May 24, 2010

Strategy Bulletin Vol.15

U.S. and German legislatures may end the market’s dark mood

- Let’s give high marks to the positive surprise from legislators -

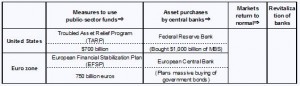

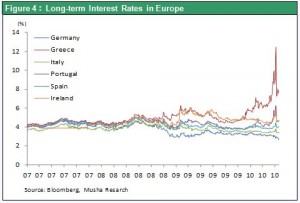

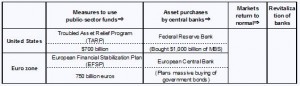

Fears about the crisis in Greece and the proposed U.S. financial regulation reform legislation that sparked market turmoil are now rapidly dissipating. On May 21, Germany’s lower house of parliament approved a 148 billion euro contribution to a financial stabilization fund. There is now little doubt that a stabilization package totaling 750 billion euros will be enacted. This is the sum of 60 billion euros of seed money (from the sale of bonds) from the European Commission, a 440 billion euro fund backed by the guarantees of countries in Europe, and 250 billion euros from the IMF. Last week, the Merkel administration of Germany shook financial markets by suggesting the imposition of its own restriction on short sales (which would have exactly the opposite of the desired effect because hedge funds would move even faster to shield themselves from risk). But now, it is very likely that this idea was merely a maneuver to gain the support of the opposing parties for the rescue package.

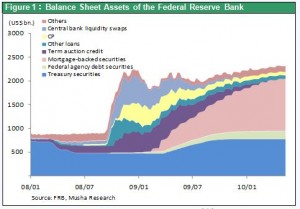

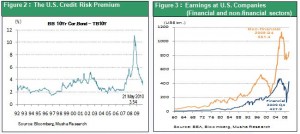

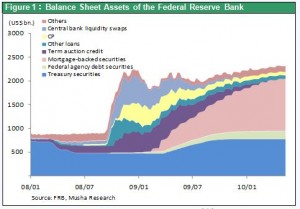

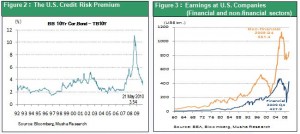

Table 1 shows the speed at which the Fed purchased assets, Table 2 shows how much financial markets reacted to these purchases, and Table 3 shows how quickly earnings at U.S. financial institutions recovered. To repeat my earlier point, the starting point for all of these changes was the establishment of a scheme for injecting $700 billion dollars of public-sector funds into the financial system.

Table 1 shows the speed at which the Fed purchased assets, Table 2 shows how much financial markets reacted to these purchases, and Table 3 shows how quickly earnings at U.S. financial institutions recovered. To repeat my earlier point, the starting point for all of these changes was the establishment of a scheme for injecting $700 billion dollars of public-sector funds into the financial system.

Following the Lehman shock, stocks did not stop falling until five months after the start of measures to use public-sector funds. But this time, stock prices will probably hit bottom and stabilize within a relatively short time.

Following the Lehman shock, stocks did not stop falling until five months after the start of measures to use public-sector funds. But this time, stock prices will probably hit bottom and stabilize within a relatively short time.

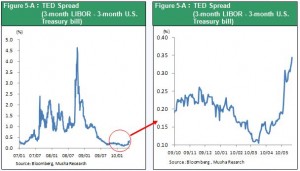

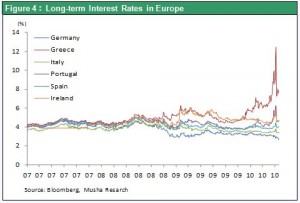

The 750 billion euro stabilization fund is the deciding blow

Formation of the 750 euro stabilization program will probably be the deciding blow in restoring stability in Europe. The reason is that, with the backing of European countries, the ECB can manipulate market prices by making massive purchases as investors rush to sell the bonds of countries with weak finances. We have already seen the powerful effects of central bank purchases in the United States, where the financial situation improved rapidly after the Lehman shock. In October 2008, the U.S. government launched the $700 billion Troubled Asset Relief Program (TARP). Since the government was covering losses, the Fed was able to buy a huge volume of assets, in the process greatly expanding its balance sheet. Making these purchases returned the oversold market for mortgage-backed securities (MBS) to normal. Earnings at U.S. financial institutions quickly recovered as a result, immediately quelling fears about inadequate capitalization and bringing the crisis to an end. Clearly, using a variety of financial stabilization actions backed by public-sector funds holds the key to resolving a financial crisis. I cannot overemphasize the importance of this lesson, which no one can deny at this point.

Table 1 shows the speed at which the Fed purchased assets, Table 2 shows how much financial markets reacted to these purchases, and Table 3 shows how quickly earnings at U.S. financial institutions recovered. To repeat my earlier point, the starting point for all of these changes was the establishment of a scheme for injecting $700 billion dollars of public-sector funds into the financial system.

Table 1 shows the speed at which the Fed purchased assets, Table 2 shows how much financial markets reacted to these purchases, and Table 3 shows how quickly earnings at U.S. financial institutions recovered. To repeat my earlier point, the starting point for all of these changes was the establishment of a scheme for injecting $700 billion dollars of public-sector funds into the financial system.

