Apr 07, 2015

Strategy Bulletin Vol.137

A view going beyond those of Piketty and Mizuno – How do we resolve r1>g>r2?

Miller

I am Kazuko Miller, a director at Musha Research. Mr. Musha, what is the most basic key to understanding the current situation in the economy and markets? Also, although this is an extremely abstract question, why do you think this type of question is necessary?

Musha

I believe that almost everyone is confused about today’s markets, the global economy and government policies. No one has a definitive view based on a correct perspective concerning what will happen if a certain action is taken. Many people have differing opinions. I think that the public is becoming increasingly confused by hearing the various positions of opinion leaders. This is why I would like to provide even a brief explanation of the most important points concerning the economy and markets.

I believe that the key point is the relationship between the return on capital and growth. Everyone is well aware that the return on capital (“r”) is greater than growth (“g”). This is the stance of the well-known economist Thomas Piketty. Dr. Piketty believes that the very high return on capital and low economic growth rate will cause wealth inequality to continue to increase. Failure to stop this growing inequality will undermine the economy. He thinks that policies are needed to correct this widening inequality and wants countries to establish progressive taxation of capital. There is no doubt about this inequality. In New York, the Occupy Wall Street protest movement started because only 1% of the population controls almost all of the wealth. Evidently, economic conditions that fuel a boom in the wealth inequality theory actually exist today.

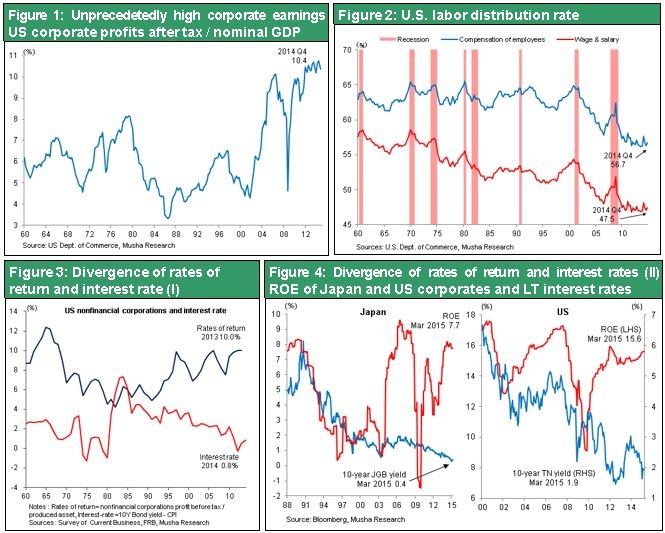

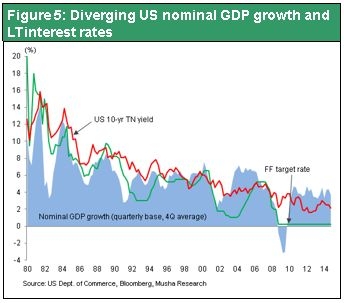

But it is a mistake to think that this view alone makes it possible to understand today’s economy. Wealth inequality is only one side of what is happening now. Another side is that the return on capital is lower than growth. There are two aspects of the return on capital. One is r1, which is a capital return higher than the rate of economic growth. However, there is also r2, which is the opposite situation. Just what is r2? The answer is long-term interest rates. Right now, long-term interest rates are at historic lows in many countries. The long-term interest rate is at the 0.3% level in Japan, the 0.1% level in Germany and even in the United States less than 2%. These unprecedented low interest rates have persisted for some time. So what is happening? The return on capital and earnings growth at companies are far higher than the economic growth rate. As Dr. Piketty says, the rich are becoming richer and companies are earning a lot of money. The result is unfairness.

At the same time, long-term interest rates are below the economic growth rate. Some economists explain the current situation by focusing on the fact that interest rates are less than the growth rate. For example, Kazuo Mizuno says that we are finally nearing the end of capitalism. But his position is that the return on capital is falling faster than the pace of economic growth. He says this is proof that the sharp drop in long-term interest rates has been unable to boost returns on capital. He concludes that this is precisely the demise of the capitalist economy. Mr. Mizuno believes that the capital return is lower than the economic growth rate, which is the opposite of Dr. Piketty’s position. A closer look reveals that Mr. Mizuno’s belief is justifiable. But a closer look at the other side consisting of people like Dr. Piketty shows that inequality is growing as people with wealth become even wealthier. In fact, both of these trends are taking place simultaneously. Consequently, we cannot explain today’s economy by looking only at one side of inequality between the return on capital and rate of economic growth.

