Jan 08, 2016

Strategy Bulletin Vol.154

The beginning of the end of the Chinese economy’s free lunch

The lockdown of China’s markets will halt the worldwide chain-reaction plunge in stock prices

(1) China responds to market turmoil with restrictions and a rejection of the market system

The vicious cycle comes back to life

No end is in sight to the chain-reaction collapse of China’s stocks and currency. On January 4, stock markets in Shanghai and Shenzhen established circuit breakers stop trading when prices fall 7%. This limit was reached on January 7 only 30 minutes after trading started. Trading was suspended for the remainder of the day. Falling stock markets in China have caused sharp downturns in stock markets worldwide during the first week of 2016. Worries about the global financial system are increasing quickly. Several geopolitical events are viewed as causes of stock market declines: North Korea’s atomic bomb test, the termination of diplomatic relations between Saudi Arabia and Iran, and tension between Russia and Turkey. But China is the primary cause by far.

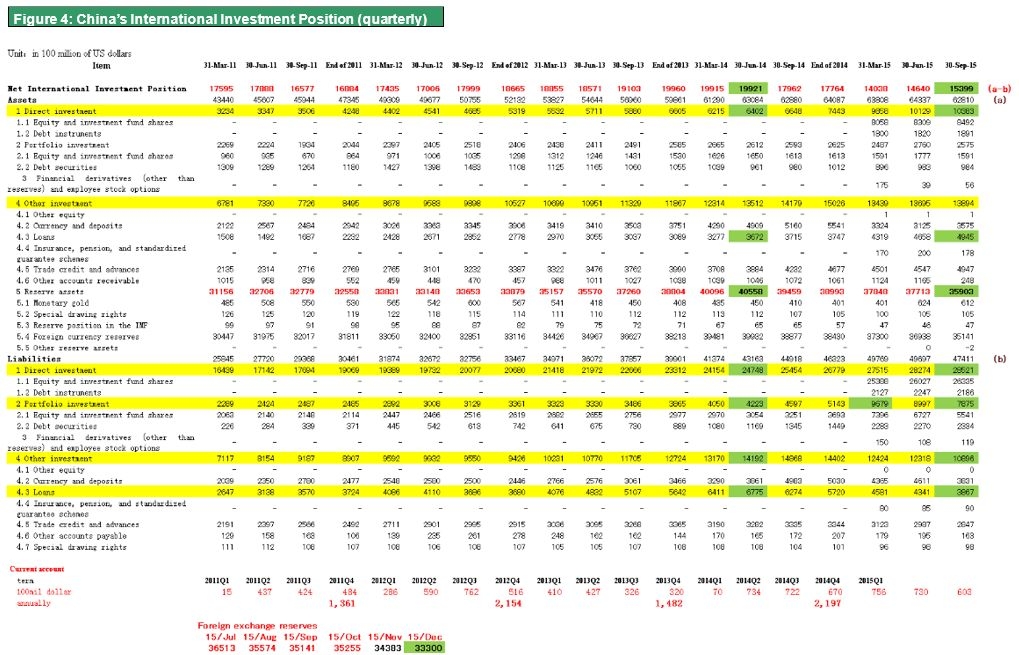

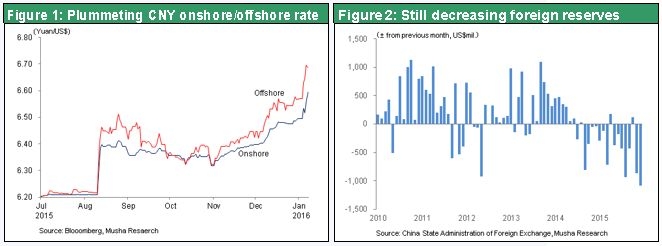

The yuan has been falling in tandem with stocks since the beginning of 2016. First, the yuan moved down in offshore markets. Next, the yuan dropped in onshore markets, which are overseen by the Chinese government. Despite government intervention, expectations for a further decline of the yuan are increasing. Furthermore, China’s foreign exchange reserves, which peaked in June 2014, continue to decrease. In fact, the rate of decline is accelerating. These reserves plunged by a monthly all-time high of $107.9 billion dollars in December 2015. Currently, China’s average monthly current account surplus is about $20 billion. Consequently, there is an average monthly net outflow of about $130 billion. Several factors may be responsible for this outflow: (1) the growth of China’s direct overseas investments, (2) the recovery of investments in China by foreigners, and (3) the shift by Chinese investors of capital to other countries. Factors two and three are probably the most important reasons. In other words, we are seeing the start of a rapid flight of capital from China.

The symptoms of China’s slowing economic growth

Falling stock prices (lower asset prices), a weakening currency and outflows of capital are precisely the three events that occurred during the 1997 Asia currency crisis. If nothing is done about the vicious cycle of China’s financial instability, we will be increasingly likely to see another crisis like the one in 1997. The conventional response to this situation is to fight the speculators who are attempting to destroy markets. Accomplishing this involves restoring faith in the values of stocks and currencies by boosting economic growth rates. But the Chinese economy is showing no signs at all of renewed growth despite a series of monetary and fiscal initiatives. Many microeconomic indicators are lower than one year ago. Examples include railroad freight volume, crude steel output, electricity consumption, and exports and imports. Moreover, China has been using real estate development and railroad investments to stimulate the economy. But by the end of 2015, these investments were less than one year earlier. If China is unable to stop its economic slowdown, the vicious cycle of falling stock (asset) prices, a weakening currency and capital outflows will inevitably gain momentum.

However, China absolutely cannot allow the bursting of an asset bubble and outbreak of a financial crisis to continue. The reason is that these problems would quickly create a crisis regarding the autocratic rule of China by the Communists.

