Jun 21, 2016

Strategy Bulletin Vol.163

Why developed country fundamentals are sound but Japan’s stocks are down

- A strong yen driven by China’s crisis explains

Japanese stocks are in turmoil

Market conditions are producing an increasing level of frustration among investors who are guided by fundamentals. The economy isn’t wonderful, but it isn’t bad either. In the second half of 2016, most market participants anticipate a steady economic recovery in the United States, Japan and Europe and even a slow increase in the rate of economic growth. In major developed countries like the United States, Japan and Germany, the unemployment rate has dropped to near full employment and companies are reporting record-high earnings. In addition, stock valuations are extremely attractive in relation to the historically low yields on government bonds. And the monetary policies of central banks have never before been this friendly for risk takers.

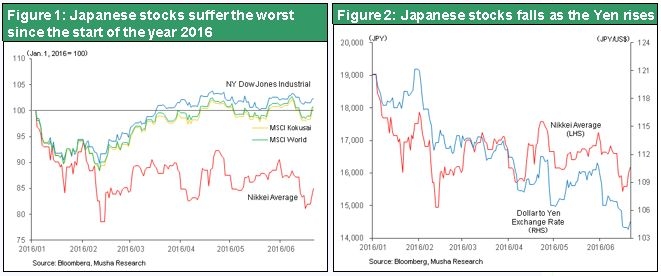

In this environment, stocks should become increasingly appealing to investors. However, stock markets are now volatile. In Japan, stock prices are remarkably sluggish as prices repeatedly make unusually big swings in both directions. With the stock market looking more like a casino, many investors are staying away. Since the start of 2016, TOPIX is down 18%, the US S&P 500 is up 1.4%, the UK FTSE 100 is down 3.7% and the German DAX is down 10.3%. Japan is clearly the biggest loser. Currently, the Brexit issue is the greatest concern among investors. Nevertheless, stock prices in Britain have been relatively firm.

US economic fundamentals are improving

The US economy is posting consistent growth and there is very little risk of a recession in the near future. There was disappointment in US financial markets because of the unexpectedly small addition of 380,000 jobs in May. However, the small growth in jobs was caused by the difficulty of hiring people in a full employment environment. The short supply of workers is exerting increasing upward pressure on wages. In the United States, we are seeing the beginning of a virtuous cycle. Strong consumption in the service sector and a high volume of investments are making personal income higher. This is boosting demand, which then raises production output and creates more jobs. Both of the major-party presidential candidates are supporting the use of fiscal measures to stimulate the economy. With the budget deficit now less than 3% of the GDP, the United States is in a position to make government spending a new driver of economic growth. Once this spending begins, upward pressure on prices and wages will probably become even greater.

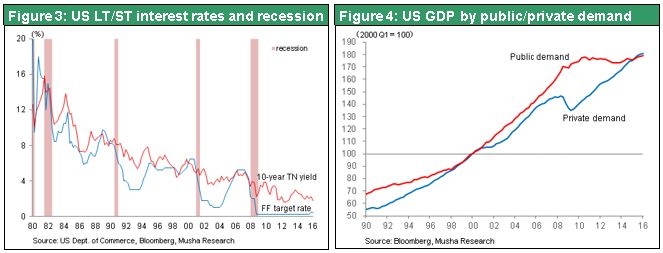

Over the past 40 years, every US recession has been caused by excessive tightening (overkill) in response to the growth of inflationary forces. All four recessions since 1980 started after the yield curve was inverted as interest rate hikes propelled the Federal funds rate beyond long-term interest rates. Furthermore, excessive tightening was triggered by either an imbalance and asset bubble created by excessive investments or by an external shock like an oil crisis.

Right now, there are no asset bubbles or excessive investments in the United States. China is the only possible source of an external shock. Even if there is a “China shock,” the result would probably be more deflationary pressure. This is the opposite effect of an oil shock. Deflationary pressure would lead to monetary easing, making an inverse yield curve (excessive tightening) unlikely to occur. The only possibility is a reversal of long and short-term US interest rates caused by a drop in US long-term rates to negative territory, as in Japan and Germany. But that is implausible. Only forces linked to supply and demand could make US long-term interest rates become negative despite the US economy’s strength. Nothing other than a massive global flow of capital to US dollar-denominated bonds could create this type of supply and demand environment. However, if this happened, it would almost certainly be accompanied by a much stronger dollar and a powerful US stock market rally.

