Dec 18, 2015

Strategy Bulletin Vol.152

US and Chinese perspectives of the US interest rate hike

(1) The US is rising – The start of new age of prosperity

Declines in the surplus of labor and capital

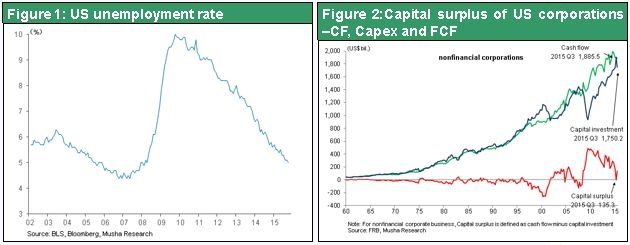

The first US interest rate hike since 2006 is a sign of confidence that the US economy is no longer feeling any effects of the global financial crisis. Starting in 2000, rising productivity fueled by the IT revolution resulted in a growing volume of surplus labor and capital. These surpluses were absorbed by the construction sector (resulting in a “bubble industry”) until 2007. But the shockwaves of the subsequent Great Recession destroyed this bubble. The surplus labor and capital problem was immediately exposed, resulting in the highest unemployment in the postwar era, stagnant wages, idle capital and low interest rates.

(Most people believe that monetary easing by central banks around the world was the cause of surplus capital and low interest rates. But this is a mistake. If there had been no monetary easing, the global recession would have been even deeper. Investors would have shunned risk even more, moving funds to safe assets like cash and government bonds. This most likely would have caused interest rates to fall even more. Interest rates would have been low with or without monetary easing. The real cause of low interest rates is an even more significant historical fact: the emergence of surplus capital due to the IT revolution.)

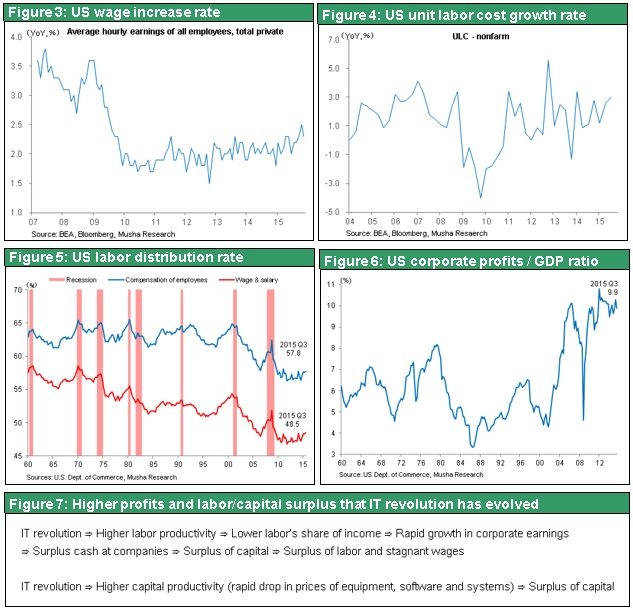

Persistent monetary easing has largely eliminated the surplus of labor and capital. As you can see in Figure 1, unemployment has dropped from the peak of 10.0% in 2009 to 5.0%. Furthermore, Figure 2 shows that free cash flows of US companies were consistently high since 2000 but are now very small. This is because growth in capital expenditures has finally caught up with cash flows. Furthermore, wages have finally started to climb (Figures 3, 4). Labor’s share of income started falling rapidly in 2000. But this decline has ended and a rebound has started (Figure 5). It was primarily this downturn in labor’s share of income that propelled corporate earnings to record highs (Figure 6). This decline was also the fundamental cause of the surplus cash at companies.

Strong growth in demand for consumer services as the IT revolution improved life styles

The IT revolution was probably also responsible for the downturn in labor’s share of income. But now this downturn has apparently ended even though the IT revolution is still moving ahead. The only plausible reason is that wages have started climbing because of the improvement in the balance between the supply and demand for labor.

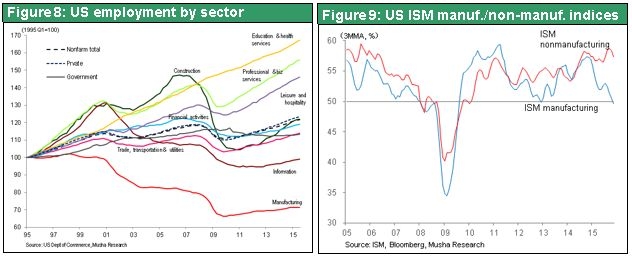

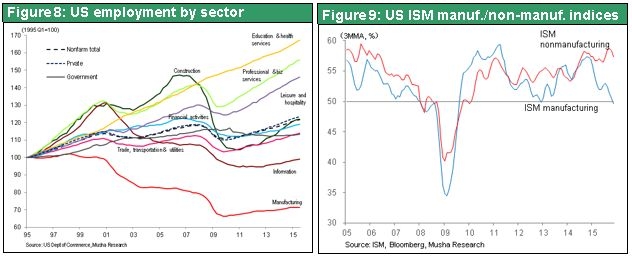

Figure 8 shows the sectors where job growth has occurred in the United States. Almost all of this growth is centered in consumer services like education, health care, professional services, and entertainment and tourism. The IT revolution has sparked progress involving innovation and life styles. The result was a surge in demand for services used by individuals. These events give us a glimpse of the new business models and life styles that will emerge in the information age. We will see more people working at home, more businesspeople with a side job, the widespread outsourcing of tasks, the birth of new network businesses, and the Internet becoming the primary channel for selling goods. Developments like these are giving people even more flexibility in choosing how to lead their lives. As you can see in Figure 9, the increasing ISM Non-Manufacturing Index also demonstrates that the service sector is driving growth of consumer spending in the United States.

