Jan 27, 2015

Strategy Bulletin Vol.134

QE is sparking a stock price revolution in developed countries

~ Why is QE, which has become the global standard, justified? ~

(1) The pivotal point for analyzing the current situation: How should we view the unprecedented worldwide decline in interest rates?

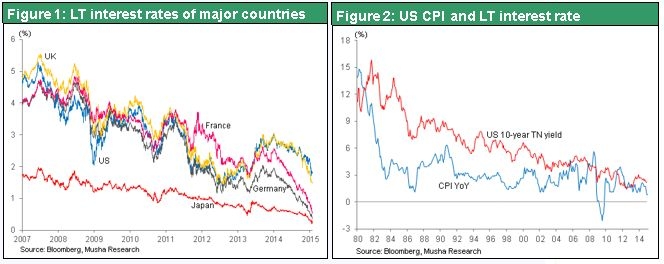

The world has reached the point of a decisive battle. The time has come to determine a victor. How we interpret the unprecedented downturn in interest rates holds the key to this battle. Countries around the world are experiencing a dramatic downturn in interest rates that no one could have foreseen. In Japan, the long-term interest rate fell below 0.2% to the 0.1% level at one point. This is virtually no return at all. In Europe, the long-term interest rate in Germany is at the 0.4% level. The strategic response to these events will differ depending on our interpretation of the meaning of this unprecedented global drop in interest rates. There are two conflicting views among investors, analysts and the academic community. We must select one. Adopting the stance of a neutral observer is not an option.

One position is to regard low interest rates as evil. Low interest rates are viewed as the result of two negative events: (1) a sharp erosion in the ability of companies to earn profits from invested capital and (2) excessive monetary easing by central banks and the associated artificial bubble in bond prices. This is the majority view. Leading supporters of this stance include Bill Gross in the US and Kazuo Mizuno in Japan. Many investors and opinion leaders believe that falling interest rates are bad. They have an ambiguous fear that low rates are a sign of a dark future. Furthermore, people who embrace this view think that low interest rates are due to a scarcity of growth opportunities holding down the amount of investments. They also think that massive quantitative easing by central banks is behind falling interest rates. Their position is that central banks are doing nothing more than buying time with measures to force interest rates down by boosting the money supply even though the economy is unable to grow. They think that the current worldwide monetary easing will fail, resulting in economic problems in the future. Based on this negative view, they conclude that this is a time to avoid all risk.

This leads to the question of what logic we should use in response if we think that low interest rates are good. Low interest rates could be the result of (1) higher capital productivity that produces surplus capital and (2) higher corporate profitability that produces surplus earnings. If this is true, then low interest rates are the precursor of a bright future. In this case, the conclusion is that investors should aggressively increase risk exposure. But this is currently the minority position.

The consensus view is that low interest rates are evil

At this point, no one knows which of these two views is correct. The direction of the economy in 2015 and afterward will determine the winner. At the same time, there will be a clear difference in the performance of investments. People with a negative view will sell stocks and people who think low interest rates are good will buy stocks.

In Japan, there is overwhelming support for the pessimistic interpretation of low interest rates among opinion leaders and the media. However, with respect to supply and demand, the optimistic view is clearly predominant. The Bank of Japan is using quantitative easing to vigorously encourage risk taking. With long-term interest rates in Japan now at almost nothing (an extremely flat yield curve), the country’s financial institutions and investors can no longer earn any income from loan-deposit spreads and bond holdings. In this environment, the only way for financial institutions and investors to earn a profit is to significantly increase their holdings of assets with risk, like stocks, foreign currency-denominated assets and real estate, where they can obtain an adequate spread. In other words, investors have no choice other than to make a move now without waiting for the theoretical determination of a winning view to occur.

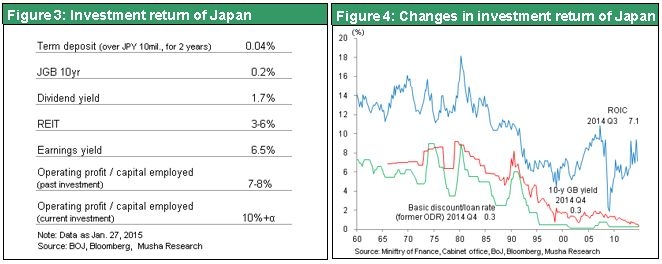

We have advanced to an age of big investment returns as surplus capital is increasingly being pushed out into the real economy and stock market. The apparent conclusion is that we are on the verge of a powerful stock market rally. Interest rates in Japan are 0% for bank deposits, 0.2% for government bonds. But for stocks, the dividend yield is 1.7% and the earnings yield is 6.5%. This gap clearly shows that stocks are a more appealing investment. Moreover, there is likely to be no change in the channeling of funds to stocks as long as the current financial policies continue.