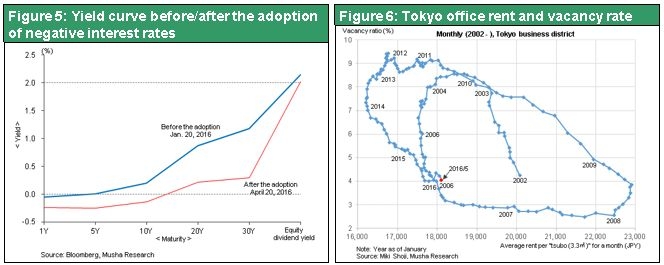

The Japanese economy will probably slowly become stronger as well as a number of positive events happen at the same time: (1) postponement of the consumption tax hike and an increase in government spending; (2) more monetary easing; (3) solid corporate earnings despite the yen’s strength; and (4) an increase in real wages. All these events point to an upturn in Japan’s lackluster consumer spending. Unlike in the past, this time the stronger yen will probably have only a limited negative impact on earnings. The reason is that Japanese companies specialize in technologically superior products that do not need low prices to be competitive. As a result, companies are now in a much better position to absorb the impact of a stronger yen by raising prices. Furthermore, negative interest rates are making the more broadly defined yield curve, which includes stocks, steeper. This is forcing surplus savings into stocks and real estate (see Figure 5). For instance, the real estate cycle is now entering a sweet spot in which the decline in vacancies is causing leasing rates to climb (see Figure 6).

(2) The mystery of why the yen’s strength is making investors shun risk

The strong yen is the main reason for low stock prices in Japan

If the situation in Japan is really this good, then why is the stock market so volatile? I think we need to look to China for the real answer. Most likely, the beginning of the crisis in China is responsible for this “special” appreciation of the yen. As I have explained, Japanese stocks have been the world’s biggest loser during the past six months. And the yen’s abnormal appreciation is obviously the cause. In relation to the dollar, the yen appreciated 15% during the past six months while the British pound depreciated 1% and the euro appreciated only 5%. But on a dollar basis, stock prices during the past six months are up 1.4% in the United States but down 4.7% in Britain, 3.1% in Japan and 5.6% in Germany. In this context, the performance of Japanese stocks is not particularly bad. Therefore, Japan’s position as the world’s biggest stock market loser is closely linked to the yen’s strength. .

So exactly why has the yen become this strong? I suspect that the US Treasury Department offered to allow the yen to appreciate as a sacrifice in return for avoiding a devaluation of the yuan. The result was the yen’s abrupt upturn, which caused Japanese stocks alone in the world to fall.

The yen’s strength can’t be explained with fundamentals

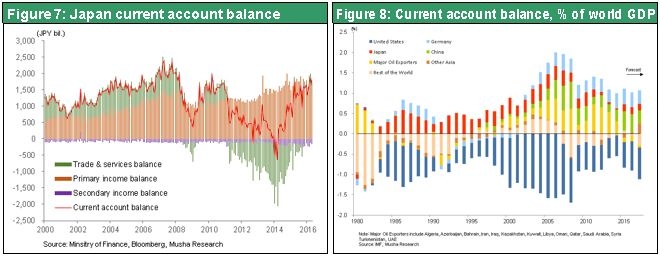

At this point, there is little doubt that China is in the midst of a serious crisis. That means people who are shunning risk have the advantage with respect to every type of investment activity. One aspect of China’s crisis is the “special” appreciation of the yen, which has hurt Japanese stocks. This conclusion is inescapable because there is not a single reason for the yen’s strength from the standpoint of fundamentals. Most importantly, every economic indicator is a reason for the dollar to appreciate. Prime examples are the differences between the United States and Japan regarding economic strength, interest rates and central bank policies. Furthermore, in the past, the yen had a tendency to strengthen when investors wanted to run away from global risk. This was because investors used the yen as the currency to procure funds for global risk investments. But now emerging country currencies and stocks are stable. As a result, there is no longer much demand to buy the yen in order to pull out of investments in assets with risk. The growth in Japan’s current account surplus is the only conceivable explanation for the yen’s strength. But the primary income balance (income from past direct overseas investments), which has nothing to do with foreign exchange, is the main reason for this growth. It’s a stretch to say that a higher current account surplus is responsible for the yen’s climb.

