Jul 30, 2015

Strategy Bulletin Vol.143

China’s weakness gives emerging countries opportunities to participate in global division of labor

China’s economy is clearly weakening

Not long ago China was the engine of growth for the global economy. But now China has become the world’s biggest risk factor. Obvious signs of economic decline are appearing. Railway freight volume, electricity generation, crude steel production and the volume of imports are all down from one year ago. Growth in the monetary value of industrial production peaked at 20% in 2010 and then fell to 10% in 2013 and 8% in 2014. The annual growth rate has dropped to about 5% to 6% this year. Capital expenditures and real estate investments, the two key sources of China’s growth, are both no longer supporting the economy. Falling real estate prices and other negative indicators show that the Chinese economy is nowhere near a 7% growth rate. There is also a marked slowdown in consumer spending. Automobile sales have been down for three consecutive months starting in April.

As of June, China’s stock markets had staged a powerful rally that raised stock prices 150% in only one year. But stock prices subsequently plunged 35% in the past month. Investors anticipate lower earnings at Chinese companies due to bankruptcies and rapidly declining economic growth. With the intrinsic value of companies declining, the big upturn in stock prices had obviously produced a bubble. But the Chinese government has not allowed the bubble to burst. Instead, the government enacted inconceivable measures aimed at propping up stock prices. For instance, at the urging of the government, 21 large Chinese securities companies pledged to invest 120 billion yuan (about ¥2,400 billion) in exchange-traded funds, approvals of initial public offerings were suspended, large shareholders are prohibited from selling their stock for six months, and penalties were established for “malevolent” short sales.

China Plus One will benefit other countries

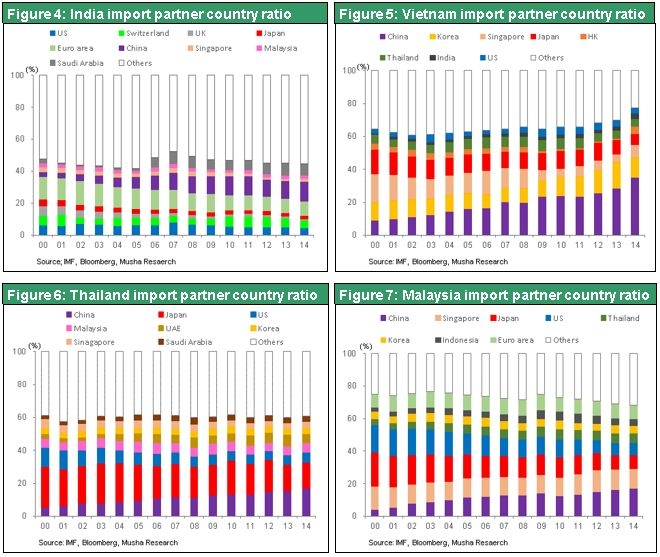

No one can deny that China’s economy is weakening. So the question we need to answer is how this will influence the global economy. There will be numerous negative effects, such as worsening business relationships with China. But we can also expect to see some countries benefit from China’s decline. Globalization sparked by China’s economic growth led to an industrial chain reaction of beneficiaries that produced the “BRICS boom” as emerging country economies expanded rapidly starting around 2000. Massive demand for natural resources in China fueled the BRICS boom. But this boom is about to disappear as the Chinese economy slows down. After all, advantages unique to China were not the reason for the country’s economic success. Above all, China excelled at using cheap labor to target the international division of labor. This is something that other countries can do, too. Today, China has the highest wages in Asia, so the competitive edge of the country’s manufacturing sector has been severely eroded (Figure 1). As China’s position within the global division of labor declines, other countries will probably emerge as beneficiaries due to the China Plus One strategy as companies reduce their reliance on China for manufacturing.

