Nov 30, 2015

Strategy Bulletin Vol.151

2016 Market Outlook

Strength in Developed Countries but Weakness in China

Miller: Hello everyone. I am Kazuko Miller of Musha Research. The subject of today’s discussion with Ryoji Musha is the market outlook for 2016, with strength in developed countries but economic weakness in China. First, please explain the key elements of the 2016 market outlook.

Musha: The end of the year is near and it’s time to think about 2016. I believe that stocks will continue to move higher in the first half of the year. The Nikkei Average may rise to ¥22,000 to ¥23,000. With a US interest rate hike likely, the dollar could strengthen even more to almost ¥130. There are two critical points involving this outlook for 2016. First is the direction of the US economy, which is the most important bright spot of the outlook. Second is the Chinese economy, which is a source of economic instability.

Miller: You said the most important point is the US economy. Do you think the US economy will remain healthy even though a December interest rate hike, the first after the global financial crisis, appears to be a certainty?

Musha: I think the US economy will be fine. In fact, I regard an interest rate hike as a signal that we can finally stop worrying because the US economy is truly sound. After this hike, I think there is a strong possibility of a strong stock market rally because this source of uncertainty will be gone. The critical point is that the economies of the world’s industrialized countries, centered on the United States, are still in an early stage of the life cycle of an economic upturn. In my opinion, the US economy is only about half way or slightly farther through this cycle and Japan and the eurozone are just short of the half way point. Consequently, I think that, with respect to this life cycle, economic growth is at a stage where expansion will continue until we reach a peak as the economy becomes overheated.

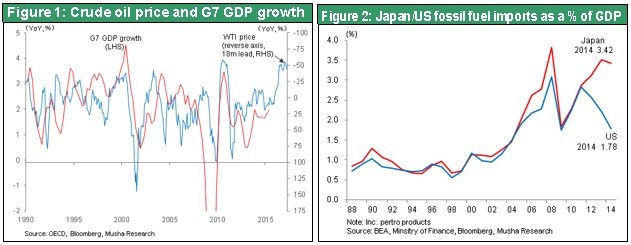

One key point concerning this cycle is that the sharp drop in the cost of crude oil that started in 2014 is finally beginning to make a big contribution to the economies of industrialized countries. As I explained in my previous report, changes in the economic health of industrialized countries are almost completely linked with crude oil price movements. Recessions have started in these countries again and again whenever there was a big increase in the price of crude oil. This time, we have seen this price drop by more than 50% from the peak. Cheaper crude oil is extremely good news for the global economy, and especially industrialized country economies. Next, I’d like to take a closer look at the magnitude of this economic contribution.

Fossil fuel imports were 3.4% of Japan’s GDP in 2014. If we conservatively estimate that this percentage has been cut in half, that means Japan’s import payments have decreased by 1.7% of its GDP. This is a very big contribution to economic growth. As I stated earlier, the most important point here is that the economic benefits of cheaper crude oil do not appear immediately after the price falls. There is a time lag of about 18 months. As a result, the benefit of the crude oil price decline that started in the summer of 2014 will probably start to emerge late this year and in the first half of 2016, which is approximately 18 months later. Until now, the global economy and financial markets have been working hard on factoring in the negative aspects of cheaper crude oil. Oil-producing countries have been selling Japanese stocks as their revenue fell. Moreover, the lower price of crude oil has sparked a sharp drop in resource stocks. Currencies of resource-rich countries have weakened, too. In other words, for the past six months to one year, financial markets have been reacting to the lower cost of crude oil as if this is entirely bad news. However, the drop in the price of crude oil has created an enormous bonus for the economies of industrialized countries. The emergence of this bonus will be one of the most important aspects of the first half of 2016.

I think the benefits of cheaper crude oil will add almost 1% to the annual GDP growth rates in Europe and the United States. This additional growth is the most critical factor regarding the positive economic outlook for the first half of 2016. Another key point is that there is a lot of good news about the US economy in addition to the drop in the cost of crude oil.

