Oct 29, 2014

Strategy Bulletin Vol.127

The next consumption hike is uncertain but stock prices are certain to go higher

The technical stock market downturn October

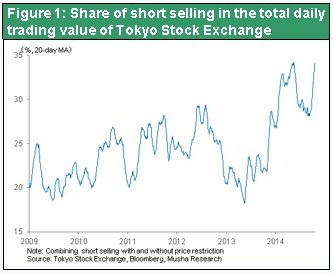

Stock prices plunged worldwide as October began. Falling prices quickly ended the optimistic mood that had prevailed until September as global investors adopted a risk-off stance. But looking back, we should probably regard the October downturn as nothing more than a technical movement. As the figure below shows, the Tokyo Stock Exchange short interest ratio has reached an all-time high. Once this technical pullback ends, investors will shift their attention in the first half of 2015 to the positive responses to improving fundamentals and a switch in government policies. For the dollar-yen rate and stocks in major countries, now is very likely an excellent opportunity to establish positions in preparation for a rally starting late this year and continuing into 2015.

The US economy is staging a powerful recovery

The consistent strength of the US economy is the key point. Contrary to the views of pessimists, the true strength of the US economy is finally becoming apparent. New unemployment insurance applications are consistently below 300,000. Clearly, the US employment picture is recovering steadily, although full employment has not been achieved. Additionally, a steady increase has started in home sales, which had been sluggish. The US home ownership ratio is currently 64%, well below the peak of 69%. People are beginning to have difficulty buying houses because of the insufficient supply. Demand for housing along with the current decline in interest rates creates good prospects for a major upswing in home buying in the United States.

Wages in the United States are climbing steadily, too. Labor’s share of income, which has fallen sharply in recent years, is starting to increase at US companies. As the US enters the second half of this period of economic growth, companies are beginning to distribute more of their income to consumers rather than simply reaping large profits. That means consumption can grow even more as household incomes rise. As a result, the US economy is poised to advance to a stage of faster growth underpinned by housing or consumer spending.

The US government’s budget deficit has declined significantly. At one point, the deficit was more than 12% of GDP. But the government’s outlook for 2014 is a deficit that is 2.8% of GDP. No longer will budget cuts, which had severely impacted the economy, exert downward pressure on demand. The public sector will thus shift from a negative to a positive factor for the economy. The US economy is benefiting from the shale gas revolution, too. All of these factors mean that there is no longer any doubt that the US economy is entering an extremely well balanced phase of growth. This is now a fact.

Lower inflationary pressure (lower interest rates and cost of crude oil) will contribute to economic growth

The US inflation target is 2%, but upward pressure on prices in the United States is much weaker because of the stronger dollar and falling prices of crude oil and other natural resources. On the other hand, less expensive natural resources and lower interest rates are boosting the effective purchasing power of US households. This will obviously fuel even more economic growth. Therefore, the power of the US economic recovery is a fact with virtually no need for doubts. Moreover, this recovery will fuel economic expansion on a global scale. Investors will probably start focusing their attention on this economic growth process late this year or early in 2015.

New directions for government policies and economic bottoming out on the horizon in the eurozone

In Europe, stress tests ended last week so we can finally see the end of the excessive credit crunch at banks. Financial institutions will probably start aggressively taking on risk by extending credit. At the same time, the ECB will at last start quantitative easing. In Germany, where economic growth has been slowing, the government is very likely to start taking some sort of financial actions. Furthermore, France and Italy will probably cut taxes due to the risk of deflation. Consequently, Europe is about to shift the focus of initiatives from the extreme cuts in public sector spending to well-balanced financial measures. This is most likely a movement that cannot be stopped. As a result, there are no longer any fears of a recession or deflation in Europe. Everything appears to be in place for a slowly increasing economic growth rate in the first half of 2015.

Big upward earnings revisions in Japan due to yen’s decline point to the start of the long-awaited positive weak-yen cycle

In Japan, the negative effects of the April 2014 consumption tax hike have ended. Now the delayed benefits of the weaker yen can begin to emerge, which will lead to a big improvement in the economy. Japanese companies do not compete in global markets based on prices because they supply superior products with respect to quality and technologies. Consequently, there is no need to cut dollar-denominated prices in response to a weaker yen. So the yen’s downturn has not raised export volumes at Japanese companies. However, there has been a benefit in terms of selling prices because companies have not cut their prices. In other words, higher export prices resulting from the weaker yen have produced enormous benefits for Japanese companies. These higher prices are on the verge of producing big increases in earnings. Companies will clearly use these earnings to raise wages and bonuses, capital expenditures, R&D expenditures, and distributions to shareholders. The weaker yen’s price increasing effect is three times greater than the benefit from the growth in export volume (because the marginal profit ratio is about 30%). In the past, a decline in the yen immediately raised export volumes. But now, a weaker yen yields an even greater price benefit, although this benefit does not appear for some time.

Import replacements and capital expenditures

The most significant recent change in Japan’s foreign trade is the start of a downturn in the volume of imports from China. There has been a big increase in prices of these imports. This decline is very likely an indication that Japan is starting to replace more expensive imported goods with goods produced within Japan. As a result, small and midsize companies in Japan are beginning to raise output to replace imports. This is leading to a positive cycle as banks extend more loans to these companies to fund capital expenditures. As the negative impact of the consumption tax ends and the positive impact of the weaker yen emerges, Japan’s economy is probably poised to enter a phase of robust economic growth.

Stocks will climb whether or not the next consumption tax hike is postponed

If Japan raises the consumption tax in October 2015, we will probably see a surge in demand prior to the tax hike. This surge makes a big improvement in the Japanese economy very likely to take place in the first half of 2015. But if this tax increase is pushed back (one view is that the October 2015 timing would result in an economic downturn in 2016, creating an unfavorable environment for Japan’s next general election), there would no longer be any worries about a slowdown in economic growth. Japan would experience a further increase in investments and spending that would raise confidence in the ability to end deflation. Stocks would probably climb even faster as a result.

If Japan pushes back the next consumption tax hike, there is no reason for fears about the possibility of a sharp drop of the yen and big increase in long-term interest rates as foreign investors lose confidence in Japan’s finances. Prime Minister Abe has clearly stated that the consumption tax hike will be postponed only if a delay is needed to further increase confidence in the ability to end deflation. Since there is no doubt about the prime minister’s position, investors are concentrating solely on whether or not Japan can eradicate deflation.

Japan must continue to bring down the yen

The key to the outlook is if the yen will continue to decline. Investors should pay close attention to the US Treasury Department’s Report to Congress on International Economic and Exchange Rate Policies on October 15. In this report, which is submitted every six months, there is criticism of exchange rate manipulation by China and Korea and their abnormally weak currencies. But there is not a single word of criticism about the yen, which has been declining steadily. Instead, the report mentions concerns about the negative effect of Japan’s excessive budget cuts on economic growth. This is clearly an indication that the Treasury Department is willing to allow the yen to decline even more. Fundamentals also point to a further weakening of the yen. International macroeconomics tell us that higher taxes lead to lower interest rates and a weaker currency. Also, a delay in tax hikes leads to mounting inflationary pressure and, again, a weaker currency. Consequently, the yen is likely to weaken regardless of whether the tax hike takes place or is postponed.

All of these points indicate that investors should view the current situation as the beginning of a positive turning point for the greatly oversold stock market and the dollar-yen exchange rate. This is why investors should expect to see another opportunity for risk-taking later this year and early in 2015.