Sep 02, 2016

Strategy Bulletin Vol.166

Global yield hunting is very likely to target Japanese stocks

- Stage two of the Abenomics market may start if the China crisis is contained

(1) Global yield hunting is channeling surplus capital to the stock market

The age of zero interest rates for long and short-term instruments

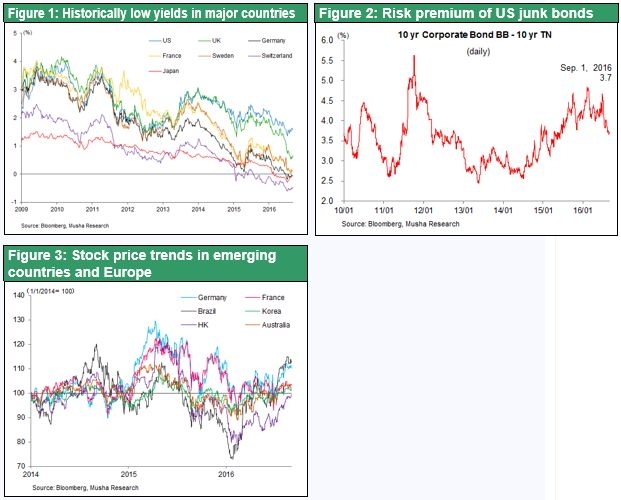

No end to the historic decline of long-term interest rates is in sight. Brexit caused UK pound interest rates to plunge. As a result, the United States is the only developed country with a firmly positive long-term interest rate (Figure 1). But there is downward pressure on interest rates even in the United States despite its healthy economy as money flows into the country from overseas. Returns are falling fast on junk bonds and emerging country bonds (Figure 2), which had been regarded as dangerous. Investors who have become tired of waiting have started to buy these bonds. We are seeing surplus capital on an unprecedented scale wandering around the world in search of a yield. Both short and long-term interest rates in the world’s major countries are virtually zero. In this environment, the traditional banking business of earning income from interest spreads between different instruments with confirmed interest rates is no longer viable anywhere in the world.

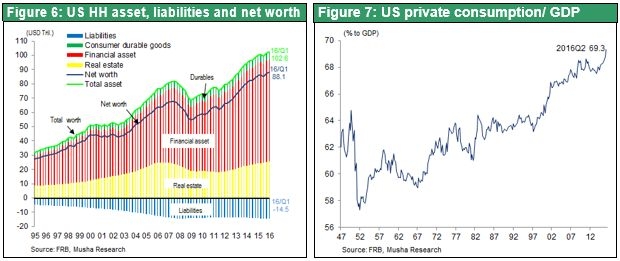

Stocks have attractive yields

It is too soon to conclude that this situation will lead to a crisis for capitalism. Although bond yields are low, investors can earn ample returns with stocks and real estate. Dividend yields are far higher than government bond yields in all developed countries. In the United States, companies are giving shareholders a 5% return with a 2% dividend yield and a 3% return through stock repurchases. This is more than three times higher than the yield on a 10-year Treasury note. The ability of companies to generate earnings and create value is not the cause of this situation. The real problem is that financial markets can no longer perform the function of properly allocating money that has been earned.

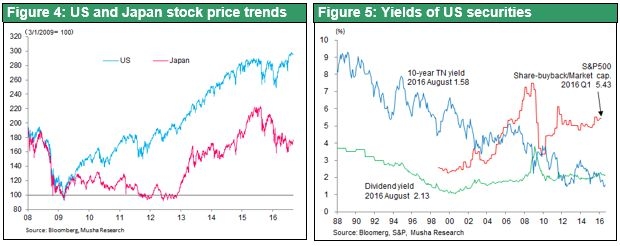

Global yield hunting is entering the virgin territory of the stock market, which is starting to fuel a worldwide rally. US stock prices are now at all-time highs. In Europe and emerging countries as well, stock prices are high as prices bounced back from downturns earlier this year. Rising stock prices will probably enable financial markets to regain the capital allocation function that has been lost.

The US success with using QE to push up asset prices

Central banks have been using non-traditional monetary policies (such as quantitative easing and negative interest rates) for the purpose of enticing people to shift their money to stocks, residential real estate and other assets with risk. The United States had the most success with these policies. As you can see in Figures 6 and 7, prices of US stocks and housing have recovered since the global financial crisis because of quantitative easing of a magnitude that no one could have imagined. The Fed’s balance sheet grew by five times as the bank purchased government bonds and mortgage-backed securities. Assets held by households improved greatly as a result. Net worth of households plummeted from a peak of $68 trillion in the first the third quarter of 2007 immediately prior to the collapse of Lehman Brothers to $55 trillion in the first quarter of 2009. But the subsequent rapid rebound in asset prices has propelled household assets to $88 trillion as of the end of the first quarter of 2016. This growth in assets was behind the upturn in household spending. A virtuous cycle has taken hold in which rising asset prices lead to growth in household spending (especially for services), a recovery in jobs and manufacturing output, and higher income for households and companies. At the recent Jackson Hole gathering, the Fed stated that it has almost accomplished its mandate of full employment and 2% inflation.

