Sep 14, 2015

Strategy Bulletin Vol.147

Japanese stocks are about to stage a short-term rally

Of course, no change in the outlook for a bull market

Stock markets worldwide have plunged 15% to 20% during the past three weeks. Some investors are preparing themselves for another financial crisis. But these fears are unfounded. Stock prices already reflect all conceivable risk factors (pessimistic scenarios). Sellers have apparently run out of ammunition. Global stock markets will probably stage a rebound regardless of the upcoming action taken by the FOMC. Japanese stocks were the biggest target of frantic selling by international investors. Now, Japanese stocks may become the best performers in the world for a while. Three factors have come together to set the stage for the beginning of a powerful supply-demand driven rally. First, international investors are buying-back stocks. Second, institutions in Japan are rebalancing their portfolios; and, third, individuals are picking up stocks at today’s low prices.

The following two causes of the stock market crash appear to be completely factored into stock prices.

(1) The pessimistic scenario of a global recession caused by slowing economic growth in China leading to a financial meltdown and economic crisis

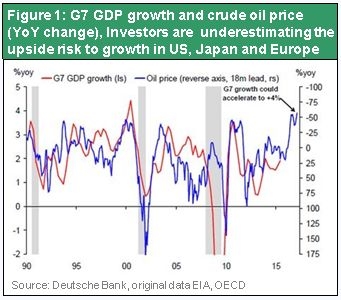

Current events are forcing investors to consider this possibility. The existence of this risk is clear, but so is the fact that this crisis will not occur in the near future. In the second half of 2015, the US, Japanese and European economies are gaining momentum after their growth rates slowed in the first half. As you can see in Figure 1 (prepared by Torsten Slok, chief international economist of Deutsche Bank in New York), although the virtual tax-cut effect of the low cost of crude oil is constantly supporting economic growth in industrialized countries, the benefits have still not come to the surface.

In China, the government is using drastic measures to stop the decline of stock prices and the yuan. As a result, there are signs of a temporary lull regarding China’s economic problems. For example, the money supply is growing faster and real estate prices have

staged a small rebound. Consequently, even if there is bad news from China involving the level of corporate activity or other microeconomic statistics, investors may not view this news as a new reason to sell stocks for a while.

(2) The pessimistic scenario of higher US interest rates and monetary tightening causing a shortage of global liquidity, resulting in an emerging country currency crisis and a global recession

There will be absolutely no change in the world’s ample level of liquidity even if there is a US interest rate hike in September. High-ranking Fed officials have repeatedly said that the Fed will exercise care to prevent any change in the risk-taking environment (equivalent to the liquidity environment) in the event of an interest rate hike. Moreover, if there is an unexpected incident (like a financial crisis in China), the Fed could obviously embark on a new phase of monetary easing (QE4). Furthermore, Japan and Europe are now in the midst of quantitative easing on an unprecedented magnitude and there is still room for additional measures.

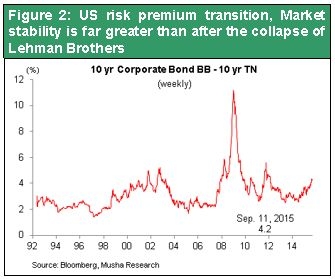

Figure 2 shows the credit risk premium, which is an indicator of the liquidity environment in US financial markets. Although the risk premium has been increasing during 2015, the stability of this premium is still far from the level that would point to a crisis.

One pessimistic scenario calls for the Fed to trigger a global recession by enacting the wrong policies. The Fed has freehand in enacting policies of its choice and also has capabilities and knowledge that no one else can match. But who can believe this scenario? If no one can have faith in this story, investors will be unable to continue to sell off stocks. Isn’t it obvious that the Fed would never take an action that would cause economic problems?

Investors will most likely welcome an interest rate hike as a sign of the Fed’s confidence in the US economy. On the other hand, investors would probably become even more confident if the Fed put off an interest rate hike. This would show that the Fed has adopted a crisis management stance that could result in QE4 and other additional actions. Consequently, whether or not the FOMC raises the federal funds rate, the outcome of the September FOMC meeting will probably be a signal for investors to start taking on more risk.

With growth of the US, Japanese and European economies clearly accelerating, a crisis on the scale of the Asian currency crisis or global financial crisis at this time is inconceivable. This is why investors may start viewing the summer stock market free fall as nothing more than a “midsummer night’s nightmare.”