Apr 13, 2015

Strategy Bulletin Vol.138

Outlook and Implications concerning the Asian Infrastructure Investment Bank Problem

- How will the U.S. respond to its humiliation?

<Contents>

(1) The first humiliation for the United States

(2) Why China’s proposal for forming the AIIB was successful

(3) The reason that China wants to establish the AIIB

(4) U.S. policies concerning China may change significantly

(5) Can China accomplish the goals of establishing the AIIB?

(6) How the AIIB may affect Japan

Miller

I am Kazuko Miller of Musha Research. Today, we will examine problems associated with the participation of 57 countries in the Asian Infrastructure Investment Bank (AIIB). This was a very surprising outcome because all European G7 countries are participating, even though the United States asked for a boycott.

(1) The first humiliation for the United States

Musha

Deciding how to view the AIIB is an extremely important topic right now. No one expected to see so many countries participate in this bank. This was a big surprise for a large number of people. Today, I would like to talk about how we should view these activities involving the AIIB.

In a few words, the U.S. policy regarding China is engagement and hedging. I think the United States is dealing with China while alternating between engagement and hedging strategies. When China supported the creation of the AIIB, the United States responded with hedging rather than engagement. But I think the United States actually started with actions aimed at elimination.

But now AIIB participation includes not only Asian countries but also the most important U.S. G7 allies in Europe: the United Kingdom, Germany, France and Italy. Even Israel, also a critical U.S. ally, is an AIIB participant. In all, 57 countries and regions have announced they will participate. So this was a spectacular failure for the U.S. policy of using hedging to hold back China. I believe this was a very humiliating outcome for U.S. diplomacy. U.S. leadership has been undermined and China has succeeded in creating a new order. For many years, China has been asking the United States for a new relationship of two major world powers. China has wanted a new world order backed by the United States and China, the world’s two powerful countries (G2). The United States has always rejected this idea but is now forced to recognize this new order.

(2) Why China’s proposal for forming the AIIB was successful

Miller

Is this a historic turning point? Perhaps this is the end of the era where the United States is the world’s only superpower.

Musha

Until now, the United States played a central role in creating all rules for the world. And the world responded to U.S. wishes. There is undoubtedly a growing perception that the AIIB may trigger a shift in the world order itself. This may be the end of U.S. dominance. U.S. influence may be starting to decline as the clout of China increases. However, I think this view is far off target. I believe there are two reasons for the success of China’s AIIB initiative.

First is the global demand for this type of institution. The existing IMF and World Bank framework has not been able to meet this global demand sufficiently. Today, there is a massive volume of idle funds in the world. This is why long-term interest rates are so low in major countries like Germany, Japan and the United States. At the same time that this surplus capital exists, the world also has the problem of inadequate demand. Despite the surplus of capital, the IMF expects sluggish economic growth because of insufficient demand. Consequently, idle money in the world must be converted into demand in order to increase the pace of global economic growth. Where is the strongest demand in the world today? The answer is Asia because of the large volume of infrastructure investments. As a result, channeling the world’s surplus funds to Asian infrastructure investments can speed up global economic growth. This enormous framework is extremely rational. The AIIB that China supports is a perfect match for the need to convert idle funds into demand. I believe this is the first reason for the big success of China’s AIIB proposal.

The second reason is mismanagement of this issue by the United States, resulting in its poor response. As I explained earlier, there was a huge bottleneck that blocked utilization of surplus funds in the world. The United States was extremely negative about eliminating this bottleneck. To resolve this problem, the existing IMF-World Bank framework should have been strengthened so that excess capital could be directed to infrastructure investments in emerging countries. However, no country was more negative about IMF and World Bank reforms than the United States. This situation caused much dissatisfaction among emerging countries, European countries and China. That means the United States is now suffering from the result of its own negative stance about international financial system reforms. So I think this unexpected success of China’s initiative is very logical based on these past events.

(3) The reason that China wants to establish the AIIB

Miller

I see. China wants to establish the AIIB for these two reasons associated with the United States. But what is the overall objective?

