Jan 01, 2016

Strategy Bulletin Vol.153

Abe initiatives are sparking “consumption power”

¥24,000 Nikkei is possible

Happy New Year from Musha Research!

A worldwide consumption power competition is likely to be the central theme of 2016. Productivity has increased everywhere because of the IT revolution and globalization. However, extra earnings at companies have been accompanied by a serious surplus of labor and capital. Boosting consumption power (improving living standards) will be critical to ending this surplus. The United States was first to increase spending on services. The result was the virtual elimination of unemployment and the end of the US zero interest rate policy. In Europe, there is an unprecedented volume of excess savings (current account surplus) but consumer spending in southern European countries is recovering very slowly. In Japan, consumption power is flat. The government’s wage hike campaign has produced no benefits even though retained earnings at Japanese companies are at record highs. Expectations concerning government initiatives are rising and there is reason to expect that the Abe administration will produce results. In China, the allocation of income is creating a barrier to the shift from investments to consumption. Enacting reforms will be difficult. China is currently working on preventing a steep economic downturn by using a variety of stopgap fiscal and monetary measures. China’s economy will probably stabilize somewhat, but there are still concerns about the future.

Institutional reforms will be vital to stimulating consumption power. People will also examine the degree to which democracy has matured. Consumption power is becoming a key indicator of the strength of each country’s economy and capitalism. Obviously, this power should also create investment opportunities. There will be questions about the rationality and legitimacy of the market economy system, too.

I want to wish everyone success in your investing activities, making 2016 the beginning of a new phase of global prosperity.

Ryoji Musha, January 1, 2016

(1) Government initiatives are likely to produce surprises

Global investors’ expectations are declining as economies and stock prices lose momentum

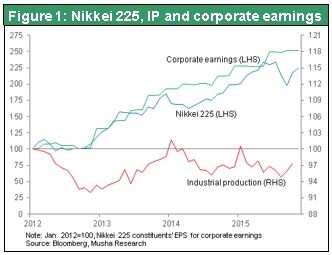

The contrast between the United States and China will probably shape the global economy in 2016. The US economy is on the verge of a bright future as the IT revolution continues to advance. But China’s economic growth is rapidly slowing due to the after-effects of excessive investments. In Japan, which is influenced by both countries, the economy is feeling the effects of the 2014 consumption tax hike and China’s weakening economy. Japan’s industrial output rebound that started in 2014 has come to a complete stop. According to the Bank of Japan Tankan corporate survey, businesspeople expect the economy to weaken slowly. The strength of the Japanese economy when Abenomics started is beginning to dissipate. Furthermore, Japanese stock prices have lost upward momentum in the wake of the global stock market downturn triggered by China’s currency devaluation in August 2015. Global investors have lost faith in Japanese stocks and some are starting to reduce their weightings of Japanese equities.

Despite these problems, Japanese companies are reporting record-high earnings. Earnings are forecast to increase about 15% in fiscal 2015 and retained earnings have climbed to ¥350 trillion. Clearly, Japan’s economy has dramatically regained its ability to generate earnings. This was a big problem only 10 years ago. Now Japan needs to use corporate earnings to create demand across many sectors in order to speed up the country’s economic growth and terminate deflation. Demands for government actions to accomplish this goal are mounting.

Government actions are even more than before to surprise investors

Once again, investors are waiting for the Abe administration to act. There is good reason to expect to see more initiatives. Most important of all is Prime Minister Abe’s strong resolve to end deflation and restore economic growth (GDP of ¥600 trillion in 2020) and his ability to translate this resolve into actions. I think the Japanese government will take fiscal and monetary actions that will surprise even cynical market observers. The first Abenomics rally started in November 2012. Next was the QQE2 (second phase of quantitative and qualitative easing) rally that started in October 2014. Now we can expect to see stock prices start moving up again because of the upcoming third phase of government initiatives.

