Apr 25, 2016

Strategy Bulletin Vol.159

Don’t fight the BOJ – The non-traditional evolution of BOJ policies is inevitable

The theoretical outcome is a powerful stock market rally

(1) The news on BOJ’s new policy reversed market sentiment weakening the yen and boosting stock prices

A sudden change in supply-demand dynamics – Investors are closing-out short positions

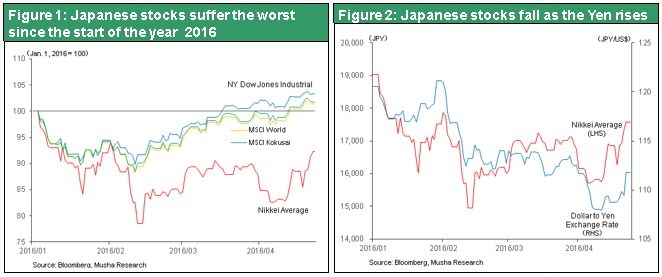

Japan has been the only country in the world to experience weak stock prices recently because of the negative cycle driven by a stronger yen and weaker dollar. But at the end of last week, there was an unexpected surge in stock prices as the yen dropped. The Nikkei Average hit a low of ¥16,254 in the middle of the week but closed at ¥17,572. In the Chicago Nikkei futures market, the price skyrocketed 9.2% to ¥17,740. With this rebound, the Nikkei Average is now down only 6% since the beginning of 2016, far less than the 22% decline that was reached on February 12. Moreover, after peaking at ¥107.6 to the dollar on April 11 and then remaining in a ¥107-¥109 trading range, the yen plunged to ¥111.8. This movement probably signifies that the technically overdue unwinding of strong yen/weak dollar positions that had been accumulating has taken place very quickly. Triggering this sudden change was a Bloomberg article with speculation about the BOJ’s new monetary easing scheme titled “BOJ to Pay Negative Interest on Loans to Financial Institutions.” No one knows if this report is rooted in any facts. However, this market movement demonstrated that everything the BOJ does has the power to determine the direction of financial markets.

Contempt for the BOJ is behind the rising yen and falling stock prices

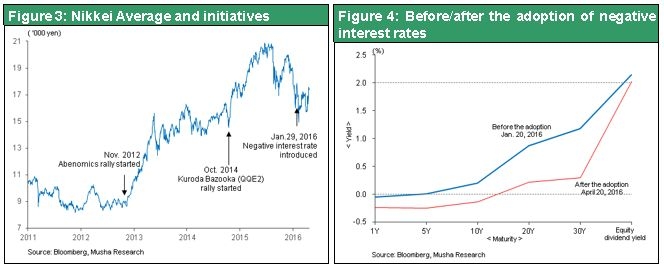

Contempt for central banks, and especially the BOJ, was what made strong yen/weak stock price speculators relatively confident from January until the first half of April. There was a chorus of criticism about the BOJ’s negative interest rate. The opinion that the BOJ had become ineffective became the consensus view of the bank. In the past, the BOJ was able to push up stock prices by enacting extremely powerful policies. But the start of negative interest rates on January 29 had absolutely no impact. In fact, stock prices continued to move down as the yen strengthened. The public was inundated with media reports about the ineffectiveness of the BOJ’s traditional weapon and the impotence of the policies of the BOJ and other central banks.

Why criticism of the BOJ was a mistake

This criticism of the BOJ had two fundamental errors. First was the belief that negative interest rates would end in failure. Musha Research believes that the effectiveness of these rates will soon be proven by a stock market rally. As BOJ Governor Haruhiko Kuroda has explained repeatedly, events outside Japan are mainly responsible for the yen’s strength and stock market’s weakness. Without negative interest rates, the yen would probably continue to climb as stock prices fell. This position is difficult to reject. The second error is the failure to comprehend and fully recognize the BOJ’s determination to achieve its goals. The BOJ has unlimited ammunition and is likely to announce new initiatives one after another to accomplish its goals. There are no indications at all of weakening or hopelessness regarding these new initiatives. Investors should realize that the BOJ’s actions are evolving to match today’s new environment.