Musha

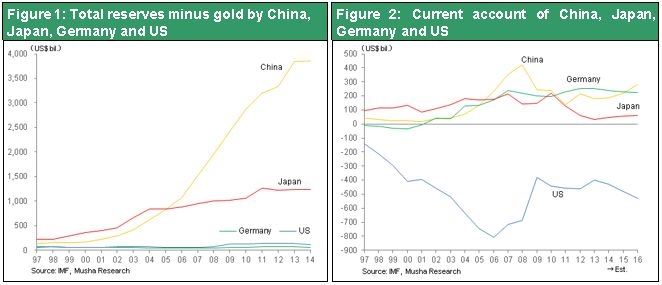

China was able to adopt a broader view for solving this problem involving the global economy and international finance. But even more important is the existence of circumstances within China that made creating the AIIB critical. China’s economy is currently struggling with a massive volume of idle funds and a severe shortage of demand. Foreign currency reserves are US$4 trillion in China, the largest in the world. This is the result of a huge trade surplus created by using cheap labor to become highly competitive. China has four times more foreign currency reserves than Japan. Therefore, China must find a way to utilize these funds effectively.

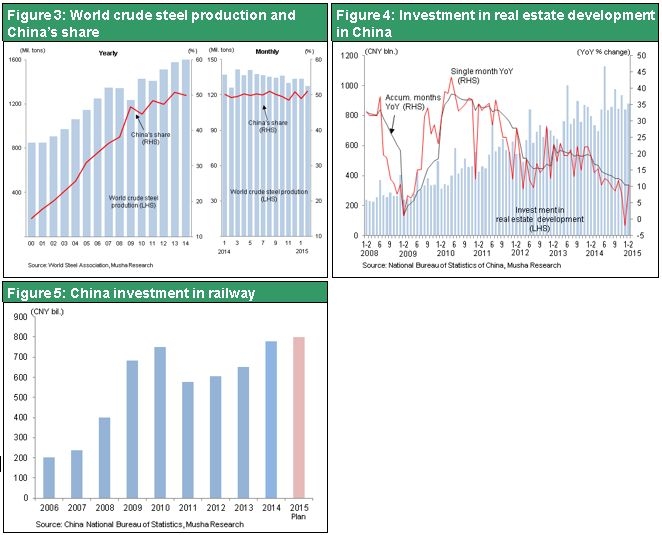

One more reason that China needs the AIIB is the enormous oversupply of various goods caused by distorted economic growth. China accounts for half of the world’s crude steel production capacity. But more than one-third of this capacity is estimated to be unnecessary. To fully utilize this excessive crude steel production capacity, China must create demand somewhere. However, there are currently no sources of new demand within China.

China’s growth in demand has been fueled by three sectors. The first is capital expenditures by large companies. But companies in China can no longer increase these expenditures. Increasing supply capabilities even more is impossible because there is already a surplus of production capacity. The second is the key role of massive real estate and housing investments in creating demand in China. But investments went too far in this sector, also. Today, China has a remarkable number of empty high-rise residential buildings. Obviously, making more investments in this sector is impossible. In fact, housing prices in China have started to fall and there is a pronounced slowdown in housing and real estate investments. This is why infrastructure investments, the third sector supporting steel demand, are the sole remaining major source of growth in demand in China.

Strong growth continues in China’s expenditures for economic stimulation projects like expressways and high-speed rail lines. But these public-works investments will become burdens on the government in the future. So the number of these projects is about to start falling. Clearly, China no longer has any way within the country to absorb the surplus production capacity. The country therefore made the very obvious decision to end the inadequate demand problem through global rather than domestic activities. Japan, as well, has many times turned to overseas activities to deal with inadequate demand as serious economic problems slowly emerged.

China has been creating many plans in addition to the AIIB. One example is its string of pearls strategy. The aim is to increase influence over sea routes from the Pacific Ocean to the Indian Ocean. China will then develop this entire region and build a base for the country’s energy security. One more example is the one belt, one road strategy. This is the modern version of the Silk Road concept. China’s intent is to create an expansive belt of economic prosperity that stretches through central Asia to the Middle East and Europe. Another objective of China is to eliminate imbalances within the country by creating opportunities for investments in other countries. Consequently, from the standpoint of China, the successful establishment of the AIIB with the support of Asian and European countries is an extremely significant strategic accomplishment. China has good reason to be proud of this achievement.

