Jul 21, 2015

Strategy Bulletin Vol.142

Do China’s repeated extreme stopgap measures signal the start of a contingency plan?

- The other side of China’s growing global presence -

How should we view China? The country has enormous economic and geopolitical clout. On the other hand, economic problems are becoming severe and the Chinese government is taking one action after another that appear to be nothing more than extreme stopgap measures. Perhaps we should believe that China has started to enact a contingency plan. The situation in China now is confusing. The perception of China can change 180 degrees depending on the focus of attention. I think that the outlook for China should be muddling through (tiding over) for the short term, cautious for the medium term and pessimistic for the long term.

(1) China’s much greater global profile

The big improvement in the world’s view of China

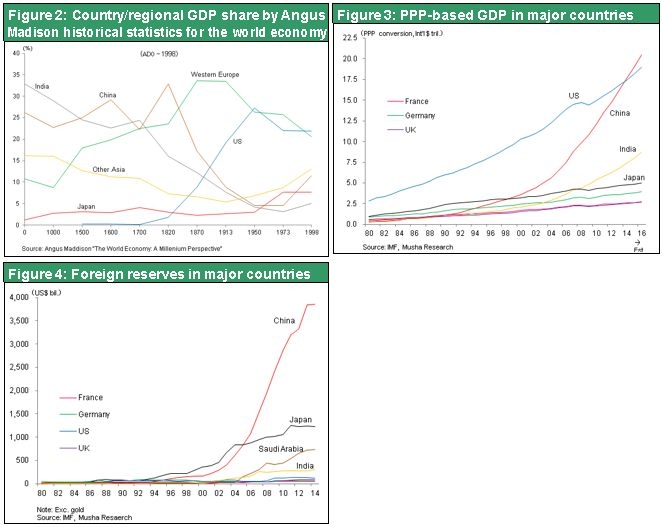

China has immense economic strength. On a 2014 purchasing power parity basis, China has passed the United States to become the world’s largest economy. Furthermore, China’s foreign currency reserves of $3.7 trillion are about three times (simple comparison is not possible since the definitions differ. China’s overseas financing ability is most likely over estimated.) higher than the $1.2 trillion of Japan, which ranks second. Early in the 19th century, China (the Qing Empire) accounted for one-third of the global GDP (according to Angus Maddison historical statistics). Today’s statistics demonstrate the long-term resurgence of China’s economy. Significantly, the majority of Europeans view this historic shift in economic dominance from Western Europe and the United States to China as inevitable.

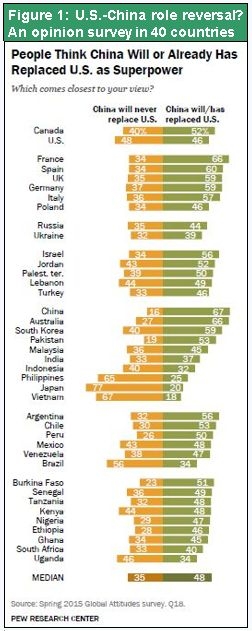

In June, the US Pew Research Center conducted a public opinion survey in 40 countries. People were asked if they think the United States can retain its position as a superpower or if China will replace the United States. In all European countries in the survey, the majority of people expect China to replace the United States as the world’s superpower. Even in the United States, opinions were divided. Only people in Japan expect the United States to remain a superpower with a remarkable 77% majority. Consequently, most people in the world believe that the title of superpower will shift from the United States to China.

As China’s power grows, the country is no longer able to conceal its desire to become the world’s rule maker. China is now clearly positioned alongside the United States as a country that determines the world order. For example, China has established the Asia Infrastructure Investment Bank (AIIB), is moving ahead with a land-based and maritime Silk Road (one belt, one road) initiative, is building reefs in the Spratly Islands, and is involved in the plan for a new canal in Nicaragua. The United States urged countries to boycott the AIIB. But the United Kingdom, Germany, France and other US allies in Europe decided to participate in the AIIB. This also reinforced China’s confidence in its stature as the final authority on world order. President Xi Jinping has rejected the US disagreement with the AIIB and is proudly demonstrating China’s equality with the United States. For instance, he talks about a new relationship between two major powers and says the Pacific Ocean is big enough for both China and the United States.