(2) If lower interest rates are good, how can this be explained?

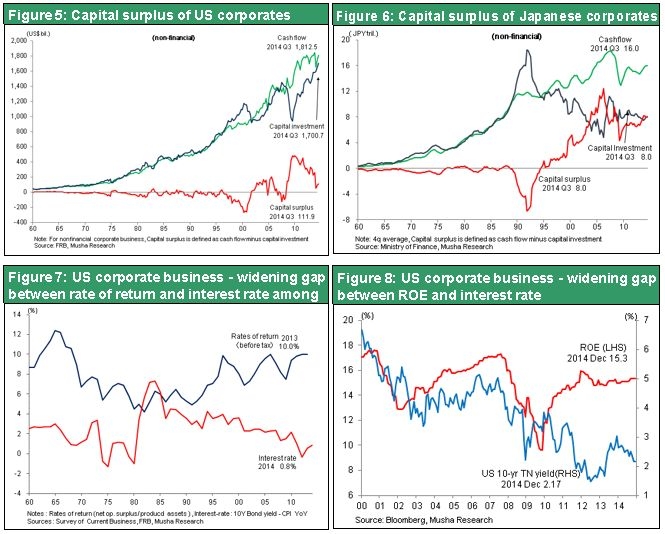

One positive factor responsible for the current downturn in interest rates is the rise in productivity, particularly for capital, due to the unprecedented technology revolution. Higher capital productivity (which equates to a big drop in the price of equipment) significantly cuts the cost of capital expenditures and starting new companies. My view is that the excess capital created by these lower expenses has been exerting downward pressure worldwide on long-term interest rates.

For pessimists, the key point is that lower interest rates lead to a decline in the ability of companies to create value that is detrimental to capitalism. However, this position is unable to explain the strong growth of corporate earnings in the US, Japan and Europe. Pessimists have been saying that today’s strong earnings will not last long. They believe that earnings will plunge when the inevitable economic recession occurs, resulting in sharply lower dividends and bankruptcies as weaker companies fail. But this stance is not persuasive because of the steady growth in earnings following the financial crisis.

Apple, Google and other comparatively new US companies that are highly profitable do not require substantial investments. Small investments allow these companies to use their strong earnings to acquire other companies and buy back their stock. These events show that we are in an era where companies are looking for new ways to use their funds externally. In the past, procuring funds was the greatest challenge for Silicon Valley start-up companies. But today, fund procurement is much easier because of technological progress involving cloud computing, the Internet and other fields. At Japanese companies too, we have seen the emergence of surplus capital as earnings and capital productivity increased (resulting in a lower cost of equipment and other investments).

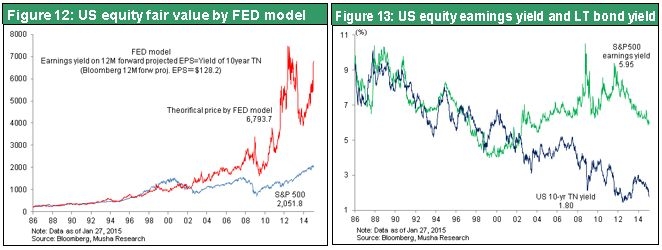

As I have just explained, the global technology revolution has significantly boosted earnings while significantly reducing the amount of investments they require by raising the productivity of capital. The result has been a decline in long-term interest rates. If this is true, then we should regard lower interest rates as a favorable event. As you can see in figures 3, 4, 5 and 6, interest rates (the cost of capital for companies) have dropped quickly as profit margins (the ability of companies to generate earnings) steadily improved in Japan and the US. The gap between earnings and interest rates is now very large. Contrary to the beliefs of the pessimists, the greater ability of companies to create value has been invigorating capitalism, which has led to surplus capital and lower interest rates.

Falling interest rates make it possible for companies to make investments at more advantageous terms because of the lower cost of funds. This creates a positive outlook for the future. In this type of environment, quantitative easing by central banks should succeed at fueling economic growth and higher stock prices while preventing deflation.