The US interest rate hike will make Japanese stocks the target of yield hunters

The Fed is now in a position to raise interest rates for two reasons. First, the employment and inflation mandate has almost been achieved. Second, instability of emerging country economics and financial markets has largely ended, thus eliminating a major cause of the delay in another interest rate hike. Most people believe that the Fed will raise rates one more time, with the hike coming in September or December. Expectations for another rate hike have stopped the dollar’s decline that began early in 2016. This may prompt yield hunters worldwide to shift their focus. Japanese stocks will probably become the new target of yield hunters as a result.

(2) Global yield hunters can no longer ignore Japanese stocks

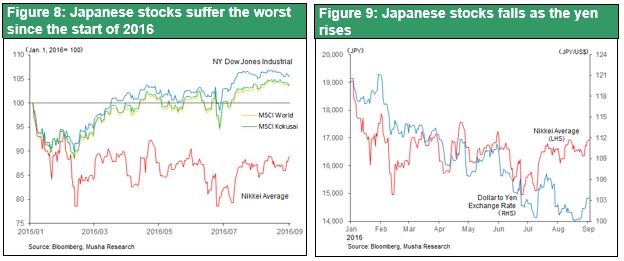

The growth in risk-taking may trigger a late summer rally for Japanese stocks

The events I have just outlined demonstrate that the recent views of Musha Research have been correct. During the past month, there has been an enormous comeback global summer rally as US stocks continued to climb to new highs and European and emerging country stocks moved up as well. Although Japanese stocks have not kept up with this rally because of the yen’s strength, these stocks are gaining strength.

About one month ago (on July 15), Musha Research posted the following outlook on the GOGOJUNGLE investor information website.

“US stocks have reached a new high for the first time in about one year. Most likely, this signifies either the end or a temporary suspension of the bear market that started in the summer of 2015 when the crisis in China created a global risk-off environment. For almost one year, the yen has consistently appreciated while global stock prices and interest rates declined. Now this trend has probably reversed direction for at least three months and perhaps much longer. There is a high probability that the Nikkei Average is in the midst of a rapid rebound after forming a double-bottom in the first half of 2016. Immediately after British voters decided to leave the EU, the Nikkei Average plunged as the yen rapidly strengthened. The Nikkei Average closed at ¥14,952, which is precisely the same as the low recorded on February 11. At that time, I made the following statement: ‘There are two possible outcomes. First is a strong rebound after the double bottom. Second is a climax of the three-stage downturn that started in August 2015. If you believe the first outlook, then this is an excellent buying opportunity. Extreme caution is needed if the second outcome is expected. I think there is a 70% probability of a rebound and a 30% probability of a downturn.’ Now answer is apparently evident. (omission) The strength of the US economy is undeniable. (omission) The US is benefiting from a virtuous cycle where strong spending for services and housing is driving growth in personal income, demand, manufacturing and jobs. Both presidential candidates plan to use fiscal measures to stimulate the economy. Therefore public-sector spending backed by a sound financial position with a deficit/GDP ratio at the 2% level will probably become a new driver of US economic growth. These events will make the dollar stronger and greatly reduce the likelihood of a US recession in the near future.

The Japanese economy as well will probably slowly become stronger. A number of events will take place at once, mainly (1) growth in government spending and a postponement of the next consumption tax hike; (2) more monetary easing; (3) strong corporate earnings despite the yen’s strength; and (4) growth in real wages. The result will be an upturn in Japan’s sluggish consumer spending. Negative interest rates are forcing surplus savings into stocks and real estate. Consequently, Japan’s real estate cycle is entering a sweet spot where falling vacancy rates push up rent.

The possibility of the crisis in China worsening cannot be rejected. But for the time being, China’s economy is sound because of government initiatives. The crisis will be contained at least until the G20 summit on September 4 and 5. The combination of the US economy’s strength and the end for now of worries about the Chinese economy and the yuan has significantly reduced pressure for a stronger yen and risk-off investments. This raises the probability of an upward market correction that ends excessive pessimism. The majority of market participants have been held back by the black swan scenario. Once this scenario has been eliminated, investors should begin to think about the possibility that the expected summer rally will take place on a considerable scale.”