(2) The causes of China’s dramatic economic slowdown

Economic activity braked suddenly - Problems created by excessive investments are emerging

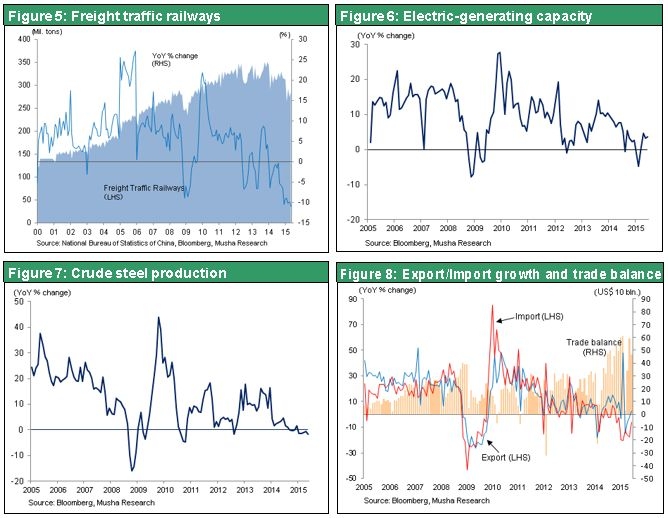

Despite China’s growing power, the economy is currently very weak. Many key statistics are down from one year ago, including rail cargo volume, electricity generation, crude steel output and the volume of imports. It is no longer an exaggeration to say that the growth in the movement of goods in China is about to end. The year-on-year growth rate of value added of industry peaked at 20% in 2010 and then fell to 10% in 2013, 8% in 2014 and then 5% to 6% in 2015. Particularly noteworthy is the drop in annual growth of monetary output to the 2% level at government owned companies.

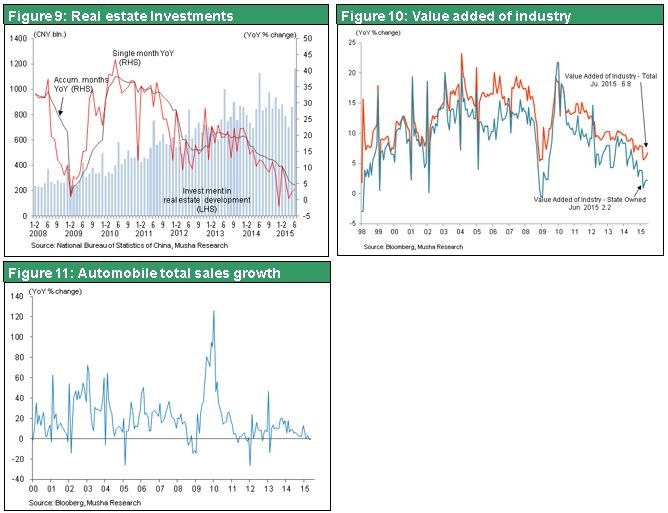

Growth of capital expenditures and real estate investments, two of the three primary drivers of China’s economic expansion, has come to a complete halt. As you can see in Figure 9, there has been a dramatic slowdown in real estate investments. Annual growth in these investments was 30% to 40% in 2010 and 2011 but only 10% in 2012. The growth rate rebounded to 20% in 2013 because real estate was a key element of the economic stimulus measures of the new administration of President Xi Jinping. But real estate investments subsequently fell sharply and are now about the same as one year ago. Empty condominium buildings are a common sight around China’s large cities and real estate prices are falling in these cities. As a result, real estate investments are unlikely to start increasing again.

In the industrial sector, capital expenditures were excessive. Capacity in China’s automobile industry is estimated to be 50% too high. With automobile sales down from the prior year in April, May and June, the gap between capacity and demand will be difficult to eliminate. In the steel industry, excess capacity is estimated at more than 30% but crude steel output is not increasing. Furthermore, work has not started on many national projects, including the enormous land reclamation project near Tangshan and plans for building massive industrial parks. Shopping mall projects has been growing quickly. The Nikkei Shimbun reported on June 17 that retail floor area in China’s 50 largest cities has increased 80% during the past two years. But retail sales are climbing slowly and there are reports of “ghost” shopping centers due to the lack of tenants. One cause is the rising market share of Internet retailers at the expense of conventional stores.

(3) Endless extreme stopgap measures point to the enactment of a contingency plan

Infrastructure investments, monetary easing and stock price support

Chinese companies have grown rapidly in the smartphone, drone and other categories of the market for high-tech products. However, this expansion alone has not been enough to offset the country’s massive lack of growth. In response, the Chinese government has been implementing a series of unsound and unwise economic initiatives. These actions succeeded, although just barely, in preventing an economic downturn thus far. Infrastructure is at the center of these economic initiatives. China is following up excessive investments in this sector with more high-speed rail, expressway, subway and other projects.

