Sep 15, 2016

Strategy Bulletin Vol.167

The US Interest Rate Hike and the Power Struggle within China

Near-term prospects for a hard landing in China have receded

Financial market risk and uncertainty increase due to differing expectations for a US interest rate hike

The actual source of uncertainty is the Chinese economy, not the United States. Risk involving investments depends on how investors decide to assess China’s economy and financial markets. But the outlook is bright for the US economy regardless of investors’ views of China and markets. Only an event with global ramifications, especially some sort of change in China, could weaken the US economic outlook. As a result, the declining power of President Xi Jinping is good news. China is now increasingly likely to pursue the policies of Premier Li Keqiang. This would raise the transparency of how China manages its economy and increase cooperation with other countries. The policies of Premier Keqiang would probably greatly reduce the near-term likelihood of a hard landing in China accompanied by a plunge in the yuan’s value. In this case, investors can expect a market environment that is conducive to risk-taking in 2017 as US interest rates climb, the dollar becomes stronger and the stock market remains firm.

Uncertainty about the US economy is minimal

Financial markets are focused on prospects for a Fed interest rate hike. There has been a consistent stream of positive and negative developments involving economic indicators and statements by key people at the Fed, which together shape the monetary policy outlook. However, uncertainty about the US economy is remarkably small from a longer-term viewpoint. Adopting this stance reveals the following points that can essentially be regarded as facts.

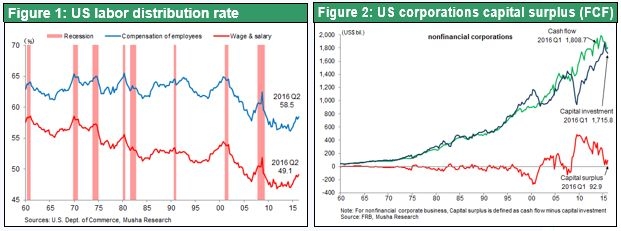

- The United States has basically achieved full employment.

- Inflation is approaching 2%. The probability of deflation starting has plummeted despite some unsatisfactory numbers like the core PCE deflator.

- US economic growth has entered the second half. (a) The increase in labor’s share of income is creating an increasing need for companies to raise prices to pass on the resulting upturn in expenses. The result is more inflationary pressure. (b) Surplus funds at companies are decreasing as capital expenditures grow and companies use cash for stock repurchases, dividends and other activities that require cash.

- The US government will increase spending in 2017 because both major party presidential candidates Trump and Clinton support more spending.

If this view is correct, another US interest rate hike in September or December is inevitable. There is an increasingly clear difference between the Fed’s stance and the policies of central banks in Japan and Europe, which are further expanding monetary easing. As a result, the dollar will appreciate as US long-term interest rates climb. Higher interest rates are certain to have a negative effect on demand. But the benefits of more government spending in 2017 will probably outweigh these negative effects. Significant growth in spending is part of the agendas of both Trump and Clinton. The United States has an excellent opportunity to adopt Keynesian policies for several reasons. One is the country’s aging infrastructure. Another is the decline in the deficit from 10% of GDP in 2010 to the 2% level in 2015. Furthermore, long-term interest rates have never been this low. For these reasons, we can expect to see US long-term interest rates and the dollar move up as the Fed raises rates, the government boosts spending and the economy remains healthy. The outlook is for more US economic growth as sound credit creation continues and the United States alone among industrialized countries avoids the liquidity trap. If this happens, there is no doubt that confidence in the US economy and the dollar will become even stronger.

Enormous uncertainties about China

Despite this favorable outlook, events outside the United States, and particularly in China, are major risk factors. China’s economy has grown at a breathtaking pace with the support of excessive investments on an unprecedented magnitude. In addition, China has the ability to supply goods on an unprecedented scale along with a massive volume of potential non-performing loans. This situation sets the stage for a financial crisis in the future. Over the next year or two, either a hard landing or a soft landing will probably occur in China. If a hard landing happens, there is a strong possibility that President Jinping’s radical reforms would result in many bankrupt companies, plunging real estate and stock prices, large outflows of capital, and a sharp drop in the yuan’s value. The president and economists supporting the president have been extremely critical of stopgap measures of the bureaucracy, chiefly the National Development and Reform Commission that is led by Premier Keqiang. If a soft landing happens, reforms would probably continue for the sake of appearance. However, China would have to place priority on more fiscal and monetary initiatives in order to prevent a sudden economic downturn. There would also be an increasing likelihood of China adopting the premier’s stance of emphasizing cooperation with other countries.