Don’t fight the BOJ if you want to be a winner

The well-known axiom “Don’t fight the Fed” is as true today as it has been in the past. Today, this saying applies to the BOJ. Don’t fight the BOJ. The non-traditional evolution of BOJ policies is inevitable. By enacting initiatives that no one expects, the BOJ will probably surprise financial markets, stimulate the creation of credit and do everything possible to raise inflation to 2%. As these events unfold, we can expect to see stock prices move even higher to boost the Nikkei Average to a level much higher than the consensus outlook. Late in 2015, Musha Research stated that the Nikkei Average may climb to ¥24,000 by the end of 2016. Obviously, global events will also play an important role in determining stock prices. Reaching ¥24,000 assumes that (1) the crisis in China will end and (2) the US will continue to see economic growth and higher stock prices. At this time, prospects are excellent for both of these outcomes.

We can look forward to a powerful stock market rally assuming that the China crisis is contained

China could spark a crisis. Nevertheless, as is explained later, the current powerful long-term upturn of Japanese is linked to the correction of two extreme abnormalities. One is abnormal stock valuations. The other is the abnormal allocation of individuals’ financial assets. The existence of these abnormalities is clear because ending them is becoming the primary focus of policies in Japan. There is no doubt that actions have started to correct the abnormally low valuations of Japanese stocks. International investors who quickly realize this process has started will probably once again start buying Japanese stocks like crazy.

(2) Higher stock prices will very quickly eradicate the fundamental mistakes about BOJ criticism

Negative interest rates have produced a steeper yield curve

As stock markets rebounded worldwide and investors started taking on risk again, Japanese stocks were the world’s only loser. The belief that the BOJ is ineffective was a major cause. However, people in Japan’s financial services sector were criticizing the BOJ for their own benefit. There were no alternatives. When Germany criticized the ECB’s negative interest rate, Mario Draghi responded that he could not accept any criticism that had no alternative. Today this is true of people who criticize the BOJ. Creating more credit is the goal of central banks. This is why actions are needed to revive as much as possible the operations of private-sector banks, which have stopped functioning and are unable to create credit. And if this is not possible, then measures are needed to use non-banking sectors for credit creation. This is the objective of negative interest rates.

Negative interest rates will probably shift money to stocks and other assets with risk

Negative interest rates have definitely created a more difficult environment for banks to earn profits, just as critics have said. Demand deposits have a negative interest rate and the yield curve has become flat. Furthermore, the extension of negative interest rates all the way to 10-year Japanese government bonds has exerted pressure on the interest margins of banks. Critics are correct to say that weakening banks will result in fewer loans. However, negative interest rates are needed even with this negative impact on loans. Economic circumstances in Japan make it impossible to create credit and properly allocate capital without negative interest rates.

The stance that a flat yield curve caused by negative interest rates will take away profit opportunities one after another is the belief of people associated with the financial services sector. The yield curve has become flat even for bonds that will mature about 30 years from now. This aspect of the yield curve definitely creates a difficult environment for banks. Figure 4 shows a yield curve with securities (stocks) that have an infinite redemption period. When stocks are included, the yield curve in April was steeper than before the start of negative interest rates. This aspect of the yield curve has increased opportunities for earning profits. If shifting money from bonds to stocks is the goal of negative interest rates, then the criticism of these rates by the financial services sector is one-sided. Negative interest rates should be regarded as having a greater benefit in terms of higher prices of stocks and other assets with risk.

The non-traditional evolution of monetary policies will not be a stopgap measure

The world has seen a procession of entirely new monetary policy initiatives since the global financial crisis began. All of these actions elicited massive criticism and opposition. All of these actions produced satisfactory results, too. In the April 25 issue of Nikkei Business, Nouriel Roubini, who predicted the global financial crisis, made the following statement. “Quantitative easing, forward guidance and zero interest rates were regarded as preposterous until only a short time ago. But these non-traditional monetary measures have been effective for the purpose of avoiding a deep economic downturn and deflation. Now these policies are taken for granted. Slow growth and deflation are persisting year after year in industrialized countries. These countries will probably have no option other than to take the evolution of non-traditional monetary policies one more step. Possible actions include taxing cash held by banks, distributing helicopter money (cash disbursements directly to households), and direct purchases of stocks and other assets with risk by central banks. A desperate age calls for desperate efforts.”

(3) Why non-traditional actions are needed as central banks confront a new environment

Stable excess profit is the primary cause of the financial crisis

Central banks have been forced to enact urgent measures because the global economy has been unable to bring an end to sluggish growth rates and worries about deflation. But actions by central banks targeting global economic problems and crises tend to be viewed as nothing more than stopgap measures. If we believe that these are short-sighted actions to deal with hopeless economic problems, then we can understand the criticism of the non-traditional monetary policies of central banks as reckless measures.