First is that the benefits of the information revolution are producing improvements in our lives and our day-to-day activities. The technology revolution is progressing rapidly. The Internet, smartphones and cloud computing are just a few examples. Clearly, these advances have made companies more profitable and generated massive business opportunities. In the past, we were unable to see how this progress would influence our lives. But now, thanks to a prolonged period of monetary easing, we can see an extremely sharp picture of the positive effects for consumers of the information revolution. I think these effects will play a major role in US economic growth in 2016.

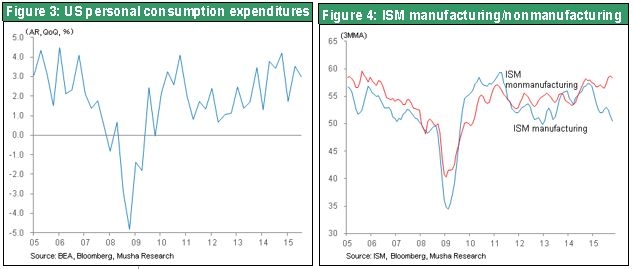

Consumer spending in the United States plunged during the global financial crisis. Next was a temporary rebound followed by a steady increase in consumption. In the recently announced third quarter US GDP data, consumption was increasing at an annualized 3%. I think these figures make it clear that growth in consumer spending is driving US economic expansion.

However, services rather than goods have been responsible for the growth in consumption. Demand for merchandise like automobiles, smartphones and televisions is not substantial. Services have accounted for most of the new growth in spending. Consequently, the ISM manufacturing index, an indicator of the demand for goods in the United States, has stopped climbing in part because of China. But the ISM non-manufacturing index shows that US demand for services is climbing steadily.

Higher consumer spending due to the benefits of the IT revolution, particularly backed by growth in demand for services, is starting to drive economic growth. This has become a major characteristic of the US economy today.

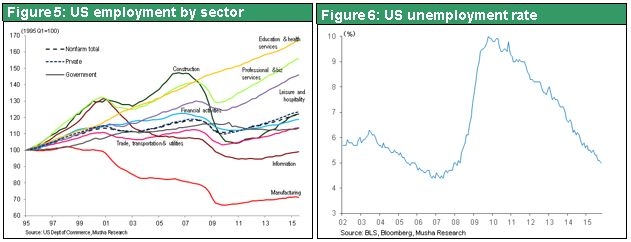

This trend is also clearly evident in US employment statistics since 1995. During the global financial crisis, there were big declines in jobs in the US construction, IT and manufacturing sectors. But in recent years, you can see that a steady recovery has been taking place in the service sector because of prolonged monetary easing. Jobs have increased in the education, health care, entertainment, tourism, logistics and other service categories. This demonstrates that services rather than goods are the new drivers of economic growth. This growth in US consumption resulting from the IT revolution is a key defining characteristic of the US economy.

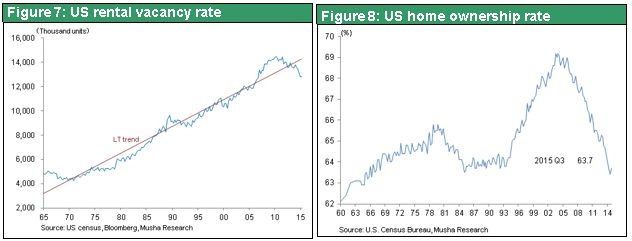

Two economic components have improved significantly: crude oil and consumer spending. A third improvement, as I have explained before, is the steady recovery in the US housing sector. Home construction in the United States plummeted after the housing bubble burst and pulled the economy down. However, the lack of growth in home construction greatly reduced residential vacancies and improved the balance between the supply and demand for rental properties. This is another point that I explained earlier.

