Oct 13, 2015

Strategy Bulletin Vol.149

Declining fears about the yuan may spark a year-end “relief rally”

China is the Achilles’ heel of the global economy. I have explained China’s vulnerability involving movements in foreign currency and exchange rates starting with my reports in September. As a result, the recent stability of the yuan can most likely be viewed as a reason for confidence concerning the Chinese and global economies.

Stability in global financial markets will increase as worries about the yuan decrease

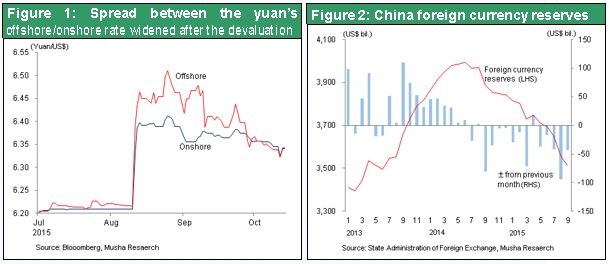

As you can see in Figure 1, the gap between the yuan’s Hong Kong rate (offshore rate) and China rate (onshore rate) widened rapidly following the yuan’s devaluation on August 11 but it is narrowing now. According to the Chinese government, this gap was the result of measures to prop up the yuan at all costs. Most significantly, speculative sales of the yuan have plummeted because of more stringent restrictions involving movements of funds starting in September. For example, there are tighter restrictions on foreign currency forward trading (only sales) and foreign currency conversions by individuals. At the G20 meeting in Peru earlier this month, China stated that the yuan’s fall is not an accurate reflection of the country’s economic fundamentals. The People’s Bank of China started a cross-border trade settlement pilot scheme for the yuan on October 8. At the same time, the rapid drop in China’s foreign currency reserves is slowing. These reserves decreased from the prior month by $42.4 billion in July, $93.9 billion in August and $43.3 billion in September. All of these events indicate that financial market turmoil caused by the yuan’s problems is beginning to settle down. For the time being, there is probably no possibility of a chain reaction in which worsening foreign currency issues in China lead to a drop in the yuan that in turn triggers a global financial crisis.

This is good news for global financial markets. First, the possibility of China exporting deflation has been greatly reduced. The reason is that China is much less likely to slash prices of exported goods in response to its enormous surplus of production capacity. Second, there is now no danger of growing global financial instability caused by massive capital outflows from China accompanied by downturns in the yuan and asset prices.

China buys time – Transaction restrictions will support the yuan

Despite these positive developments, there are still doubts about China’s ability to stabilize its economy and achieve steady long-term growth. Economic growth in China is slowing rapidly. There is an urgent need for measures to (1) increase demand, (2) prevent a drop in asset prices, especially real estate, and (3) make China competitive in export markets again (by devaluing the currency or cutting wages). Monetary easing and currency devaluation are the normal actions in this situation. However, China’s current actions clearly show that devaluing the yuan is not an option. The administration of President Xi Jinping will not allow the yuan to weaken because preserving the country’s prestige is a priority.

Measures to maintain the yuan’s value may have positive effects on a global scale. But these initiatives will not necessarily be good news for China’s economy. This can be explained by using the trilemma of international finance, which is the inability to have at the same time (1) an independent monetary policy, (2) unrestricted movements of capital, and (3) a stable currency exchange rate.

In 1992, short sales by George Soros forced the United Kingdom to drop out of the European monetary system (EMS) and allow the pound to fall significantly. Speculation against the pound was based on the hypothesis of this “impossible trilemma.” Countries firmly believed in the freedom of capital movements at that time. In that environment, the United Kingdom had only two options: dramatic monetary easing to stimulate the economy or maintaining the value of the pound (staying in the EMS). Just as Mr. Soros expected, the United Kingdom selected monetary easing.

Limitations of the trilemma of international finance remain

China will most likely aim for two parts of the trilemma: an independent monetary policy (enormous monetary easing) and an unrestricted foreign exchange rate (preserving a strong yuan). On the other hand, China has started further tightening restrictions on the movement of capital. In contrast, the United Kingdom retained a steadfast commitment to free flows of capital. China’s reforms are the exact opposite of flexible foreign exchange markets that rely on the free movement of capital. This is what the United States and IMF want. The Chinese government and central bank have not selected the path that leads to the restoration of confidence in markets. Instead, China is headed in the direction of using tighter controls to create awe and fear in financial markets.

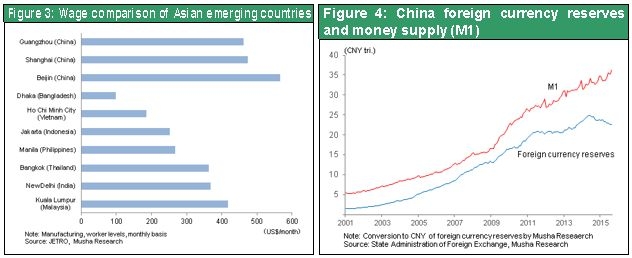

If China’s priority is maintaining the yuan’s value, one result will be a negative impact on China’s global competitiveness because the country has the highest wages among Asian emerging countries. Furthermore, any benefits of frantic monetary easing in order to keep real estate prices stable will be offset by pressure from outflows of capital. Consequently, policies to prevent the yuan from falling will probably create even more downward pressure on the Chinese economy.

Benefits of China’s financial initiatives will be the focus of 2016

The current situation will create an even greater need for financial initiatives by China. China must use these activities to prevent an economic free fall while continuing to reduce the present over-reliance on monetary easing. If this can be accomplished, China will be able to continue measures to prop up the yuan for a while. But if holding up the yuan becomes difficult, China will have to increase monetary easing. This would exert more downward pressure on the yuan. This is why one of the most crucial points about China in 2016 will probably be how the country’s new policy mix will function.

As I have explained, China has decided to buy time by using restrictions on capital transactions for the purpose of propping up the yuan. It is too soon to say that these actions cannot stabilize China’s economy and lead to steady growth. But there are doubts. In theory, tighter financial restrictions along with higher government expenditures distort the allocation of resources and make economies weaker. Furthermore, a currency that is too strong will make a country’s industries less competitive. As China enacts drastic emergency measures, boosting government spending and preserving the yuan’s value would be a very bad move.

Nevertheless, for the time being, China’s decision to take these actions is good news for the world’s stock markets.