What equation of unequals should we then use for this explanation? I think the answer is r1>g> r2. In this equation, r1 is corporate earnings or the profit margin and r2 is the cost of capital for companies, which equates to interest rates. Growth is g. So this existence of two inequalities is a major characteristic of the current situation. As I said earlier, earnings and profit margins at companies are very high. As a result, companies are paying dividends of 2%, the earnings yield on stocks is 6% to 7%, and the ROE is about 10%. Next let’s look at the cost of procuring the funds that companies need for their operations. Government bond yields are less than 1% in Japan and Europe. Even in America it is just at the 1% level. The result is an enormous gap between earnings and interest rates. This is another major characteristic of the current situation. Normally, profit margins and interest rates should move largely in tandem. This was true in the past. The reason is that interest rates should obviously increase when the economy and earnings are strong. The conclusion is that profit margins and interest rates are actually the same thing. According to economics textbooks, r1 should equal r2. But now we see a big gap. Sandwiched by this gap is a stagnant economic growth rate. The most important key to understanding today’s economy is deciding how to interpret r1>g> r2.

Miller

Is this associated with the investment strategy recommendations of Musha Research?

Musha

Yes because …

Miller

Get rid of cash?

Musha

That’s right. Investments in r2 have produced almost no returns. But investments in r1 have generated very high returns. So people should sell r2 and buy r1. Or they should increase their leverage by borrowing money (r2) and buying r1. The question is whether or not the combination of high profit margins and low interest rates will continue for a long time. The gap between profit margins and interest rates has existed for 10 years. As you may remember, Alan Greenspan, who was then chairman of the Fed, first used the word “conundrum” in 2005. The conundrum was low interest rates despite economic growth, higher corporate earnings and monetary tightening by the Fed. Subsequently, this conundrum temporarily appeared to disappear because of the global financial crisis and other events. But once the crisis ended, there was again a big gap between profit margins and interest rates as if nothing had happened. Therefore, this phenomenon has now lasted for a decade. This raises the question of what people should have started doing 10 years ago. Investors who borrowed money and bought stocks then would have earned big profits. The same is true today.

Now let’s think about if the current inequality can be corrected by taxing capital as recommended by Dr. Piketty. I think that this taxation alone is not enough. Mr. Mizuno believes that falling interest rates are a sign of a sharp downturn in the return on capital, signifying the demise of capitalism. But I don’t agree. Coming up with an answer is impossible without determining how to interpret the equation of unequals with “g” in the middle.

I think the short answer is that we should view the current unusually high profitability as the cause of the unusually low interest rates. Earnings at companies are enormous. Since companies are unable to reinvest these funds, the money has become idle. The result is declining interest rates. In other words, high earnings and low interest rates are caused by the ongoing advances with technology and economic globalization. High earnings and low interest rates are very likely to be simply different sides of the same coin. So what is going to happen after the current environment of strong earnings and low interest rates? One possibility is an economic downturn resulting from idle capital despite a continuation of economic growth. Another possibility is a steady increase in damage to the economy.

The significance of idle money is the existence of idle labor, too. If companies alone earn profits as capital and people remain unused, there is a risk of an economic collapse. But if idle money can be used effectively to boost economic growth, the economy may become stronger and living standards improve. Properly using the equation of unequals (r1>g> r2) can lead to prosperity as stock prices climb, resulting in a better standard of living. The current quantitative easing measures of developed countries are aimed at narrowing the gaps separating r1, g and r2 by creating new demand or using money effectively.

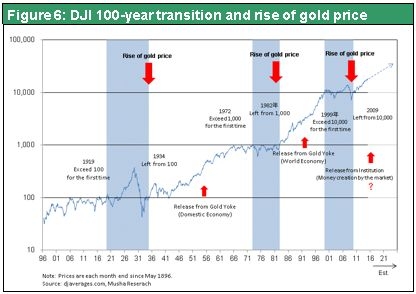

If nothing is done about these gaps, there is a possibility of a drastic economic downturn on the scale of a depression. I will talk more about this point at another time. What I want to emphasize now is the importance of the equation of unequals. How we decide to interpret the differences among r1, g and r2 will be the most decisive factor for establishing outlooks for stock investments and the economy. Determining this key will require more than the positions of opinion leaders like Dr. Piketty and Mr. Mizuno. Please keep this point in mind. The critical point is demand creation by utilizing idle capital and idle labor. Quantitative easing should be regarded as the nucleus of measures to achieve this goal. I believe the ramifications of these measures will be on the same magnitude as the effects of the end of the gold standard and the appearance of inconvertible paper currency 80 years ago.

Miller/Musha

Thank you very much.