Jun 08, 2015

Strategy Bulletin Vol.140

Global economic growth fueled by Japan, the US and Europe while the BRCS (exc. I) economies weaken

A stronger dollar and rising stock prices in Japan and Europe will characterize the summer rally

(1) The obviously temporary nature of US first quarter weakness and outlook for faster growth in the second half

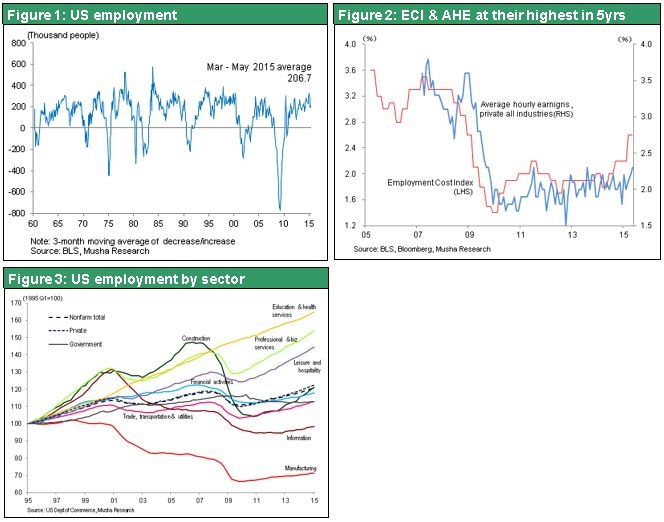

The strong US employment statistics for May make it very likely that the first quarter GDP decline of 0.7% was caused by one-time events like the cold winter, harbor worker strike and weakness in the energy sector as crude oil prices fell. There were also problems involving seasonal adjustments. With the US economy currently near full employment, upward pressure on wages and prices, although only moderate, is growing. The possibility of an interest rate hike in September or December has increased. As a result, faster US economic growth and a stronger dollar will probably be the central themes for financial markets in the second half of 2015.

Wages and labor input are increasing due to low US unemployment

The United States reported an increase of 280,000 non-agriculture jobs in May from the prior month, which was higher than most predictions. Furthermore, job growth for March and April was revised upward by 32,000. Employment was down only in the natural resources and mining category. Jobs fell for the fifth consecutive month because of the drop in the price of crude oil. Job creation was especially strong in categories linked to household demand, such as retailing, education, health care, and entertainment and hotels. Furthermore, there was a solid recovery in three categories where many jobs were lost during the global financial crisis: manufacturing, construction and the public sector. Clearly the breadth of the employment recovery is increasing. Although the US unemployment rate rose from 5.4% in April to 5.5% in May, there is no reason for concern because the cause is the resumption of job hunting by people who had given up on finding work.

Labor input (number of workers x working hours), which is closely correlated to the GDP, is up significantly. This figure increased 0.3% in May from the prior month following a 0.2% increase in April. The rate of increase in hourly wages is rising as well, climbing 0.3% in May after a 0.1% increase in April from the prior month. The result was faster growth in the income of workers (Labor input x hourly wage), which was up 0.6% in May after a 0.3% increase in April. This was the highest growth rate since January 2015. All of these high growth rates may be a signal that the US economic cycle is about to reach the second half of the phase of accelerating growth.

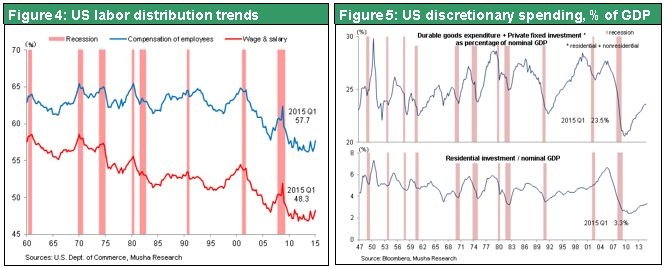

Expectations for higher consumer spending as labor’s share of income stops falling and corporate earnings growth slows