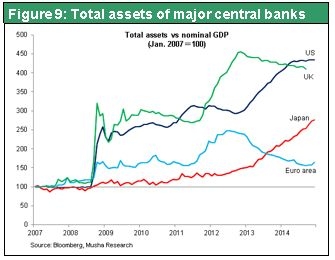

(3) Long-term QE, the absolute 2% inflation goal, and non-absolute financial policies

On January 22, the European Central Bank announced its decision to continue implementing quantitative easing by purchasing 60 billion euros of assets every month until September 2016. Furthermore, ECB president Mario Draghi said that he will continue to use quantitative easing until achievement of the 2% inflation target is within sight. Central banks of the US, Japan and Europe are in agreement regarding two points. First is the 2% inflation target. Second is the resolve to do whatever is needed (no limit on quantitative easing) to reach that target. Unlimited quantitative easing for 2% inflation has become the global standard. The significance of this position is enormous. The 2% inflation target and quantitative easing are still the targets of much criticism (mainly involving doubts about the effectiveness of QE and its adverse effects). But all of these concerns have already been resolved by debates about these policies. Central banks of the US, Japan and Europe have no choice other than to continue expanding their balance sheets until their objectives are achieved regardless of the level of criticism. Furthermore, the US economic recovery following the financial crisis is proof that persistent quantitative easing is succeeding.

(4) The central bank revolution (2% inflation target and unlimited QE) is sparking a stock price revolution

The unprecedented magnitude of today’s quantitative easing means that financial policies are no longer fixed and absolute. The firm goal of 2% inflation was established and then governments stated that they will do whatever is needed to reach that target. In other words, central banks are determining the level of quantitative easing based on the probability of achieving the 2% target.

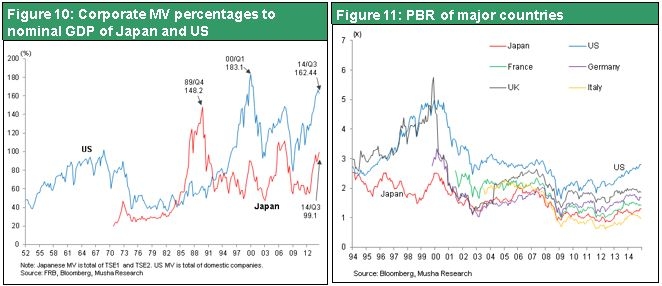

The proper level for stock prices depends on progress with reaching the 2% inflation target because quantitative easing has an immediate impact on stock prices. That means the volume of quantitative easing required for raising inflation to 2% will produce a substantial increase in the proper level for stock prices. As a result, we can probably say that stock prices, in addition to financial policy, have become linked to quantitative easing. Japan and the eurozone are still far below 2% inflation. Since we can expect to see stock prices continue to climb until this target is reached, the upside for stocks is enormous because Japan and Europe will have to implement quantitative easing on a massive scale. Figure 10 compares stock market capitalization with the GDP in Japan and the US. As you can see, there has been a big upturn in the US, which has vigorously implemented quantitative easing, creating a growing gap compared with Japan’s performance. This gap is also evident in the difference between stock PBRs in Japan and the US. Japan and Europe are following US down the QE path. As a result, we will probably see these two regions catch up to the US in terms of the ratio of stock market capitalization to GDP and the PBR.

The value shift is another way to justify the high stock prices in developed countries. Both labor productivity and capital productivity are climbing rapidly because of the new industrial revolution. The result is surplus labor and capital, which cuts the cost of the labor and capital that companies require. This is probably the reason for the extremely high profitability of companies in developed countries. In these countries, the ability of companies to create value is increasing even while their cost of doing business is decreasing. Higher corporate value and stock prices, which are linked to this value, are the obvious result of this situation.

Economics tells us that wealth (value) is created by the input of labor and capital at the production stage. However, this does not mean that labor and capital are the only sources of value. I believe the value is based on the following formula:

Labor + Capital + Knowledge = Value

Labor and capital alone have no value. The source of value creation is the knowledge needed to combine labor and capital. Companies have this knowledge, which is eventually reflected in their stock prices. People without wisdom might easily choose government bonds with returns of less than 1% , but certain management with wisdom (for example, Mr Nagamori of Nidec) would seek returns of 5% or 10% through M&A. If we embrace this view, then there is no reason for the surplus capital produced by the industrial revolution and rising capital productivity to be sleeping in risk-free government bonds and bank deposits. The obvious theoretical conclusion is that surplus capital should be channeled to stocks, where these funds can generate more value.

If the world can achieve a proper allocation of capital by shifting funds from government bonds to stocks, the endless global decline in long-term interest rates will finally stop. Ending this decline would most likely bring about the restoration of the Fed model.

In my next report, I will discuss the reasons for my belief that quantitative easing may eventually lead to the restoration of the Fed model.