Apr 27, 2010

Strategy Bulletin Vol.12

The revival of the U.S., German and Japanese economies

– Germany is gaining a competitive advantage as the crisis in Greece unfolds –

“Holding down unit labor costs” is becoming the key to economic vitality

During the first four months of 2010, we have seen an almost consistent rally in stock prices in industrialized countries and a decline in emerging countries. This reality is precisely the opposite of the consensus outlook for economic growth in emerging countries and stagnation in industrialized countries. Significantly, stock prices have been very strong in three unpopular countries: the United States, Germany and Japan. Japan has been widely viewed as an Asian country in decline due to the lack of economic growth over the past decade. But in 2010, Japan has recorded the best performance in Asia. In Europe, one of the best performers is Germany, a country that had been the region’s most stagnant economy because of its high wages. The reviving economies of the United States, Germany and Japan share a common characteristic: all three are “holding down unit labor costs” by boosting productivity while tightly controlling costs. I have discussed the U.S. and Japanese economies in previous reports. In this report, I will focus on how Germany is making progress in lowering unit labor costs. This subject has a bearing on stock market performance and is also one cause of the current crisis in Greece. *I have explained that U.S. labor productivity increased because of workforce reductions that could even be regarded as excessive (unemployment rose by almost 4 percentage points in 2009 far exceeding 2.4% GDP decline ). The result was a sharp decline in labor’s share of income (See Key Strategy Issue Vol. 289 and other reports). I have also explained that Japan achieved the world’s only significant decline in unit labor costs as the yen appreciated over a period of more than 20 years (See Key Strategy Issue Vol. 287 and 288).

Dealing with unbalanced economic growth is a constant problem with currency unification

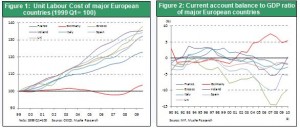

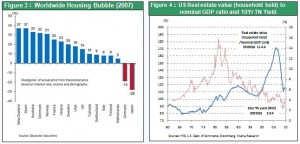

The worst of the Greek debt crisis seems to be behind us because of financial aid from the IMF and a number of countries. However, this aid package does not eliminate the fundamental cause of this crisis. As a result, the world may have to deal with a much larger economic crisis during a future downturn in the global economy. The crisis in Greece, along with other problems the EU faces, are all linked to uneven economic growth among EU countries (differences in costs and the rate of improvement in productivity). Without currency unification, economic stability of individual countries would be preserved through changes in exchange rates of national currencies that offset these differences. But a single currency makes it impossible to rely on exchange rates. This explains why EU countries with low productivity are having such difficulty in taking the actions they require. Greece, which is the economically weakest EU member, has emerged as the first victim of the unified currency system. Soon after EU currency unification in 1999, there was an outflow of jobs from Germany, which had high wages at that time. Taking away these jobs were Ireland, Spain and new EU members with emerging economies, chiefly countries in Eastern Europe. The outflow of jobs created intense deflationary forces that pressured Germany to raise productivity and cut wages. On the other hand, costs rose sharply in EU countries that were capturing jobs from Germany because of severe labor shortages (Figure 1). Higher costs in other EU countries made Germany’s exports more competitive. Germany was soon reporting large current account surpluses while other countries had consistently large deficits (Figure 2).  The fixed exchange rate within the EU imposed by a single currency has the effect of increasing Germany’s competitive advantage, year after year. I believe there are four ways to resolve this problem within the eurozone. First is to improve the productivity of weaker EU members . Second is to lower wages and prices (deflation) in these weaker EU members . The third is to raise wages and prices (inflation) in Germany. And finally, if none of these three measures are possible, the fourth option is to terminate currency unification in Europe. However, it would be impossible for the European Central Bank (ECB) to simultaneously execute policies with differing results – wage inflation in Germany and wage deflation in weaker EU members . Furthermore, the role of the ECB differs from that of the U.S. Federal Reserve Bank, which is responsible for supporting employment and economic growth. The sole mission of the ECB is preserving the value of the euro. Fulfilling this role makes it almost impossible for the ECB to enact policies to produce deflation in emerging economies (option 2) or inflation in Germany (option 3). Due to these limitations, I believe that the only option for the EU and ECB is to enact emergency stopgap measures while waiting for the productivity of weaker EU members to improve (option 1). But if there is a steep decline in the global economy, the fourth option of considering the termination of currency unification looms larger. But taking this step would be very difficult from a political standpoint. For these reasons, I think there is still more potential for higher wages and corporate profit margins in Germany for the time being. Passing through the powerful winds of globalization and an unprecedented financial crisis, the global economy has returned to its most critical value metric: the unit cost of labor. Japan and Germany are the leaders in this respect. Furthermore, the prices of assets are far below their true values in both countries, despite the recent worldwide bubble in housing prices (Table 3). In addition, the United States is rapidly unwinding its housing bubble. This is why I believe that Japan, Germany and the United States will present attractive opportunities to investors.

The fixed exchange rate within the EU imposed by a single currency has the effect of increasing Germany’s competitive advantage, year after year. I believe there are four ways to resolve this problem within the eurozone. First is to improve the productivity of weaker EU members . Second is to lower wages and prices (deflation) in these weaker EU members . The third is to raise wages and prices (inflation) in Germany. And finally, if none of these three measures are possible, the fourth option is to terminate currency unification in Europe. However, it would be impossible for the European Central Bank (ECB) to simultaneously execute policies with differing results – wage inflation in Germany and wage deflation in weaker EU members . Furthermore, the role of the ECB differs from that of the U.S. Federal Reserve Bank, which is responsible for supporting employment and economic growth. The sole mission of the ECB is preserving the value of the euro. Fulfilling this role makes it almost impossible for the ECB to enact policies to produce deflation in emerging economies (option 2) or inflation in Germany (option 3). Due to these limitations, I believe that the only option for the EU and ECB is to enact emergency stopgap measures while waiting for the productivity of weaker EU members to improve (option 1). But if there is a steep decline in the global economy, the fourth option of considering the termination of currency unification looms larger. But taking this step would be very difficult from a political standpoint. For these reasons, I think there is still more potential for higher wages and corporate profit margins in Germany for the time being. Passing through the powerful winds of globalization and an unprecedented financial crisis, the global economy has returned to its most critical value metric: the unit cost of labor. Japan and Germany are the leaders in this respect. Furthermore, the prices of assets are far below their true values in both countries, despite the recent worldwide bubble in housing prices (Table 3). In addition, the United States is rapidly unwinding its housing bubble. This is why I believe that Japan, Germany and the United States will present attractive opportunities to investors.  bulletin_e_20100427.pdf

bulletin_e_20100427.pdf