As I have explained, in the United States, changing life styles resulting from massive quantitative easing after the start of the global financial crisis created new demand in the service sector. Burgeoning demand is now beginning to absorb the surplus of labor and capital. Until now, benefits of the IT revolution had been limited to corporate earnings. Now these benefits are finally starting to alter life styles and improve living standards. In the United States, we can regard these events as the first signs of a momentous new age of information and networks. Next, we can expect these new and improved US life styles and higher living standards spread to Europe, Japan and other regions.

The first country to end the risk of a deflation crisis

The United States probably does not have to worry about deflation any longer. The proof is that long-term interest rates are more than one percentage point higher in the United States than in Japan and Europe. High valuations of US stocks further demonstrate that the risk of deflation has ended. The clear downturn in the surplus of labor and capital is what made the December 16 US interest rate hike possible.

(2) China is declining – Maybe China will give in to the temptation to devalue the yuan

Will the yuan’s instability increase?

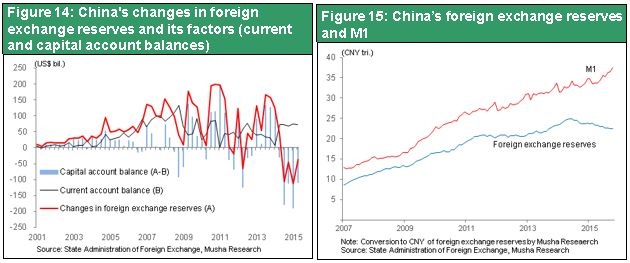

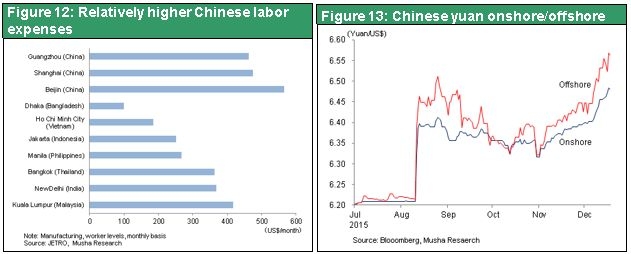

Instability of the yuan is the biggest worry about the negative effects of the US interest rate hike. In China, where economic growth is continuing to slow, a weaker currency is both a natural and desirable outcome. First, China needs to make its exports competitive again in order to stop the drop in exports. As Figure 12 shows, China has the highest labor expenses among Asia’s emerging countries. As a result, companies are quickly relocating factories from China to the ASEAN region and elsewhere. A weaker yuan will be vital to stopping the loss of these factories. Second, a weaker yuan is desirable for the effectiveness of China’s many easy-money measures aimed at preventing the bursting of the real estate bubble. Avoiding the collapse of this bubble is of critical importance. Intervening in foreign exchange markets to sustain the yuan’s appreciation by buying the yuan and selling dollars would cancel the benefits of China’s monetary easing.

Nevertheless, China’s downward guidance of the yuan in response to increasing foreign exchange rate volatility, based on an August IMF recommendation, triggered an enormous panic and ended in failure. So this US interest rate hike may become a perfect excuse for China, where there is a desire for a weaker yuan. The Chinese government may not resist the temptation to take advantage of this excuse.

A weaker yuan is a double-edged sword

For China, a weaker yuan may not be entirely good news. The reason is that a weaker currency may make it impossible to stop the massive outflow of capital from China to continue. The majority of China’s enormous foreign exchange reserves are reliant on foreign debt. Once people become concerned about China’s slowing economic growth, the bursting of its asset bubble and a drop in the yuan’s value, there could be an outflow of foreign investments in China like the collapse of a dam. Even the people of China may step up the pace of moving their own money out of the country. If this happens, there could be an uncontrollable plunge of the yuan. A sharp drop of the yuan would make Chinese companies, which have too much capacity, to rush to increase exports. The result would be increasing deflationary forces worldwide as prices fall and China captures market share in other countries. Moreover, the loss of foreign capital in China would make credit more difficult to obtain. This could contribute to the bursting of China’s asset bubble. For these reasons, the treatment of the yuan is the Achilles’ heel of China as country that is dependent on an enormous volume of foreign capital.

My conclusion is that a sharp drop of the yuan, although unlikely, is the most dangerous event that could occur in response to this interest rate hike.