China has few options for avoiding a crisis

China’s only course of action now may be to distort the price determination mechanism, prohibit stock sales and return to a fixed-price market. That means the country has one choice: a rejection of the free market mechanism. The Chinese government is responding to plummeting stock prices by reinforcing its market interventions aimed at propping up prices. For instance, the government has once again prohibited sales of stocks of listed companies by large shareholders, a measure that was enacted for a while in 2015. In addition, the government has decided to stop using the circuit breaker, which is an easy target for speculators. When stocks fell sharply in 2015, the Chinese government responded by suppressing information. One action was rounding up securities company people, investors and journalists who recommended selling stocks for questioning by the police. The government may step up actions to control information.

For foreign exchange, the Chinese government may restore a fixed exchange rate and enact even tighter controls on cross-border transactions involving capital. In September 2015, China effectively prohibited sales of forward exchange contracts. But now this measure has become completely ineffective. Only very strong actions implemented with an iron fist can stop the outflow of capital and the yuan’s downturn. Under the leadership of Prime Minister Mahathir, Malaysia used an iron fist during the 1997 currency crisis. Ignoring the urging of the IMF to accept its support, Malaysia instead drastically devalued its currency and established a fixed exchange rate. Malaysia also placed limitations on capital outflows. Foreigners were prohibited from sending proceeds from asset sales outside the country and a tax was imposed on capital leaving Malaysia. These actions largely ended foreign exchange speculation.

Today, China appears to have only one way to deal with this crisis. The government needs to prohibit cross-border capital movements, stabilize the yuan, effectively prohibit stock trading and take other decisive actions. If this is really the country’s sole option, we can expect to see positive outcomes. Speculators will no longer be able to sell stocks and the yuan, the chain reaction of global financial market instability will be blocked, and stock prices worldwide will stop falling. In this case, the world can probably avoid another crisis like the Asian currency crisis of 1997. But all of these extreme measures would effectively shut down markets.

For years, China has been attempting to establish a socialist market economy, which is itself a contradiction. China wanted a free lunch by cherry picking only the good parts of a market economy. Rejecting the market component of its economy would bring China back to socialism (a controlled economy). But this goes against the reforms toward the market capitalism desired by the world. We will be pushed to a stage where we will have to give up and conclude that there is no other option.

(2) Financial isolation would be a double-edged sword for China

Enormous reliance on foreign capital is China’s Achilles’ heel

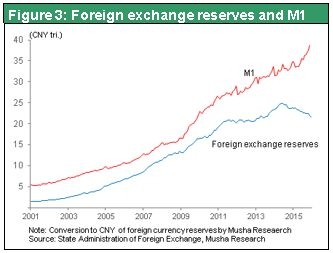

Rejecting markets may be effective at preventing a crisis for the time being. But this stance will create even more serious problems for the Chinese economy. The resulting difficulty using markets to procure funds would almost certainly lead to the collapse of the entire economy. This is because huge inflows of foreign capital have been the single greatest factor underpinning the strength of the Chinese economy. In particular, a free lunch resulting from the catch-up growth of emerging countries (in the past, Japan and Korea also benefited from this free lunch) has been a key element of the growth of the Chinese economy. This free lunch included the ability to receive technologies and gain access to overseas markets. Receiving capital from overseas was an especially valuable part of the free lunch. Idle capital from around the world flowed to China in the form of investments and loans. This explains why China accumulated a massive volume of foreign exchange reserves. But becoming a financially closed country would block all paths to procuring funds from global financial markets.

Huge investments that fueled the remarkable growth of the Chinese economy originated from equally huge foreign currency inflows and loans. Rising foreign external debt caused foreign exchange reserves to skyrocket. These foreign funds backed money supply growth in China that made possible investments on an unprecedented scale. For proof, we need only note that foreign currency assets account for more than 80% of the assets of the PBOC, the country’s central bank. Foreign exchange reserves are the symbols of a country’s international financial power. But in China, more than half of these reserves rely on the funds of other countries. We must therefore conclude that China’s international financial power is very low.

China’s debt-reliant reserves create foreign currency problems

As I have discussed in previous reports, the nature of foreign exchange reserves in Japan and China is completely different. Government agencies hold foreign currency-denominated assets for the purposes of making payments to other countries and stabilizing foreign exchange rates. Japan defines foreign exchange reserves as foreign currencies held by the Bank of Japan and the Ministry of Finance. Most of Japan’s reserves were acquired during foreign exchange market interventions. Japan’s current account surplus is the source of all of these reserves. At the end of November 2015, Japan’s foreign exchange reserves totaled $1.23 trillion. Of this figure, 1.07 trillion (87%) was foreign government securities, chiefly U.S. Treasuries.

In China, foreign exchange reserves originate from the current account surpluses of prior years and, to a much greater extent, loans from overseas. China has strict rules for the foreign currency holdings of private-sector and foreign-owned companies. As a result, the PBOC holds the majority of the foreign currency received in the form of payments for exports, loans from overseas and other sources. Apparently, China counts these central bank deposits as part of its foreign exchange reserves. Consequently, foreign exchange reserves represent only 16% of Japan’s foreign assets but are an unusually high 61% of China’s foreign assets.

In Japan, foreign exchange reserves have no strings attached. But in China, more than half of these reserves are funds linked to a huge volume of debt. Since this money belongs to other countries, it cannot be used for foreign exchange market interventions. Therefore, if overseas Chinese investors start to pull out their enormous volume of investments and loans in China, the country may discover that its foreign exchange reserves, which are considerably overstated, are insufficient. The data on China’s foreign assets and liabilities in Figure 4 provide an additional perspective concerning this potential foreign exchange crisis.