The Jinping administration’s power declines as China shifts to the Keqiang stance of prioritizing the economy and international cooperation

The apparent rapid erosion of the president’s power has significant implications for investments. If China enacts the policies of Premier Keqiang that prioritize the economy and cooperation with other countries, global economic and financial stability would increase dramatically for the time being. A variety of signs of the decline in President Jinping’s power are beginning to emerge. One example is the downfall of Huang Xingguo, the mayor of Tianjin and one of the president’s few trusted allies. Another is an article titled “Shock at the Beidaihe Conference! President Jinping Loses to Party Elders” in The Economist (September 13) by Hidetoshi Kaneko, a veteran Beijing watcher and member of the Mainichi Shimbun External Editorial Committee. Mr. Kaneko believes that there was a fight for power between the president, who was attempting to reinforce his authoritarian power, and party elders in which the president was defeated. The article includes several observations to justify his belief that changes are taking place. First, after the Beidaihe conference, the president lost his title as “core leader,” which was the symbol of his absolute power. China has returned to having a “central party with President Jinping as the general secretary,” which means the country is led by a group. Second, conference participants stopped criticizing Premier Keqiang, who wants to continue the reform and open-door policies of Deng Xiaoping. This was the start of moves to return Deng policies to the mainstream. Third, Han Zheng was removed from his post as the Communist Party Secretary of Shanghai. He had been the president’s leading candidate to become the next general secretary. At the same time, the stature of Sun Zhengcai, Communist Party Secretary of Chongqing (Jiang Zemin faction), and Hu Chunhua, Communist Party Secretary of Guangdong (Communist Youth League faction) increased.

The US welcomes the policies of Premier Keqiang

The next leader of China’s Communist Party, and the successor to President Jinping, will be chosen by a process that uses the general meeting this fall and at the National Congress of the Communist Party in the fall of 2017. Caution will be required until this selection is made. However, it appears to be obvious that China is going to use the economic policies of Premier Keqiang. This should make the United States very happy. After the Shanghai G-20 financial leaders meeting in February 2016, US Treasury Secretary Jack Lew went to Beijing for two days of meetings with the premier. At that time, China stated that it would not attempt to boost exports by devaluing the yuan. Mr. Lew responded by saying that “the risk of a devaluation has been greatly, greatly reduced.” This demonstrates the level of trust that Mr. Lew has in the premier.

China’s greater commitment to international cooperation greatly reduces the possibility of a hard landing in China at least for the near future. This most likely means that we can move to the back burner for now the scenario backed by George Soros and others in which China triggers a global financial crisis.

All quiet for now on China’s economic front

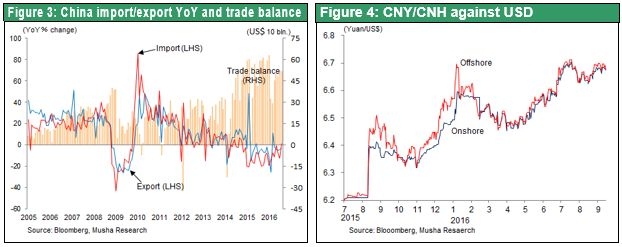

Statistics announced for August show that the Chinese economy is improving slowly in all sectors. The industrial production index was up 6.0% in July and 6.3% in August from one year earlier. Also, real retail sales increased 9.8% in July and 10.2% in August from one year earlier. The main source of growth was automobile sales because economic stimulus measures are expected to expire at the end of 2016. China’s fixed-asset investments during the first eight months of 2016 were 8.1% higher than in the same period of 2015. On a monthly basis, these investments were up 4.0% in July from one year earlier, which was an all-time low, and up 8.1% in August. But the higher growth rates of infrastructure and real estate investments were offset by the continuation of slowing growth of investments by manufacturers. Furthermore, China’s imports increased in August for the first time in about 18 months, climbing 1.5% on a dollar basis. Growth was probably attributable to public-sector infrastructure expenditures and the benefits of monetary easing. The floor area of real estate sold was up 19.8% in August from one year earlier compared with 18.7% in July. But housing starts are slowing again, rising 3.3% in August compared with 8.1% in July. These numbers show that investors need to closely monitor China’s real estate and manufacturing investments.