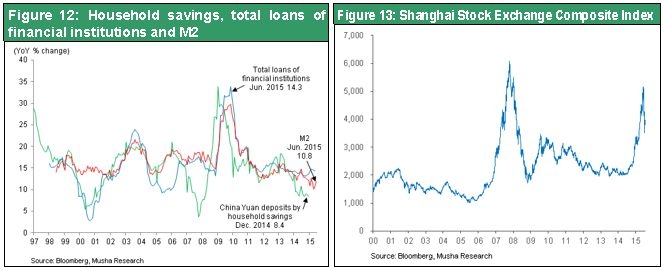

Monetary easing is another initiative. China is cutting the deposit reserve ratio for banks, lowering interest rates, easing housing loan restrictions and scrapping restrictions on the loan-deposit ratio (current upper limit is 75%). In addition, the government is considering the securitization of the local government debt and sale of these securities to China’s central bank (the Chinese version of quantitative easing). So China may securitize and sell debt that the central bank may not be able to collect while enacting monetary easing to allow the bank to buy this debt. The result could be the transfer of a huge volume of non-performing assets to the national government that would quickly increase the budget deficit. China put off the most important actions: reforms for government owned companies and an increase in labor’s share of income. These measures are vital if China is to switch to an economy fueled by consumer spending. This is why China’s long-term economic outlook is bleak.

Unsound and unwise economic initiatives are particularly evident in China’s stock markets. During the 12-month period that ended last June, stock prices in China surged 150%. But share prices then plunged 35% in the following month. The past year’s rally was obviously a bubble. It occurred as earnings weakened due to bankruptcies and slowing economic growth and the true value of companies deteriorated. But China did not recognize it as the bursting of the bubble and arrested the decline with share price support measures that were inconceivable. A group of 21 large securities companies pledged to invest 120 billion yuan (about ¥2,400 billion) in exchange-traded funds, approvals of initial public offerings were suspended, large shareholders are prohibited from selling their stock for six months, and penalties were established for “harmful” short sales. It also enacted measures to control securities market information and prevent spreading of rumors to influence stock prices. These actions are inconceivable for a country with a market economy. The Chinese government will probably succeed at preventing a further drop in stock prices even while enacting more of these actions that are difficult to believe. If stock prices rebound due to buying funded by the government, there will obviously be an increase the assets of companies on the books. But the book value of these assets will move farther and farther away from each company’s true value. Stock prices are like a thermometer that shows the health of the economy. China is attempting to change this thermometer’s scale, which is a rejection of market principles. Consequently, this can mean nothing other than the death of China’s stock markets from the standpoint of global standards.

Tighter controls on what people can think

All of these actions indicate that China may have finally started enacting a contingency plan that is designed to deal with a severe crisis. If a full-blown crisis does occur, China will also require political measures for maintaining the public’s confidence.

On July 1, China passed the National Security Act. This law tightens a broad array of social controls and is reminiscent of pre-war Japan’s Maintenance of Public Order Act. The new law immediately led to the arrests of a diverse range of human rights attorneys. The precursor to this new law was the January 2015 announcement by the Communist Party and Chinese government of a statement for asking universities to strictly adhere to socialist values. The aim is to eliminate Western values from universities. China wants to position universities at the forefront of Marxism, core socialist values, and the Chinese Dream. With this new law, we are now seeing the extension of restrictions on ideas and speech to cover all sectors of Chinese society.

Improving external relationships

Even while tightening internal restrictions, China appears to be taking big steps to improve external relationships. The current Chinese regime had continued to adopt a negative stance regarding Japan, including the rejection of summit meetings, because of events that occurred many years ago. But now China has reversed this position. Prime Minister Abe has been invited to visit China and there was a warm welcome for Shotaro Yachi, the head of Japan’s National Security Council who visited China last week. The United States is also hardening its stance regarding China because of its construction and reclamation activity in the Spratly Islands. But President Xi Jinping adopted a more accommodative position about this issue prior to going to the United States in the coming September. Tighter internal controls accompanied by the sudden switch to a friendlier external posture may appear to be contradictory at first. However, these actions may instead signify that China has started implementing its contingency plan for a severe crisis. Both these internal and external actions are similar because they are strong drugs for ending a crisis with the understanding that there will be side effects. These contingency plan initiatives will probably provide short-term containment of the crisis.

Expect the contingency plan to produce short-term benefits and improvements

China today is increasing its stature while struggling with economic problems that require extreme stopgap measures. Which one of these factors will determine the country’s upcoming direction? We can probably dismiss the scenario in which China’s rapid economic growth continues, resulting in an even stronger economic and political profile in the world. At some point, an economic crisis will abruptly emerge as China’s economic growth comes to a halt. After this happens, there will be problems involving the current Communist single-party system. Furthermore, the United States has also finally started to move in response to the China’s steady external growth. This may be the sign of a new Cold War between the United States and China. In what form will China’s economic crisis start? How will this crisis affect the world and Japan? These two questions demonstrate the immense medium- to long-term uncertainties involving China today.

Nevertheless, China’s stopgap measures will probably be successful for a short time as growth in developed countries, led by the U. S., accelerates boosting Chinese exports. China is likely to avoid a more serious economic downturn. Stock price countermeasures are yielding benefits, too. Consequently, I believe that the best outlook for China is to be muddling through (tiding over) for the short term, cautious for the medium term and pessimistic for the long term.