QQE3 is unavoidable – No more doubts about BOJ Governor Kuroda’s actions

Financial markets are becoming increasingly disappointed with Japan’s monetary actions because reaching the 2% inflation target is becoming more distant. In December, Japan initiated more quantitative easing (the third phase) by announcing new supplementary measures. One step is the extension of the average remaining maturity of Japanese government bond purchases. Buying bonds with more remaining time will result in more growth of base money. However, this announcement sparked stock price volatility because investors regarded the new measures as a gradual deployment of force that will do very little. Furthermore, most economists believe that reaching the 2% inflation target will be very difficult. As a result, investors have doubts about BOJ Governor Kuroda’s resolve. For example, he stated that the yen is very weak at ¥124 to the dollar and he supported the 2014 consumption tax hike. Inflation of 2% should be a target to be accomplished at all costs and the exchange rate, tax hikes and other issues should be regarded as subordinate to this primary objective (or as means of achieving this objective). But investors are starting to worry about these subordinate issues blocking the path to the primary goal. These worries cannot be ignored. This is why Japan’s next initiatives must eliminate these worries. Mr. Kuroda is absolutely unable to accept the belief of many investors and economists that a new policy is needed because monetary easing has been ineffective and a failure. As a result, Mr. Kuroda is very likely to quickly start phase three of quantitative easing.

Shifting from taxes to growth to restore government financial soundness

Regarding budgetary measures in 2016, we can expect the Japanese government to enact a supplementary budget, increase spending and push back the next consumption tax hike, among other actions. Japan’s next consumption tax revision, which will raise the rate by 2 percentage points (increasing revenue by almost ¥5 trillion), is scheduled for April 2017. But Prime Minister Abe plans to reduce the impact of the tax increase by lowering the tax rate for a larger number of business sectors. This initiative of the prime minister has greatly weakened the influence of two organizations. One is the Ministry of Finance, which had been guiding public opinion to accept the next consumption tax hike as a fait accompli. The other is the Liberal Democratic Party’s Research Commission on the Tax System, which is the mouthpiece for the Ministry of Finance.

The December 2014 general election made Prime Minister Abe very confident that he made the right decision when he postponed the October 2015 consumption tax hike by a year and a half. Raising this tax as planned may have started another recession and renewed deflationary forces. This would have signaled the failure of Abenomics and destroyed the long-range plan for Japan. The Ministry of Finance and the large number of economists and others in the academic sector who backed a tax hike must now look back on their stance as a mistake. Japan could be about to see a transition in budgeting power to the US system. The budget making process may shift from its bureaucratic focus (Ministry of Finance) to the legislature (the Congressional Budget Office in the US) and the prime minister (the Office of Management and Budget, which is overseen by the president, in the US).

Moreover, the Japanese government plans to use the foreign exchange funds special account surplus, an enormous amount estimated to be almost ¥20 trillion, and other sources to bolster spending. The government could even suspend the consumption tax hike planned for 2017. Consequently, we can make the following well-balanced argument. First, the government must be cautious about enacting the next consumption tax hike, which has been delayed to April 2017. Second, the government needs to think about prioritizing either (a) ending deflation and restoring growth or (b) raising the consumption tax by two percentage points. From the standpoint of the long-term balance of the budget, focusing on deflation and growth is preferable. Therefore, the Abe administration will, sooner or later (and either before or after a consumption tax hike), probably shift its focus from raising taxes to restore financial soundness to using economic growth to restore financial soundness. In the fiscal 2016 budget proposal, tax revenue is ¥13.6 trillion higher than in fiscal 2012, which was prior to the start of Abenomics. The consumption tax accounts for ¥6.3 trillion of this increase and other taxes for ¥7.3 trillion (mainly the result of economic growth). This clearly demonstrates that economic growth is the most effective way to restore government financial soundness.

The upper house election in Japan that will take place in July 2016 is increasingly likely to become a general election for both houses of the Japanese Diet. Fiscal and monetary policy initiatives to stimulate the economy during the first half of 2016 may produce a surprise that surpasses the expectations of investors.

(2) With Japan’s profitability back, stock valuations have become an urgent problem

Abenomics cannot succeed without higher stock prices

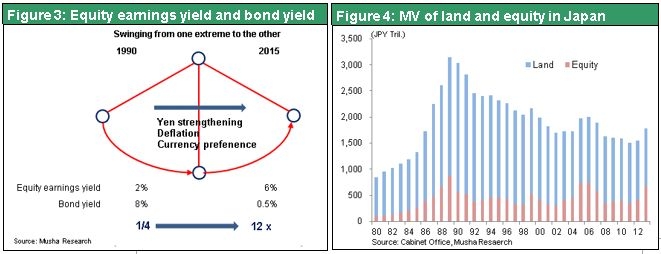

Japan is caught between the robust US economy and the weakening Chinese economy. Rising stock prices will be critical to the Abenomics goal of ending deflation. Excessive savings is a particularly big problem in Japan. The disparities among investment returns for a variety of financial assets are widening significantly. Yields are almost nothing on bank deposits and 0.3% on government bonds while investors can earn 2% from stock dividends and 3% to 6% from REIT distributions. The income yield on stocks is 7% and returns on business investments are more than 10%. Huge differences in what money can earn are a key characteristic of savings in Japan today. Nevertheless, very low yielding bank deposits and government bonds account for about 70% of savings by individuals.