(4) U.S. policies concerning China may change significantly

Miller

How do you think the United States will react to the creation of the AIIB without its participation?

Musha

Now that we have reached this point, I don’t think the United States can refuse to recognize the existence of the AIIB. The United States will probably have to manage this situation in an appropriate manner while inviting the AIIB, which is backed by China, into the framework of international finance. Therefore, although Japan is not yet participating in the AIIB along with the United States, Japan will ultimately become a participant. I think that the AIIB will need to transform itself into a global institution by achieving transparency under China’s guidance. However, this will be a mixed blessing from China’s standpoint. This is because China’s objective is to use its surplus funds to heighten its profile in the world and build a stronger position of geopolitical world leadership. In somewhat stronger terms, China has imperialistic ambitions.

But if European countries and Japan, and perhaps the United States, stand in the way of China’s goal, China will not be able to do as it wants because of numerous checks on its activities. In this case, China may be subject to restrictions. The country could spend its money but would be unable to control outcomes. Consequently, the United States is unable to reject the creation of the AIIB because actions are already under way. I think the only option for the United States now is to switch its stance to altering the AIIB establishment process so that an institution that reflects U.S. wishes is created.

At the same time, the United States should reflect on its mistake, which was to allow this situation to occur through its negligence. Specifically, this negligence was the failure to promote reforms of the IMF and World Bank. I think the United States will reinforce this weakness, which will be very good news for the world.

The third U.S. reaction that I foresee is to further strengthen hedging. China’s clout became much greater as the country negligently failed to recognize the seriousness of the situation. As a result, I think China’s emergence was a big shock for the United States. If the United States does nothing about China’s more prominent global presence, there could be a further increase in the influence of China, which is something the United States does not want. China embracing democracy to become a citizen of the world is what is wanted. But China has a Communist one-party system. Moreover, China has recently been greatly tightening controls on thoughts and ideas. China’s universities are called the vanguard of China’s measures to mold what people think in the spirit of Marx and Lenin. We are also seeing the emergence in China of the belief that schools should adhere to the country’s national philosophy, which is based on Marx and Lenin.

If the profile of this type of China grows on the international stage, China could become a serious threat to democracy in the world. Therefore, I think the United States must pay considerable attention to holding back the uncontrolled emergence of China. China is becoming increasingly cooperative in the world regarding economic measures. On the other hand, China has become more aggressive militarily than anyone expected. The country is occupying disputed islands in the Spratly Islands, building bases and taking other actions. If the United States looks the other way as China expands, Taiwan could be next. Taiwan is a vital interest of China, so China may say that the United States should get out of Taiwan. Going farther down this path could lead to all of Asia coming under the influence of China. At one time, China’s President Xi Jinping said that the Pacific Ocean should be divided between the United States and China. The U.S. sector would be up to Hawaii and everything west of that would be China’s sphere of influence. This division could become reality. Of course, the United States would never allow this to happen. On the other hand, the United States may adopt a tougher stance about containing China while recognizing the existence of the AIIB.

We must keep in mind the fact that the United States is providing close and extensive support for the Chinese economy. China is using a variety of U.S. technologies and has access to the global market, including the United States. This is the new framework based on expectations in the United States and Europe for China to become a democratic country with a market economy. But China is receiving the benefits of this framework while making no effort to bring about change. There is a possibility that China will strengthen its global presence without making any improvements at all involving intellectual property rights, the rule of law, democracy, human rights and other issues. If this happens, there would naturally be considerable resistance.

The United States would very likely use a variety of measures to halt China’s self-centered actions consisting of one-sided demands accompanied by no attempts to change. First would probably be a resolute stance for refusing to allow any further military expansion by China. Next, I think very strong checks on China’s activities would be imposed. This would cover intellectual property rights, the rule of law, cyber attacks and cyber spying, which China is believed to be engaged in, and other activities. Consequently, the establishment of the AIIB, which on the surface looks like a success for China, must also be regarded an event that may cause a major shift in the U.S. strategy for China.