One more point that I have covered is the big decrease in the US home ownership ratio. People can no longer easily buy houses by taking out loans. The home ownership ratio peaked at 69% and is now 63%. The downturn in this ratio, on the other hand, is a sign of a big increase in pent-up demand for using loans to buy houses. That means the US economy is about to enter a phase in which demand for rental and owned housing is growing. I think we can regard this as the third positive factor.

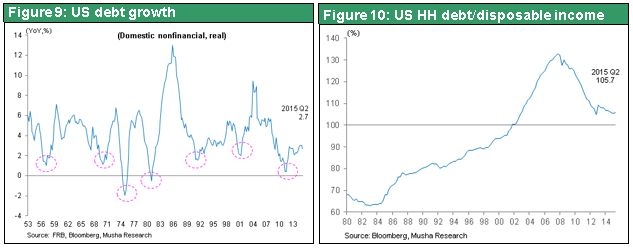

The fourth key factor is the big contribution to the economy from the credit cycle. Credit growth is closely linked with the US economic cycle. The real growth rate of US debt since 1953 reveals a number of unmistakable patterns. One significant and obvious pattern is that credit has hit bottom in years ending with a one. This happened in every “one” year from 1971 to 2011. The only exception is the credit bottom in 1975. But this occurred because of a drop in real debt caused by high inflation triggered by the first oil shock. Consequently, there has been a 10-year cycle in which credit hit bottom in “one” years and then expanded steadily until hitting another bottom 10 years later. Although the most recent bottom was 2011, the growth of credit has finally started only recently. US banks have completed the long process of eliminating non-performing loans and bolstering balance sheets. As a result, they are now beginning to increase their loans. Furthermore, the debt ratios of borrowers, both consumers and companies, are declining. The cost of loans as a percentage of income has fallen to an all-time low. Clearly, there is still much more potential for credit growth with regard to lenders and borrowers alike. Therefore, from the standpoint of the credit cycle, the US economic upturn is still young.

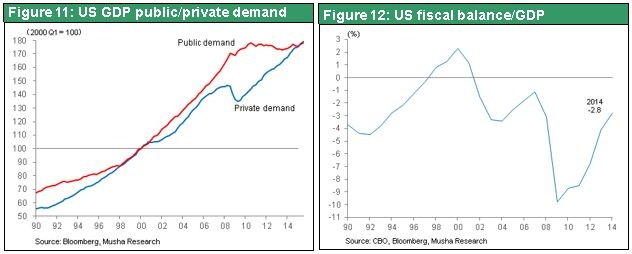

A fifth improvement involves public-sector demand, which has holding back the US economy consistently since the start of the global financial crisis. Now that governments have largely completed measures to reduce deficits, public-sector expenditures are finally starting to climb. I think that all of these improvements point to a significant upturn in the US economy in 2016. If the US economy, which is the largest among industrialized countries, fuels global economic growth, we should obviously expect to see the dollar become even stronger.

I believe that earnings of Japanese companies will be a big plus for the Japanese economy in this environment. A healthy US economy signifies higher exports to the United States. Additionally, as the US economic strength boosts the dollar (and makes the yen weaker), earnings of Japanese companies will become even higher. The Japanese economy was strong following the start of Abenomics. But the April 2014 consumption tax hike slowed economic growth and Japan’s economy is currently sluggish. Nevertheless, companies in Japan are reporting record-high earnings. I think there is no doubt that a cycle in which growth of household income creates more demand is now slowly starting because of these earnings. Apparently, the benefits of cheaper crude oil are finally appearing. Furthermore, the wealth effect is increasing because of higher stock prices associated with the extended period of monetary easing. This is slowly making consumers more willing to make purchases. In addition, capital expenditures by companies, especially small and midsize companies, is relatively strong. My conclusion is therefore that the Japanese economy as well will continue growing.