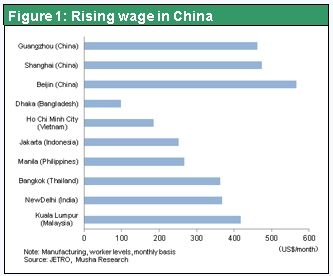

Investments in China are declining; the peak is behind us

As you can see in Figure 2, direct investments in China by foreign companies have reached a peak during the past few years. These investments were $116 billion in 2011, $111.6 billion in 2012, $117.6 billion in 2013 and $119.5 billion in 2014. Only investments from Hong Kong, which now account for 70% of all direct investments, have been climbing. Direct investments from the rest of the world are down significantly. Japanese companies used to be a major source of growth in these investments but are now making dramatic cuts in these outlays. Until seven or eight years ago, China accounted for about half of all of Japan’s direct investments in Asia. In 2012, Japan invested ¥1,075.9 billion in China, surpassing the trillion level. Investments then dropped 20% to ¥887 billion in 2013 and another 20% to ¥719.4 billion in 2014.

As investments in China fell, Japanese companies made a big increase in ASEAN investments. Japan’s direct investments in the ASEAN big six (Singapore, Thailand, Indonesia, Malaysia, Philippines, Vietnam) surged from ¥847.1 billion in 2012 to ¥2,311.5 billion in 2013 and ¥2,134.3 billion in 2014, about three times more than investments in China. These investments clearly show that Japanese companies are rapidly moving factories from China to the ASEAN region. As China slowly sinks, other regions are rising. Increasing participation in the global division of labor by more countries is offsetting China’s economic decline. As a result, we can expect to see the global economy continue to expand at a steady pace.

The emergence of India and the ASEAN countries

Now India is the center of attention. In the past, India participated in the global division of labor by adopting the unusual approach of specializing in the service sector. But this approach is no longer viable. The service sector has a weak industrial chain, making it insufficient to fuel the growth of an enormous economy of 1.2 billion people. Under the leadership of the Modi administration, India has started to concentrate resources on the manufacturing sector. India will probably quickly replace Chinese imports with internally produced goods. Manufacturers from developed companies are likely to move even faster to set up operations in India. Taiwan’s Hon Hai Precision Industry (Foxconn), a huge company that makes all of Apple’s smartphones, has announced a plan to build 10 to 12 factories in India by 2020. These factories will have about one million workers, more than Hon Hai currently employs in China.

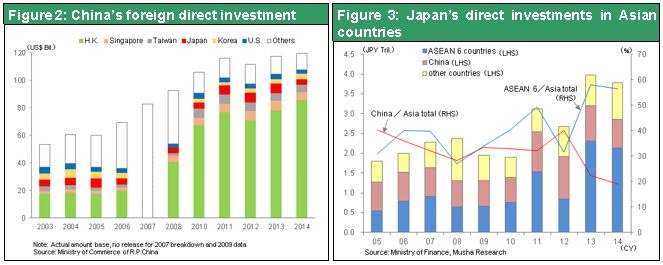

Furthermore, the concentration of ASEAN industrial activity in Thailand will probably continue. In addition, Vietnam, Myanmar and the Philippines, a country where labor is extremely cheap, are becoming more attractive as places for investments. NAFTA member Mexico and Turkey are also positioned to benefit from China’s decline. Following the start of the global financial crisis, the excessive concentration of manufacturing in China created a structure in which Asian countries (India, Vietnam, Thailand, Malaysia and others) relied greatly on China for the supply of manufactured goods. As the Southeast Asian country import data in Figures 4 to 7 show, China (purple) accounts for a large share of the imports of these four countries.

As the concentration of industrial activity in the ASEAN countries increases, goods produced in these countries will start replacing imports from China. We are witnessing a change similar to what happens when small trees sprout after a large tree falls down. Industrial activity that was dominated by China is spreading out to many emerging countries. This signifies that these countries will replace China as the engine of global economic growth. Consequently, slower economic growth in China will not necessarily hold back growth of the global economy.