The crisis in Greece is near the end

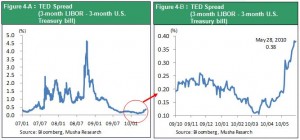

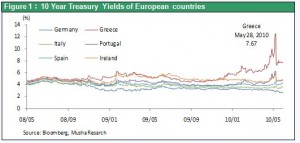

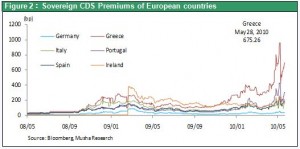

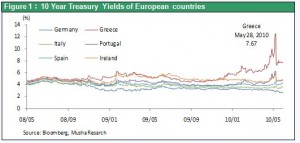

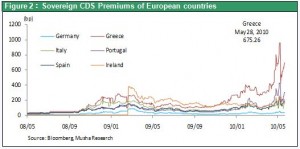

It seems that the crisis in Greece will soon be resolved, although devising a solution for this problem is certainly no easy task. Early in May, there was a surge in interest rates on Greek government bonds and in the CDS premium. But both have since stabilized. Furthermore, fears about a liquidity problem are receding as encouraging signs appear, such as the narrowing of the TED spread at the end of last week. Another positive sign is that stock prices in many countries have been establishing a bottom during the past three weeks.

What will happen after the Greek debt crisis? This is what market participants want to know. The answer is probably that the leadership of the United States will become even greater. Right now, the most important factor is the strength of the U.S. economy. Companies have completed streamlining their inventories, workforces, capital equipment and balance sheets. As a result, the U.S. economy is on the verge of its next phase of growth. Once improvements at U.S. companies start producing a rapid recovery in earnings and an enormous volume of excess liquidity, we will probably see an even stronger rebound in real demand (consumer spending and investments). Furthermore, one surprising result of the crisis in Greece is the even greater leadership of the U.S. in global finance.

The Geithner Initiative

Leadership from the U.S. Treasury Department and Fed during the eurozone crisis has been quite conspicuous. Pressure from the United States as European countries were hesitant to act was critical to the creation of a 750 billion euro financial stabilization plan. The United States also urged European countries to use injections of public funds to stabilize financial markets. To make these purchases, the ECB fulfilled the role of “buyer of last resort” during this crisis just as the Fed did during the U.S. financial crisis. U.S. pressure was a major reason that the ECB took this action. We also saw the Fed move quickly in response to the difficulty of some European banks in procuring dollar-denominated funds. The Fed supplied dollars to these banks by reestablishing currency swap agreements even though Fed officials realized this would spark criticism from Congress. In a related development, Treasury Secretary Timothy Geithner went to Europe immediately after the U.S.-China Strategic and Economic Dialogue. Mr. Geithner pressed European countries to act in a quick, decisive and prudent manner to quell the crisis. He believes that the speedy enactment of a stabilization plan is vital to ending volatility in financial markets. At the same time, he cautioned European countries to avoid excessive government budget cuts that would stand in the way of economic growth. He also asked these countries to shun inappropriate restrictions like Germany’s ban on certain short sales. In addition, Mr. Geithner obtained the cooperation of China by easing pressure to enact financial reforms (allowing the yuan to appreciate and adopting a tighter monetary policy). Immediately afterward, China eliminated fears in the foreign exchange market by labeling as groundless foreign media reports claiming that China was thinking about shifting some foreign currency reserves away from the euro. All of these events demonstrate the increasing prominence of the United States with regard to the governance of global finances.

U.S. financial imperialism gains momentum

The decision to leave the Volcker Rule out of financial reform legislation is a sign of U.S. ambitions concerning international finance. Many proposed reforms are almost certain to be left out this time: separation of the banking and securities industries; the ban on proprietary derivative trading; splitting up financial institutions with more than 10% domestic share of total insured deposits; and other reforms. Both Timothy Geithner and Fed Chairman Ben Bernanke oppose the Volcker Rule primarily because of their shared conviction that it would erode the competitive edge of U.S. financial institutions. Obviously, they are very concerned about the need to protect the financial services sector, which is the fastest-growing and most-profitable industry in the United States.

The extremely radical fair value standard of the FASB

The U.S. Financial Accounting Standards Board (FASB) has submitted a shocking proposal to impose fair value accounting rules not only to derivatives, but also to loans and similar assets (credit card loans, residential mortgages, unsecured loans to companies, and other types of loans) and liabilities. This stance is far more radical than the position of the International Accounting Standards Board (IASB), which recommends the use of fair value accounting only for derivatives and other securities. Many small and midsize banks oppose this fair value standard. But this proposed FASB standard has the strong support of numerous institutions, including Goldman Sachs and a large number of pension funds and mutual funds. In the midst of last year’s financial crisis, fair value accounting was the villain that caused market price volatility sparked by the recession and speculation to have a direct impact on the capital of financial institutions. This link to capital makes fair value accounting rules pro-cyclical because banks can lend more when markets are strong but less when markets are weak. This explains why European banks have asked for an easing of fair value accounting standards.

Providing investors with more transparent information is the objective of this new FASB proposal. In this respect, the proposal is probably on target. But this fair value standard would make it almost impossible for banks to continue using the traditional “originate-to-hold” loan business model. Instead, banks would have to switch to the “originate-to-distribute” business model in which loans are securitized for resale. Managing risks associated with financial instruments that have values determined by securities markets requires the use of these markets to establish hedges. This is why I believe that adoption of the proposed fair value rules would make the U.S. investment bank business model even more competitive.

As you can see, earnings at U.S. financial institutions are recovering rapidly. Furthermore, the dollar has strengthened and U.S. interest rates have declined as the crisis in Greece eroded the euro’s value. The bottom line is a further increase in the financial clout of the United States. Immediately after the Lehman shock, people were talking about the demise of the dollar and end of U.S. financial imperialism. But subsequent events have moved in precisely the opposite direction. I believe that this increase in U.S. financial strength will stabilize markets and lead to growth in risk taking.