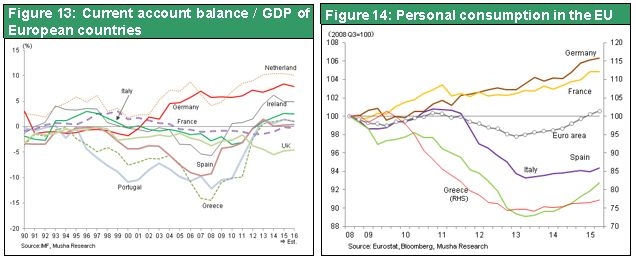

In Europe, as you can see in Figure 13, southern European countries have ended their current account deficits. Furthermore, the Greek debt problem has been resolved and interest rates are falling rapidly. We are also seeing the growth of consumer spending throughout Europe gain momentum. Consequently, I think there is reason to expect the US, Japanese and European economies to be a powerful source of growth for the global economy in 2016.

Miller: There are still no signs of the end of slowing economic growth in China. Is there a risk of China’s problems creating global deflation or a financial crisis? What are the key points for investors to watch?

Musha: I don’t think China’s difficulties pose a significant risk to the economies of industrialized countries. China itself is the real problem. Fifteen years of rapid economic growth in China has come to an end. Now the country has reached the point where all the distortions created by this growth have come to the surface. Massive investments were a particularly noteworthy result of China’s rapid growth. There have been excessive investments involving housing, capital expenditures, public works and infrastructure. Many of these investments are starting to become non-performing loans. With respect to this debt, the condition of the Chinese economy is extremely serious. From a long-term perspective, I think the Chinese economy may stop growing due to the difficulty of achieving a soft landing.

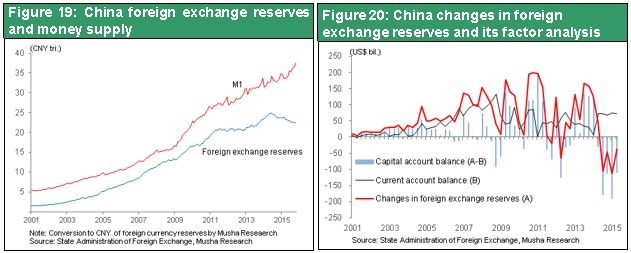

However, China will be relatively stable for the time being. I think the marked stability of China’s stock and foreign exchange markets, which have been tumultuous since August, is encouraging. The free fall in stock prices has ended. Additionally, the August devaluation of the yuan sparked fears of a plunge in the yuan’s value. But worries about the yuan have dissipated for now. Another concern is the steady decline in China’s foreign currency reserves during the past year. However, there was a small increase in October. Due to these events, China’s financial sector has currently returned to stability.

We cannot be entirely optimistic about China because the government’s forceful interventions are the reason for stability in both the stock and foreign exchange markets. Without this intervention, volatility in these two markets would probably increase. This is why China has not achieved a true resolution of its problems. Current actions are only stop-gap measures. Once these measures are no longer effective, we may see a return to financial market turmoil in China in 2016.

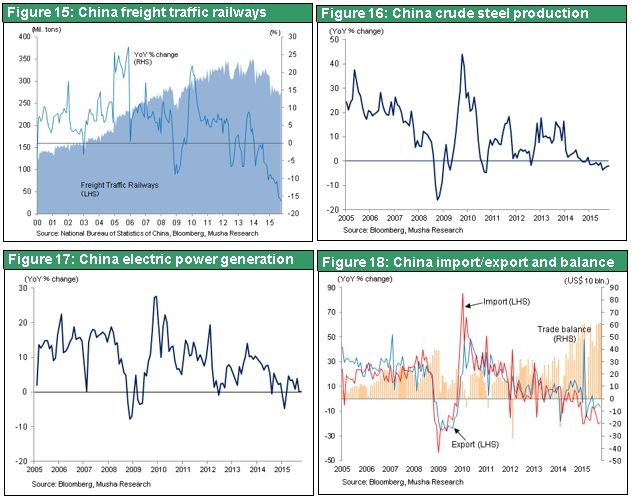

The critical point regarding the Chinese economy in 2016 will be if activity in various industries stops falling. Microeconomic indicators of activity like railroad cargo volume, electricity output and crude steel production are still declining. It is still too early to confirm that these figures have hit bottom. Although financial markets are stable, there is still reason for caution concerning optimism about the Chinese economy. As I said, one key point is if the economy can stop declining. I think China will enact a variety of economic stimulus measures along with monetary easing. As a result, I think that the end of China’s economic downturn, even though it may be only temporary, will have a positive effect.