To determine the current phase of the economic cycle, we need to determine if we have reached the point where wage growth is increasing and consumer spending is increasing significantly. Past economic cycles provide useful insights. Usually, wages are held down and labor’s share of income decreases during the first half of economic growth. But in the second half, the speed of economic growth increases as rising wages (higher share of income for labor) fuel a big increase in consumer spending. The US economy is precisely at the point where labor’s share of income has stopped falling and is about to start rebounding. That means we can expect to see the US economy advance to a stage of rising consumer spending as wages climb. At present, the growth in wages has been absorbed by a higher rate of saving. But higher wages will eventually push up spending. In the United States, discretionary spending (consumer durables, housing, capital expenditures, etc.) has still not reached a sufficient level. Prospects are especially good for growth in housing construction because of the increasingly pronounced supply shortage during the past two years.

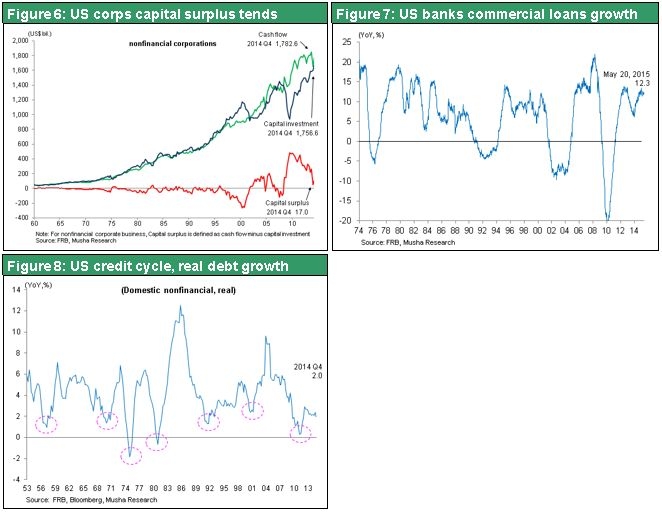

A slow upturn in US long-term interest rates is about to start

These economic fundamentals point to a steady increase in US long-term interest rates in the second half of 2015. Higher interest rates will probably keep the dollar strong. The imminent end of surplus capital at companies is the first reason to expect long-term interest rates to climb. As Figure 6 shows, the rebound in labor’s share of income is limiting growth in cash flows even as companies consistently raise capital expenditures. Massive free cash flows of the past decade are about to disappear. In addition, companies are using bonds (debt) rather than stocks (equity) to procure funds as interest rates remain low. One example is Apple’s decision to sell $17 billion of bonds to fund shareholder distributions. These sound financial moves by companies will probably cause long-term interest rates to move upward.

The second reason is the ongoing growth in credit because banks have finished actions needed to restore financial soundness. Credit growth and economic cycles have moved in tandem during the past decade. As you can see in the credit cycle in Figure 8, only four years have gone by since the cycle hit bottom in 2011. So the credit cycle is still young. Consequently, there is significant potential for growth in demand as the amount of credit continues to increase. Of course, higher demand for capital will cause interest rates to rise. The third reason to expect higher long-term interest rates is the interest rate hike by the Fed that is expected later in 2015. However, the Fed will apparently boost interest rates slowly and cautiously in order to prevent a negative impact on housing demand.

For these reasons, I believe that the US economy will enter the second half of its growth cycle in the second half of 2015 and early 2016. As a result, we can expect to see investors continue to shift their money from bonds to stocks as long-term interest rates move up slowly and the dollar strengthens.

