Sep 23, 2016

Strategy Bulletin Vol.168

Regulated market interest rates

Thoughts about the effectiveness of a third round of the “Kuroda Bazooka”

The BOJ has reached the point of controlling market prices directly

At its September 21 Monetary Policy Meeting, the Bank of Japan announced new initiatives with three key elements. First is yield curve control by controlling short and long-term interest rates. Second is an inflation overshooting commitment, meaning the bank places no limits on measures needed to accomplish its goals. Third is the use of additional actions. This announcement means that bank will be targeting both short and long-term interest rates, buying assets, and moving even faster to expand Japan’s monetary base.

Is the bazooka’s third round coming?

Controlling long-term interest rates is a new direction for the Bank of Japan. Even the Fed’s quantitative easing did not go this far. The central bank of an industrialized country will now begin to control market interest rates directly for the first time since the developed world embraced financial deregulation and the financialization of markets in the 1980s. The announcement has triggered a growing response that is cynical although not necessarily negative. Most people interpret these new initiatives as a sign of the bank’s failure, the use of clever but desperate actions and the use of forbidden measures. There is no doubt that these measures take the Bank of Japan even farther away from traditional policies and mainstream thinking than its extreme quantitative easing did. Nevertheless, we cannot deny the possibility that these initiatives may have an enormous impact on markets precisely because these measures are so unusual. Perhaps the bank’s actions will quickly raise prices of Japanese stocks by 30% to 40%. If this happens, investors will obviously shift to a risk-on sentiment and the yen will weaken. There is even a possibility that yield curve (interest rate) control measures will fuel a virtuous cycle in which interest rate control leads to higher stock prices that cause the yen to depreciate.

An editorial in the September 22 Wall Street Journal proclaimed that “Japan nationalizes the yield curve.” The editorial stated that, having run out of monetary initiatives, the Bank of Japan is embarking on an extreme policy of controlling long-term interest rates, which are normally determined by markets. Quantitative easing is nearing the limit because the bank will no longer be able to buy Japanese government bonds in 2017. Also, negative interest rates are damaging banks’ earnings. So the Bank of Japan has used up its monetary measures. Ultimately, the bank decided on the new and ingenious step of controlling the yield curve (short and long-term interest rates). This policy may have negative effects. For example, the policy may boost market volatility, further increase savings (as people shun risk), and delay the restructuring of Japan’s banks by creating an artificial opportunity to earn profits. The editorial concluded that the Abe administration should admit that monetary policy has reached its limit and the country should shift its focus to fiscal measures and regulatory reforms.

Media reports are wrong – The BOJ has not failed and monetary measures are still effective

Has the Bank of Japan really run out of ammunition? Is the goal of 2% inflation out of reach? From a fair standpoint, the answer to both questions is probably no. There is now virtually no chance at all that the Japanese economy will return to deflation and prolonged stagnation. As Mr. Kuroda has stated many times, the financial cause of Japan’s deflation and extended period of no economic growth was real interest rates that were far higher than was justified by the economy’s actual strength (the natural interest rate and the real equilibrium interest rate). Throughout the decade that began in 2000, Japan’s real interest rates were about the same as in other major countries even though Japan’s economic growth potential declined sharply. Japan’s economy was severely weakened by this high real interest rate.

The natural interest rate is the inflation-adjusted interest rate that allows an economy to grow while functioning at full capacity without overheating. This can also be regarded as an equilibrium interest rate that achieves a balance between saving and investment. Consequently, the natural interest rate should be the basis for determining policy interest rates. In the Bank of Japan’s September 21 Comprehensive Assessment, the bank stated that Japan’s natural rate of interest has been almost 0% since 2010.

Since 2013 in Japan interest rates have been lower than the GDP growth rate

However, as is stated in the Comprehensive Assessment, since the start of quantitative easing, there has been a big drop in Japan’s real interest rates because of a decrease in nominal long-term interest rates and rising prices. As a result, the bank believes that real interest rates have been far below the natural rate of interest.