However, the reality is quite different. The financial environment is changing along with technological advances and the evolution of the economy. A search is under way to determine the best systems and policies for this new environment. This is the correct view of central bank actions. Japan is in an unusual and historic period in which surplus earnings at companies are constantly growing due to the IT/AI revolution and economic globalization. Companies are creating large volumes of value but are unable to use capital (the value that is created) effectively. As a result, the growth of money placed in so-called safe assets (cash, deposits, Japanese government bonds) has been gaining momentum in recent years as money flows to risk-free assets (zero-return assets = assets with no future cash flows).

The biggest contradiction of finance today: The widening gap between profit margins and interest rates

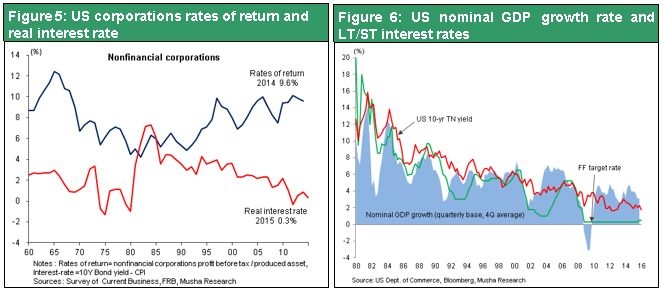

In normal circumstances, all capital should have the same return. But we are now in the midst of a prolonged period of abnormality because of the gap between profit margins and interest rates. This abnormality can be expressed as follows: r1>g>r2 (r1 is the profit margin, g is the economic growth rate and r2 is the interest rate). This inequality has been the most important characteristic of the global financial picture for more than 10 years. Thomas Piketty argues that capital returns that are higher than the economic growth rates (r1>g) are responsible for increasing wealth and income inequality. In industrialized countries, central banks must deal with the reality of g>r2. In other words, the drop in the return on capital to almost nothing is exerting downward pressure on economic growth rates. Returns on capital, which should be uniform, have been split into the profit margin (r1) and interest rates (r2) and the gap between r1 and r2 is continuing to grow. Figure 5 illustrates this situation in the United States. But as you can see in Figure 6, US long-term interest rates have been low since about 2004. This clearly shows that long-term interest rates were not influenced at all by an increase in the nominal economic growth rate or tight-money policies (short-term interest rate hikes), which is the so-called Greenspan conundrum.

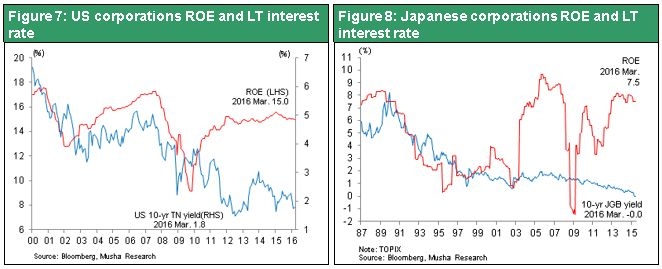

In a textbook economy, profit margins and interest rates move in tandem and this has in fact occurred. Interest rates naturally climb when corporate earnings improve along with economic growth. Nevertheless, a wide gap between profit margins and interest rates exists today. The reason is that companies are earning large profits but are unable to reinvest this money. Funds sit idle as a result, which pushed interest rates down. Profit margins are currently high at more than 7% on a market price basis (Stock yield = Profit/Stock price) and a book value basis (ROE = Profit/Equity). Long-term government bond yields are unusually low, with a negative yield in Japan, no yield in Germany and France, and even in the United States only a 1.8% yield. Figures 7 and 8 compare changes in the ROE and 10-year government bond yield in Japan and the United States. These figures clearly show that the link between the ROE and this bond yield ended in Japan in 2004 when corporate earnings started to recover and in 2010 in the United States when corporate earnings started to recover after the global financial crisis.