(2) The European economy will continue to recover despite worries about Greece

Expectations grow for a recovery in Europe

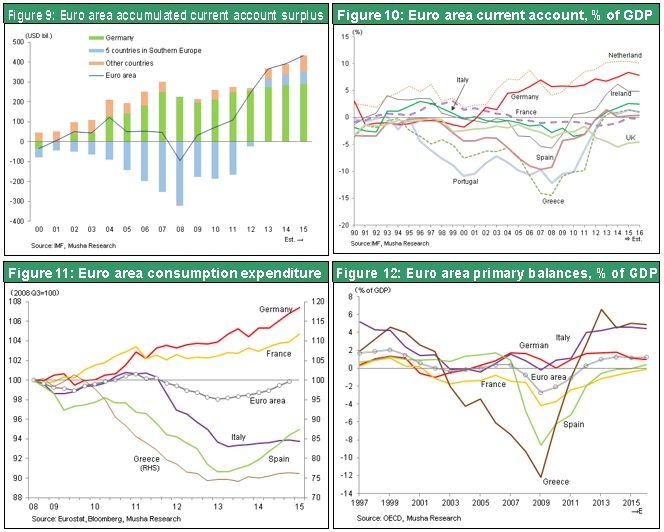

The OECD has raised its outlook for the European economy, which contracted 1.3% in 2013 and expanded 0.9% in 2014. The November 2014 forecast for economic growth has been raised from 1.1% to 1.4% for 2015 and from 1.7% to 2.1% for 2016. The ECB also has an upbeat outlook, predicting eurozone growth of 1.5% in 2015 and 1.9% in 2016. Forecasts are based on expectations for benefits from the weaker euro and cheaper crude oil as well as from bank loans, which have finally started to increase. Additionally, demand in southern European countries is likely to be supported by pent-up demand following a prolonged period of economic stagnation. The situation in Greece is also expected to start improving soon. Bond market volatility has become a source of uncertainty. For example, the German government bond yield surged from 0.1% to 0.9% in only about one month. However, this volatility is probably nothing more than a sign of a shift in interest rate trends. The same type of upturn occurred with Japanese government bonds immediately after the start of quantitative easing. There is no need to worry because investors are merely seeking a fair value for bonds after deflation has been eradicated. Looking at the eurozone imbalance (current account balance) in Figure 9, we can see that there is still a large surplus of savings in Europe, and especially in Germany. The upside potential for long-term interest rates in Europe is probably very small due to the ongoing quantitative easing of the ECB. Once the Greek debt problem has been resolved this summer, stability in European bond markets is likely to return.

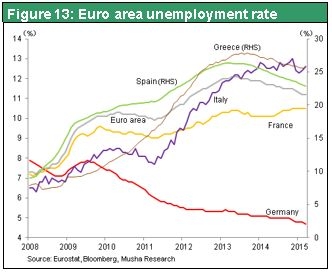

EU has room for negotiations because the external deficit and primary balance of Greece are improving

The current situation in Greece is significantly different than in 2010. At that time, Greece and other southern European countries were struggling with excessive consumption and debt. Today, these countries no longer have too much debt because of measures to hold down consumption. As Figure 10 shows, the external current account deficit of southern European countries has declined from about 10% of GDP to near zero or moved into a surplus. Moreover, based on the primary balance (budget deficit or surplus excluding interest expenses), Greece and all other southern European countries have a surplus (Figure 12). These improvements are the result of a dramatic decline in the standard of living of the residents of these countries as interest rates rose and governments cut budget deficits. On the other hand, unemployment increased in southern European countries because of the economic downturn.

In 2010, the proper response to the crisis was to hold down consumer spending in southern European countries while repaying debt. But these measures were followed by an economic pullback. Today’s problem is exactly the opposite of events in 2010. There is a surplus of savings and insufficient demand. The proper response is to eliminate surplus savings by creating demand. In other words, governments need to enact reflationary policies for the purpose of stimulating economic growth. But Germany is opposed to reflationary actions because of its reluctance to implement monetary easing. Although Germany has massive excess of savings resulting from a large current account surplus, it supports fiscal austerity. Due to this situation, there is a growing risk that the entire eurozone will become mired in the same type of deflation that plagued Japan.

Consequently, there is a legitimate reason for the demand of Greek Prime Minister Alexis Tsipras, leader of a far-left coalition, for the easing of austerity measures. Flexibility will be required as well at the IMF, EU and ECB, which have been demanding a strict continuation of tight budgets and debt repayments. The IMF repayment deadline has been extended to the end of June, so this is when Greece will reach a crucial point. Public opinion in Greece appears to favor meeting EU demands and keeping the euro. Therefore, both sides will probably reach an agreement. Even if there is a national vote on this issue in Greece, the EU can most likely prevent Greece from abandoning the euro.