(5) Can China accomplish the goals of establishing the AIIB?

Miller

You believe that the United States will step up its hedging. As this takes place, do you think that China’s actions, including the formation of the AIIB, will succeed at achieving the country’s goals?

Musha

I do not think that China’s actions will be successful. Initiatives by China will probably succeed at creating a fund that the entire world can use. However, China’s goals are to end the contradictions of its domestic economy and heighten its geopolitical stature in the world. But creating this fund is very unlikely to enable China to accomplish its objectives for two reasons.

First, signs of weakness are appearing in many ways concerning China’s global activities that to some degree prioritize the country’s own interests. Myanmar is an excellent illustration. China plans to develop its Yunnan province and neighboring Myanmar by building a pipeline, rail line and expressway to link these two regions. China would then effectively have control of this area. However, the shift of Myanmar to democracy has completely halted plans for these Chinese-led pipeline and rail line projects. Major construction projects are now under way in Myanmar with the support of Japan and the United States, which are democratic countries. I think we can say that China’s strategy to gain influence over Myanmar has failed.

Similar events are taking place in Sri Lanka. The regime in Sri Lanka that aimed for economic growth by deepening ties with China is no longer in power. The people of Sri Lanka have elected a government that wants to distance the country from China. Sri Lanka is transitioning to a more balanced policy of moving closer to democratic countries like the United States, India, Japan and European countries. So China’s attempt to build ties with Sri Lanka failed as corruption and environmental problems sparked a backlash by the residents of Sri Lanka.

Therefore, activities by China in other countries based solely on its own interests have not produced benefits for these countries. Instead, numerous events have clearly demonstrated that these activities are creating resentment. China is looking for places to direct its surplus supply. But I think China will have to make revisions to its policy of using overseas activities for its own benefit by utilizing nearby countries as destinations for this surplus supply.

The second reason is tied to problems with the Chinese economy. The question is whether or not these are problems that can be solved by overseas activities. An imbalance between investments and consumption is at the core of China’s problems. China has achieved remarkable economic growth. But the surplus capital generated by this growth was used for investments that further increased manufacturing capacity. This created a framework in which the beneficiaries were government agencies and officials, large corporations and government-owned companies that were associated with these investments. China’s supply side continued to grow but there was little growth on the demand side. The result was growth in surplus funds. Solving this problem will require a shift from an economy centered on investments to an economy centered on consumption. China needs a big change of direction to a policy of creating demand by raising the living standards of its citizens.

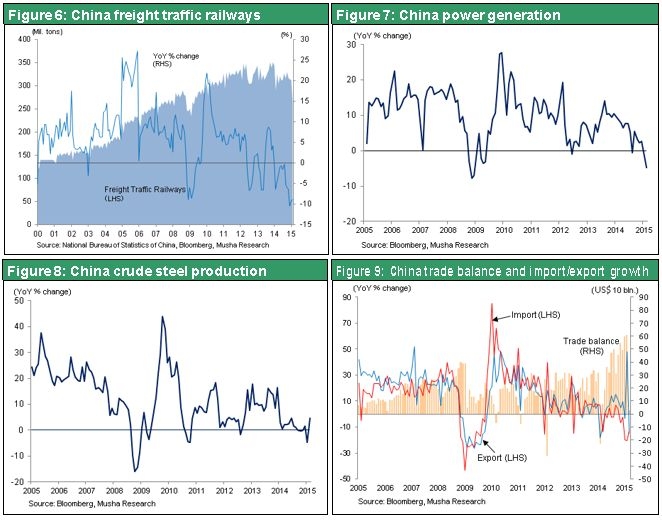

Simply put, China should increase domestic demand and consumption by raising labor’s share of income. But China is not making any efforts to alter its demand structure. Instead, the country’s policy is to send its excess supply to other countries. This policy is not likely to succeed. There is a high probability that China’s economic problems will become even more serious. Earlier, you asked if the AIIB will erode the dominance of the United States and make China more influential. The reality is precisely the opposite. Right now, the U.S. economy is very healthy and the United States is strengthening its position as world’s only economic winner. At the same time, numerous problems in China are causing its economic growth rate to slow as economic problems become worse. Many economic indicators in China are now in negative territory. Rail cargo transport volume, crude steel production, electric power output and the monetary value of imports are a few examples. China’s economy has reached a difficult situation where economic growth is no longer possible. The conclusion is that China’s current policy of responding to internal difficulties by extending its overseas influence is virtually certain to fail.