The crisis in Greece has been contained

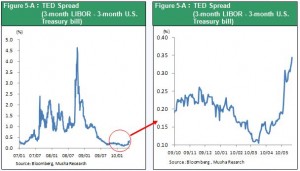

Just as we saw after the Lehman shock, this decisive blow in Europe has caused stock prices to fall and created other instability. I think there are two main causes. First, people cannot easily comprehend the enormous significance of injecting public-sector funds. In fact, many people laughed when U.S. Treasury Secretary Henry Paulson said he was firing a bazooka in the wake of the Lehman shock. Second, there no assurance that public-sector funds will actually be used or that assets will be purchased. This is why investors are likely to be positively rather than negatively surprised as events unfold. We have already seen a big increase in the market prices of Greek government bonds. Yields on these bonds are down sharply and the Greek government has completed its 2010 bond issues with no difficulty. Furthermore, Greece, Portugal, Spain and other countries are putting together plans to cut spending. In another development, the European Commission is considering the tighter oversight of government finances and the imposition of penalties. This crisis has spotlighted the contradiction of having a unified EU financial system while allowing individual countries to pursue their own fiscal policies. Collectively, these events appear to be setting the stage for a decision to establish restrictions on the finances of individual countries. In addition, the Fed and ECB have once again established a currency swap agreement. With this action, there is virtually no danger that shock waves from the Greek crisis will cause countries to abandon the euro, thereby destroying the EU. Following the Lehman shock, stocks did not stop falling until five months after the start of measures to use public-sector funds. But this time, stock prices will probably hit bottom and stabilize within a relatively short time.

Following the Lehman shock, stocks did not stop falling until five months after the start of measures to use public-sector funds. But this time, stock prices will probably hit bottom and stabilize within a relatively short time.

People are losing faith in the Volcker Rule

One more source of positive news from legislatures is the agreement by both houses of the U.S. Congress on a single financial regulatory reform law. With this move, the Volcker Rule will almost certainly be shelved. U.S. regulatory reform has postponed action concerning many issues: prohibiting proprietary trading at banks; prohibiting the use of derivatives, and particularly swap trading; prohibiting investments in high-risk hedge funds and private equity; splitting up financial institutions that have a domestic market share (based on liabilities) of more than 10%; and other issues. Most of these proposed actions would give the Treasury Department and Fed more control of the financial sector. In other words, the U.S. Congress had admitted that regulatory matters in the rapidly changing financial sector should be entrusted to the professionals with a thorough knowledge of the industry. Obviously, members of Congress are demonstrating extreme caution due to the need to protect one of the most profitable and fastest-growing sectors of the U.S. economy. Looking back, the Volcker Rule may have been merely posturing for the Obama administration’s senate candidate in the Massachusetts special election. But this candidate lost, meaning that Congress has defeated populism.No problem about an economic recovery, the key to ending the crisis

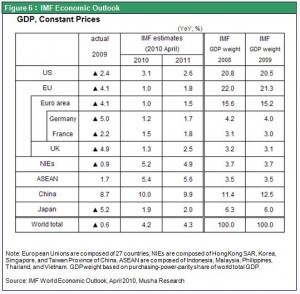

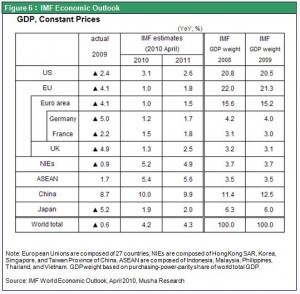

Once the Greek crisis, which has upset financial markets for about six months, and questions about the Volcker Rule have been resolved, investors will turn their attention to the economy. At this point, people will realize that the outlook for global economic growth in 2010 is positive despite the debt crisis in Greece. In April, the IMF announced a forecast for 4.2% growth of the global economy. This is an improvement of 4.8 percentage points compared with 2009 when the economy contracted by 0.6%. The driving force behind this growth forecast, which is well above most other forecasts, is the U.S. economy. Few people believe that the Greek crisis will prevent the U.S. economy from expanding by more than 3% in 2010. Just last week, the Fed increased its 2010 growth forecast from the 2.8%-3.5% range to the 3.3%-3.7% range. Furthermore, China has benefited because problems in Greece have reduced pressure to allow the value of the yuan to increase. Easing this pressure means that China’s economy could grow by 10% in 2010. Even within the euro zone, the crisis may also have a positive effect on German economy. One reason is the depreciation of the euro. Another reason is the drop in interest rates as investors move their money from Greece to Germany. In fact, German stocks have performed relatively well since the beginning of this year. One scenario for the euro calls for the currency’s value to be dragged down as Greece alone among euro zone countries sinks. But another possible outcome is an upturn in the German economy as Greece sinks that fuels growth in the entire euro zone. If we adopt this view, investors will have to fundamentally rethink their one-sided belief that the financial crisis sparked by Greece will lead to a rapid decline in the global economy. Credit markets in Europe, which is where this crisis originated, are basically stable. The euro has stopped its rapid fall due to fears about central bank interventions. As investors run away from risk, the yen continues to climb and stock prices remain volatile. But these are merely aftershocks of this financial crisis. I believe that the overall picture is returning to one of stability.