Massive low-yield savings have serious implications for Japanese government policies associated with Abenomics. The Japanese economy is no longer struggling with the low corporate earnings that occurred around 2000. Profits have grown dramatically and companies are now reporting record earnings. The Japanese economy is still weak despite this strength because profits at companies are not creating actual demand. Companies are retaining most of their earnings and refusing to use these funds for higher dividends, wages or investments. The Abe administration has consistently stated that it is vital to convert corporate earnings into as much demand as possible. Raising wages by about 3% as the Abe administration wants would not significantly reduce the massive amount of surplus funds held by companies. One option is for the government to use even more debt to fund spending for creating demand. However, almost all bureaucrats and academics oppose more government debt. So should we conclude that the Japanese economy will continue to decline even though companies are very profitable?

The most important way to create demand is probably an increase in the Nikkei Average to ¥40,000. At this level, the value of all Japanese stocks would double from ¥600 trillion to ¥1,200 trillion. Since foreigners hold about one-third of these stocks, the assets of stockholders in Japan would increase by approximately ¥400 trillion. This is ¥4 million for every citizen of the country. Even if only a small portion is spent, the Japanese economy would be benefit from an enormous wealth effect. A big positive shift in sentiment about the economy would definitely produce rapid growth in the “animal spirits” of investors.

Some people may worry about an asset bubble or moral hazard if the Nikkei Average climbs to ¥40,000. But there is no reason at all for these concerns. A twofold increase of the Nikkei Average would lower the income return of stocks from 7% to 3.5% and dividend returns from 2% to 1%. But even 1% is more than three times higher than the government bond yield. So stocks would still not be overpriced in relation to deposit and bond returns. Growing retained earnings are another reason for the value of stocks to climb. Whether or not companies raise wages and dividends, higher stock prices are likely to fuel a positive chain reaction backed by growth in purchasing power across a broad spectrum of Japan’s population.

Japan damaged itself with unnecessary and harmful asset deflation

For these reasons, a stock market rally that lifts the Nikkei Average to ¥40,000 alone would probably solve a multitude of Japan’s problems. This is because the inexplicable and excessive downturn of stock and real estate prices has been the most important cause of Japan’s abnormally long period of deflation. Unneeded disposals of non-performing assets created losses from sales at low prices. The result was an enormous burden for both Japan’s economy and corporate sector. There is an obvious need for a correction of prices that have fallen too far in order to end this asset mispricing.

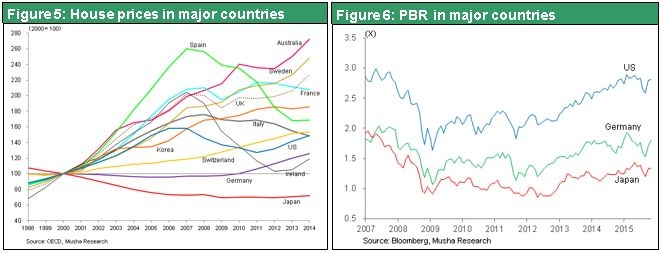

2% inflation is impossible without asset inflation

Japan is the only country where housing, real estate and stock prices remained depressed by 50% following the end of an asset bubble. Normally, a country should enact financial policies aimed at preserving positive sentiment about the economy by keeping prices of stocks and other assets as high as possible. However, Japan’s policies radically destroyed asset values. There is no doubt that Japan mismanaged the economy. Japan has been criticized because emphasis on stock prices has increased economic inequality by making only speculators and wealthy people even richer. But the fact is that most people view stock prices as the indicator of economic health. Consequently, higher stock prices are undeniably a vital pathway to the success of Abenomics.

Since 2013, Prime Minister Abe and Bank of Japan Governor Kuroda have been concentrating on asset prices. They should continue to steadfastly enact policies that target asset prices (and aim for asset inflation) while refusing to be swayed by criticism from the academic sector and the media.