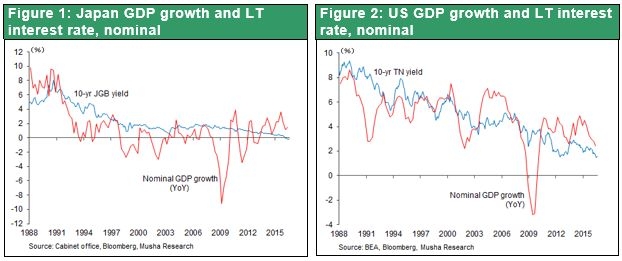

Different results are reported concerning Japan’s economic condition and the level of the natural rate of interest depending on the measurement method used. But we can use a simple approach in which nominal GDP growth is the economy’s health and nominal long-term interest rates are the cost. This approach reveals a clear relationship between the GDP and interest rates (the relationship between the nominal growth rate and nominal interest rates is the same as the relationship between the real growth rate and real interest rates). As you can see in Figure 1, there is a dramatic change between the period before Abenomics and quantitative easing and after the start of these policies. During the two decades prior to Abenomics (1992-2012), interest rates were consistently higher than the GDP growth rate. This clearly demonstrates that interest rates (credit) were holding back economic growth. But this relationship has been reversed since 2013. Now interest rates (credit) are unmistakably contributing to economic growth.

Deflation did not occur in the United States because of the continuation of sound credit creation. Interest rates were consistently lower than the GDP growth rate, except for a brief period during the global financial crisis. The cause of Japan’s deflation may have been the big differences in the level of Japanese and US interest rates in relation to their respective economic strength. If this is true, then this cause of deflation no longer exists. If Japan can keep its GDP growth rate above interest rates, as has been the case since 2013, the country will be able to establish a positive cycle in which the restoration of risk-taking sentiment produces benefits for risk takers. In 2015 and 2016, there was a decline in inflation because of the drop in the cost of crude oil (a one-time event). To prevent this from increasing real interest rates, nominal interest rates must be lowered. This is why negative interest rates are needed.

0% long-term rates may spark an explosion of risk taking

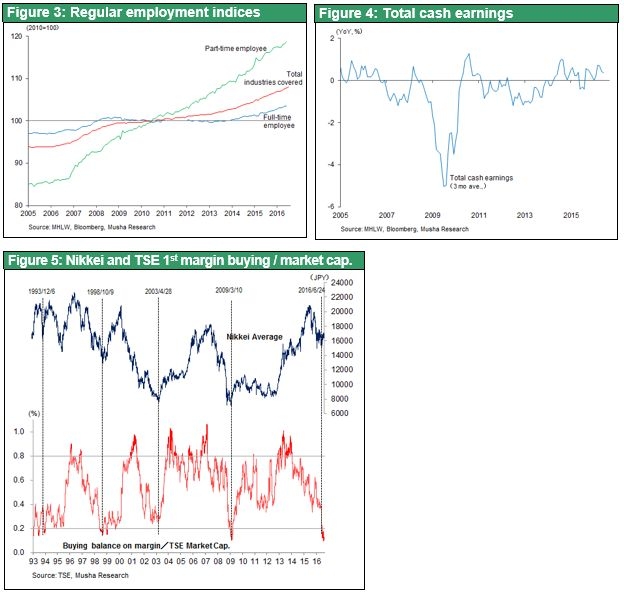

The Bank of Japan’s policy of pinning long-term interest rates at 0% makes it virtually certain that the GDP growth rate will remain higher than interest rates for a long time. This may trigger a surge in risk taking. Japan’s job market has become tight because of growth in the number of jobs since 2013. Now wages in Japan are finally starting to climb because of this situation (Figures 3, 4). Furthermore, prospects are excellent for a return of Japan’s inflation (CPI) from a temporary dip into negative territory to about 1% in 2017 as the price of crude oil climbs. Furthermore, there are many positive events in the economic climate: Japanese government expenditures of ¥28 trillion, a lull in China’s economic problems, the bottoming out of global commodity markets, the end of the downturn in global trade and a slow recovery, and the soundness of the US economy. This is why the consensus outlook of economists is for Japan to stage a recovery to real GDP growth of about 1% (the ESP forecast is 0.9%). In 2016, there were reforms in Japan involving corporate governance (the Corporate Governance Code and Stewardship Code). These reforms are likely to be followed by changes in how people work, including the gradual acceptance by Japan of foreign workers. Japan will also probably enact tax reforms (end of the spouse deduction) and other measures to support economic growth. Furthermore, if the negative impact of a strong yen on corporate earnings comes to an end, stock prices will probably increase significantly. Japanese stocks have been extremely oversold by foreigners who think that Abenomics has failed or at least reached a dead end. Japan’s balance between the supply and demand for stocks (a historically low level of long arbitrage positions) has improved greatly. In addition, the valuations of Japanese stocks are currently unusually low.

The majority of foreign exchange market participants still expect the yen to remain strong. But most of the people with this outlook are also pessimistic about Japanese stocks. However, these people are not considering the possibility that a shift to risk-on sentiment caused by the start of a Japanese stock market rally would make the yen weaker.