Ending the yen’s appreciation may launch the second phase of the Abenomics market

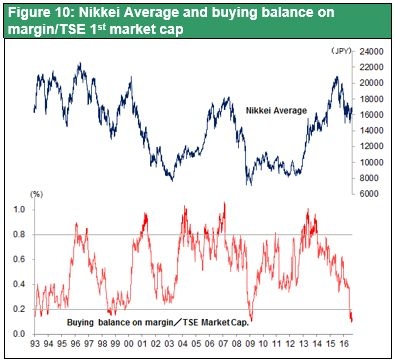

Once the dollar reverses direction and begins to appreciate, the long-delayed summer rally of Japanese stocks is very likely to start. Until now, investors who buy Japanese stocks have been extremely averse to risk despite the global stock market rally. The drop to a historic low of outstanding arbitrage stock purchases is the most noteworthy evidence of this risk aversion. People have become prejudiced against investment in Japanese stocks. However, as is evident from Chart 10, Japanese stocks have always rebounded strongly immediately after the unsettled buying balance of arbitrage trading declined to historic levels. People have been embracing pessimism for no legitimate reason even though economic fundamentals are sound. Consequently, everything is in place in terms of supply and demand for stock prices to begin staging a comeback.

An unprecedented government commitment

Enormous expectations exist in Japan concerning government and Bank of Japan initiatives to push up stock prices too. The Bank of Japan has roughly doubled its ETF purchases (from ¥3.3 trillion to ¥6 trillion) and the Financial Services Agency and other government agencies are enacting reforms at the GPIF, Japan Post Bank, Japan Post Insurance and other public-sector institutional investors to shift money from savings to investments. Taking these actions will probably significantly alter the balance between the supply and demand for stocks. Now that selling by foreigners has come to an end, the emergence of a new source of annual stock purchases of ¥6 trillion is likely to drive a powerful stock market rally. On August 30, Chief Cabinet Secretary Yoshihide Suga took the highly unusual step of using a Reuters Newsmaker event for global investors to say that the Abe administration has a strong commitment to investments in stocks and other assets with risk and to a stable foreign exchange rate. This statement will probably further contribute to changing the direction of the stock market.

There has been criticism of these so-called “price keeping operations” (PKO) in Japan as the government plays an increasing role in determining the supply and demand for stocks. But PKO critics are wrong. As Japan’s asset bubble burst during the 1990s, the government bought stock (a PKO) in an attempt to raise prices of stocks that had lost value because of falling earnings. But this PKO was not justifiable and there was no reason to expect it to succeed. The situation is different today. The government is attempting to correct market prices that are not rational because investors have not given stocks valuations that reflect their rising value due to recovering earnings. This will be a successful operation. In the past, hedge funds responded to a Japanese PKO by selling stocks. But responding in this manner this time would obviously be pointless. I was a strident opponent of PKO during the 1990s. Now, for the same reasons, I am a strong supporter of PKO initiatives.

A catch-up rally is very likely to begin in Japan only about one month from now. This rally will probably raise the Nikkei Average to the ¥18,000-¥19,000 range. Moreover, if an explosion of the China crisis can be prevented, Japanese stocks will continue to move up. This raises the possibility of the second stage of the Abenomics market taking the Nikkei Average to ¥30,000 by 2020.

Don’t forget the risk of a crisis in China

Investors must closely watch upcoming events in China, which holds the key to the longevity of a stock market rally in Japan. China’s economy continues to weaken. There are serious problems with all three drivers of growth.

(1) Exports have been declining from one year earlier at a rate of about 4% since the beginning of 2016. So exports have become a drag on economic growth instead of a driver.

(2) Investments (investments in fixed assets) are increasing at a rate of 10% compared with 20% two years ago. As of July, these investments in 2016 were up only 8%. Significantly, investments by private-sector companies were up only 2%, showing that these expenditures have completely lost momentum. China’s real estate investments increased briefly because of monetary easing that began in 2015. But these investments are slowing again, posting growth of only 5% in July. Public-works investments were up 20% but these expenditures as well are showing signs of losing momentum. China is nearing the point where growth in all categories of investments will stop.

(3) Consumer spending is relatively healthy with retail sales up 10%. However, this growth is largely the result of higher automobile sales supported by a tax cut and monetary easing. There are worries that consumer spending will slow down once the contribution of the tax cut winds down in 2017.

China continues increase government spending while implementing monetary easing on a reckless scale. China’s M1 is 25% higher than one year earlier and M2 has increased 10% in July 2016. But bank deposits by households are up only 9%, demonstrating that the Bank of China’s rapid growth of credit has not led to broad-based growth in the money supply. Clearly, China’s monetary easing has been completely ineffective other than as a means of fueling more growth of the country’s housing bubble. If economic growth declines even more, China will again see outflows of capital, which would cause foreign exchange reserves to plummet again. If this happens, the yuan would depreciate faster and the world would go back to a risk-off environment. Investors must not forget that this scenario is a possibility.