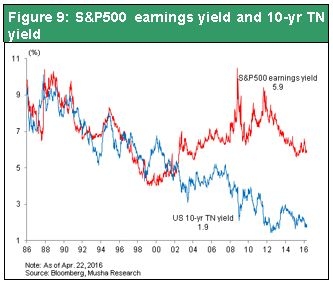

Figure 9 compares the market price-based profit margin (earnings yield) with the 10-year Treasury yield. These two figures moved in tandem until about 2002 but have subsequently been moving farther and farther apart. One scenario is for higher stock prices (which lower the earnings yield) to eliminate the gap between the market price-based profit margin and bond yield. This will probably be one outcome of non-traditional monetary easing.

The true intent of QE and negative interest rates is shifting capital to knowledge risk assets

The profit margin-bond yield gap is the result of substantial surplus earnings at companies that in turn results from higher productivity fueled by the IT/AI revolution. Knowledge is at the core of surplus earnings at highly profitable companies like Microsoft, Apple, Google, Facebook and Amazon. Knowledge in the form of AI and other technologies and machinery has been a source of prosperity by creating value that makes our lives much more pleasant and convenient. In fact, knowledge and the activities of companies are one and the same. And stocks are a representation of the value created by knowledge.

These points show that two types of capital exist: capital with knowledge and capital without knowledge. So-called safe assets like cash, deposits and government bonds are capital without knowledge and must therefore have a return that is almost nothing. The equity of companies overseen by skilled executives is capital with knowledge. This type of capital obviously has a far higher return. But the surplus capital generated by the IT/AI revolution is sitting idle in risk-free government bonds and deposits because there are no places to invest these funds. Interest rates have declined as a result. These events signify that the substantial value created by companies is simply being stored and thus is not functioning as capital. A sharp drop in the velocity of money, which is like the flow of blood that is vital to life, will result in a zombie economy. This may cause the problems of slow economic growth and deflation. Ending these problems requires the use of quantitative easing, negative interest rates and other entirely new non-traditional monetary policies for the purpose of shifting money from capital without knowledge (safe assets, which have no cash flows) to capital with knowledge (assets with risk, which generate substantial cash flows). This is why we can regard non-traditional monetary measures as worthwhile actions that produce positive results.

(4) Guiding money to stocks will be an inevitable measure for returning Japan’s abnormal financial asset allocations to normal

Japan’s two financial abnormalities: The return gap and unbalanced asset allocations

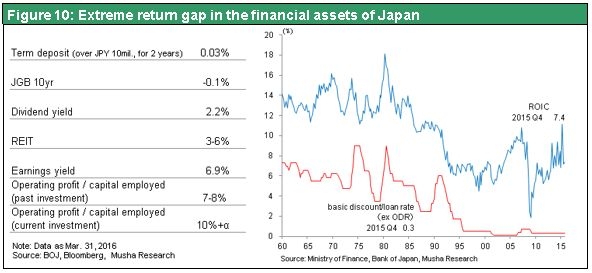

The extreme gap between profit margins and interest rates is the biggest contradiction of the Japanese economy today. Moreover, this gap is obviously responsible for Japan experiencing the most severe deflation in the world. As a result, the two financial abnormalities grew to the point where they became extreme. One abnormality is extreme differences in returns. The other is an extremely unbalanced allocation of financial assets. Eliminating these two abnormal situations is an urgent goal of government policies. Non-traditional monetary initiatives of the BOJ are attempts to end these abnormalities. The unusually large differences in returns of financial assets are shown in Figure 10.