(3) Consumption power is the focus of the global economy

The new age of consumption power is emerging in the United States

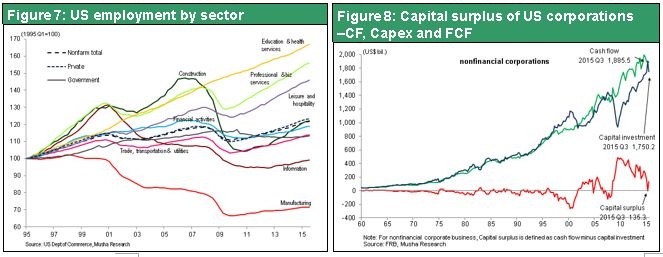

The first US interest rate increase since 2006 demonstrates the confidence that the US economy is no longer suffering at all from the after-effects of the global financial crisis. Rising productivity since about 2000 resulting from IT revolution generated surplus labor and capital. Until 2007, these surpluses were absorbed by the construction sector (a bubble industry). But these surpluses quickly became a problem during the subsequent Great Recession. The result was unemployment, wage stagnation, idle capital and low interest rates on the greatest scale in the postwar era. Thanks to persistent monetary easing, these labor and capital surpluses have been largely eliminated.

The US unemployment rate has dropped from a peak of 10.0% in 2009 to 5.0%. Furthermore, free cash flows at US companies, which have been substantial since 2000, are now relatively small because the growth of capital expenditures has caught up with cash flows. Wages have finally started to climb. Labor’s share of income dropped rapidly starting in 2000 but is now beginning to rebound. This downturn in labor’s share of income was the primary reason that companies were able to produce record-high earnings. This was also the fundamental reason that companies accumulated excessive amounts of cash.

Figure 7 shows the sectors where job growth has occurred in the United States. Almost all of this growth is centered in consumer services like education, health care, professional services, and entertainment and tourism. The IT revolution has sparked progress involving innovation and life styles. The result was a surge in demand for services used by individuals. These events give us a glimpse of the new business models and life styles that will emerge in the information age. We will see more people working at home, more businesspeople with a side job, the widespread outsourcing of tasks, the birth of new network businesses, and the Internet becoming the primary channel for selling goods. Developments like these are giving people even more flexibility in choosing how to lead their lives. The increasing ISM Non-Manufacturing Index also demonstrates that the service sector is driving growth of consumer spending in the United States.

Until now, benefits of the IT revolution have been restricted to corporate earnings. But now these benefits are at last starting to alter life styles and improve living standards. We should regard this as the first signs of a new information network age in the United States of historic proportions. There is no longer a risk of US deflation. For proof, we need only to note that US long-term interest rates are at least one percentage point higher than rates in Japan and Europe. High valuations of US stocks are another indication that the deflation risk has ended. Big declines in surplus labor and surplus capital are what made possible the first US interest rate hike of December 16 in nine years.

In 2016, these US improvements in life styles and living standards will probably begin to spread to Europe, Japan and other developed countries of the world. Japan’s fiscal 2016 budget includes many major initiatives. Examples include support for raising children, logistics networks for Japan’s three large metropolitan areas, and measures involving senior nursing care facilities and personnel. All these initiatives show the Japanese government’s determination to boost consumption power.

(4) All signs point to renewed investor interest in Japanese stocks

If deflation signifies low valuations, does inflation signify high valuations?

Assuming that Japan chooses the right policies, Japanese stocks may be the world’s most attractive assets in an environment in which appealing investments are becoming difficult to find. No one can deny that the US economy is stronger than the Japanese and European economies. However, there is little upside potential for US stocks because prices have already increased significantly. On the other hand, valuations of Japanese stocks based on the PBR and other metrics are the lowest among the world’s industrialized countries. This undervaluation reflects the well-established mindset among investors of assuming that Japan’s economy will continue to shrink. The reason is that Japan was the only country in the world to become mired in long-term deflation. But deflation is clearly coming to an end, so we can expect to see a dramatic shift in stock market valuations.

The change in stock prices that will accompany this paradigm shift will create an enormous opportunity for investors. From the standpoint of upside potential, Japan’s stock markets are the most attractive in the world. The Abenomics rally has pushed up stock prices in Japan by as much as 140%. Even at the current level, stocks are still undervalued because of the strong growth in earnings. Although stock prices will be influenced somewhat by the health of the Chinese economy, the Nikkei Average will probably climb to about ¥24,000 in 2016.

During the past 20 years, the nominal GDPs of most major countries have grown by three to four times. Japan alone had virtually no growth. Now there is no doubt that Japan is about to end two decades of stagnation with a powerful resurgence.