(3) Reversal of the global trend toward declining interest rates is most likely to start with the U. S. ~ The core of the debate is on recognition of the natural decline in interest rates

The US in 2017 – Faster growth supported by government spending, a stronger dollar and slowly rising long-term interest rates

Yield hunting is gaining momentum now as the world again shifts to a risk-on environment. Major causes include the stabilization of China to some degree, more stability in emerging countries, the end of a correction to factor in Brexit and less uncertainty about the US presidential election. What will happen next? In the United States, Musha Research expects three events: (1) faster growth of the economy and investments, (2) a decline in surplus capital and (3) a Fed interest rate hike. The result will be a narrowing of the gap between profit margins and interest rates as long-term rates increase slowly. This will reduce opportunities for yield hunters. In this environment, a large volume of idle capital worldwide will probably start heading for Japan after the yen stops appreciating. In 2017 and 2018, the United States will probably be first in the world to demonstrate how to eradicate deflation with these steps: monetary easing, higher asset prices, a resurgence of growth, and central bank rate hikes along with rising long-term interest rates. Japan, European countries and other developed countries are then likely to enact the same policies.

Many views of the causes for the declining natural rate of interest amid full employment

Many US economists view the unprecedented downturn in long-term interest rates as the result of “the decline in the natural rate of interest.” The natural rate of interest is the interest rate adjusted for inflation that facilitates economic growth without overheating even when the economy is running at full capacity. This rate can also be regarded as the equilibrium interest rate at which there is balance between saving and investing. That means the natural rate of interest is a key reference point for determining policy interest rates. A rapid drop has occurred in this rate with the consensus natural rate of interest falling from the 2%/3% range to almost nothing. A growing number of people believe that the natural rate of interest has been low for the past several years. Falling long-term interest rates and the decline in the natural rate of interest are closely linked. As a result, increases in the federal funds rate, if there are any hikes at all, should take place very slowly and in small increments.

But no one wants market-friendly monetary policies to end

The US natural rate of interest has not increased at all even at full employment and an economy at full capacity. In fact, this rate is going down. Economists have many explanations for this situation. Previous Fed chairman Ben Bernanke points to the global surplus of savings as the cause. Harvard professor Lawrence Summers thinks the cause is “long-term stagnation” resulting from the chronic shortage of demand for investments. Fed chair Janet Yellen and others at the Fed regard this as a temporary headwind that has held back economic growth since the start of the global financial crisis. In other words, the Fed thinks the cause may be economic uncertainty, the dollar’s strength, and slowing growth of productivity and the working-age population.

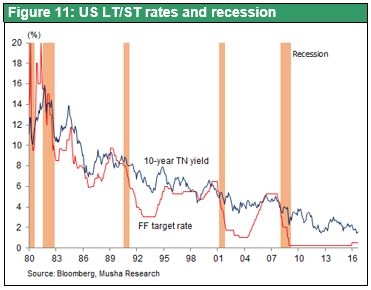

Although there are many ideas about the cause of the low natural rate of interest, everyone clearly agrees that market-friendly policies should continue. There is no need for haste regarding interest rate hikes. Boosting interest rates while the natural rate of interest is low would create a credit contraction cycle and slow economic growth. Four recessions have occurred in the United States since 1980. Each one started after a reversal of long and short-term interest rates caused by monetary tightening. If the natural rate of interest continues to decline, this rate could fall below the federal funds rate after a Fed interest rate hike. This yield reversal would negatively impact the interest margins of financial institutions and a recession would be unavoidable, although it would be small. The Fed is now doing everything it can to prevent this from happening.

Expect growth-oriented fiscal and monetary policies as interest rates and the natural rate remain low

What would economic growth look like if growth was based on the premise of a declining natural rate of interest (which equates to long-term rates consistently at a historically low level)? Two scenarios are possible. In one scenario, extreme monetary easing would boost the investment income of households as stock prices rise and companies buy back stock and distribute earnings in other ways. The result would be growth in consumption. In other words, money would flow into assets with risk because extremely low interest rates would make stocks more valuable. In the other scenario, governments enact Keynesian policies by borrowing money to create demand. This would facilitate the effective use of idle funds.

Large-scale government spending is part of the agendas of both major party presidential candidates in the United States. The US budget deficit has fallen from 10% of GDP in 2010 to the 2% level in 2015 and long-term interest rates are at an all-time low. The combination of a low deficit and interest rates and the need to update the aging US infrastructure create an excellent environment for Keynesian policies. This fiscal and monetary cycle for using surplus capital would probably raise long-term interest rates, although very slowly, as well as the natural rate of interest. If this happens, we can expect to see a long-term upturn in stock prices and the dollar. For these reasons, investors should have a positive medium to long-term outlook while keeping a close eye on risk factors involving China.