Oct 17, 2016

Strategy Bulletin Vol.169

Japan-US Relations under a New President could change presumptions of US$/Yen Exchange Rates

A strong yen is the natural enemy of Abenomics

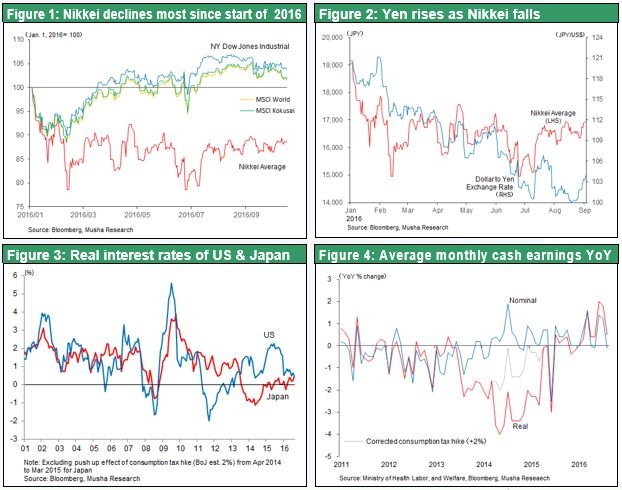

It is fair to say that a strong yen is the natural enemy of Abenomics. Today, many economists and other people are saying that the yen’s strength has caused Abenomics to fail. The steady increase of corporate earnings, igniting inflation and the stock market rally since 2013, these accomplishments of Abenomics, now seems to be seriously affected. The yen’s upturn of 20% over only six months was an extreme move with enormous destructive power.

The yen’s surge has no relationship with fundamentals

A significant number of market participants think the yen’s strength is linked to economic fundamentals in the form of a weakening US economy. Can this be true? Every indicator shows that the US economy is outperforming the Japanese economy. The IMF forecasts US economic growth of 1.6% in 2016 and 2.2% in 2017 but growth of only 0.5% in both years in Japan. Monetary policies differ too. The US Fed is considering monetary tightening while the Bank of Japan took monetary easing to a new dimension by implementing yield curve targeting. Some people think rising real interest rates caused by negative inflation have brought about yen’s hike. But in fact the yen’s appreciation has lowered prices of imported goods. So the real cause-and-effect is the opposite. Wages greatly influence the level of prices in Japan. Currently, the tight supply of workers is starting to produce clear upturns in both nominal and real wages.

The yen was sacrificed to prevent a global crisis and prop up the yuan

Why did the yen become so much stronger? We tend to conclude that forces behind the yen’s appreciation originated in the United States. There is considerable evidence. The risk of a China sparking a global financial crisis was growing. To avoid this crisis, measures were needed to stop China from devaluing the yuan. A joint initiative to limit the yuan’s decline began, resulting in the suspension of US interest rate hikes and a stronger yen. China may demand a stable yen in exchange for reigning in devaluation of the yuan. After resurgence of the China crisis and accompanying anxiety at the beginning of the year, U. S. authorities’ position on the exchange rate of the yen may have changed from 120 yen to a dollar to 100 yen.

The decisive gap in forex influence clout between Lew and Aso

US Treasury Secretary Jack Lew verbally intervened to guide the yen upward by insisting that the yen’s rapid climb as orderly manner. But Taro Aso, Japan’s Finance Minister, rejected this view by saying that the yen’s sudden appreciation was a problem. But markets completely ignored Mr. Aso. The reason was that market participants believed that the United States has overwhelming power to the dollar/yen exchange rate.

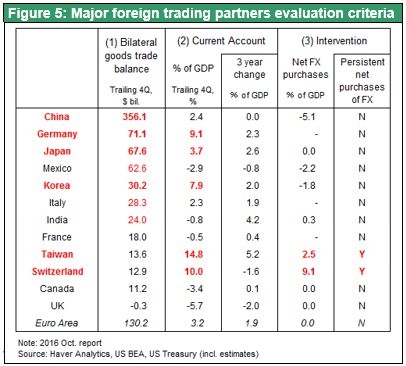

In April 2016, the US Treasury Department created a new monitoring system concerning countries that manipulate foreign exchange rates. A country is designated as foreign exchange manipulating if it met three criteria: (1) a bilateral trade surplus with the United States of at least $20 billion, (2) a current account surplus of at least 3% of GDP and (3) persistent foreign currency intervention of at least 2% of GDP. In this case, retaliatory measures are used. Japan is the only country where there is a possibility of meeting all three criteria. Therefore, it appears to be obvious that this monitoring system was started in order to target Japan.