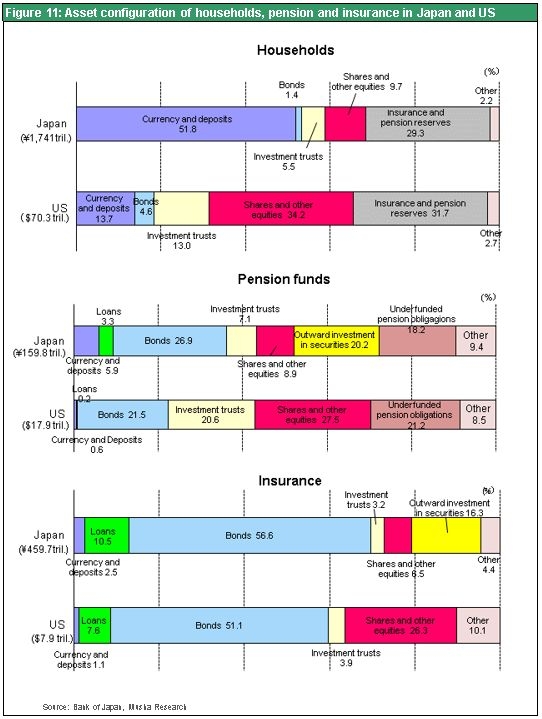

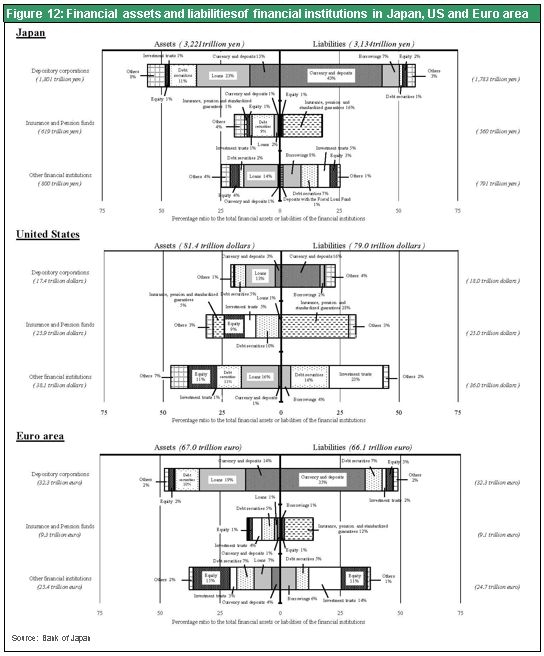

The skewed allocation of financial assets held by individuals in Japan is shown in Figure 11, which compares Japan and the United States, and Figure 12, which compares Japan with the United States and Europe. At the end of 2015, individuals in Japan had financial assets of ¥1,741 trillion. The amount that is available for investments is ¥1,231 trillion, which does not include pension plan assets of ¥510 trillion. Of this available amount, ¥920 trillion (75%) of the total is sleeping in cash, deposits, government bonds and other assets with virtually no return. Stocks are only ¥169 trillion (14%) of money available for investments. In the United States, financial assets of individuals total $70.3 trillion and, after deducting pension plan assets of $22.2 trillion, $48.1 trillion is available for investments. Only $12.9 trillion (27%) is in safe assets like cash, deposits and government securities. Stocks account for more than half of available funds at $24 trillion. Consequently, there is a remarkable gap of 14% to 50% in the percentage of money that individuals in Japan and the United States allocate to stocks.

If households in Japan divided their savings available for investments evenly between safe assets and stocks as in the United States, there would be ¥300 trillion of new stock buying power from the ¥920 trillion currently in safe assets. This buying would probably fuel a strong stock market rally. Shifting part of these savings to stocks would therefore be one method for the effective use of surplus capital that is now idle. This is why Japan needs to take actions involving monetary policy and financial systems that encourage people to put more money in the stock market. Government Pension Investment Fund (GPIF) reforms in 2015 represented an enormous policy change. The GPIF realigned its investment portfolio, which had overweighted safe assets, by purchasing stocks and other assets with risk. In 2016, Japan will need more actions aimed at shifting money to stocks that target Japan Post Insurance, Japan Post Bank and other institutions holding massive amounts of Japanese government bonds as well as individuals and other investor categories.

Japan’s one-sided household income structure

The two abnormalities are also creating significant problems concerning household income in Japan. In the United States, wages account for three-fourths of disposable income and interest, dividends and other income from assets for the remainder. In Japan, wages are almost 100% of household income. Negative interest rates and very small holdings of stocks keep income from assets to almost nothing. Consequently, US households have income as workers and asset holders. They can benefit from increases in wages, stock prices and dividends. But in Japan, households rely solely on wages. Households are unable to increase spending without a hike in wages. Of course, Japanese companies are distributing part of their earnings as dividends. Therefore, it is possible to create a stronger connection between household income and the income of Japanese companies.

Japan must find a way to fully open channels for the effective use of idle purchasing power at companies. One way is to pass on purchasing power to employees by raising wages, thereby boosting household spending. Actions for accomplishing this goal are progressing, but more measures are needed. Building a framework that allows the earnings of companies to contribute to household income is another way to establish a channel. If individuals own more stocks, their asset income will grow and create another source of income. The Abe administration has clearly stated that it wants people to buy more stocks. Historically low interest rates and non-traditional monetary initiatives should therefore be viewed as components of the government’s policies for increasing stock ownership by individuals.