from Japan and foreign exchange gains. This helps support Japan’s current account balance by improving the income balance. Furthermore, a weaker yen may produce benefits for manufacturing in Japan. In this case, companies may move production activities back to Japan and importers may replace imports with products made in Japan. These events would revitalize Japan’s manufacturing sector. At present, capital expenditures and manufacturing in Japan are sluggish. But this is probably caused by the time lag for benefits to emerge and lingering doubts about how long the yen will continue to fall. There is no doubt that higher prices caused by the weaker yen will bring down real wages for a while. However, this temporary reduction is nothing more than a process that is required to establish an upturn in Japan’s wages. As long as corporate earnings grow due to the weaker yen, real income in Japan is certain to increase if sustained economic growth can be achieved.

The sustainability of corporate earnings is critical to the outlook for the economy and stock market. Earnings are the starting point for changes in the number of jobs, wages (and thus consumption), corporate investments and stock prices. In Japan today, keeping the yen weak will be vital to enabling companies to continue raising earnings. In the fiscal year ending in March 2015, Japanese companies are expected to record 10% growth in earnings to a record high. Furthermore, the earnings forecast is certain to be raised because of the increasing speed of the yen’s decline.

As I explained earlier, the only remaining question mark is the Japanese government’s policies and actions.