China has a trade surplus of $356.1 billion with the United States, more than five times higher than Japan’s surplus of $67.6 billion. That means China is taking away far more US jobs than Japan is. However, China’s foreign currency intervention is negative by a wide margin. Negative intervention signifies that China is selling the dollar massively so that raising the yuan’s value above the normal market value. As a result, it is impossible to identify China as a country of foreign exchange manipulation.

Germany current account surplus is 9.1% of GDP, the highest in the world and about 150% higher than Japan’s 3.7%. Despite this big surplus, Germany is immune to the US monitoring system because it does not have its own currency. Consequently, the United States has created a monitoring system that has no effect on Germany and China that are responsible for global imbalances. Establishing a monitoring system that targets only Japan is an excellent way for the United States to exert pressure on the yen’s value.

The composition of Japan’s foreign currency reserves clearly shows the nature of its subordinated nature regarding the determination of the dollar/yen exchange rate. Almost all of the country’s reserves of $1,000 billion are invested in US treasury securities. By comparison, US treasury securities account for about $1,000 billion of China’s $3,200 billion of reserves. The majority is invested used for other foreign investments and loans that support China’s national interests. In June 1997 when Bill Clinton was president, the United States made a one-sided attempt to make the yen stronger. Prime Minister Ryutaro Hashimoto responded with a speech at Columbia University in which he said Japan could have respond to this pressure by selling US treasury holdings. He was immediately the target of intense criticism. Since then, there has been a well-established perception that the United States is in a much more powerful position than Japan is concerning foreign exchange negotiations. There is a consensus among investors that the United States is able to maintain the dollar/yen rate at a level that best suits US interests.

US interests and geopolitical forces may soon weaken the yen

Two points must be considered to determine the outlook for the dollar/yen exchange rate. First, we must decide what level is most consistent with the national interest of the United States. Then we must decide if there will be a change in the balance between Japan and the United States concerning the determination of an exchange rate.

Regarding the first point, the yen should move down from the current level of about ¥100 in order to match US national interests. There are three reasons. First, the increasing risk of inflation means that US fundamentals justify higher interest rates and a stronger dollar. Second, there is little risk for now of a sharp drop of the yuan triggering a global financial crisis. This is due to the effectiveness of stop-gap fiscal and monetary measures to prevent a crisis and capital restrictions to control the yuan’s value. With little risk of a crisis, there is no need for a sacrificial strong yen to prevent the yuan from depreciating. Third, doing nothing about Japan’s economic difficulties caused by the yen’s strength would not be in the best interests of the United States.

The second point is the balance between US and Japanese influence for determining the foreign exchange rate. This requires thinking about the possibility that administration of Hillary Clinton, who is almost certain to be the next president, will alter the balance. A Clinton administration will most likely exert pressure on China and reinforce ties with Japan. The United States will probably welcome a legitimate increase in the stature of Japan. Hillary Clinton’s request for a special meeting with Prime Minister Abe, who was in New York in September for the UN general assembly session, demonstrates the importance she places on Japan. Kurt Campbell, her foreign policy adviser, also attended the meeting. Afterward, he said that Clinton accepts Abe’s dealings with Russia.

This statement may be a signal of a move toward a more even US-Japan balance of power for determining the foreign exchange rate. Furthermore, we could even see revisions to the foreign exchange monitoring system, which is unfair to Japan, or even the termination of this system. Abe may ask for less US exchange rate influence in return for an increase in Japan’s national security cooperation. Perhaps we have reached the point where people should start thinking about the possibility of changing power balance that determine dollar yen rate that is suitable for the new age of the Japan-US alliance. This may alter the sentiment of market participants.