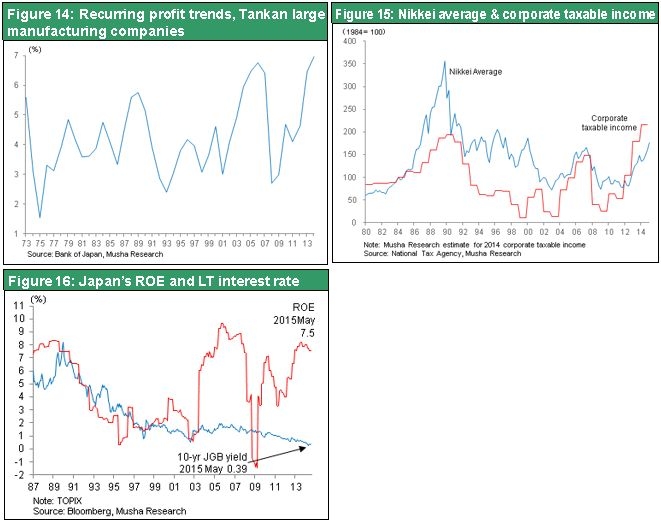

(3) Japan is in the midst of the best part of Abenomics

Strong corporate earnings are starting to produce a favorable cycle

There is no doubt that corporate earnings are strong in Japan. According to Nomura Securities, excluding the financial services sector, the growth in operating income at 300 Japanese companies was 34% (after-tax earnings were up 80%) in fiscal 2013 and 5% (after-tax earnings were up 8%) in fiscal 2014. In fiscal 2015, which ends in March 2016, the forecast is for an operating income of 17% and after-tax earnings growth of 17%. A virtuous cycle with strong corporate earnings as the starting point has started. Clearly, companies have become the primary source of demand growth by raising wages, capital expenditures and dividends, buying back stock, and through other actions.

Consumer price indicators are rising at an increasing rate

Ending deflation began with prices of exported goods. Now price increases have spread to the back end of the economy with upturns in the cost of construction and real estate, prices of imported goods, domestic restaurant menu prices, and hotels. According to the ESP forecast (the consensus of 41 economists), the Japan’s CPI will almost stop increasing in the middle of 2015 because of the drop in the price of crude oil and the end of price increases caused by the April 2014 consumption tax hike. But the outlook is for the CPI to increase 1.3% by the end of 2016. Reaching the Bank of Japan’s inflation target of 2% in the first half of fiscal 2016 will be difficult. However, the upturn in Japan’s CPI will be adequate for ending deflation and increasing domestic demand.

Japan’s stock market rally will speed up again

Interest in Japanese and European stocks will probably grow along with the dollar’s strength, weakening performance of US stocks and increasing interest rate risk in industrialized countries. But risk involving China, which is the greatest of all, will most likely not become a problem. The marked improvement in Japan’s real economy is the primary reason to expect stock prices to move even higher. Another reason is the expected continuation in favorable supply-demand dynamics. Net purchases of Japanese stocks by foreigners totaled ¥15 trillion in 2013 but fell to only ¥800 billion in 2014. During the first five months of 2015, net purchases have been more than ¥2.8 trillion. This indicates that foreign investors are still underweighting Japanese stocks. Individuals continue to sell stocks to lock in profits with a sigh of relief. Overall, individuals have been significant sellers of stocks, with net sales totaling ¥12 trillion in 2013, ¥5 trillion in 2014 and ¥4.5 trillion during the first five months of 2015. Due to these sales, individuals in Japan have an enormous volume of money waiting on the sidelines. Moreover, institutions like the GPIF, Yucho Bank, pension funds, insurance companies and others are increasing holdings of Japanese stocks. Consequently, investors in Japan and overseas probably have an unprecedented volume of funds available to buy Japanese stocks. The improvement in geopolitical factors following Prime Minister Abe’s successful US visit is another reason for confidence about buying Japanese stocks. An agreement concerning the Trans-Pacific Partnership would provide major psychological support for the stock market. Consequently, although investors will need to monitor economic and financial news from China, today’s favorable investment climate on a scale that has never been seen before will probably continue.