Is a strong yen part of US measures to fight global financial instability?

The points I have explained demonstrate that the yen’s strength since the beginning of 2016 has almost no relationship at all with economic fundamentals. Instead, the yen has probably appreciated as one element of US actions for suppressing global financial instability (including the slower pace of interest rate hikes). The US Treasury Department has asked China not to devalue the yuan. In return, the United States offered as a sacrifice the stance of allowing the yen to appreciate. The yen quickly began to strengthen as a result and Japan became the only country where stock prices fell. Please see Strategy Bulletins No. 160 (May 2) and No. 162 (June 6) for more information about this subject.

The end of the yen’s climb is near

Due to this probable link with China, upcoming events involving China’s crisis will greatly influence the yen/dollar exchange. If the slowdown in China’s economic growth ends and there is no longer pressure to devalue the yuan, there would obviously be an end to the forces behind the yen’s appreciation. On the other hand, there could be a further downturn of the Chinese economy that results in the outflow of capital and a weaker yuan. If this happens, upward pressure on the yen could briefly become even stronger. On the other hand, if the yuan falls even faster due to an increasingly severe crisis in China, other countries could conclude that China has started using competitive devaluations. In this case, the United States would no longer want the yen to appreciate. In both of these scenarios, the yen can probably go no higher than about ¥100 to ¥105 to dollar, which is its purchasing power parity. But the yen could overshoot this range to the high ¥90 level for a short time.

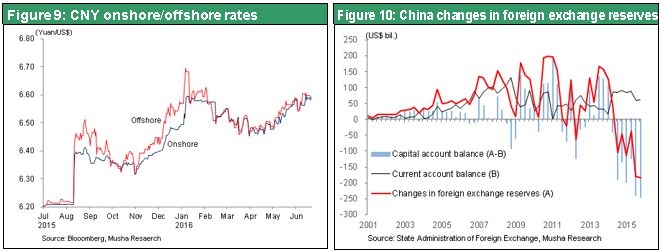

The outlook for the Chinese economy is for economic stimulus measures to prop up the growth rate for the time being. But this growth will probably not last long for three reasons. First, excessive investments of prior years have created a massive problem. China has become unable to sustain long-term growth in railroad cargo, crude steel output, electricity generation, exports and imports, and other volume-based indicators of economic activity. Second is the deteriorating situation involving foreign currency, which is China’s Achilles’ heel. A pathway is now visible that could enable a weaker yuan to trigger a financial crisis within China. Third, conflict concerning the different goals of President Xi Jinping and Premier Li Keqiang is casting doubt on ability of the Chinese government to rule the country.

There may be a decline in the absolute authority of the Chinese government, which is vital to having confidence in China itself. A loss of confidence would mean that investors could no longer be defenseless with respect to the yuan and holdings of Chinese assets with risk exposure. China has been using stop-gap measures like restrictions on changing the yuan to foreign currencies to limit capital outflows and foreign exchange market interventions using derivatives to buy the yuan. But no one knows how much longer these actions will be effective. Later this year and in 2017, more US interest rate hikes and drop in Chinese economic growth will almost certainly produce even more upward pressure on China’s capital outflows. From a longer-term perspective, China will probably be unable to avoid a severe crisis. However, the link between China’s crisis and the yen’s strength is likely to disappear within about the next six months.

Investors should focus on two scenarios for upcoming events. Right now, we may see an upward correction in stock prices from the current excessive pessimism as the crisis in China is brought under control. Prospects for another global financial crisis are small for three reasons: (1) no signs of too much optimism or of an asset bubble in industrialized countries; (2) friendly government financial policies; and (3) consistently high earnings at companies. The 2016 G20 Summit will take place in Hangzhou in September. If China can continue to suppress its crisis up to then, we could see a surprisingly strong stock market rally. But if China’s crisis deepens at some time after this summit, there is a possibility of a climactic upturn of the yen and downturn of Japanese stocks. After that, the yen would most likely begin to weaken.

These scenarios are based on the premise that the United Kingdom stays in the European Union. If a Brexit is approved, the yen will probably become even stronger and stock prices go even lower for a short time. Subsequently, I believe that the yen and stocks will follow the two scenarios in the preceding paragraph. That means the yen may appreciate about ¥5 against the dollar and the Nikkei Stock Average may drop about ¥1,000.