As you can see, many complex elements are behind the launch of the AIIB. We cannot adopt a one-sided view of this issue. Is this the end of the era of the United States? Should Japan participate immediately in the AIIB? I think there is no need to rush to reach a conclusion.

(6) How the AIIB may affect Japan

Miller

Japan has not yet made a decision about AIIB participation. How will the AIIB affect Japan?

Musha

I don’t think the AIIB will have a significant influence on Japan, regardless of upcoming events involving this bank. I expect that the AIIB will provide a certain amount of loans that will result in a certain amount of investments in emerging countries. Even if these investments create a little demand for Japanese companies and the Japanese economy, the benefit will be very limited. After all, demand for the products of Japanese products will exist even without these investments. So AIIB-related demand will not have a meaningful impact on the Japanese economy.

The most important implication of the AIIB is a big shift in the global strategies of the United States. As I explained earlier, the United States has used a policy of engagement and hedging for China. Until now, the United States has placed much more emphasis on engagement than hedging. The aim was to make growth in China the driver of global economic growth by inviting China to join the global community. Now, the United States is obviously having regrets about its decision to welcome China, which was then somewhat defenseless, into the global community. To repeat, China is increasing efforts to shape the thoughts of its citizens. China is also increasing its military expansionism. There is no doubt that China is on a course leading to a collision with the United States. Military and other U.S. leaders are becoming increasingly aware that China’s actions must be contained quickly in order to avoid an extremely dangerous situation in the future.

As a result, the United States will probably pull back from its excessive engagement policy of the past and place more weight on hedging. Japan will have to be the most important U.S. ally as the United States alters its stance. Looking at responses to the AIIB, we have seen European countries agree to participate solely from economic and financial standpoints. But these are not the standpoints that cause alarm in the United States. Geopolitical and military issues are the primary concern. Japan, Taiwan, Vietnam, the Philippines and other Asian countries share this concern with the United States. I think the United States will have to shift its priority to reinforcing ties with these Asian countries in order to contain China’s expansion. Due to this shift, the Japan-U.S. alliance is very likely to become even stronger.

When Prime Minister Shinzo Abe goes to the United States in April, he will become the first Japanese prime minister to address a joint session of Congress. This prestigious invitation obviously shows how much the United States needs to strengthen its alliance with Japan with respect to current geopolitical events. Overall, I believe that events triggered by the AIIB will create an obvious trend reflecting the unavoidable need to strengthen the Japan-U.S. alliance. Furthermore, I believe that this trend will have an extremely positive effect on the Japanese economy and Japanese stocks.

Miller

You have used the word ‘geopolitical’ many times. Please explain the meaning of geopolitics.

Musha

Geopolitics is a term for an extremely complex concept involving how geographic, political and military factors affect the ability of countries to survive. This is more than just economics. Geopolitics is the process by which the balance of power, including politics, military strength and other items, create the world order. From the viewpoint of this type of global power, looking back on Japan’s recent history and financial markets reveals some very interesting facts.

In the modern era, Japan has experienced two periods of prosperity. Stock prices rose considerably during both of these periods. The first period of prosperity started in 1902 with the signing of the Anglo-Japanese alliance and lasted for about 30 years. So what happened after 1902? There was a war with Russia in 1905 and the start of powerful economic growth in Japan. In addition, Japan gained enormous strength during this period as one of the Asian powers and the only imperialist country in Asia. All of this started in 1902. So the 1902 Anglo-Japanese alliance was a decisive event for the modernization of Japan.