A second key point is whether or not financial market volatility in China has really ended and markets can remain stable. Here, we need to focus on foreign currency, which is the weakest element of China’s financial markets. Policies of the government and Bank of China backed by brute force can control most problems involving the stock market and financial sector. However, using this type of force for issues involving foreign currency is difficult. China’s foreign currency reserves are massive, amounting to $3.5 trillion at the end of October. However, loans account for more than half of these reserves. This is why there could be a dramatic drop in foreign currency reserves. One cause could be a rush by foreigners to Chinese debts. Another possible cause is a faster flight of capital as people in China move their assets to safe overseas locations. Consequently, there is still a small possibility of global financial instability triggered by a decline in China’s foreign currency reserves because of these types of events and the resulting plunge in the value of the yuan.

For these reasons, investors need to pay attention to whether or not the foreign currency situation in China has really stabilized. I think there will probably be no reason for concern for about the next six months. In the second half of 2016 and 2017, investors will have to carefully monitor China’s financial condition along with changes in its economic fundamentals. In the unlikely event that China’s fundamentals continue to deteriorate and financial instability increases, I think global stock markets will be very strong in the first half of next year. However, investors need to keep in mind the possibility of major instability emerging in the second half of 2016.

Miller: My final question is about the view that there is a stock market bubble. The PER of US stocks is now far above the historical average. The CAPE ratio is now 26 compared with the average of 16. What is your opinion?

Musha: Stock prices do not necessarily move up when the economy is healthy. When stocks are extremely overpriced, monetary tightening and higher interest rates are used to correct prices. These actions can exert substantial downward pressure on stocks. This is why I think it is important at this time to think about how to regard stock valuations. People who think stocks are overpriced base their opinion on the CAPE ratio. This is a cyclically adjusted price-to-earnings ratio that was developed by Robert Shiller, who received a Nobel Prize in Economics. The ratio tracks stock prices by using 10-year averages as the proper PER. The current S&P500 PER is 26 but the CAPE ratio average for the past 10 years is 16. Based on the CAPE ratio, we can say that US stock valuations are very high relative to the average of prior years. By comparison, multiples rose to 30 and even 50 at the peak of stock market bubbles. We can therefore conclude that stock market valuations have not reached the peak of a bubble.

I think the most important point is whether or not the CAPE ratio is a suitable method of evaluating stock prices. My belief is that this ratio is not right for current market conditions. The CAPE ratio assumes that historical averages are all correct regardless of changes in other financial parameters. But today, long-term interest rates that are far below historical averages are a major aspect of the economic and financial environment. Therefore, we need to determine the proper level of stock prices for this environment.

Falling interest rates signify that there is an abundance of money. Low interest rates also mean that investors can borrow money cheaply to buy stocks. We should therefore expect to see stock prices move above average levels when interest rates decline. In fact, it is reasonable to conclude that stock prices should be even farther above the average after eliminating periods of extreme interest rate volatility from prior-year data. I believe that the role of investors today is to seek the proper level of stock prices in today’s low interest rate environment. Based somewhat on my instinct, I think that a legitimate level for stock prices is 70% above the historical average CAPE ratio or perhaps even twice the historical average in certain circumstances. From this standpoint, US stocks are not overpriced at all. Moreover, I think stock prices can go even higher if the economy remains sound. From this perspective, I also want to point out that the undervaluation of Japanese stocks will become even more apparent.

Miller/ Musha: Thank you.