At that time, the United Kingdom controlled the world’s oceans and had no alliances, even with the United States, due to the pride in its self-reliance. Japan was the first country chosen for an alliance. Why? Britain wanted to counter the southern expansion of Russia. During the Crimean War (1853-1856), Russia fought the Ottoman Empire and others. The United Kingdom entered the war to back the Ottomans because Russia’s goal of southern expansion was a major geopolitical threat for the British then. Forming an alliance with Japan was therefore necessary to keep Russia out of Asia. This Anglo-Japanese alliance was also the reason for Japan’s victory in the Russo-Japanese War (1904-1905). We can say that this was the starting point of Japan’s growth. Establishing the alliance with the United Kingdom was therefore the event that quickly transformed Japan, an island nation in Asia, into one of the world’s greatest powers.

The second period of prosperity started in 1951 with the signing of the San Francisco peace treaty. This was the beginning of the Japan-U.S. security partnership. For several years after the war, Japan had no clear objectives. But the establishment of the U.S. alliance enabled Japan to decide to focus on rebuilding its infrastructure and economy. Forming this security partnership was important because the cold war had just started in 1950. For a while after the end of World War II, the United States and Soviet Union enjoyed a honeymoon. But the outbreak of the Korean War sparked the beginning of a cold war between East and West. As a fortress of freedom in Asia, Japan was a very important ally for the United States. To make this ally stronger, the United States started openly and secretly backing up the Japanese economy. This was the start of Japan’s postwar prosperity.

Prosperity during this period reached its peak in 1990. What happened? The Berlin Wall came down in 1989 and the Soviet Union collapsed in 1991. So 1990 was about the time that the enemy shared by the United States and Japan disappeared. The United States no longer needed to support Japan for geopolitical reasons. In 1990, Japan’s asset bubble burst and the prolonged period of prosperity came to an end. Looking back at Japan’s history since about 1900 therefore reveals a close relationship between the country’s prosperity and changes in geopolitical factors.

Now the Japan-U.S. security partnership is about to become stronger. I think there are excellent prospects for this to become the backdrop for Japan’s third period of prosperity. I think that the unexpected speed at which China gained strength is the biggest regret of the United States and the event that requires attention most of all. I think this is also true of the unexpected speed of Japan’s decline. China’s emergence and Japan’s decline are probably both largely the result of U.S. geopolitical considerations. When the Cold War ended in 1990, the extreme economic strength of Japan became a threat to the United States. This led to the yen’s unusual strength and Japan bashing. Next, instead of bashing Japan, the United States supported the economies of South Korea and other countries near Japan. The result was a dramatic shift in the balance of power in Asia. Recognizing its mistakes, the United States is starting to see the geopolitical need to once again give Japan a relatively greater economic profile.

As a result, only two years after the start of Abenomics, the yen has depreciated 40%. In the past, the United States would never have allowed this to happen. But now there were no U.S. objections at all to the yen’s decline. The reason is obviously a shift in U.S. geopolitical interests. Consequently, these interests are clearly connected to Japan’s economy and financial markets. For these reasons, establishing the AIIB has produced powerful geopolitical repercussions that will have enormous indirect effects on the economy and financial markets of Japan.

Stock prices in Japan have more than doubled since Abenomics began. Will prices keep going up or is this the end of the rally? The debate is becoming increasingly heated. Many people think that it is time for a correction after a rally of this magnitude. But I don’t agree. Because of the geopolitical background that I have just explained, I think we are very likely to see more price gains as a rally of historic proportions takes place.

In the past, there were very large increases in stock prices during all of Japan’s biggest bull markets. During the first half of Japan’s postwar era of rapid economic growth, there were three major bull markets. Prices rose more than five times during all three. The big bull market of this era’s second half pushed up stock prices an amazing 10 times. If a historic rally of this type is now under way, there is still much upside potential because stock prices in Japan have only doubled since Abenomics began.

I will explain at another time why this level of stock prices can be justified with respect to economic fundamentals, stock valuations, and the enactment of appropriate economic and financial policies. This is a point I have been discussing for some time. At this time, I want to stress that, from a geopolitical perspective, the foundation and conditions are in place for higher stock prices in Japan.

Miller

Your opinions are truly based on the big picture. Many of your statements were surprising viewpoints that I heard for the first time. I hope to see stock prices go up as I watch upcoming policies and actions to strengthen the relationship between Japan and the United States.